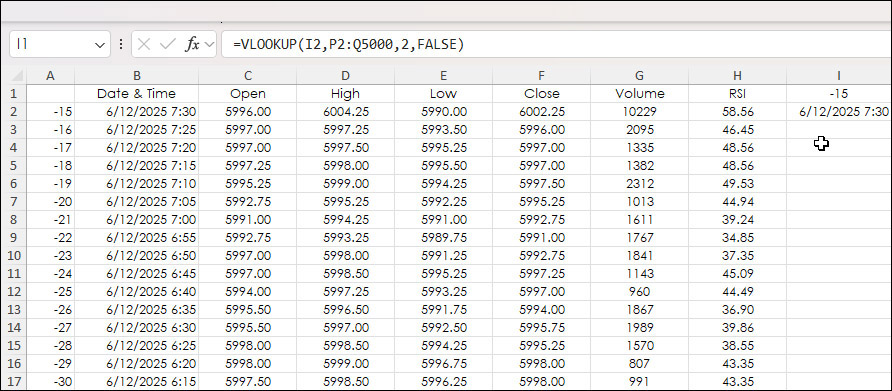

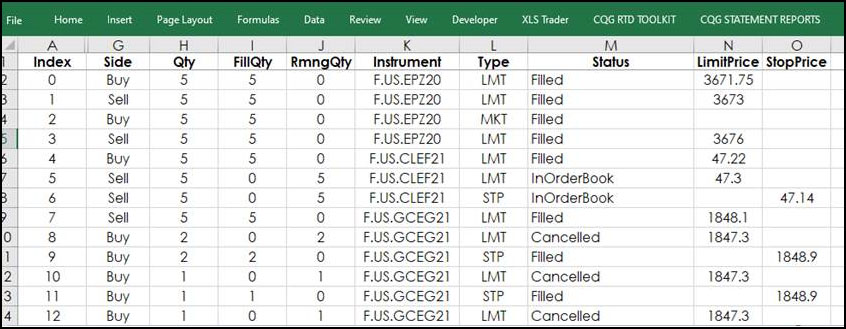

A typical historical Excel RTD dashboard pulls in market data using the bar index parameter. Below, the bar index is in column A. The most current bar is "0". The previous bar is "-1", etc.

… moreOptions

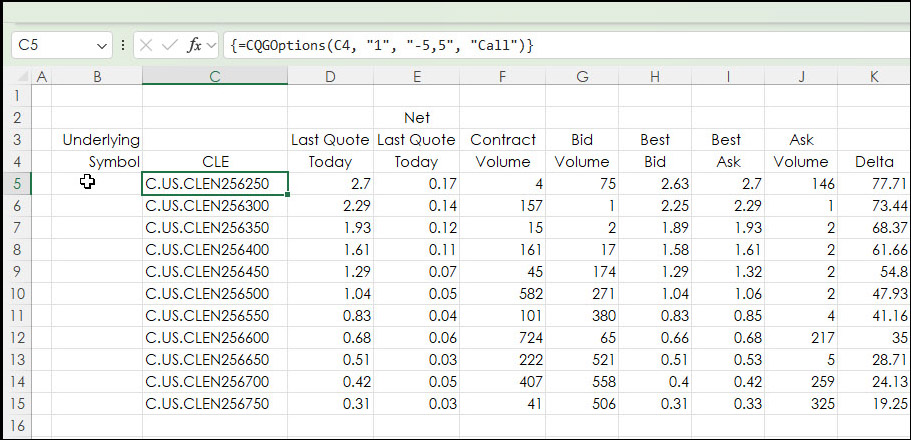

This post walks the reader through building option chains in Excel. The CQG RTD Toolkit offers this functionality, however, the same feature can be implemented using Excel's CONCATENATE function.… more

