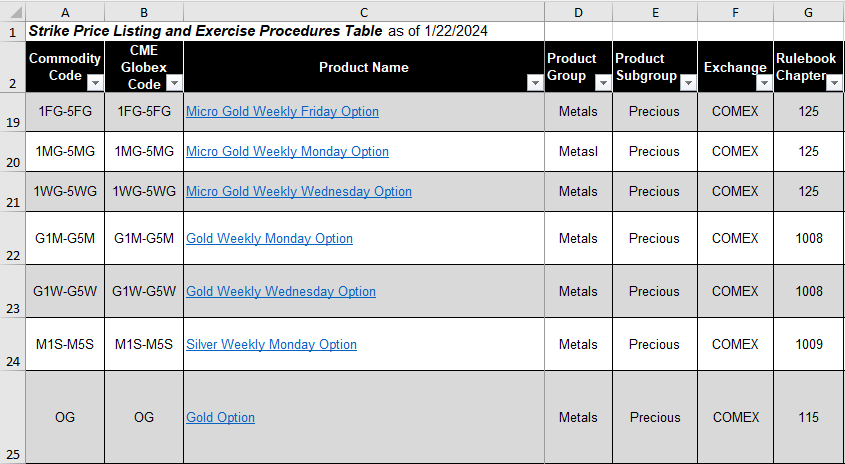

The CME Website has information resources for options traders in the form of downloadable Excel tables with important needed details such as:

Commodity CodeCME Globex CodeProduct NameProduct… moreOptions

CQG One provides an "Active RFQ" widget. A Request for Quote (RFQ) is functionality provided for traders to access electronic quotes on multi-leg options strategies. It is an electronic message… more

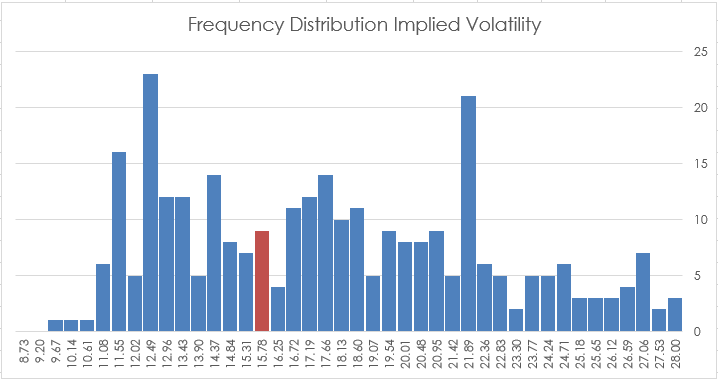

CQG IC and QTrader offer two studies that track volatility: Implied Volatility and Historical Volatility. This post details each study and provides an Excel spreadsheet for tracking the two.

