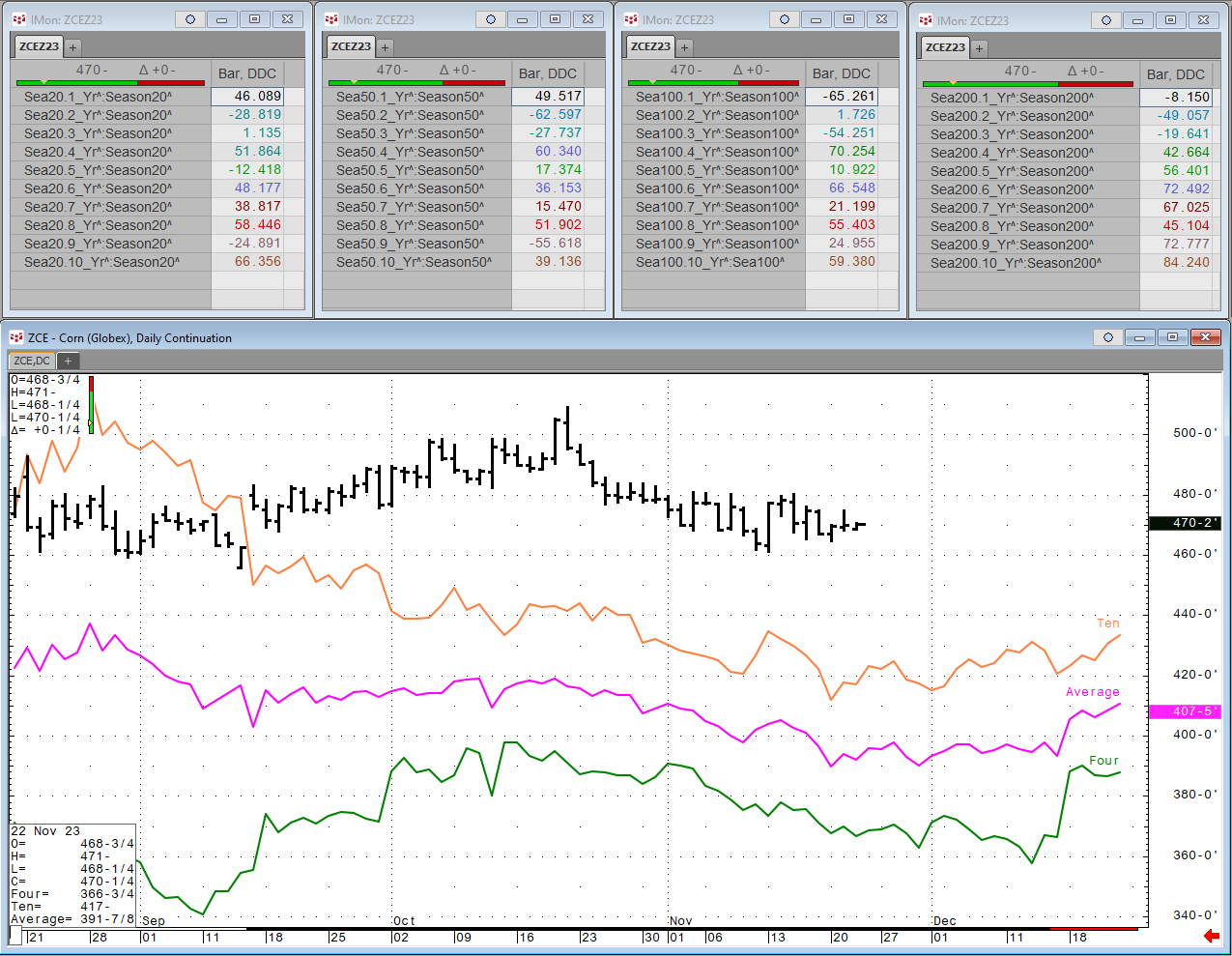

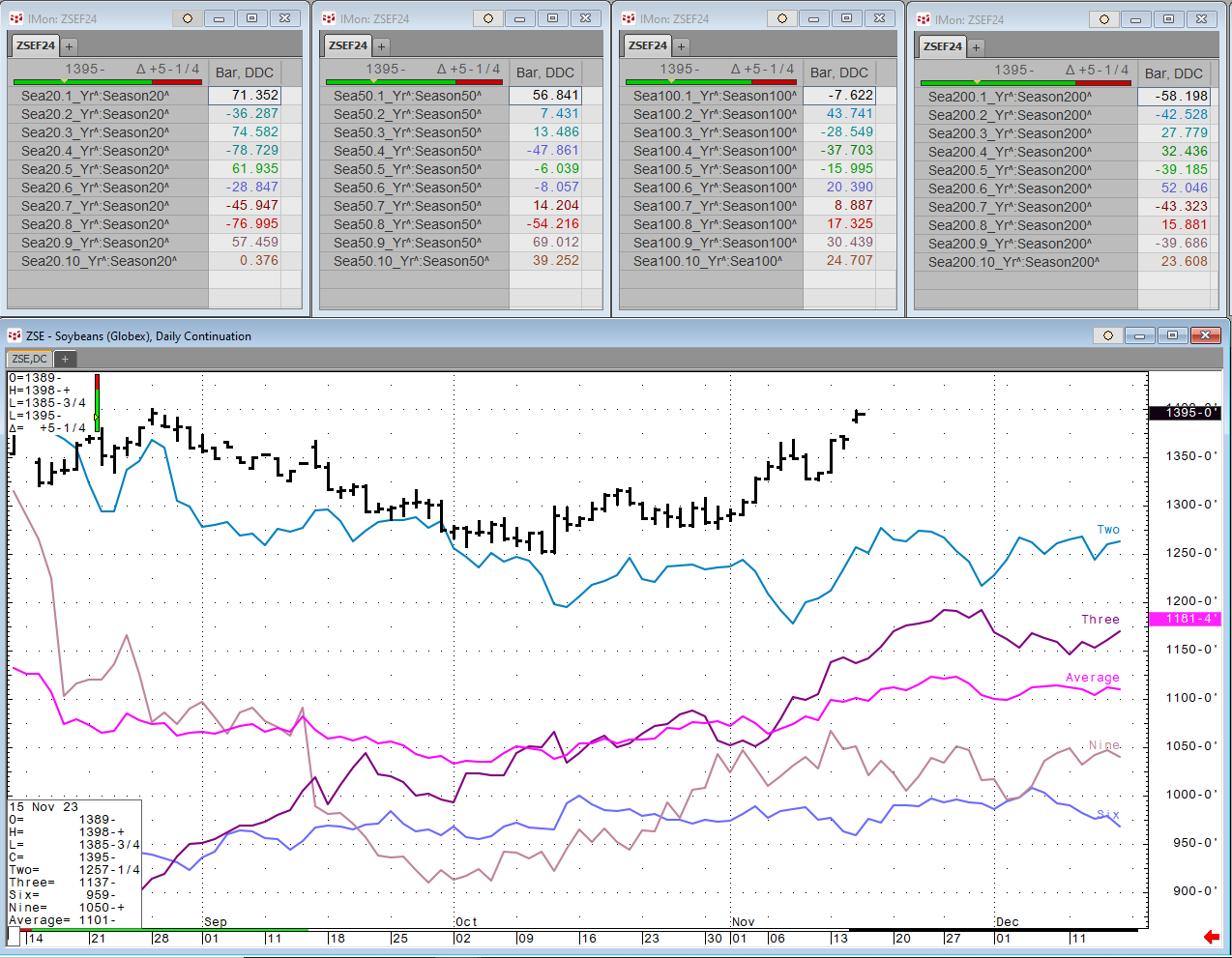

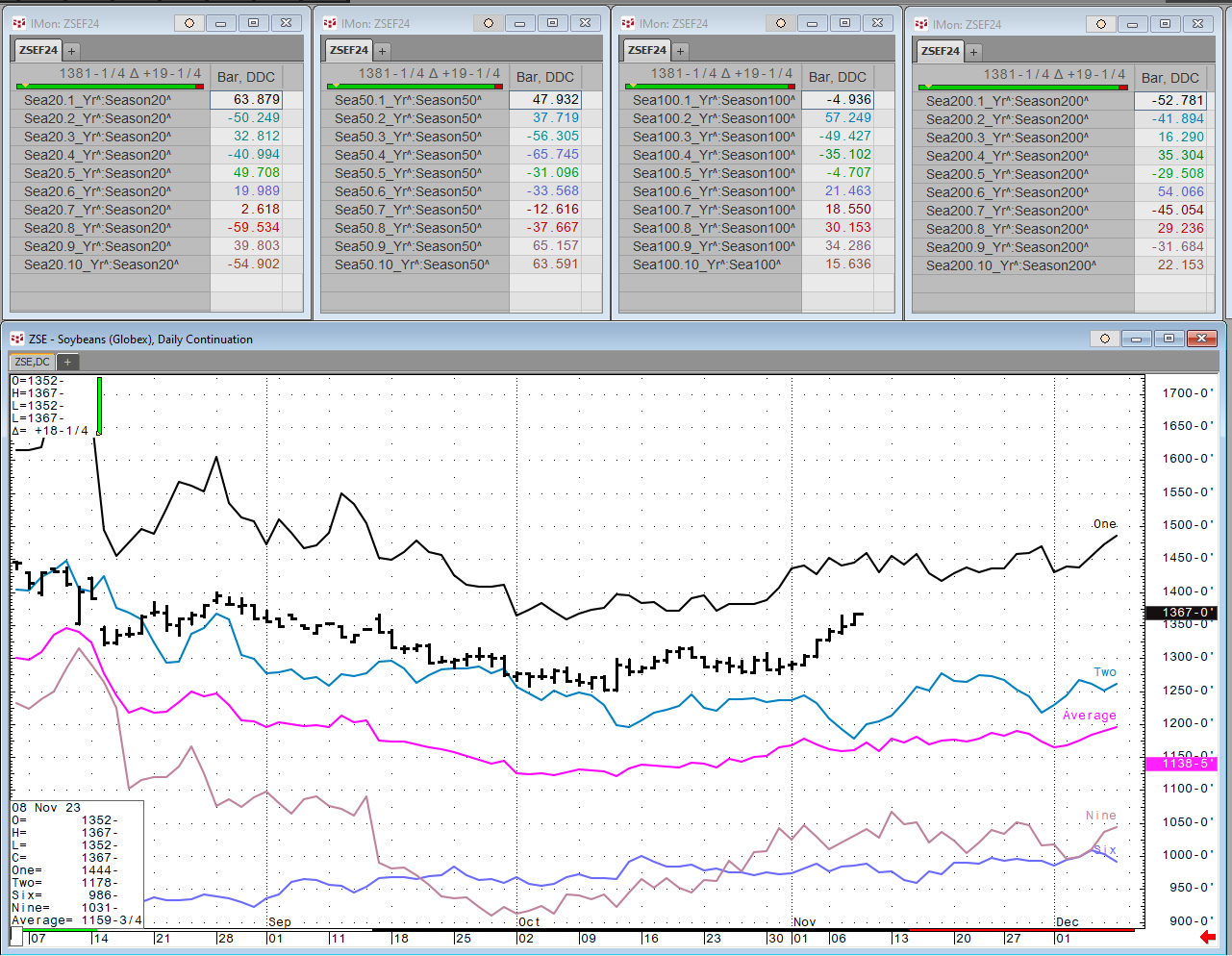

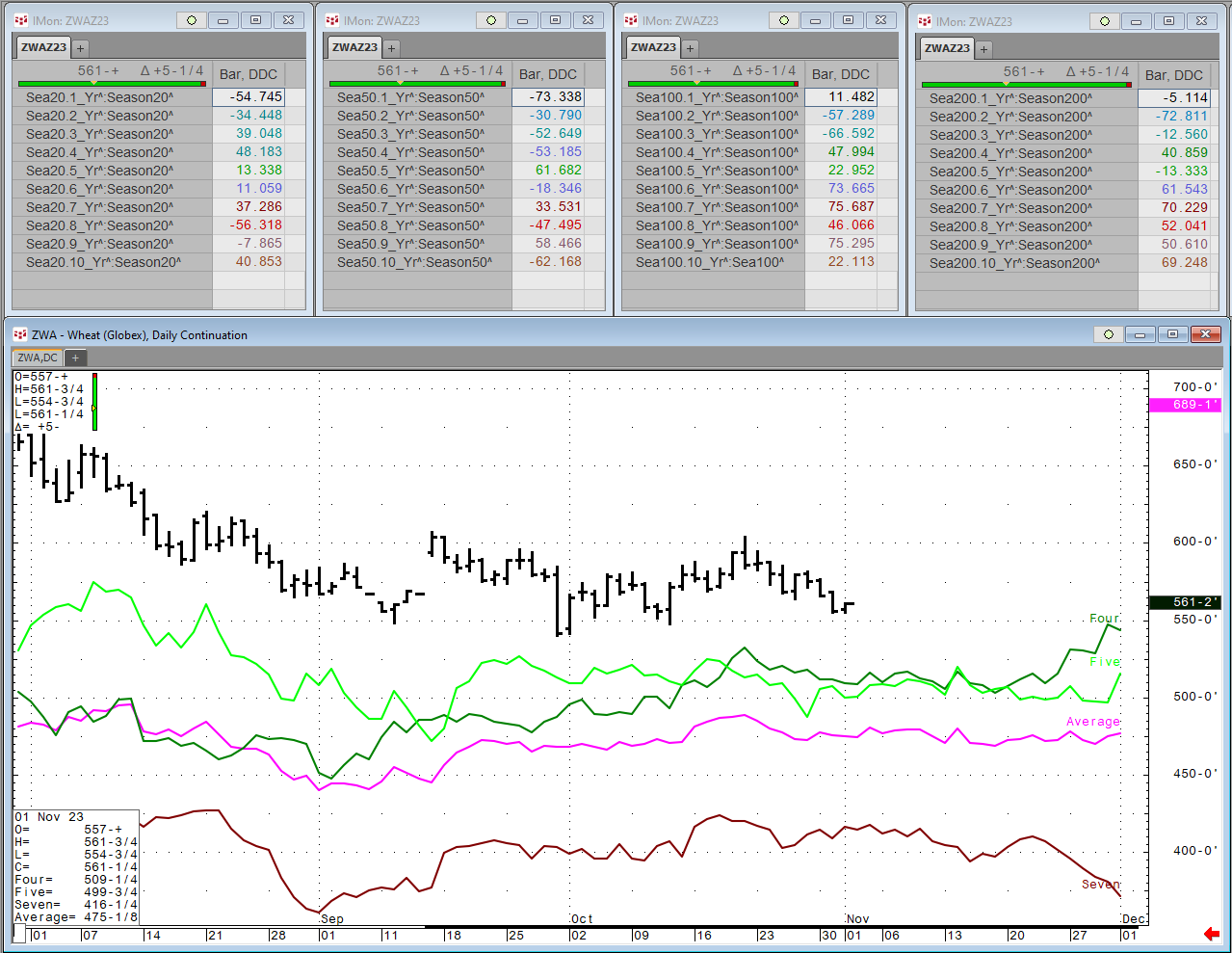

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Various improvements and bug fixes.

TradingStrategy builder added to CQG Desktop for creating user-defined