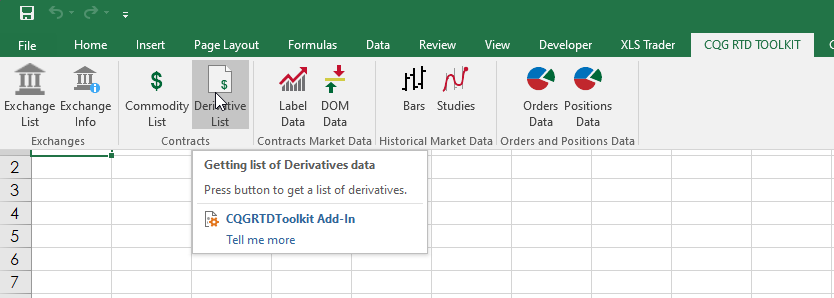

The CQG RTD Toolkit is an Excel Add-in installed with CQG IC and QTrader. This post details how to pull contract information: specifically the First Notice Date and the Expiration Date for a list… more

Workspaces

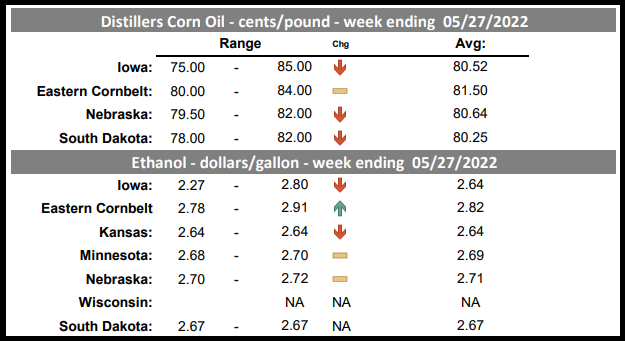

The CQG Data Quality Team has added the USDA Daily Ethanol Report found under USDA in the CQG Symbol Finder. Thirty-four new symbols are available. At the bottom of the post is a CQG PAC that… more

