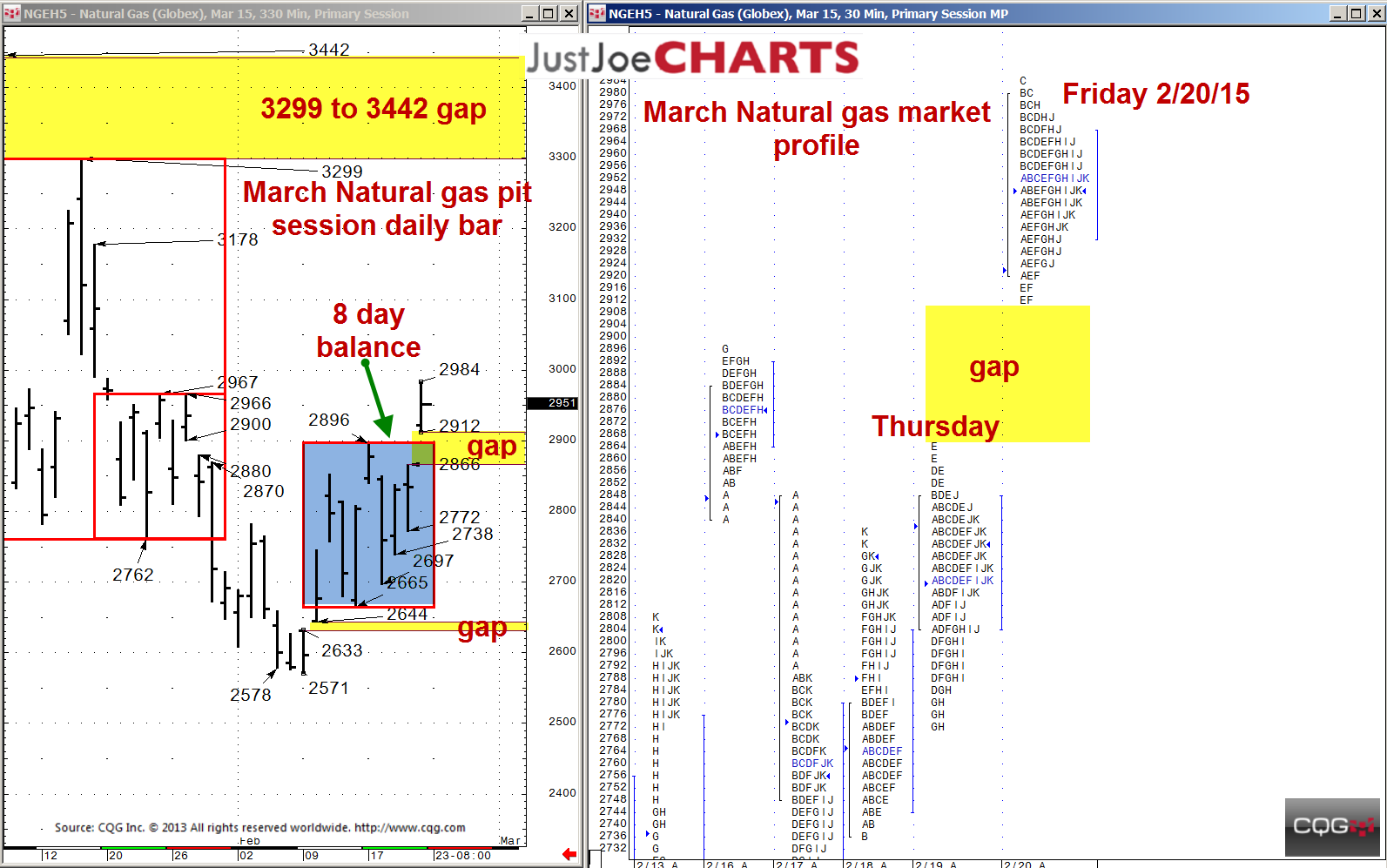

For eight straight trading days, March natural gas has been contained within a 2665-to-2896 rotational balance range. On Friday, February 20, 2015, the market gapped open higher, above the 2896 eight-day balance high. Although Friday had a relatively tight rotational range, the gap remains and the market settled above the eight-day balance range. When a market trades outside a defined balance range, the two most likely scenarios are:

- Gain acceptance outside the balance range and accelerate.

- Trade outside the balance range, get rejected, and then begin a rotation to the opposite end of the balance range.

Continued Upside Breakout

If the market gains acceptance above the eight-day balance, the large 3299-to-3442 gap becomes the possible destination. A visual bar chart reference is at 3178.

Upside Breakout Failure

If the market fills the 2866-to-2912 gap below and gains acceptance back below the 2896 eight-day balance high, then a rotation back down to the 2665 balance low is the most likely scenario.