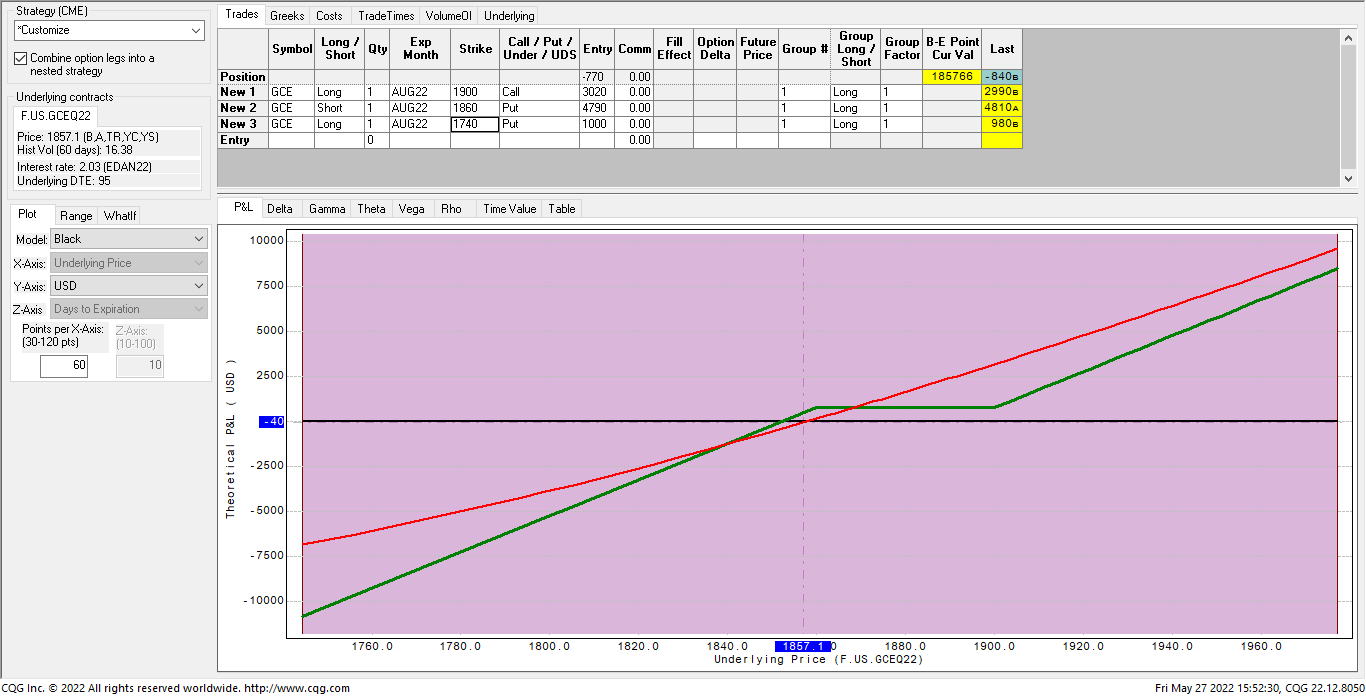

… moreOver the past few weeks, I’ve asked several options pros with over forty years’ experience about a specific options strategy that I developed for speculators which has limited downside risk and… more

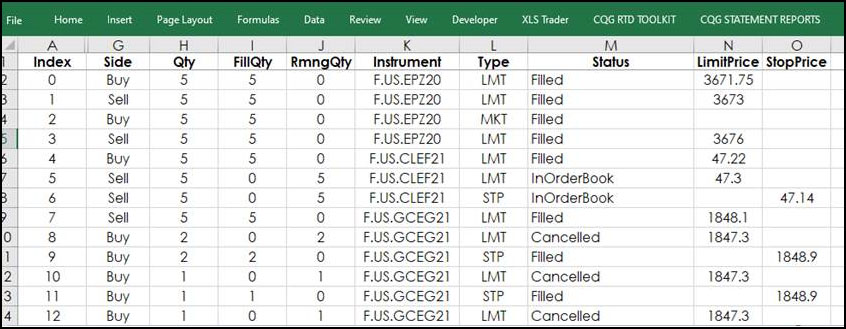

The CQG RTD Toolkit Add-in has been updated. This updated Excel add-in is automatically installed with CQG IC 21-12-8042 Beta and higher. The updates are to the Orders and Positions tabs. New… more