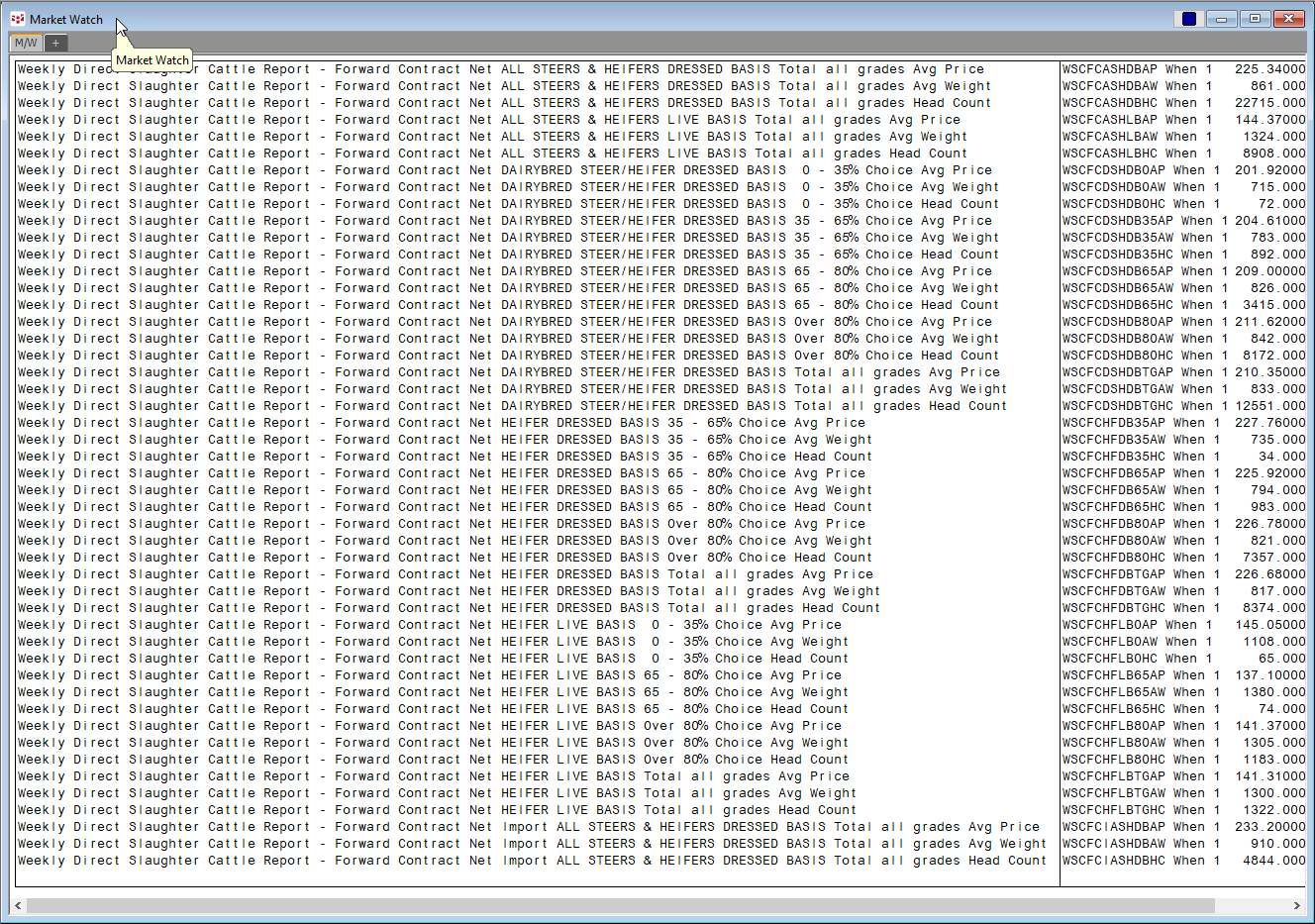

The CQG Data Quality Team has added over 1,000 USDA Cattle Market reports. The symbols are found under the USDA-WASDE group in the CQG Symbol Finder when searching for Cattle.

