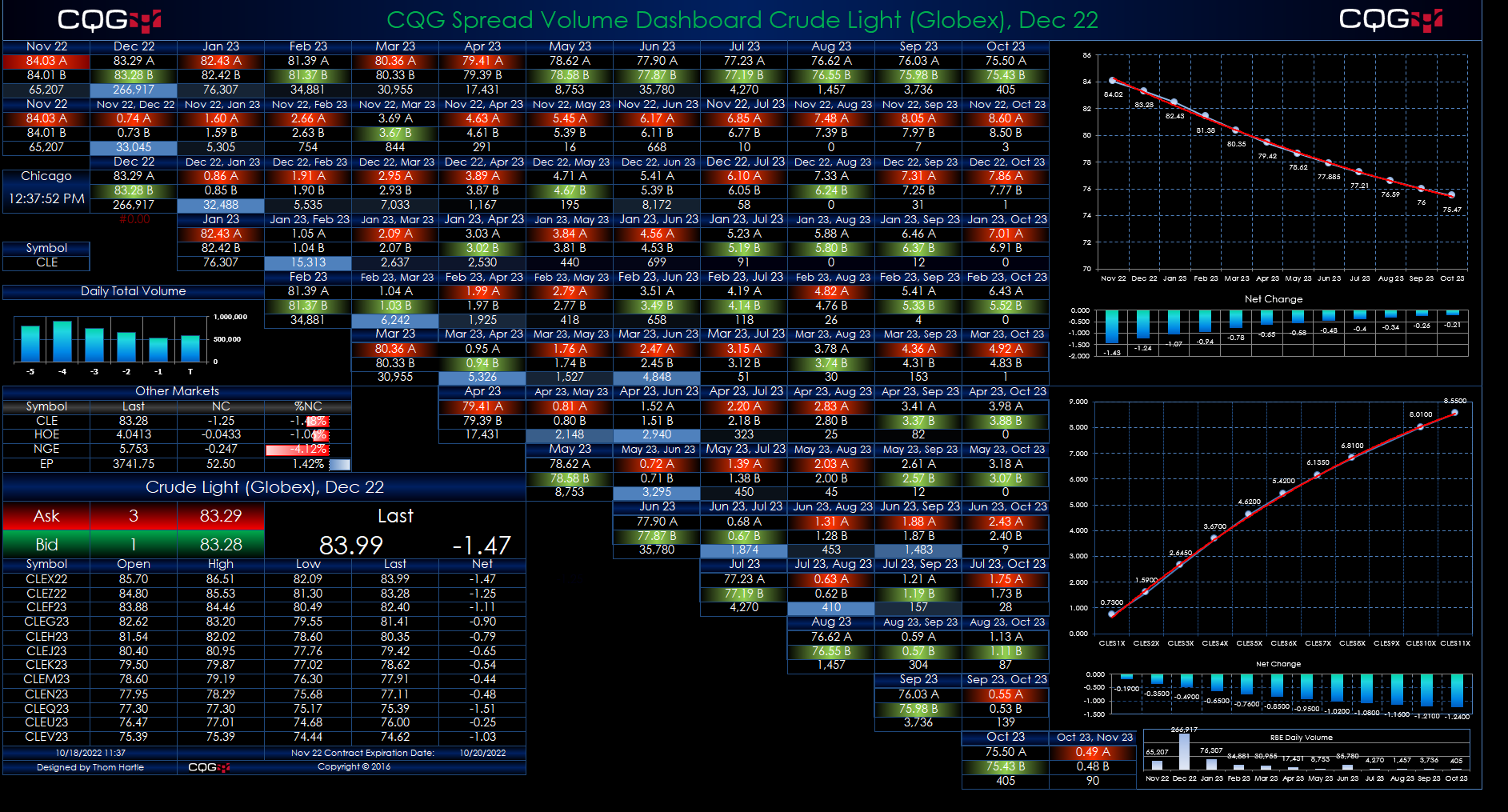

This Microsoft Excel® dashboard displays exchange traded spread market data for a user input symbol. The Excel dashboard uses the CQG RTD Toolkit Add-in, which is installed with CQG IC or CQG… more

