Sometimes it is not necessary to write a complex trading system when you want to accomplish something minor in the trading environment. For example, CQG provides built-in trailing stop… more

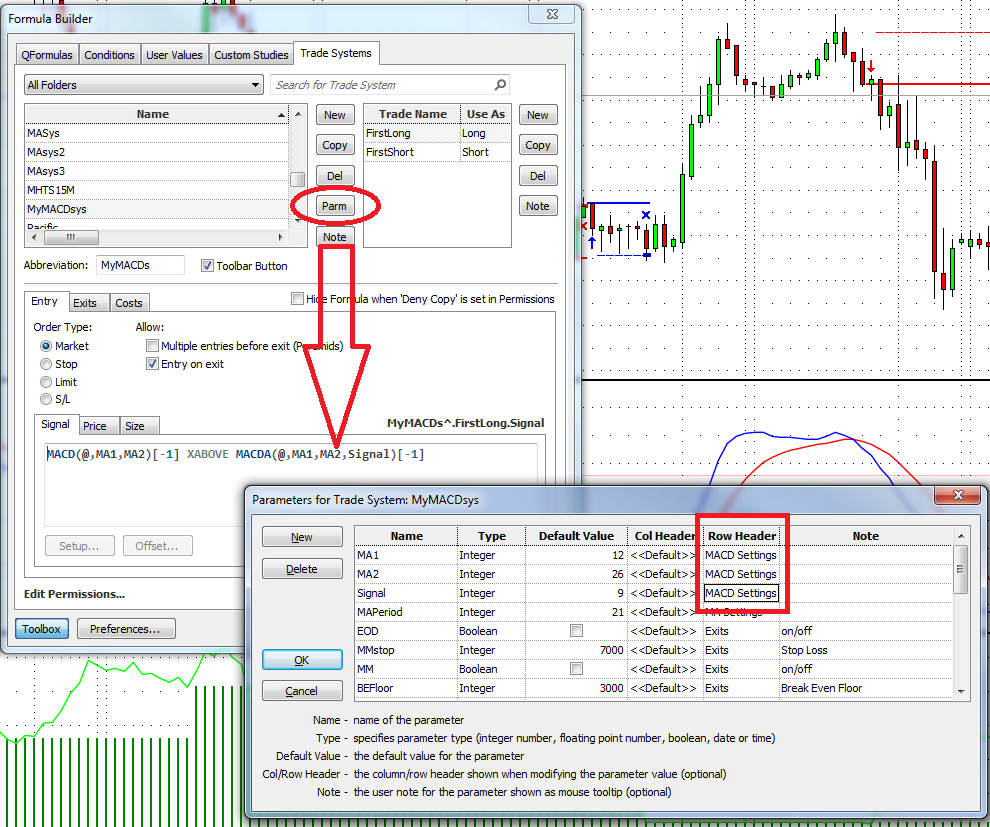

Trade Systems

This is a quick-start guide to building your own trading system based on the Super Template. The Super Template comes pre-installed with CQG Integrated Client. As a basic example, we will create a… more

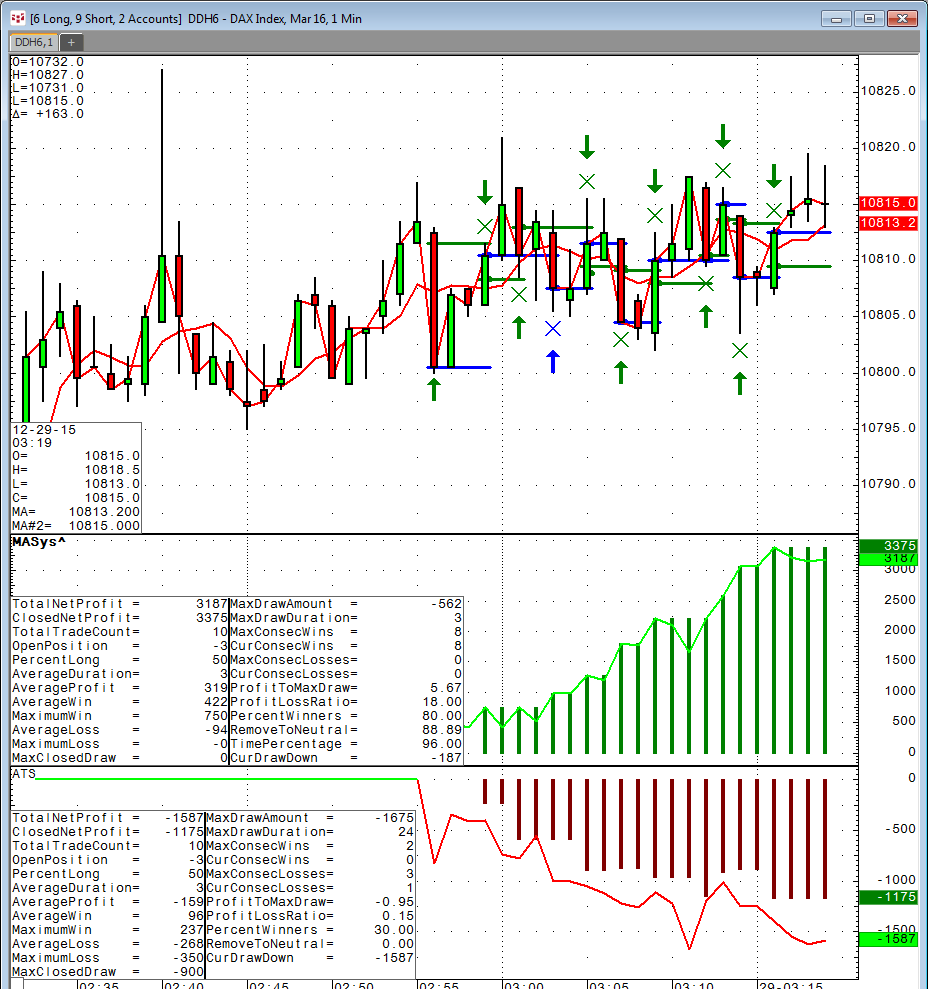

After supporting auto trading for one year now, it seems to be that understanding the difference between backtesting and real-time trading might be the biggest struggle. If your backtesting… more