In… more

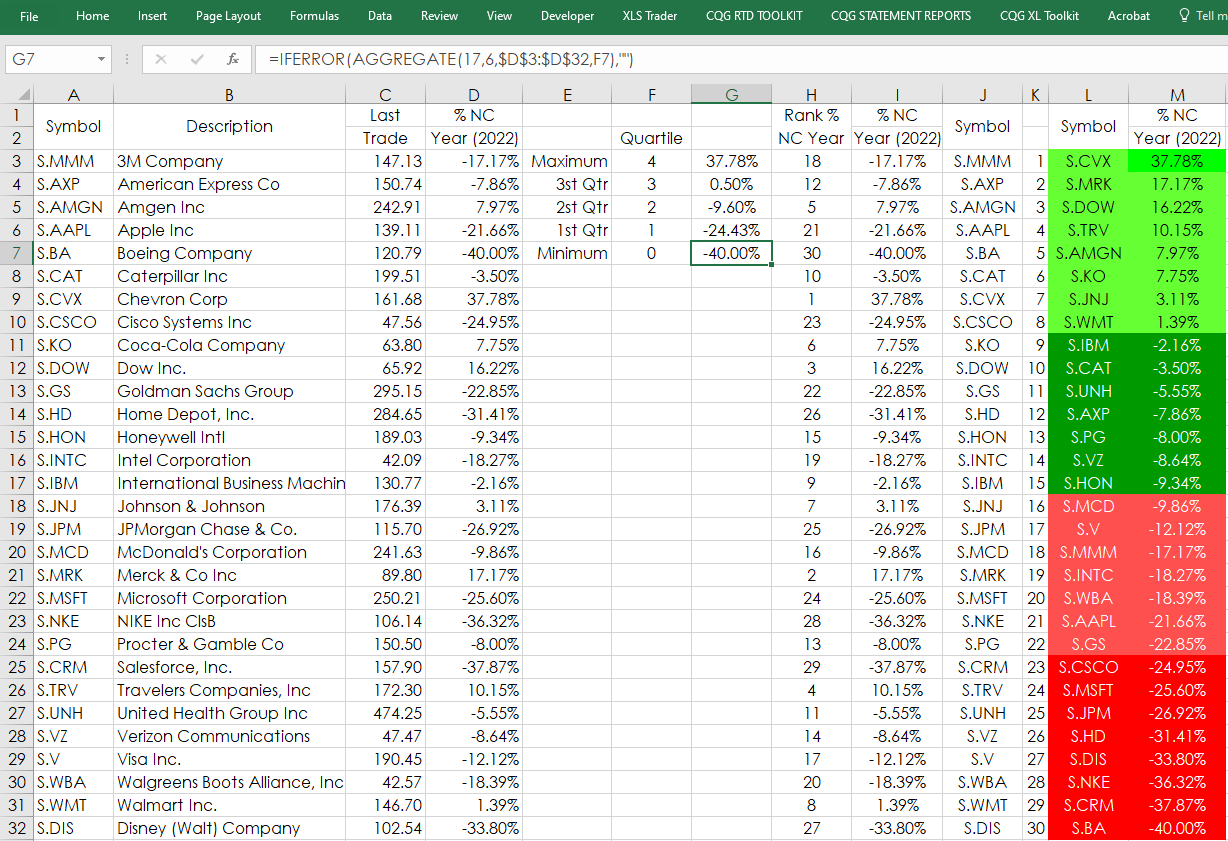

The Excel AGGREGATE function returns an aggregate calculation such as AVERAGE, COUNT, COUNTA, MAX, MIN, PRODUCT, etc., applied to a list of data while optionally ignoring hidden rows and errors.… more

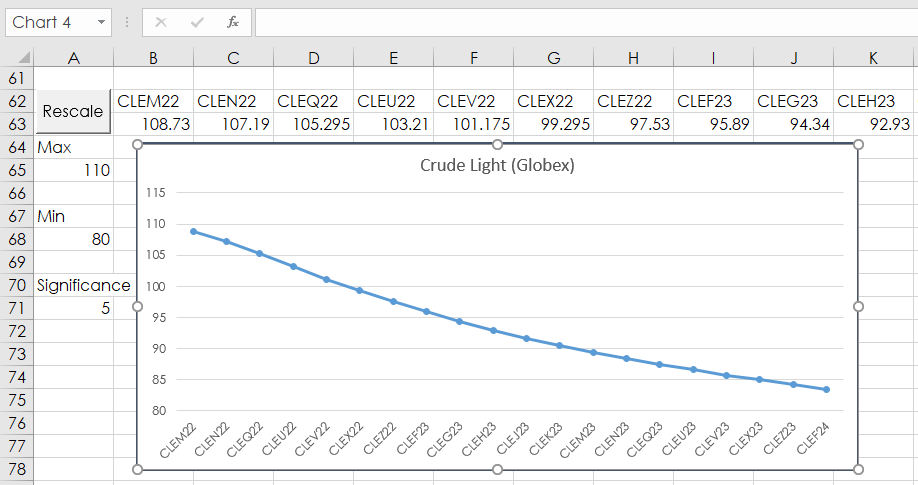

Monitoring market data in Excel may be enhanced by including Forward Curve charts. However, there are issues with Excel charting and the purpose of this post is to offer solutions using Excel… more