Workspaces

This Microsoft Excel® spreadsheet uses the CQG XL Toolkit to pull in market data based on the symbol entered by the user. The XL Toolkit requires the customer’s FCM enable it. The data is pulled… more

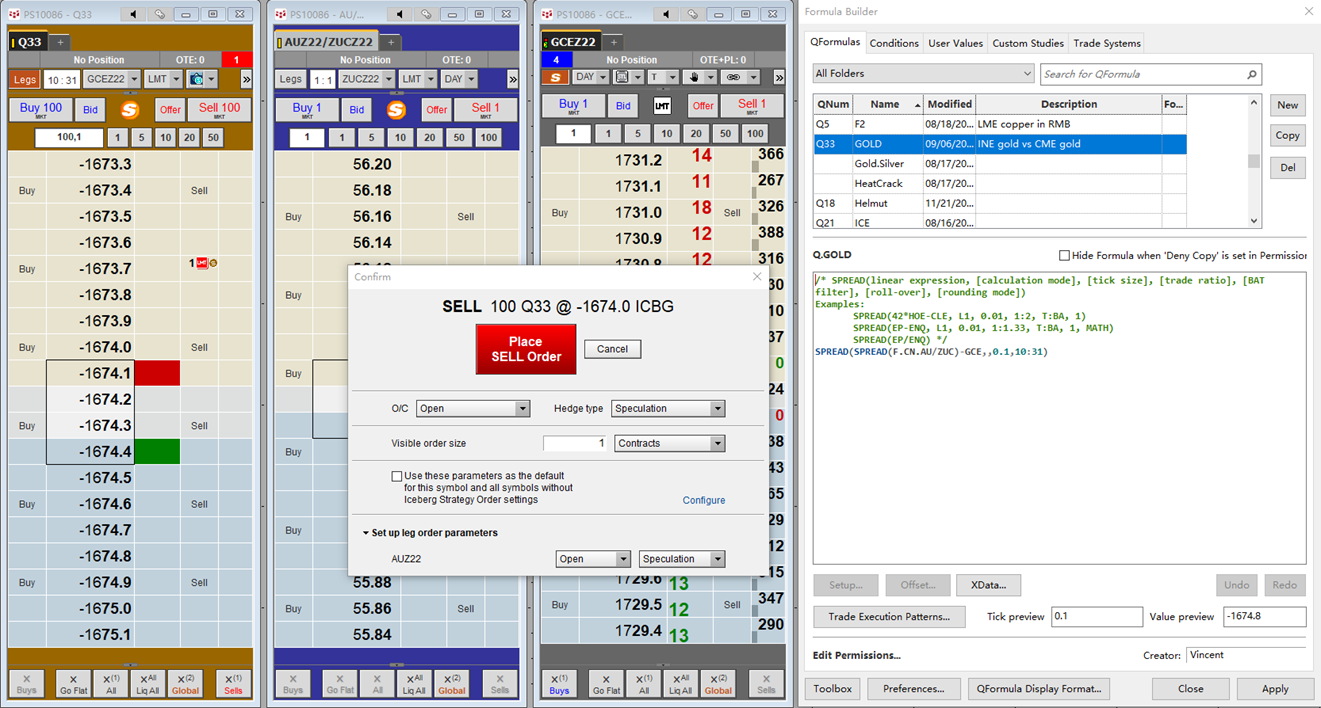

Shanghai Futures Exchange (SHFE) has announced approval for participation of Qualified Foreign Institutional Investors (QFII) and RMB Qualified Foreign Institutional Investors (RQFII) in commodity… more