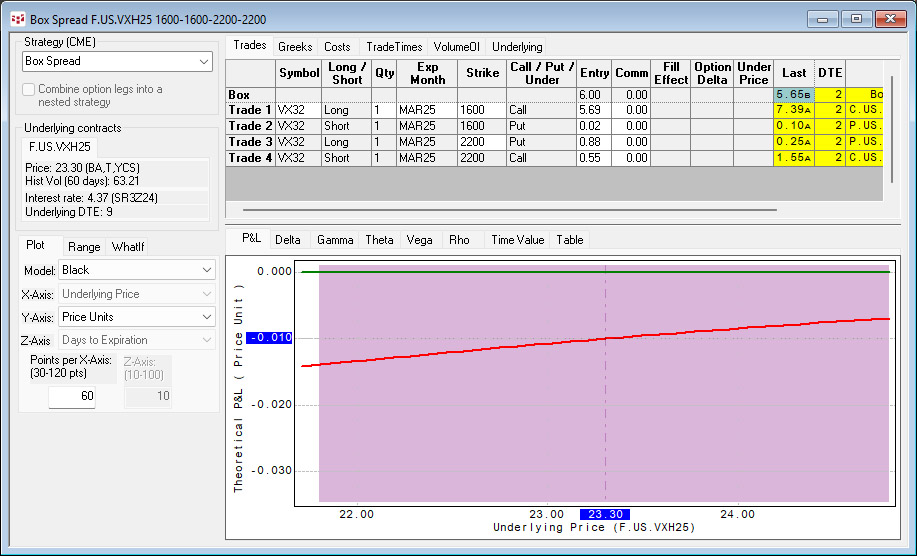

October 14, 2024, the Cboe launched weekly options on the Cboe VIX futures. To find the symbols in IC or QTrader, open the Symbol Search, select Cboe Futures Exchange (CFE), sort the Asset column… more

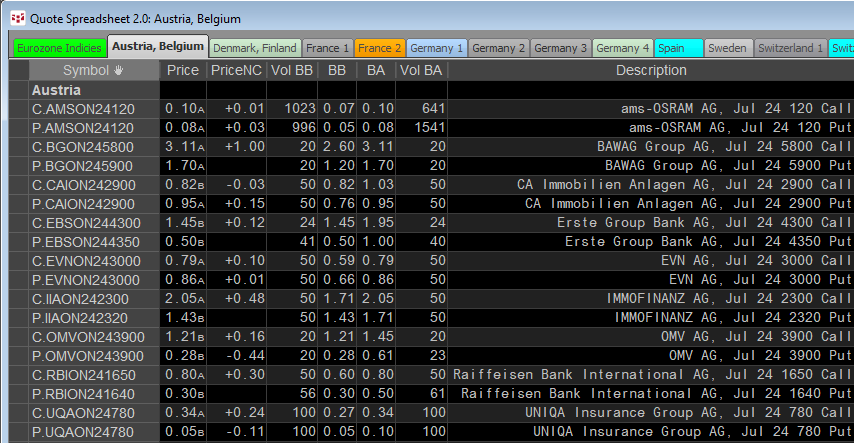

Cboe Europe Derivatives (CEDX) is a European derivatives marketplace which enables participants to access equity derivatives markets for quotes and trade execution.

CEDX offers a… more

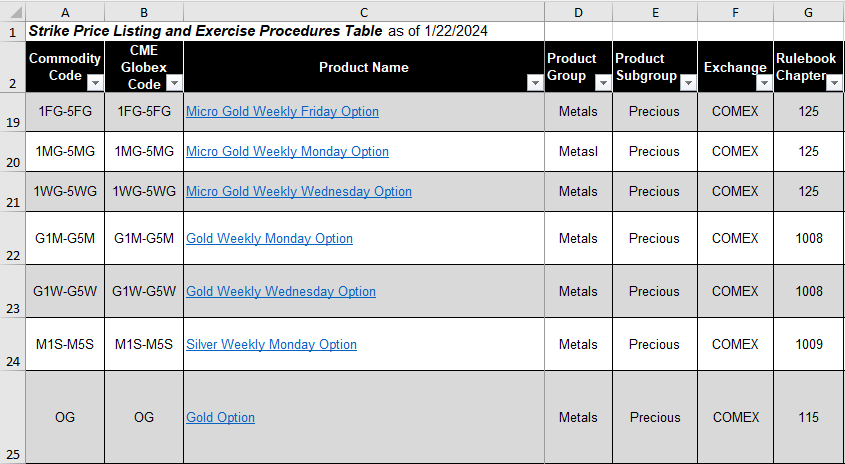

The CME Website has information resources for options traders in the form of downloadable Excel tables with important needed details such as:

