CQG offers a collection of conditions you can use to mark points on a chart when the condition is met. In addition, you can create your own custom conditions. You can easily bring conditions… more

Thom Hartle

This Microsoft Excel® dashboard displays market data for cocoa spreads traded on the ICE platform using a matrix-style format. The outrights are along the top row and at the start of each row. The… more

This Microsoft Excel® dashboard displays market data for coffee spreads traded on the ICE platform using a matrix-style format. The outrights are along the top row and at the start of each row.… more

You can use LocalHour and LocalMinute functions in the RTD formula to pull in the open price for a market using a 5-minute bar at 12:00. This technique was detailed in a previous article here.… more

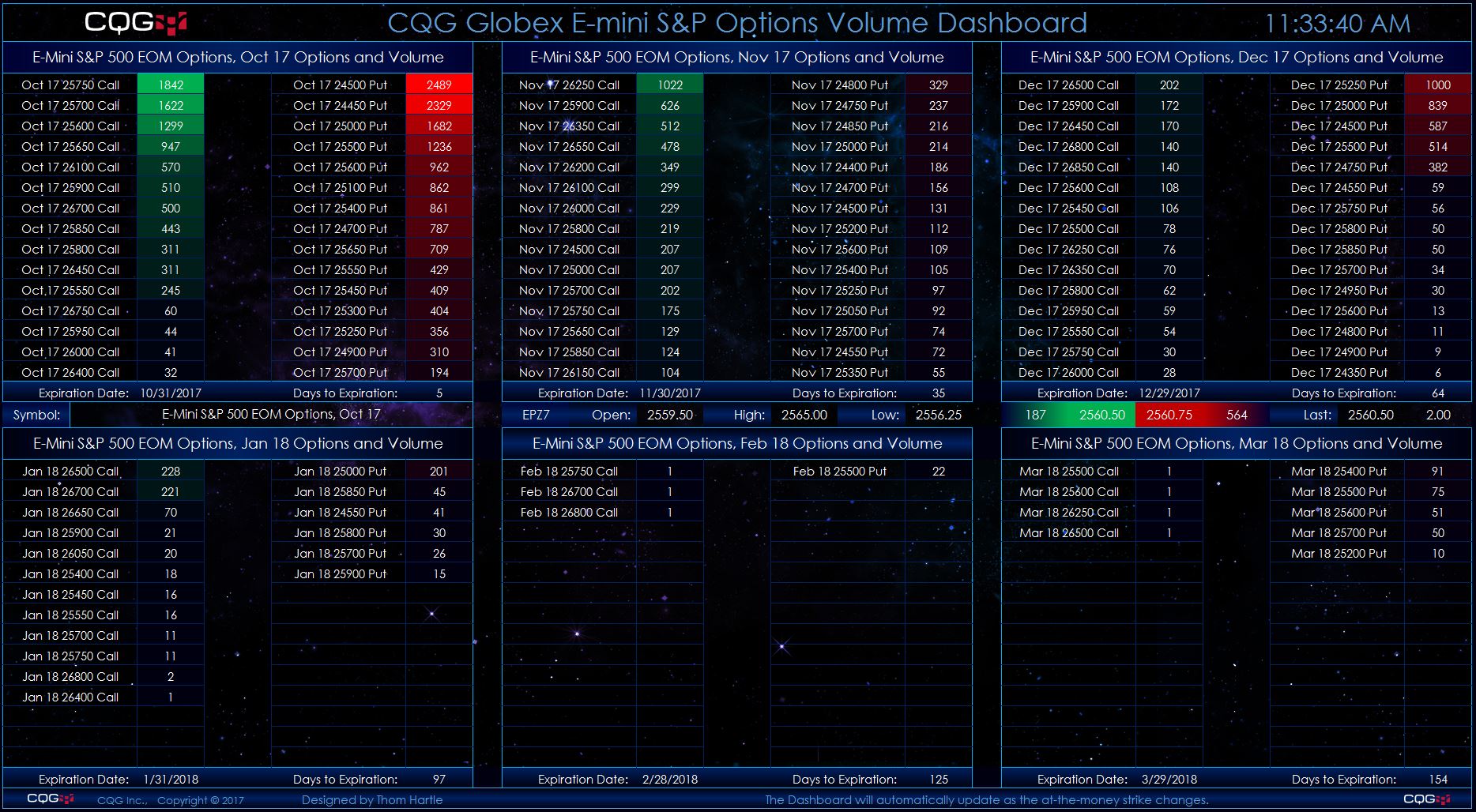

This Microsoft Excel® dashboard scans options on the E-mini S&P 500 futures market using the CQG RTD Toolkit for volume and displays strikes ranked by the volume traded for each listed expiry… more

