Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Blogs

Various improvements and bug fixes.

GeneralWidgets can now belong to more than 1 linking groupAdded Messages to the right barAdded Spanish language supportTrading/ReportingStrategy builder can… moreEach Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

As the markets head into 2024's second quarter, the North American agricultural planting season is getting underway. Farmers are now planting the grains that feed and increasingly power the world… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Original article: https://market-news-insights-jpx.com/insights/article006875/

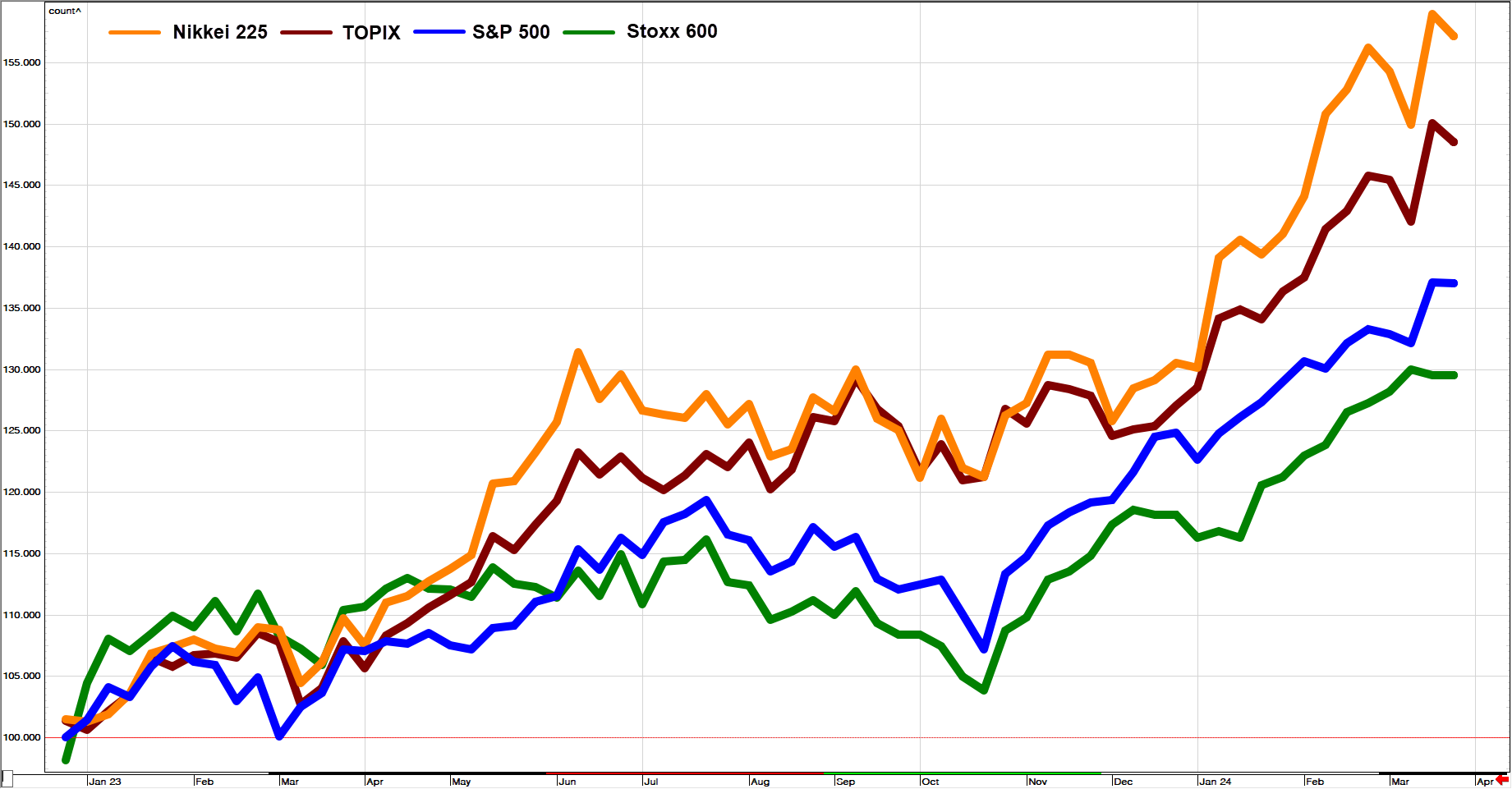

EQUITIES: Significant rise in 2023 to new highs in 2024

The Japanese stock market… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Various improvements and bug fixes.

GeneralAdded display of exchange close pricingImproved digit display for crypto currencies in various placesAbility to have multiple widgets open in the… more