Commodity CodeCME Globex CodeProduct NameProduct… moreThe CQG RTD Toolkit Add-in has been updated. This updated Excel add-in is automatically installed with CQG IC 21-12-8042 Beta and higher. The updates are to the Orders and Positions tabs. New… more

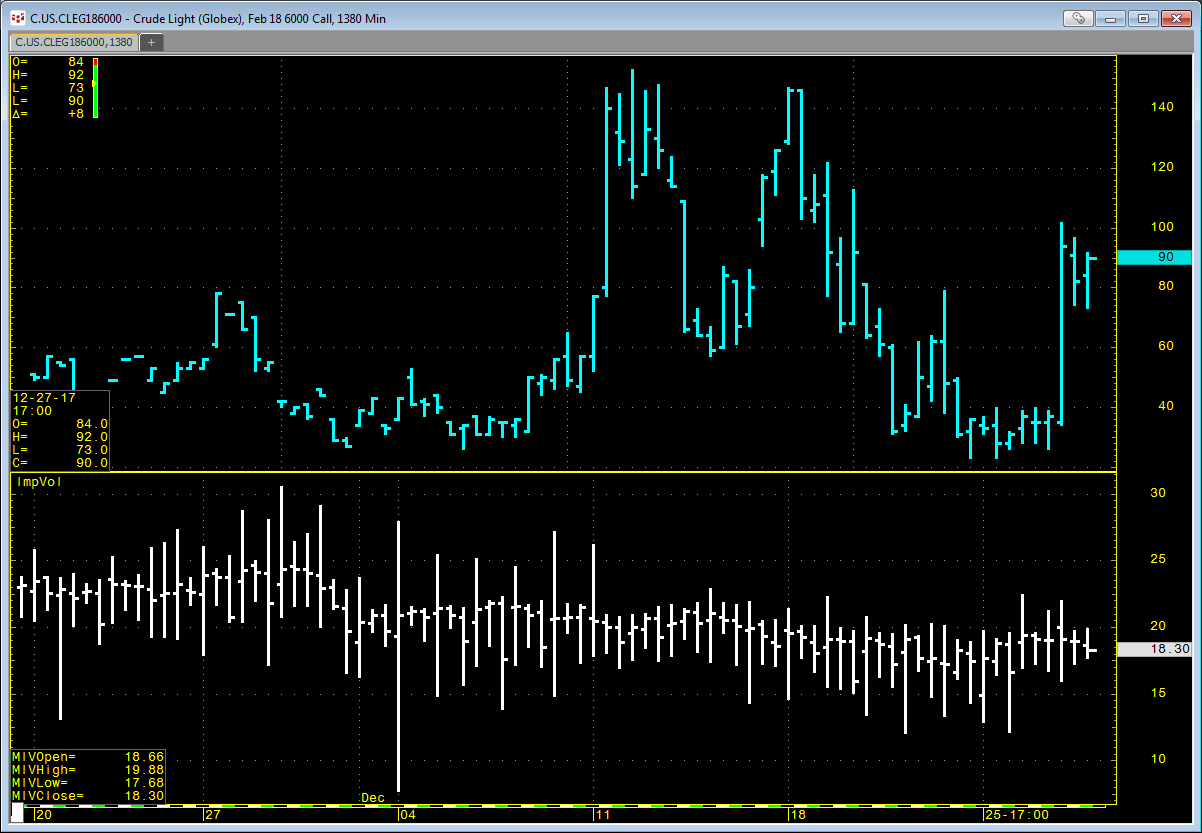

CQG offers an Implied Volatility (ImpVol) study that allows you to pull in historical implied volatility data onto a chart. ImpVol is not the implied volatility of one particular option.… more