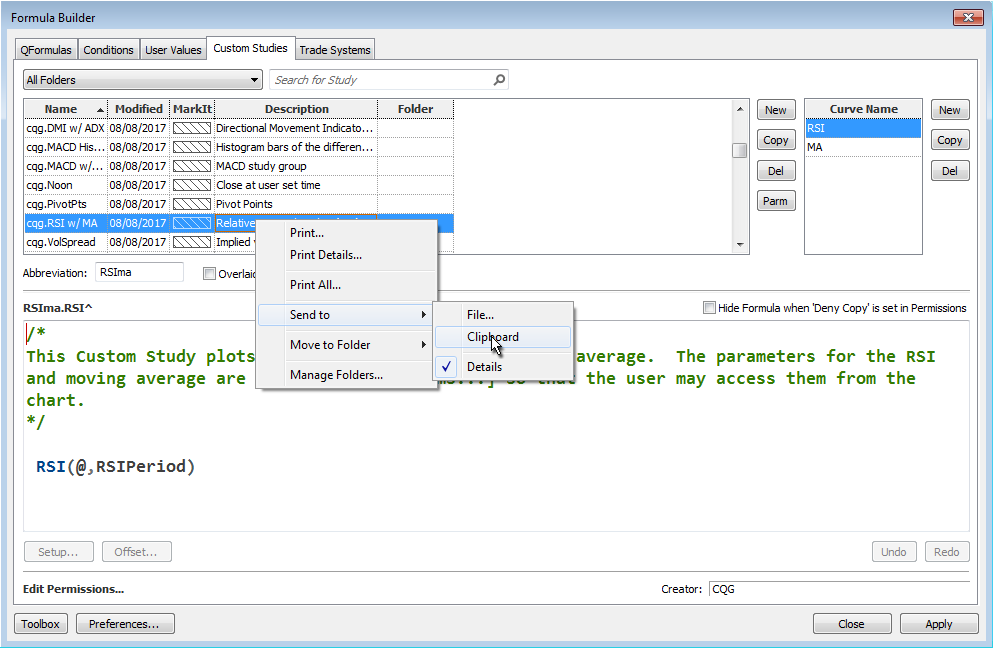

There are numerous Excel samples that walk you through bringing various market data into Excel using RTD formulas. However, there is a lot to look through. One solution is to use the CQG Formula… more

This Microsoft Excel® dashboard presents different styles of viewing market and study information. The left-hand side is today's current market data. You can enter symbols and set the number of… more

This Microsoft Excel® dashboard has three tabs. The first tab displays today’s market quotes, volume, and open interest data. If the last price is matching the open price, then the open price… more

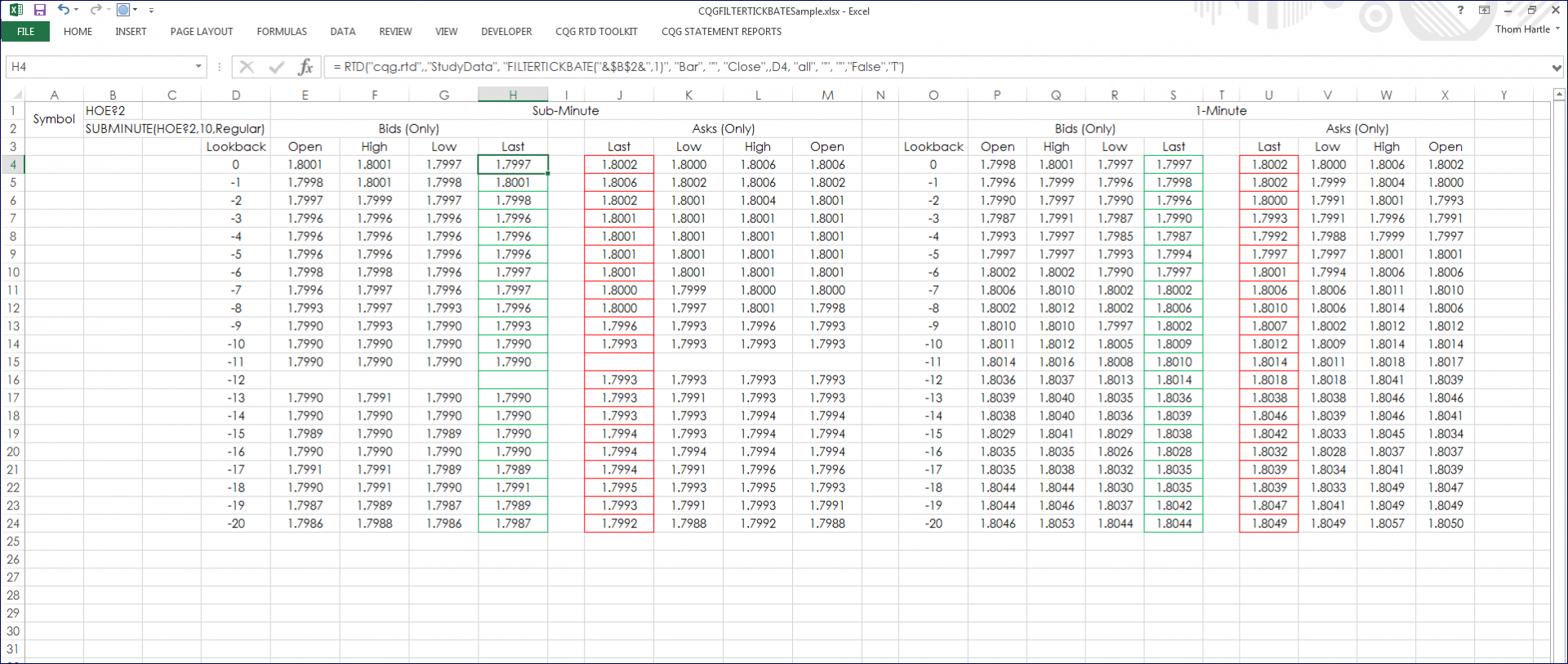

CQG charts have a setting called the BATS Charts Preferences. Here, you select what data to use to build the chart. You can use the default setting where the chart is built using trade and… more

These two Microsoft Excel® spreadsheets present Globex crude oil market data and forward curves, both current and historical. Two dashboards are available: The first the data includes outrights… more