As a devoted CQG trader, investor, portfolio manager, hedger, etc., how does high frequency trading (HFT) affect the way you do business? Some might say that you can't get a good fill at your price, while others have just thrown their collective hands in the air and backed away from those markets where you cannot get a good fill.

I have an answer to the problem, and it is based on the belief that there will always be someone crying foul, and that the markets are not fair. The SEC/FINRA really cannot control the big guys' behavior. The answer to the problem is technical analysis. With that tool and your CQG system, we can price our trades and solve for supply and demand. We know where we want to be long, where we want to be short, and most especially, where we don't want to be in the markets. The use of options enhances your ability to hedge and create synthetics.

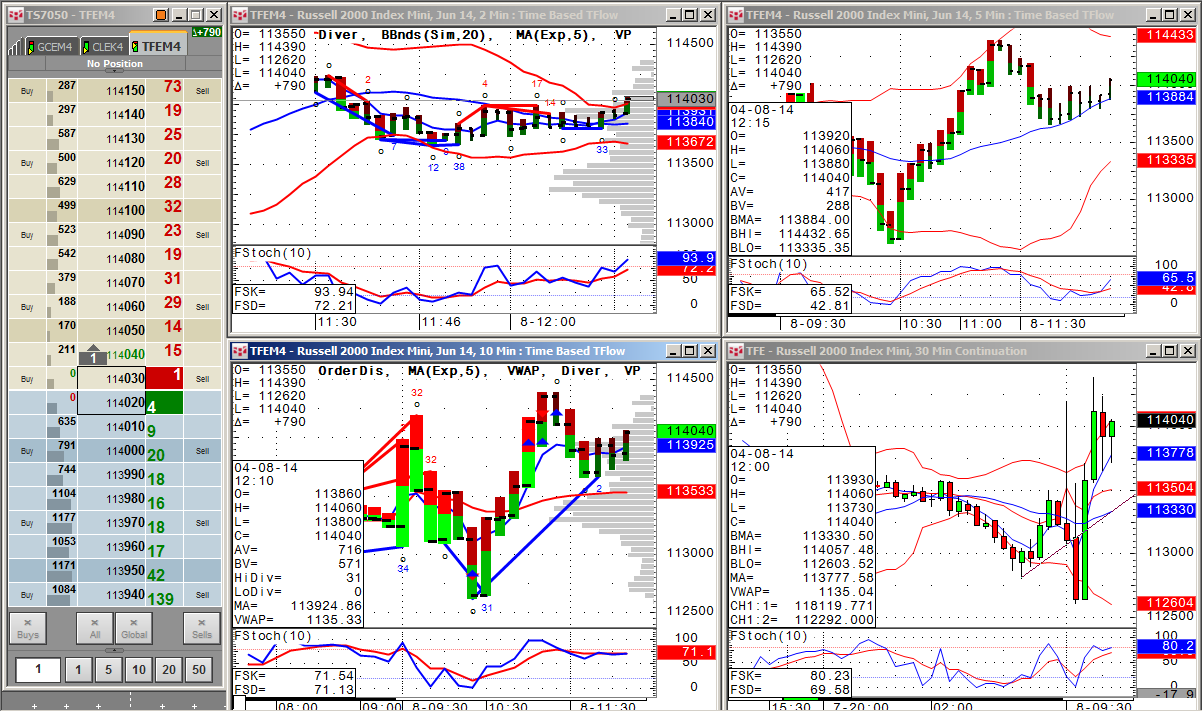

I use Time-Based TFlow® charts for intraday trading. To aid my trading, I apply a Fast Stochastic indicator. To that I add a Divergence Index. My page contains multiple time frames of a single product, say the Russell 2000 or the S&P 500. Currently I am using 2-, 10-, and 15-minute TFlow charts coupled with a 30-minute candlestick chart. I like candlesticks because they clearly give you a flavor of the market. Prior to any trading, I review the daily and weekly charts, looking for confirmation of indicators and good-old-pattern analysis, which, in the long run, works. It is not about the newest toys but rather about what works and what doesn't work.

Using multiple time frames allows you to see the noise in the market. What do I mean by that? Simple: if the 2-minute chart is bullish, but the 10-minute chart is not, there is no trade. We are looking for confirmation of all the intraday time frames under investigation. The Commodity Channel Index (CCI), when coupled with a 5-period Exponential Moving Average, does give good signals and will keep you long, short, or out of the trade. I use this with other indicators such as a nine-period RSI and a Fast Stochastic, always looking for confirmation.

HFT isn't the only bad press that the markets have received. Films like "The Wolf of Wall Street" do not help either. Remember that we have an answer to the problems and can solve for the obstacles put in our path. Our answers lie in our skill. Technical analysis and CQG can give you an advantage in the markets and provide you with the tools to overcome any obstacle thrown in your path.

Jeanette Young, CFP®,CMT, M.S. has been a Wall Street professional since 1981 when she began her professional career with Thomson McKinnon Securities. Her career includes portfolio management, syndication, option strategist, hedger, operations principle, bond principal, pit trader and general market trader. She has been a frequent guest on FOX, CNBC, Bloomberg, Yorba TV, CNN, and others. In 2007, her book, The Options Doctor: Option Strategies for Every Kind of Market, was published by John Wiley & Sons.

Jeanette Young Risk Disclaimer:

Trading futures, options on futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Past performance is not necessarily indicative of future results.