Katie Stockton, CMT is Founder and Managing Partner of Fairlead Strategies, LLC, an independent research firm and investment advisor focused on technical analysis. Prior to forming Fairlead… more

Commentary

We at Notes From Underground haven’t been publishing as frequently but we have been working more intensively than ever. The global financial situation is fraught with many areas of potential… more

In April of this year, Live Cattle futures broke 2014 all-time highs at $171.975. In prior articles and books, I've named this phenomenon, "blue sky", which occurs whenever an asset makes new all-… more

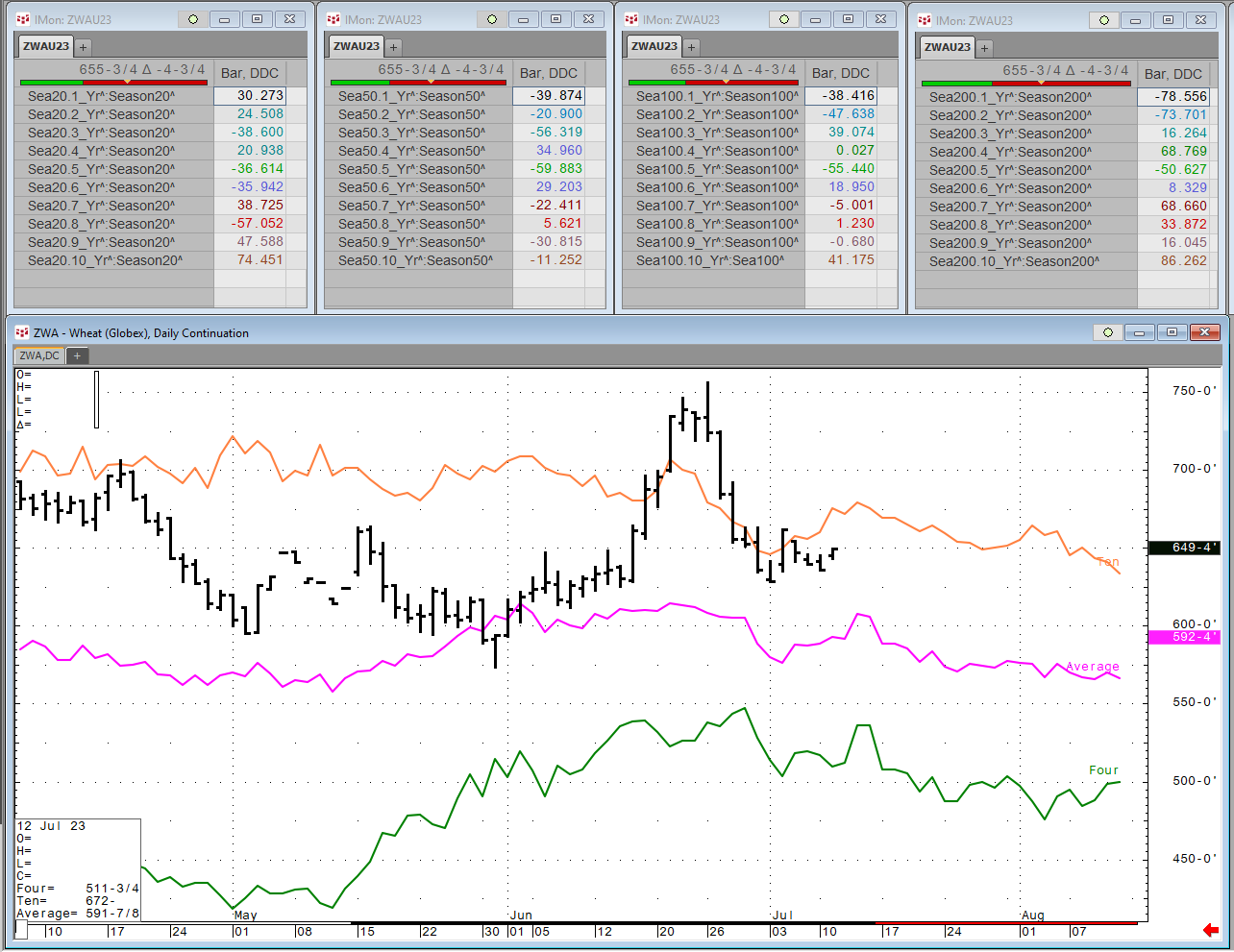

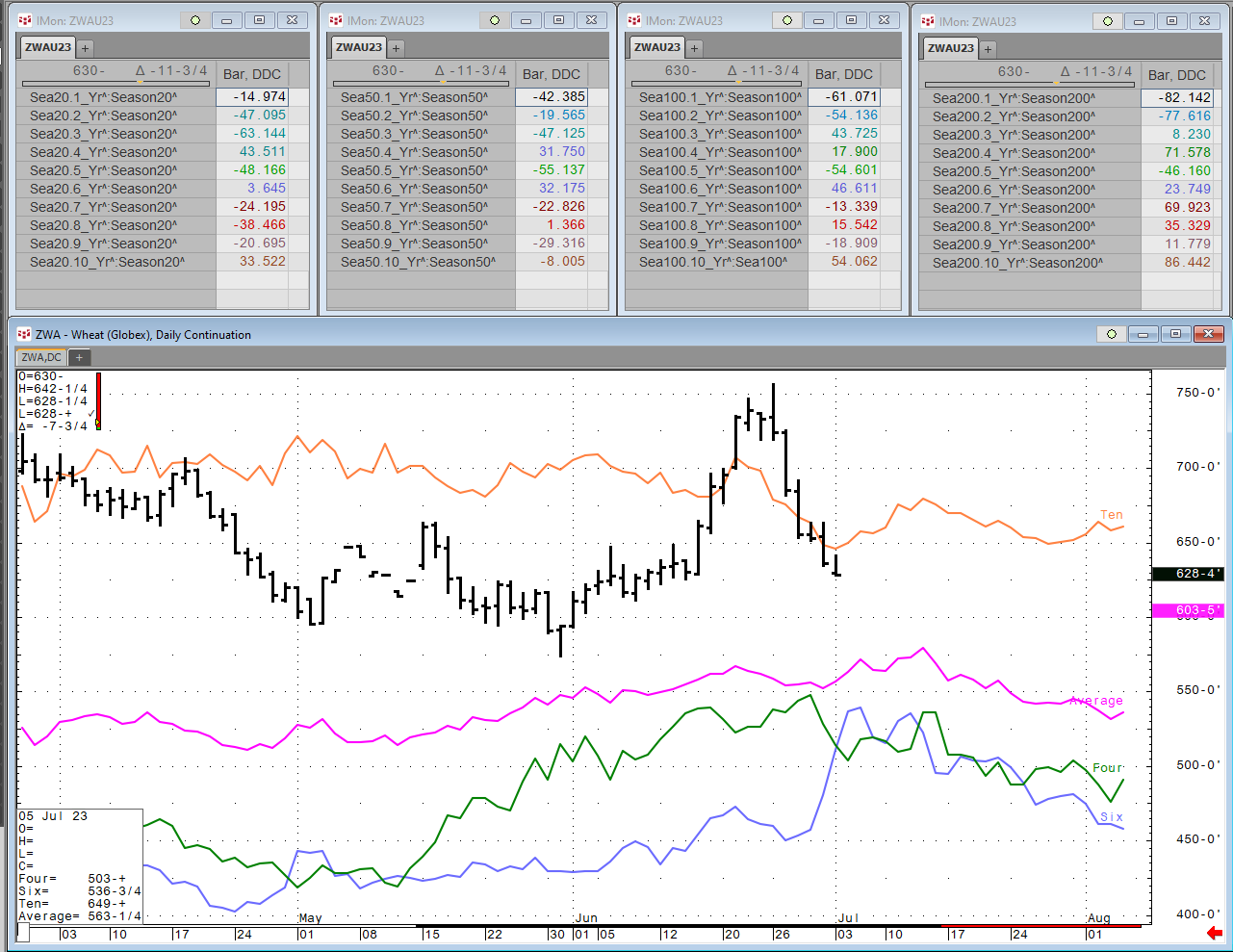

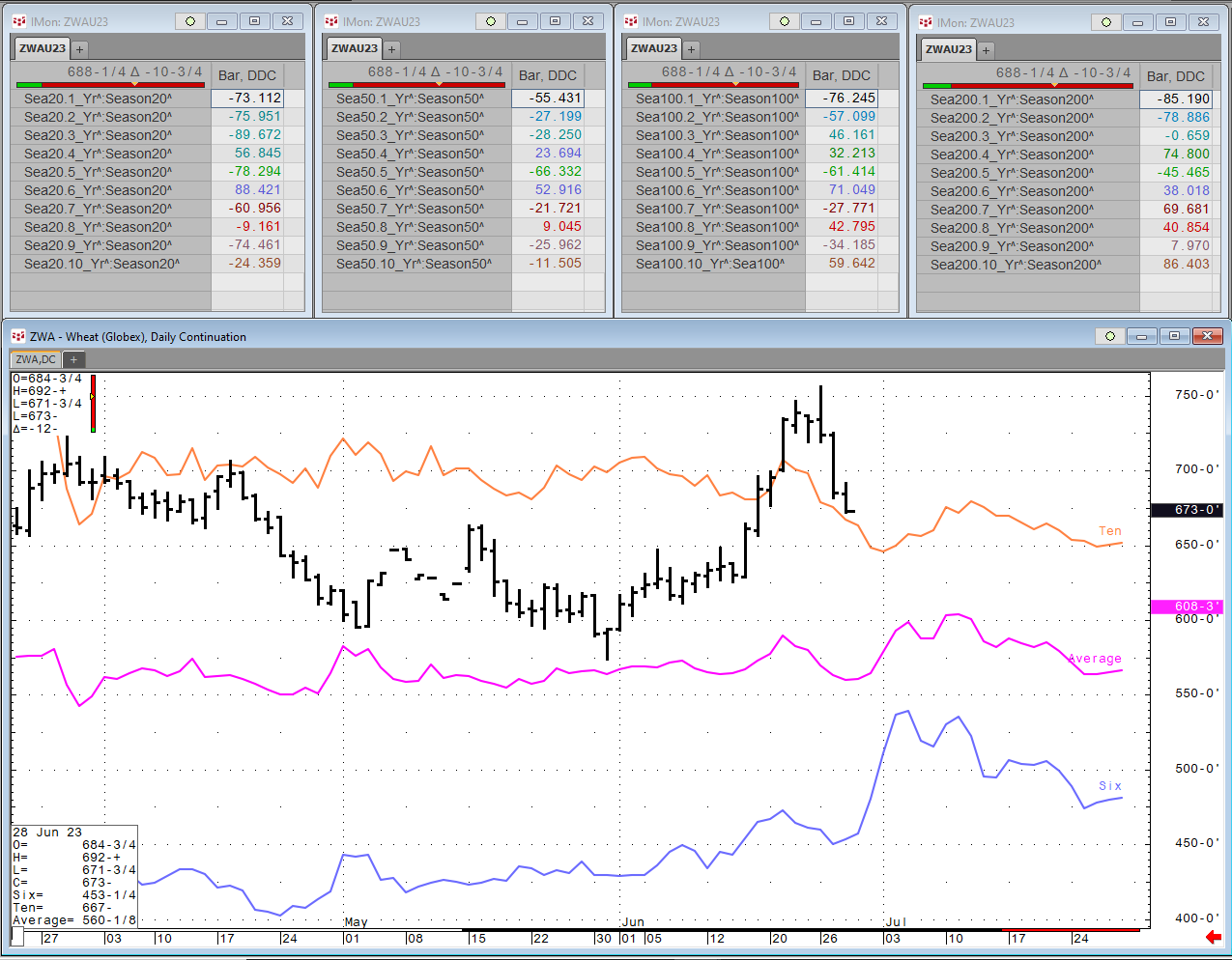

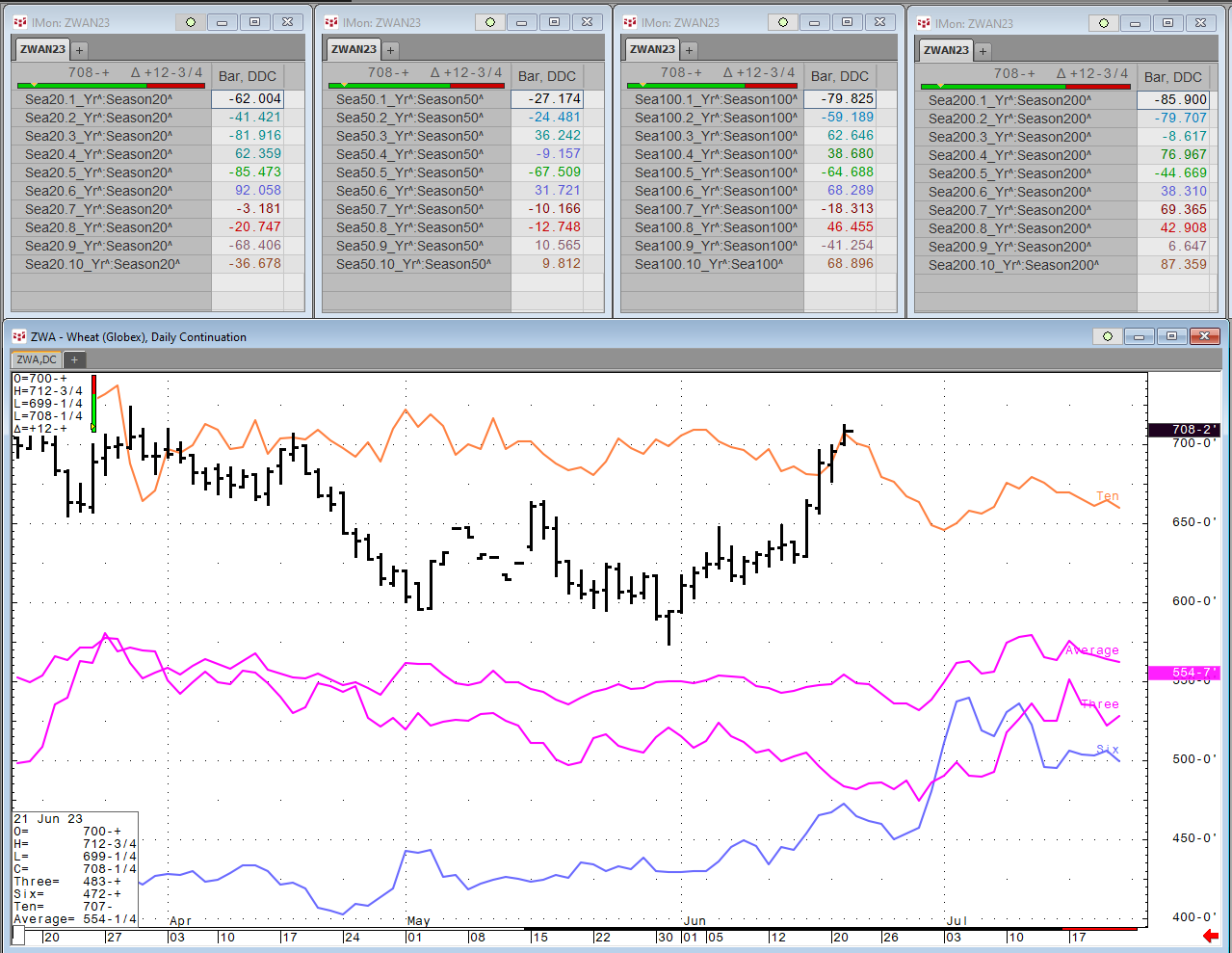

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

A composite of the 29 primary commodity markets traded on the U.S. and U.K. exchanges edged only 0.21% higher in Q2, thanks to gains in animal proteins and soft commodities. Over the first six… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Adam Rozencwajg: Currently, a Managing Partner of Goehring & Rozencwajg, Natural Resource Investors. Adam has many years of investment experience. Between 2007 and 2015, he worked exclusively… more

A giant hello and salutations from Notes From Underground.

It has been quite a long time since I have sat down to write about the state of things, but it is not because I haven’t been… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more