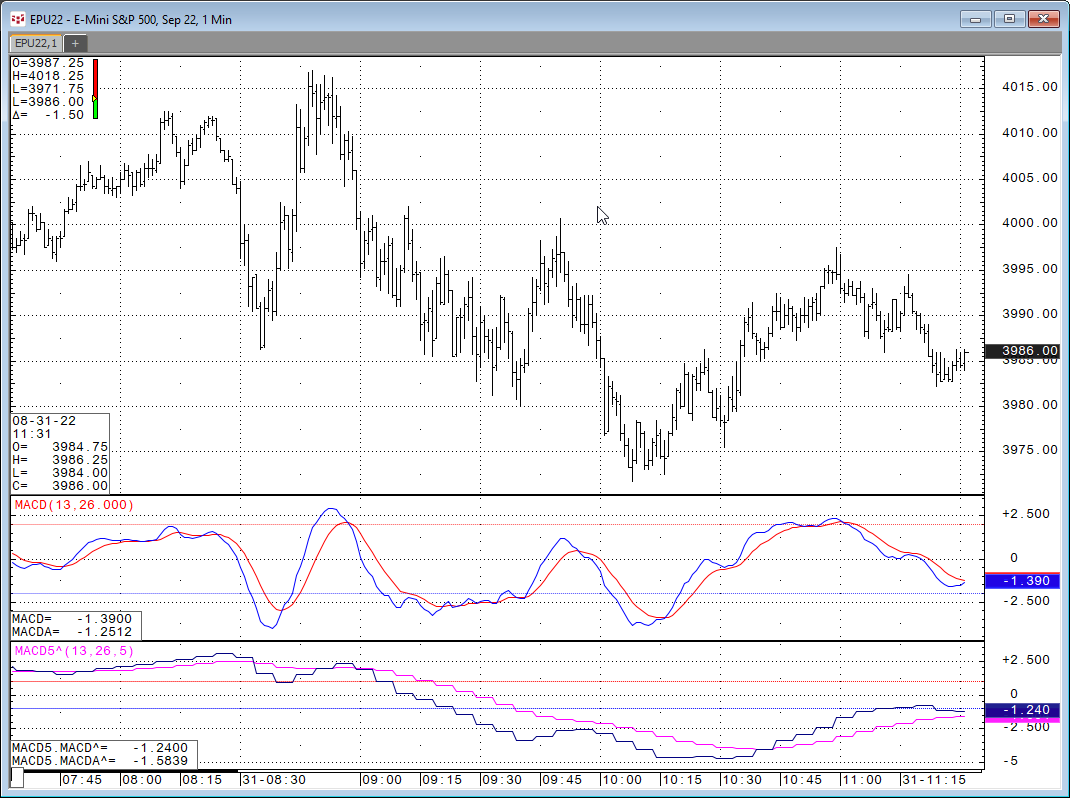

Let's say you want to look at a study on a chart but you want the study to use a different time frame than the time frame for the bars. For example, the MACD Study on a 1-minute chart using 5-… more

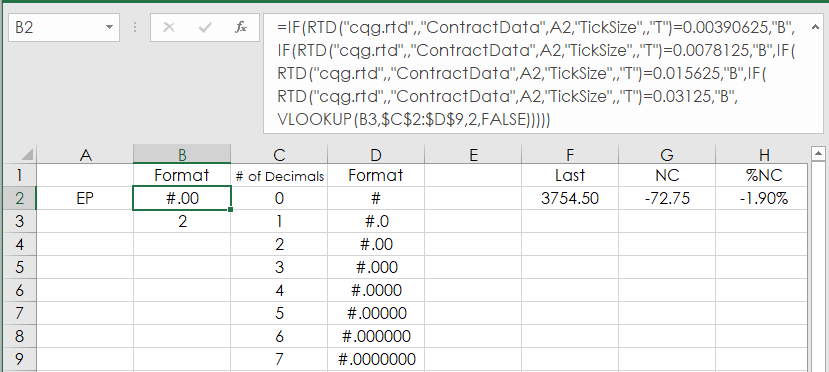

When using RTD functions in Excel to pull in market prices you have to manually format the prices. Excel does not know that the E-mini S&P 500 price has two decimals places (i.e. 3909.25) and… more

