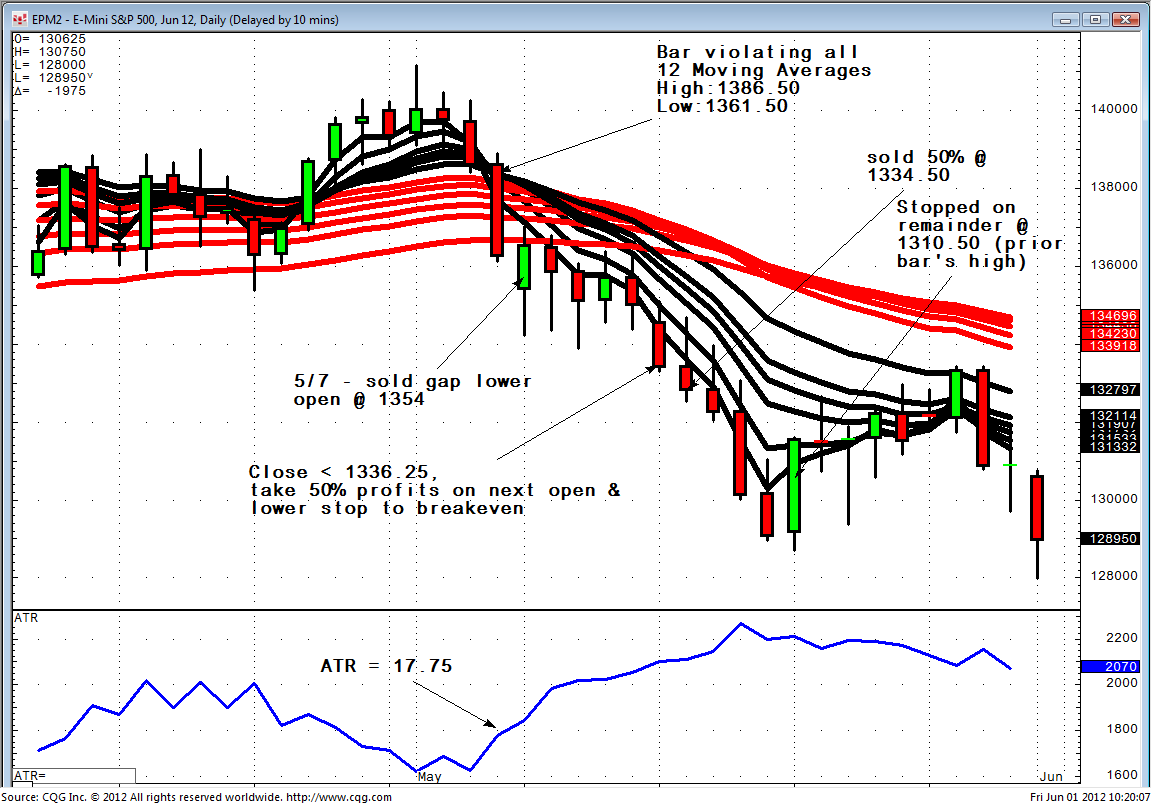

Daryl Guppy developed a trend-following technique using twelve exponentially-weighted moving averages. The twelve periods featured in his books are 3, 5, 8, 10, 12, 18, 30, 35, 40, 45, 50, and 60. The 3-, 5-, 8-, 10-, 12-, and 18-period exponentially-weighted moving averages are used to show the short-term trend's momentum and the 30, 35, 40, 45, 50, and 60 show the longer-term trend's momentum. Although there are many ways to use the Guppy Multiple Moving Average™ (MMA), perhaps the most valuable to many traders is when compression of both groups of moving averages occurs on the same bar, as this could indicate major re-evaluation of assets and potential for a trend change.

I personally look for a compression bar in which the high and low violate all twelve moving averages. One way to trade this set-up is to place buy stops and sell stops above the high and below the low of the compression bar. Once filled, the opposite stop becomes your initial stop-loss level. After entry, I would take profits on fifty percent of the position once a daily close occurs where unrealized profits are greater than the ten-period Average True Range (ATR) of the entry bar. I would then move the stop to breakeven on the remainder of the position. Thereafter, I would trail the stop at the prior bar's high (or low) until stopped out of the position.

Below is an example in the June 2012 CME Group E-mini S&P 500 futures. On May 4, the market violated all twelve moving averages, so I placed a buy stop at the prior day's high and a sell stop at the prior day's low. On May 7, I gapped below my sell stop level and therefore sold the opening at 1354. Also note that the ten-day ATR on the day of entry was 17.75 points. Based on my entry price of 1354, this means I will exit fifty percent of my position and lower my stop to breakeven on the remainder of the position when there is a close below 1336.25. On May 14, the market settled at 1334, so I exited fifty percent of the position on the opening of May 15 at 1334.50 and lowered my stop on the remainder of the position to my entry price of 1354. Thereafter, I lowered my stop to the prior day's high until stopped out on May 21 at 1310.50.

For more on Guppy's MMA, I recommend his book, Trend Trading: A Seven-step Approach to Success.