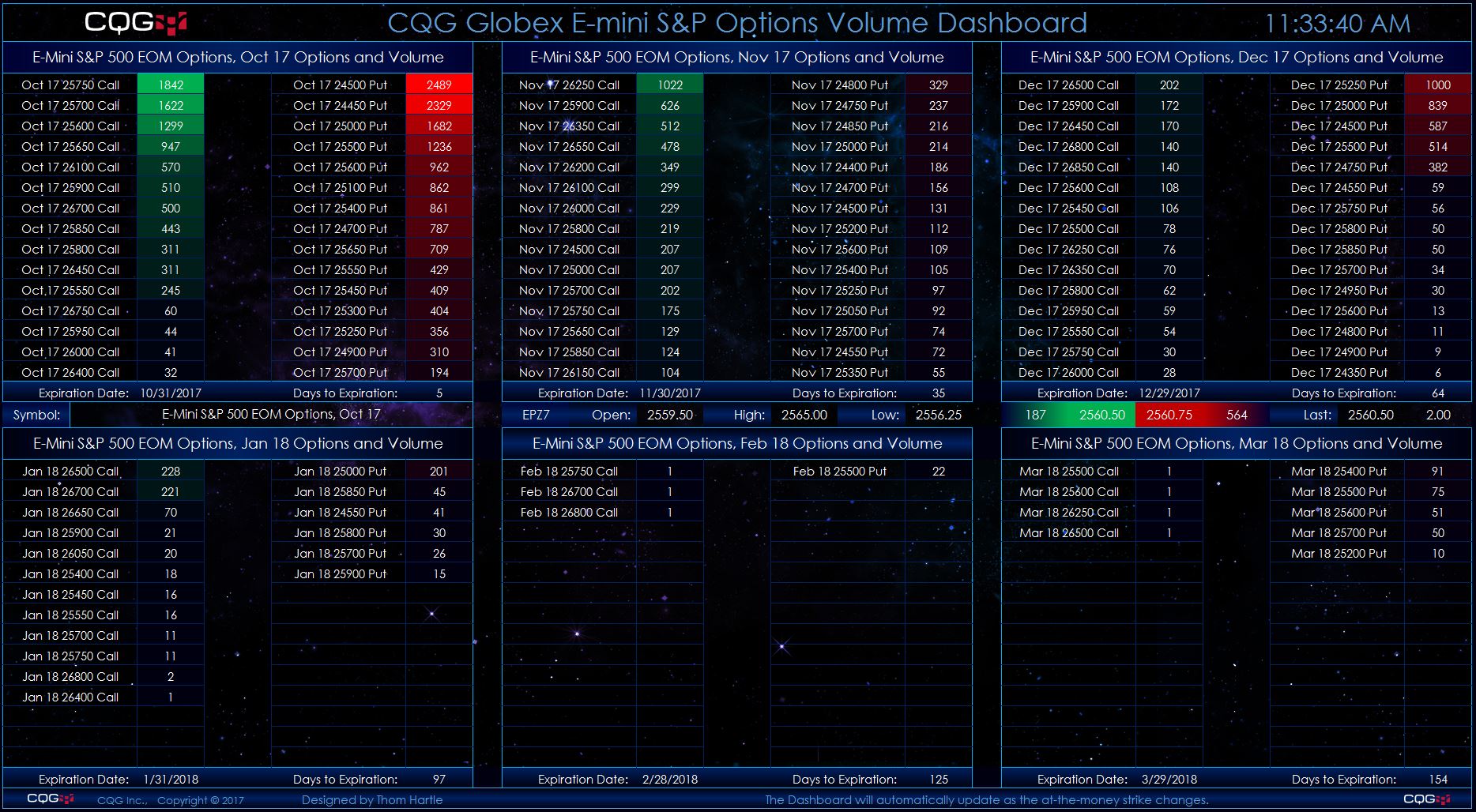

This Microsoft Excel® dashboard scans options on the E-mini S&P 500 futures market using the CQG RTD Toolkit for volume and displays strikes ranked by the volume traded for each listed expiry… more

These two Microsoft Excel® dashboard display market quotes for tradable UDS for the crude oil contract and the E-mini S&P 500 traded on Globex. There is also a quote display with at-… more

This Microsoft Excel® dashboard provides a drop-down menu where you can select the underlying market, such as E-mini S&P 500. The display will then show all front contract option symbols… more