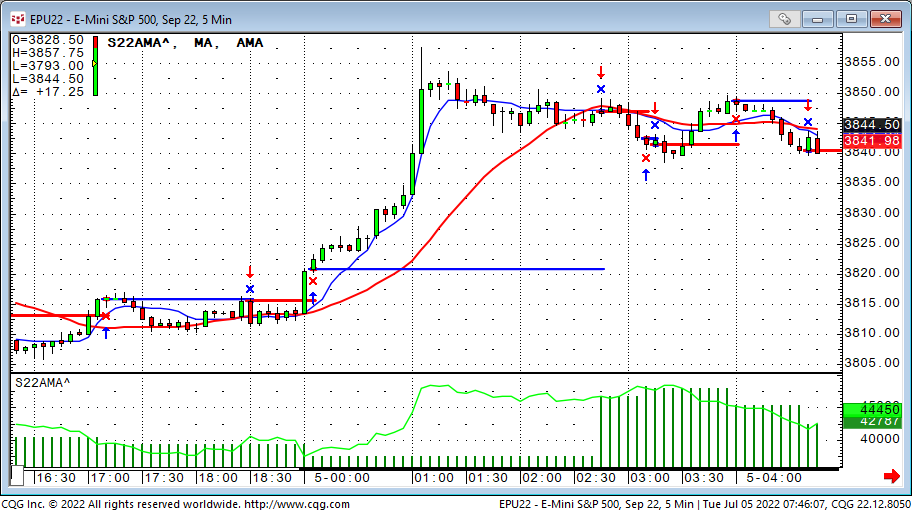

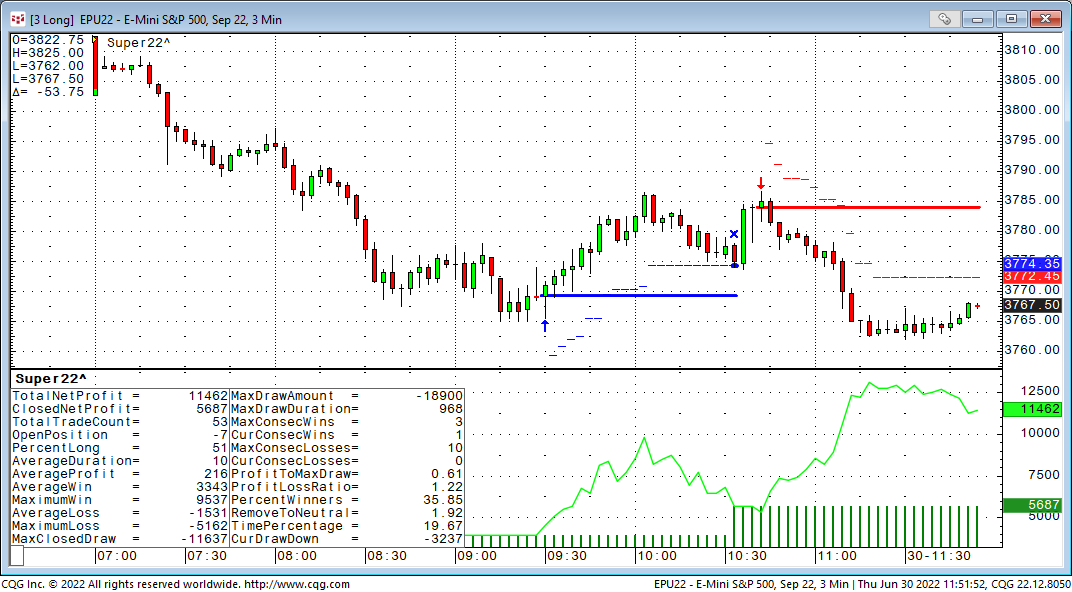

In July 2022 CQG Product Specialist Helmut Mueller updated his Super Template, which is a sample trading system ready to run that has a long and short entry, and many programmed different exits.… more

