It is now grilling season in the United States, which commences each year during the Memorial Day holiday weekend and runs through Labor Day. As Americans spend the next few months enjoying warm temperatures and slapping animal protein on their grills, this year there is a serious issue facing the meat markets. This issue may create an opportunity for knowledgeable traders.

Last year a problem with the hog population, the PED virus, caused the death of over 7 million suckling pigs and resulted in much higher pork prices. In fact, lean hogs traded up to all-time highs over $1.30 per pound. This year PED was not an issue and the pig population was more than ample to meet demand. Lean hog prices fell, trading down to lows of 73.45 on March 24 on the active month July futures contract.

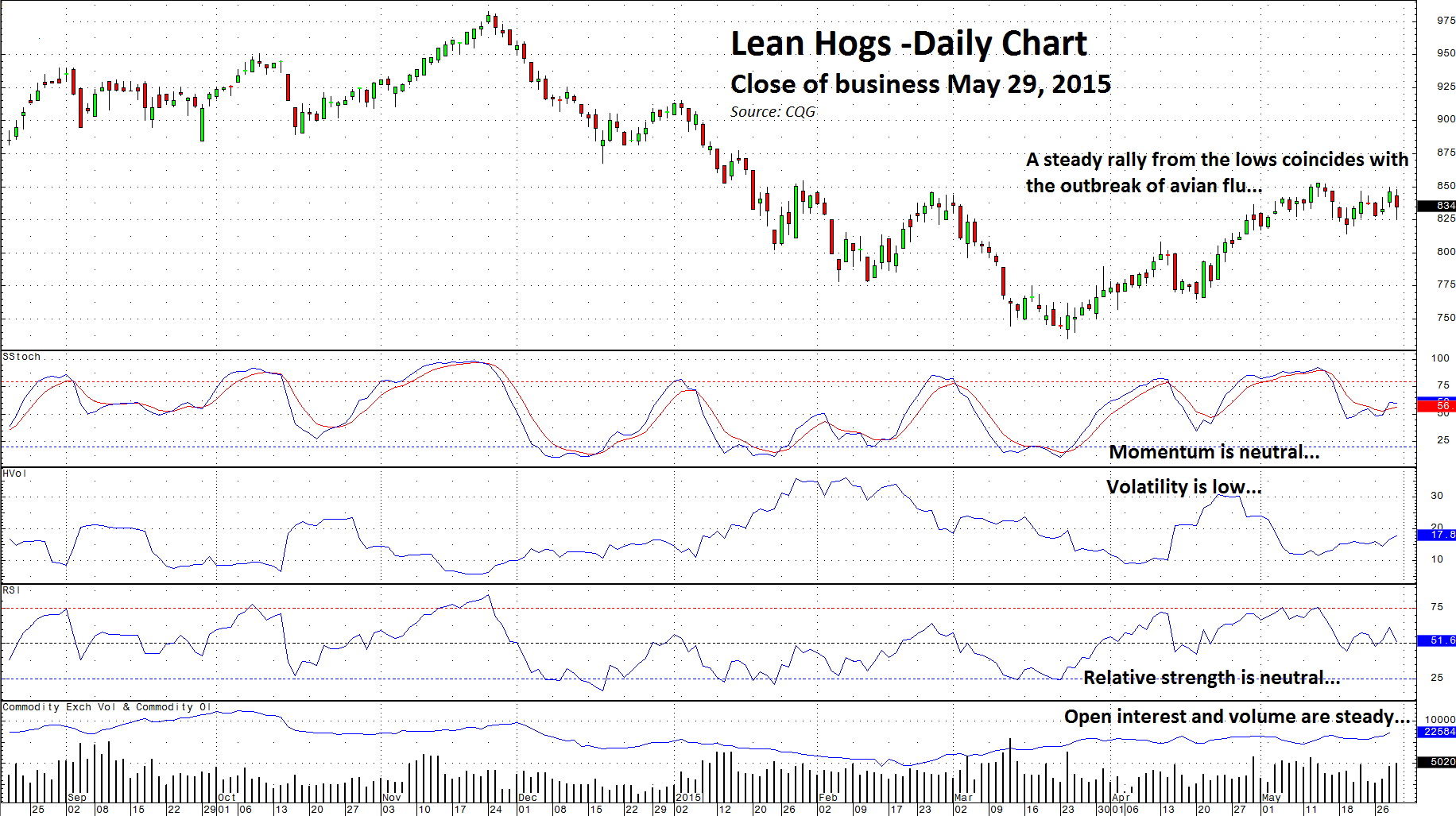

As the daily chart indicates, even though hog prices have rallied by almost 14%, a momentum indicator and the relative strength index are in neutral territory. Volatility remains low and open interest and volumes are steady. Technicals are neutral however; the uptrend that began in late March continues to be in place.

Meanwhile, hog fundamentals appear to be positive. Meanwhile, tight supplies and growing global demand for beef have kept cattle prices firm as hog prices swooned. Recently, a problem in another animal protein sector, poultry, has invigorated the price of pork once again. Like chicken, pork is a white meat and the outbreak of avian flu has turned out to be supportive for the price of lean hogs.

Since making lows at the end of March, lean hogs have taken off to the upside. There are two reasons for the rally. First, demand for pork during grilling season tends to peak in the US. Second, and perhaps more importantly this year, the avian flu has decimated the poultry market. The outbreak caused animal protein producers to kill and incinerate 40 million chickens in the past few weeks. This is affecting poultry supplies, but demand is suffering too because of the fear of eating poultry due to the avian flu issue. Substitution of another white meat, pork, is therefore choking chicken demand and increasing pork demand.

Lean hog futures have moved from 72 cents to the 84-cent level on active month August futures. Resistance now is at the May 12 highs of 85.32. Once that level is broken, hogs may have clear sailing up to 92.5 cents, the January 5 highs and the next level of resistance. That is a 10% move above current levels.

Technicals and fundamentals could be lining up in the lean hog futures market today. On the fundamental side, we are at the very beginning of grilling season, which is high-demand season for the animal protein markets. The avian flu may increase pork demand. Cattle prices are firm and moving higher, which is also bullish for pork as it is a cheaper substitute for high priced beef for frugal consumers. As far as technical factors are concerned, lean hog futures are trading up to resistance. Momentum indicators like the slow stochastic are not currently overbought. Open interest has started to rise. Rising price accompanied by rising open interest is a bullish technical signal.

When fundamental factors line up with technical indicators in commodity futures, a technomental buy signal results. Lean hogs could be presenting an interesting opportunity for traders right now. Look at the lean hog market; the charts as well as the issues in poultry are telling us that the price of those ribs and pork chops that we throw on the grill this summer may be heading higher.