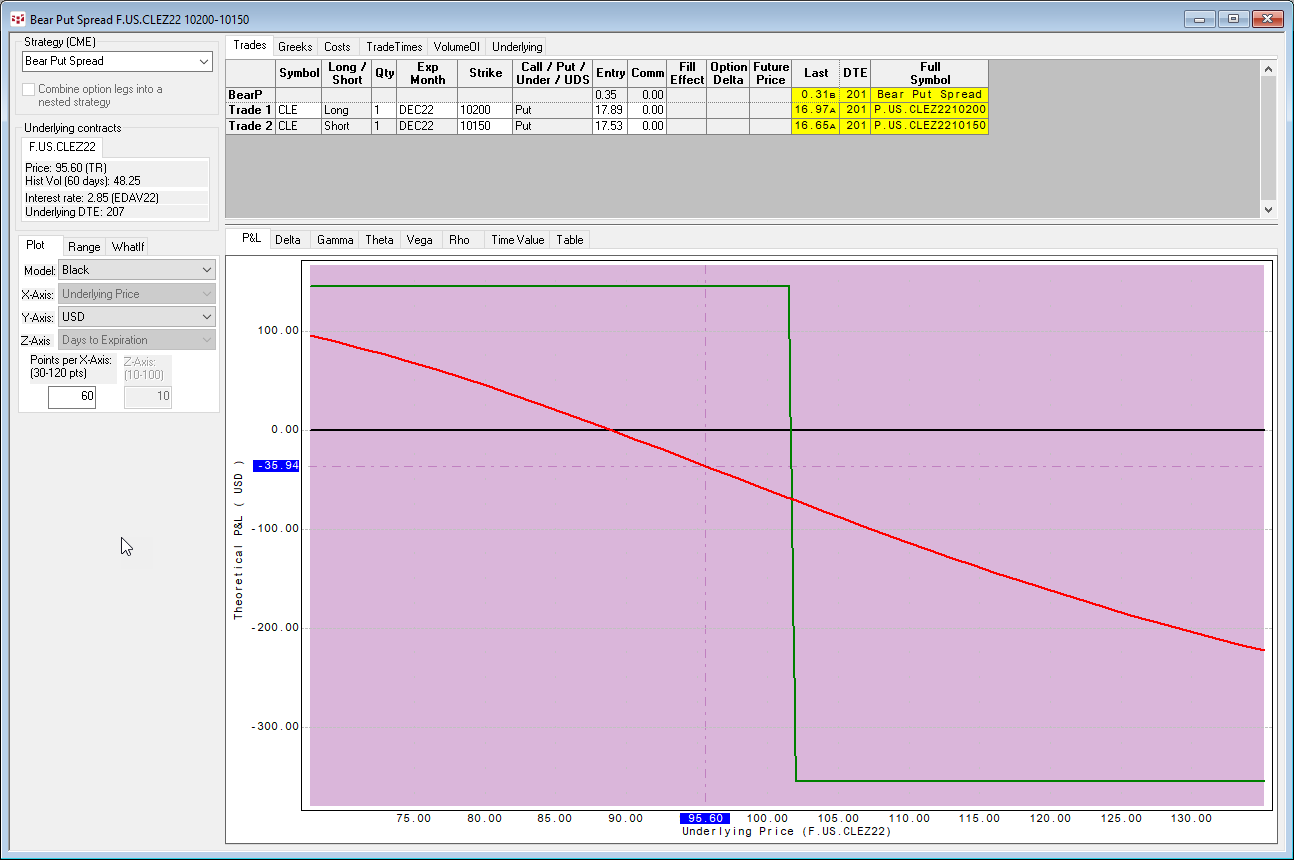

The UDS functionality in CQG Version 2022 has been significantly updated with many more strategies, as well as the available strategies are now grouped by exchanges. This post introduces UDS… more

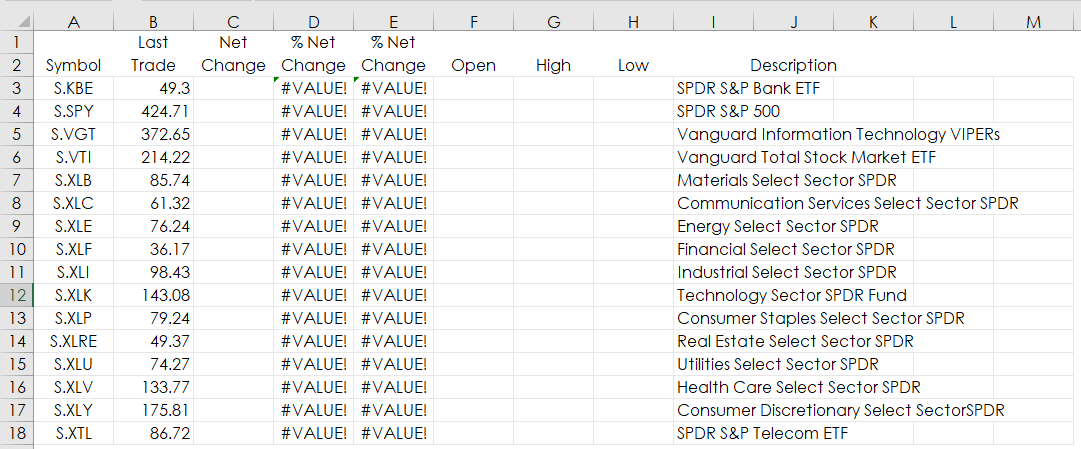

When designing Excel quote dashboards there should be a commitment to have it be a clean looking dashboard. However, sometimes an RTD call for market data can generate an error in Excel. For… more