CQG Integrated Client version 2015 offers sophisticated auto execution based on the CQG backtesting environment. Basically, all of your trading systems can be set to auto execution with only a few… more

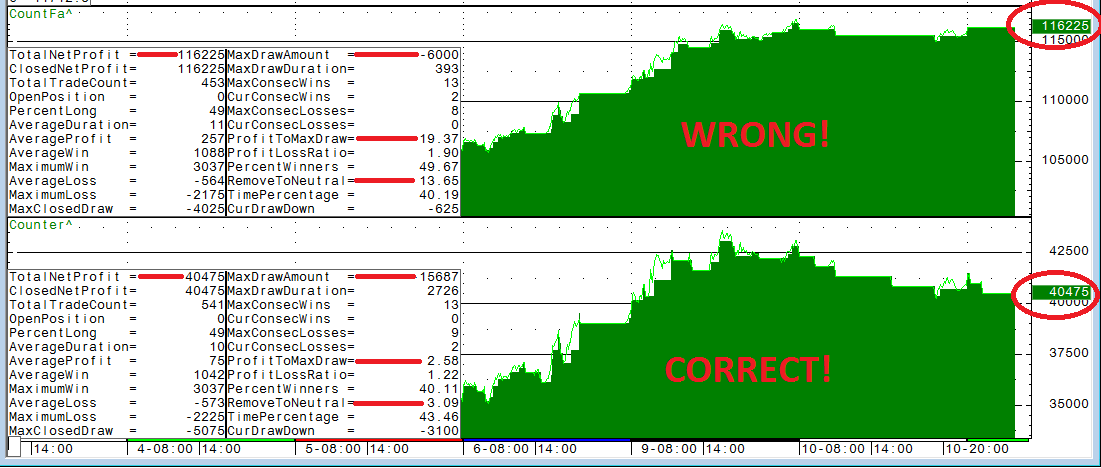

In this article I want to show how misleading a peak-ahead failure can be on a trading system.

I was working on a countertrend system and the backtesting results showed that it picked up… more

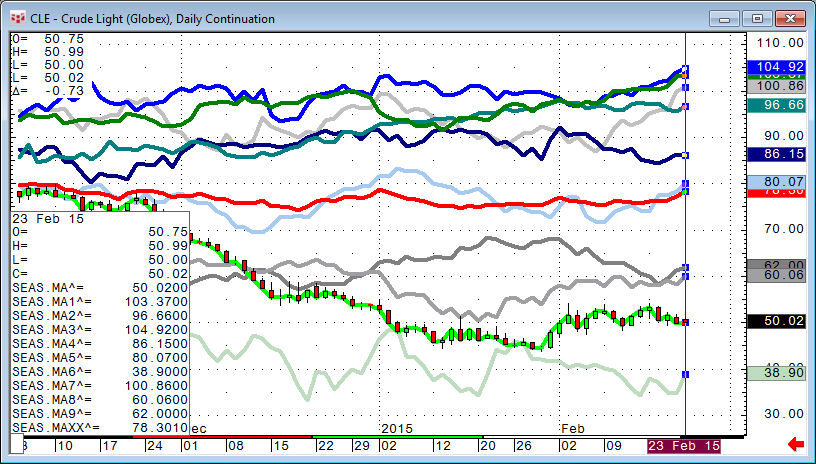

Quite some while ago I showed, in a very simple way, how to overlay 2011, 2012, 2013, and 2014 data in one chart. I created two very simple code snippets to accomplish that.

This time, I… more

A couple of months ago we looked into CQG's built-in Divergence Index and how to use it.

Following up on this topic, I want to show a much simpler approach using the Formula Toolbox.

… moreIn this article we take a look at two examples where trades are placed on or around significant lines. The first idea is to change the classic daily pivot lines into intraday pivot lines and trade… more

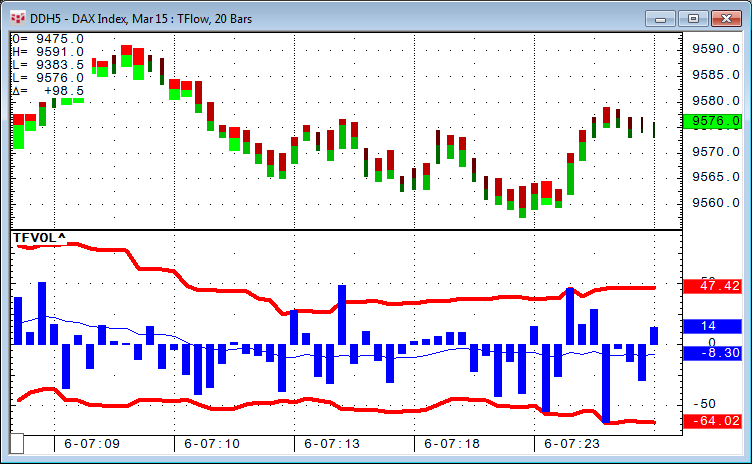

Recently, we had a request to show, in real time, how many contracts are available on the buy and sell side in the order book. This can be accomplished with a very simple study: DOM Ask Volume (… more

In this article, we will review a CQG indicator that has been available for many years and is still very relevant. It is possible to find divergence using the CQG formula toolbox, but it usually… more