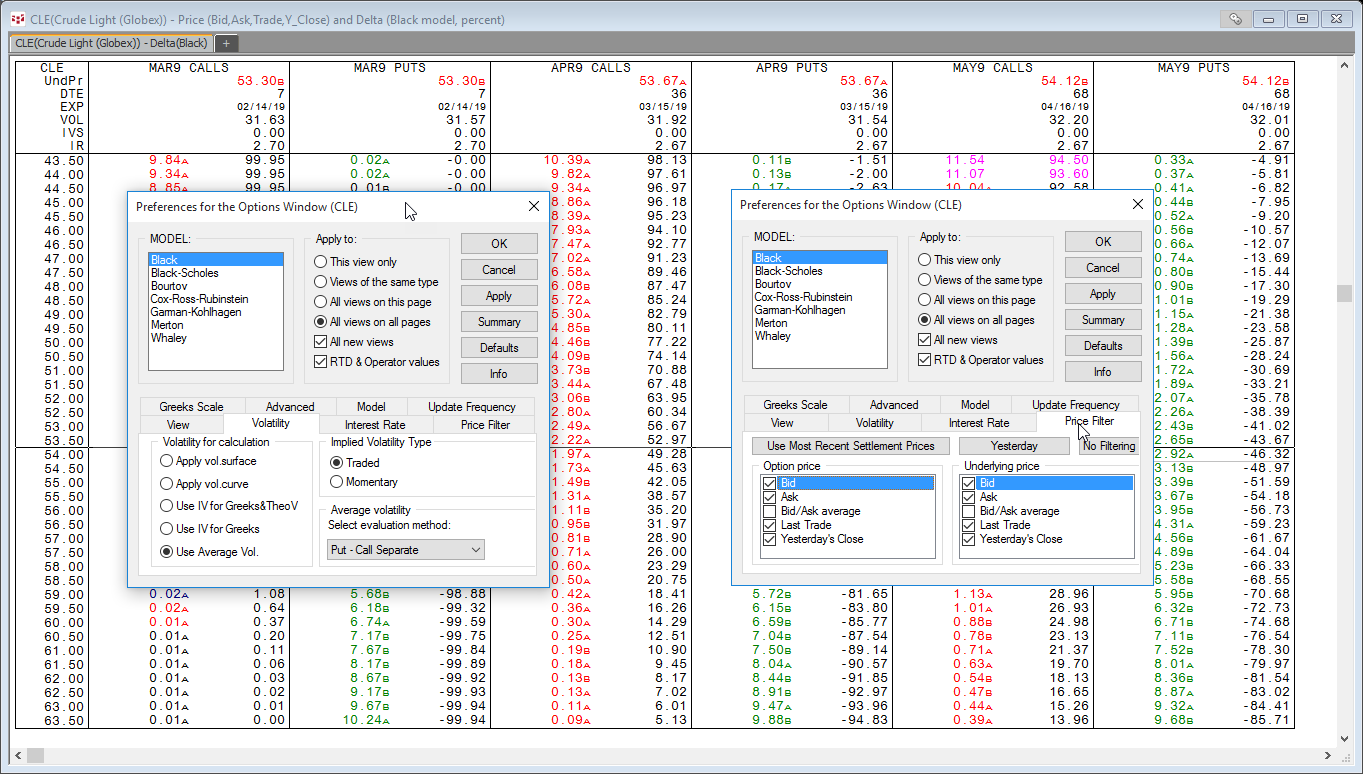

If you set up a Microsoft Excel® dashboard to monitor options prices and their respective deltas you may see the delta values disappear occasionally in the dashboard. In other words, the value for… more

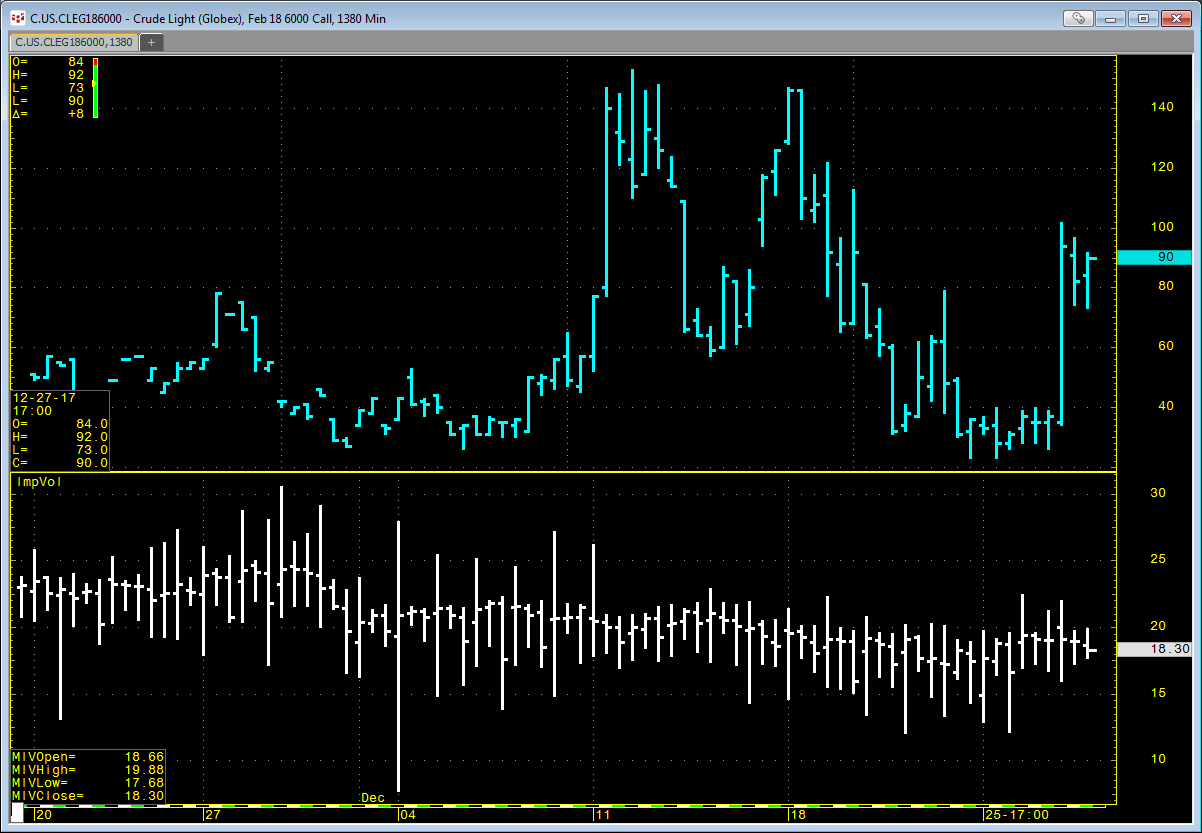

CQG offers an Implied Volatility (ImpVol) study that allows you to pull in historical implied volatility data onto a chart. ImpVol is not the implied volatility of one particular option.… more