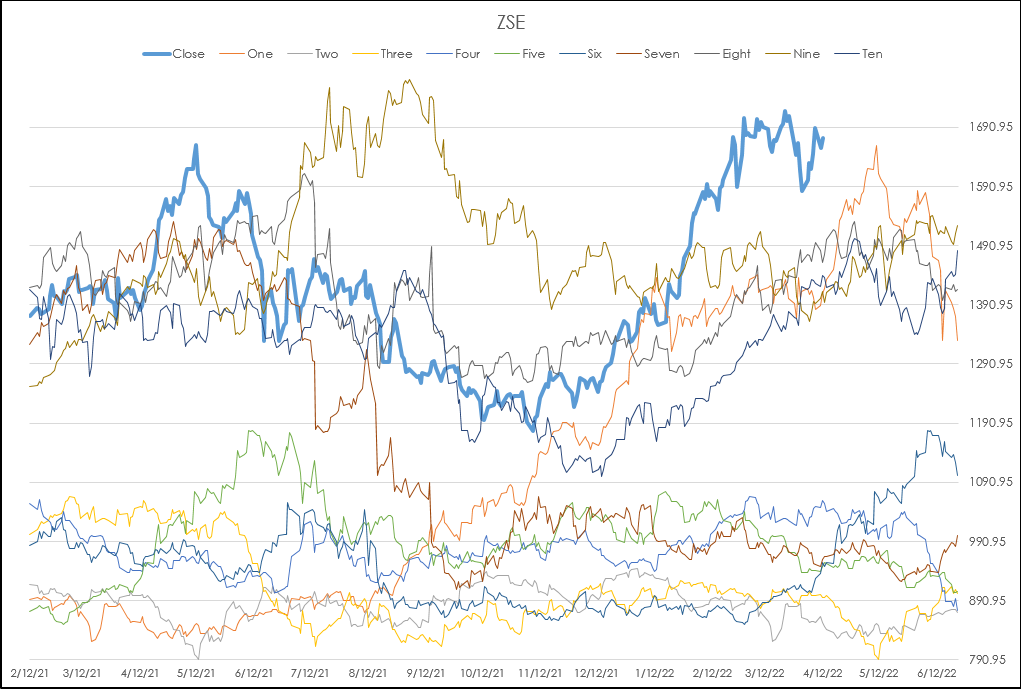

CQG offers the Seasonal Study for comparing the current market price action to the previous 10 individual years as line charts overlaid on the daily bar chart as shown below. In addition, the… more

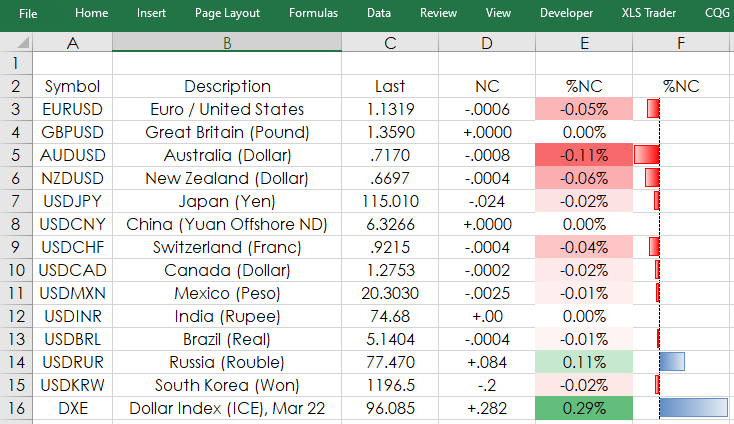

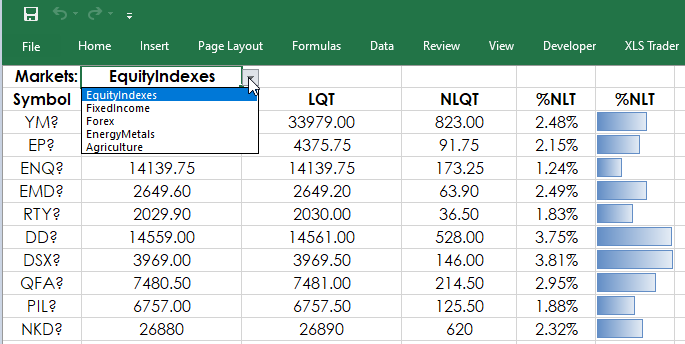

Microsoft Excel spreadsheets have functionality to format cells based on conditions. This feature is also referred to as data visualization. This post details two types of data visualizations… more

This post walks you through using Microsoft® Excel’s Indirect function and other Excel features to make usable Quote Dashboards. The provided sample Excel spreadsheet is unlocked.

Consider… more