Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Various improvements and bug fixes.

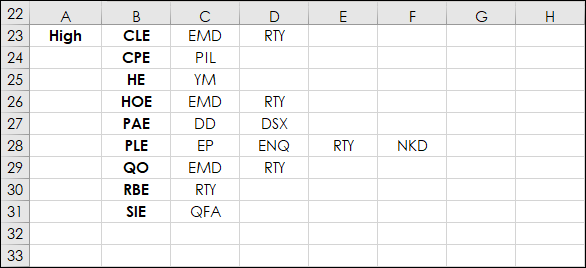

GeneralWidgets can now belong to more than 1 linking groupAdded Messages to the right barAdded Spanish language supportTrading/ReportingStrategy builder can… moreThis post details how to extract data from a large array, such as a correlation matrix, to make your workflow more efficient.

First, as the LAMBDA function is used, a brief overview is… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

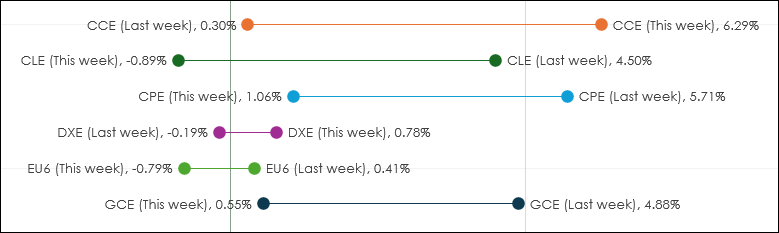

Dumbbell charts have the name due to the look of the data displayed having the appearance of a dumbbell.

In other words, a circle at each end connected by a line. In the image above… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

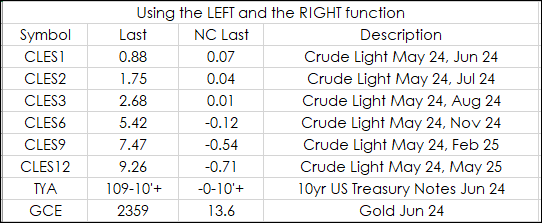

This post offers solutions to parsing data in Excel using string functions. As an example, this RTD formula returns the long description of a Crude Oil calendar spread:

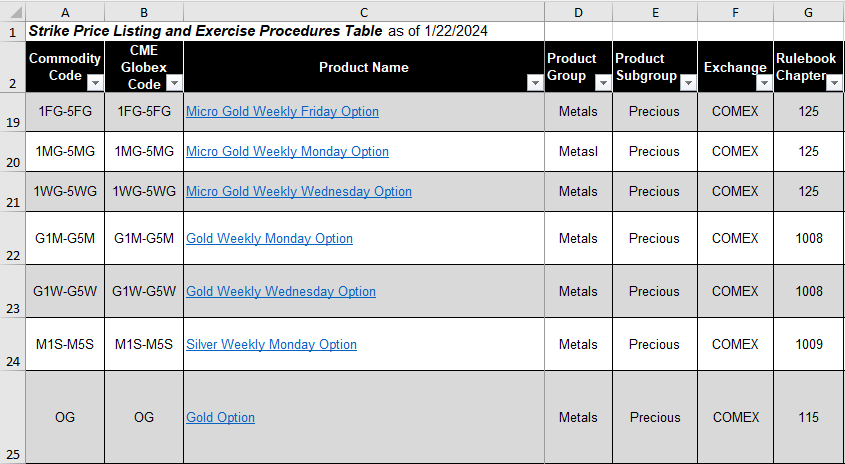

=RTD("cqg.rtd", ,"… moreThe CME Website has information resources for options traders in the form of downloadable Excel tables with important needed details such as:

Commodity CodeCME Globex CodeProduct NameProduct… moreEach Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

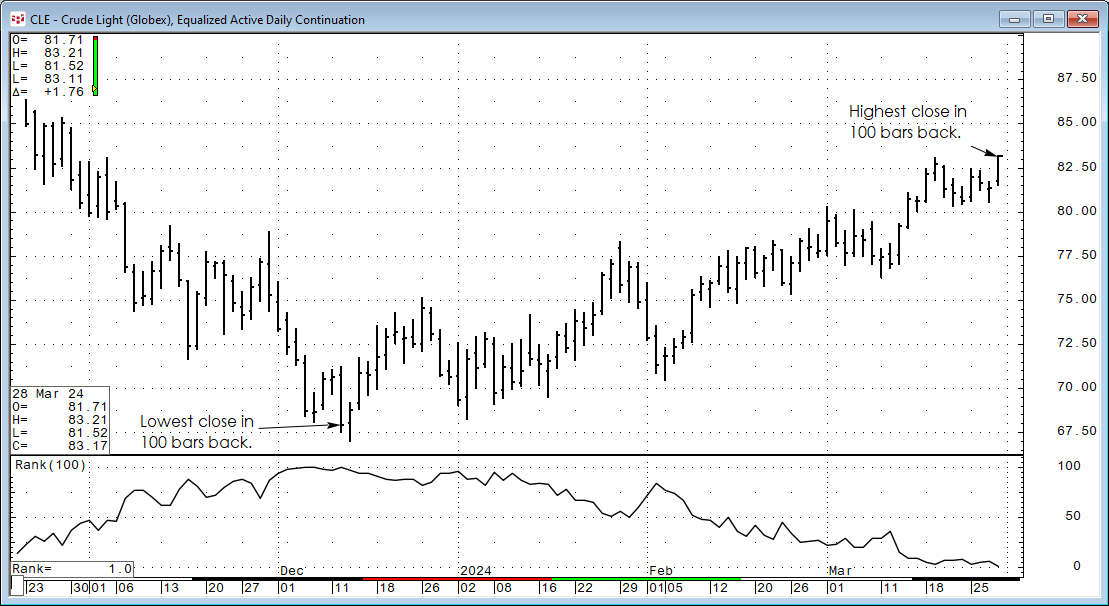

The CQG Rank Study ranks the individual chart points of a market over a specified number of previous trading periods. For example, if the current bar's close had a rank of 3, and the periods were… more