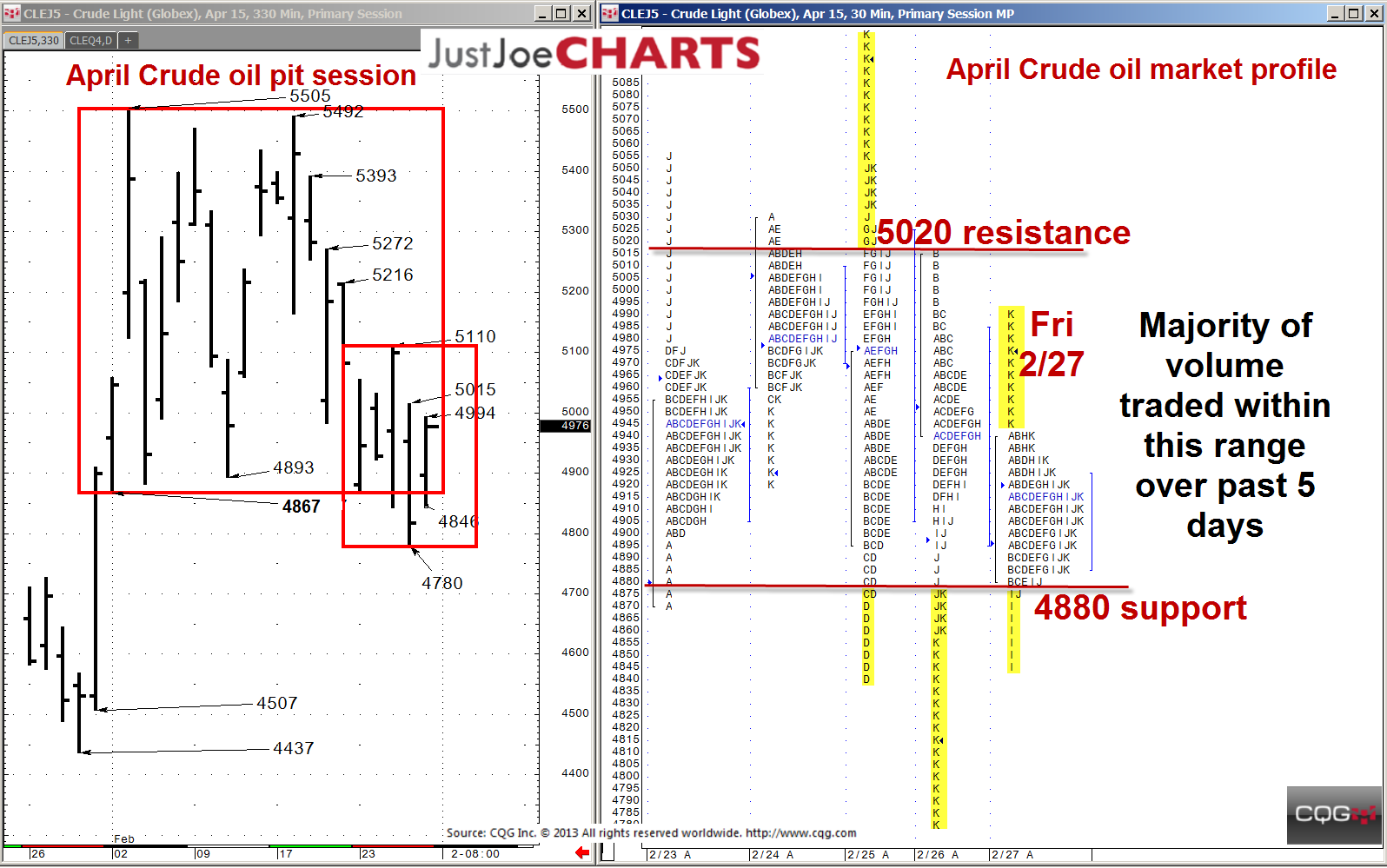

Over the past three weeks, April crude oil found a rotational balance range of 4867-to-5505, traveling from the bottom to the top and back to the bottom of that range a few times. However, three times in the last three days, the market traded below the 4867 balance, but was quickly met with buyers, bringing the price back into the balance range. When a volatile market, such as crude oil trades outside a defined balance range, the two most likely scenarios are:

- Gain acceptance outside the balance range and accelerate.

- Trade near or outside the balance range, get rejected, then begin a rotation back to the opposite end of the balance range.

From Monday, February 23, 2015 to Friday, February 27, 2015, the majority of the crude oil volume traded within 4880 to 5020. Each day, the market attempted to trade outside that range but was quickly rejected.

Downside Breakout

If the market gains acceptance below the 4880 support, the 4507-downside reference may be the destination.

Upside Breakout

If the market gains acceptance above the 5020 resistance, it may begin a rotation back up to the 5505-balance high.