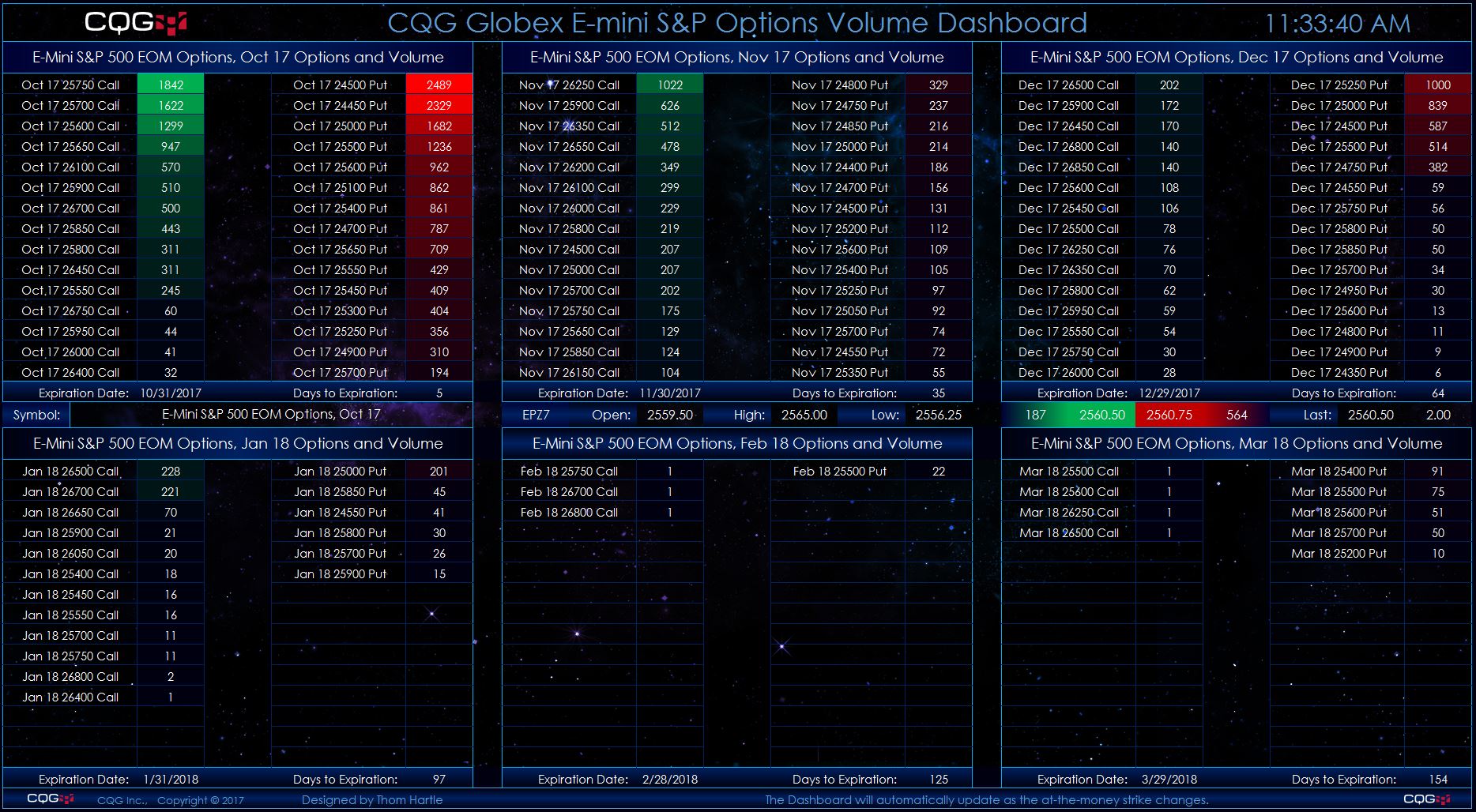

This Microsoft Excel® dashboard scans options on the E-mini S&P 500 futures market using the CQG RTD Toolkit for volume and displays strikes ranked by the volume traded for each listed expiry… more

Watch our recorded webinar to learn about the following services that CQG Integrated Client customers can access for free through the end of the year:

Market Scan Advanced OptionsOur… more

This Microsoft Excel® dashboard provides a drop-down menu where you can select the underlying market, such as E-mini S&P 500. The display will then show all front contract option symbols… more