It has been a while since I introduced the Super Template as a shortcut to build trading system inside CQG. In a nutshell, the Super Template is a trading system ready to run, that has a long and… more

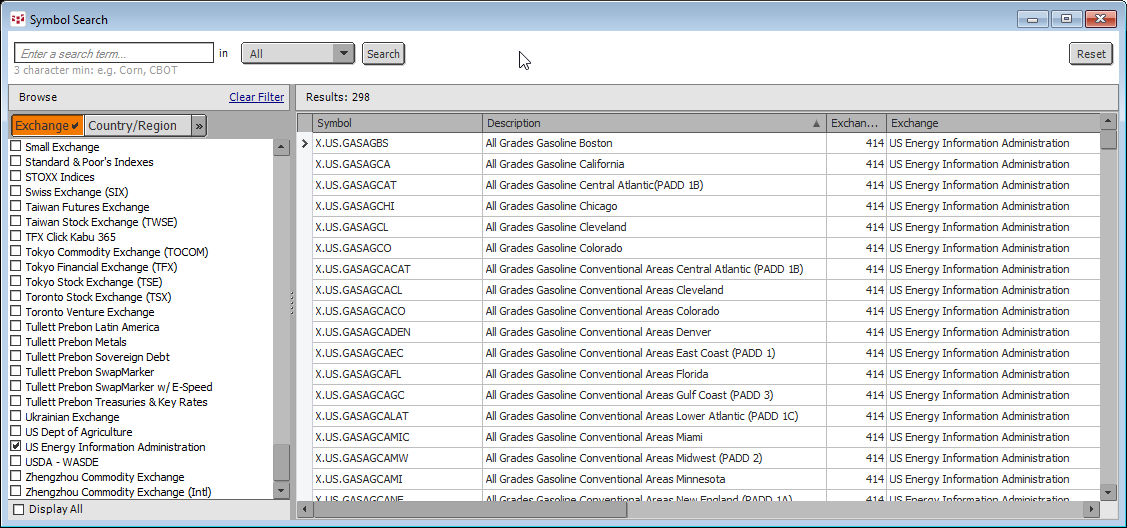

The CQG Data Quality team has added the US Weekly Retail Gasoline and Diesel Prices including the PADD1 to PADD 5 numbers published by the US Energy Information Administration (EIA). There are a… more

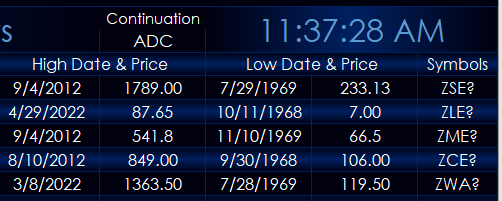

This post details a custom CQG study for pulling a market’s all time high price and date and the market’s all time low price and date.

The custom study was built by CQG’s Product Specialist… more

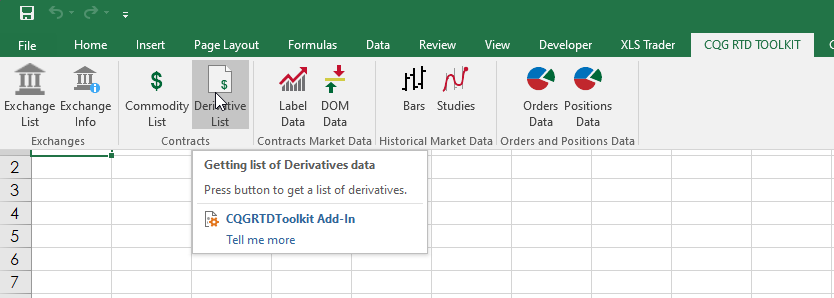

The CQG RTD Toolkit is an Excel Add-in installed with CQG IC and QTrader. This post details how to pull contract information: specifically the First Notice Date and the Expiration Date for a list… more