strategiesTrading/ReportingAdded expand all/collapse all in positions widgetAdd fill… more

One of the most frustrating aspects of long-term trend following systems is drawdowns from unrealized mark to market peaks in equity. Let’s look at an example:

Figure 1… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

CQG One provides an "Active RFQ" widget. A Request for Quote (RFQ) is functionality provided for traders to access electronic quotes on multi-leg options strategies. It is an electronic message… more

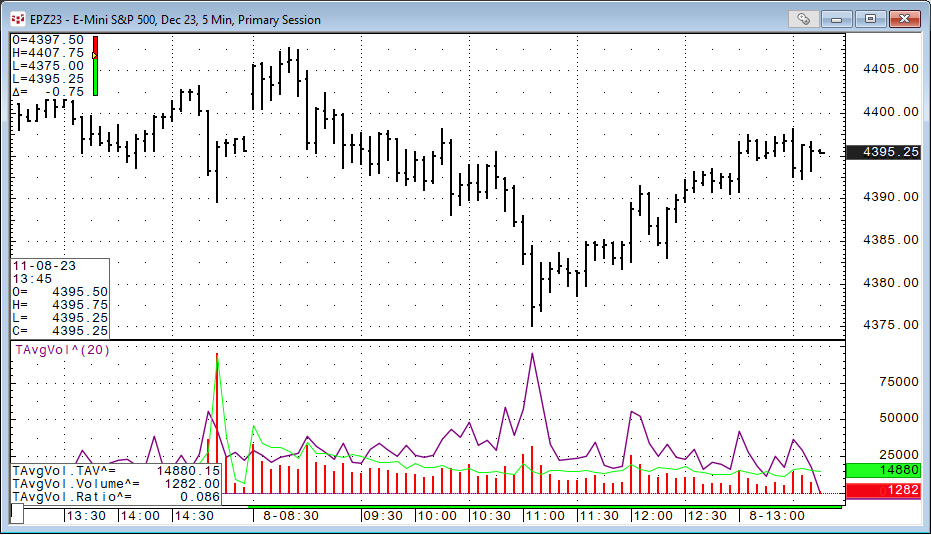

This post details the use of the CQG function: Time Average (TimeAvg), which calculates the average for values taken at the same time of day over the lookback period.

In this example, the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Tom Lam has over two decades of experience in the realm of economics and finance, with expertise ranging from covering the global economy, deciphering financial markets, including macro… more

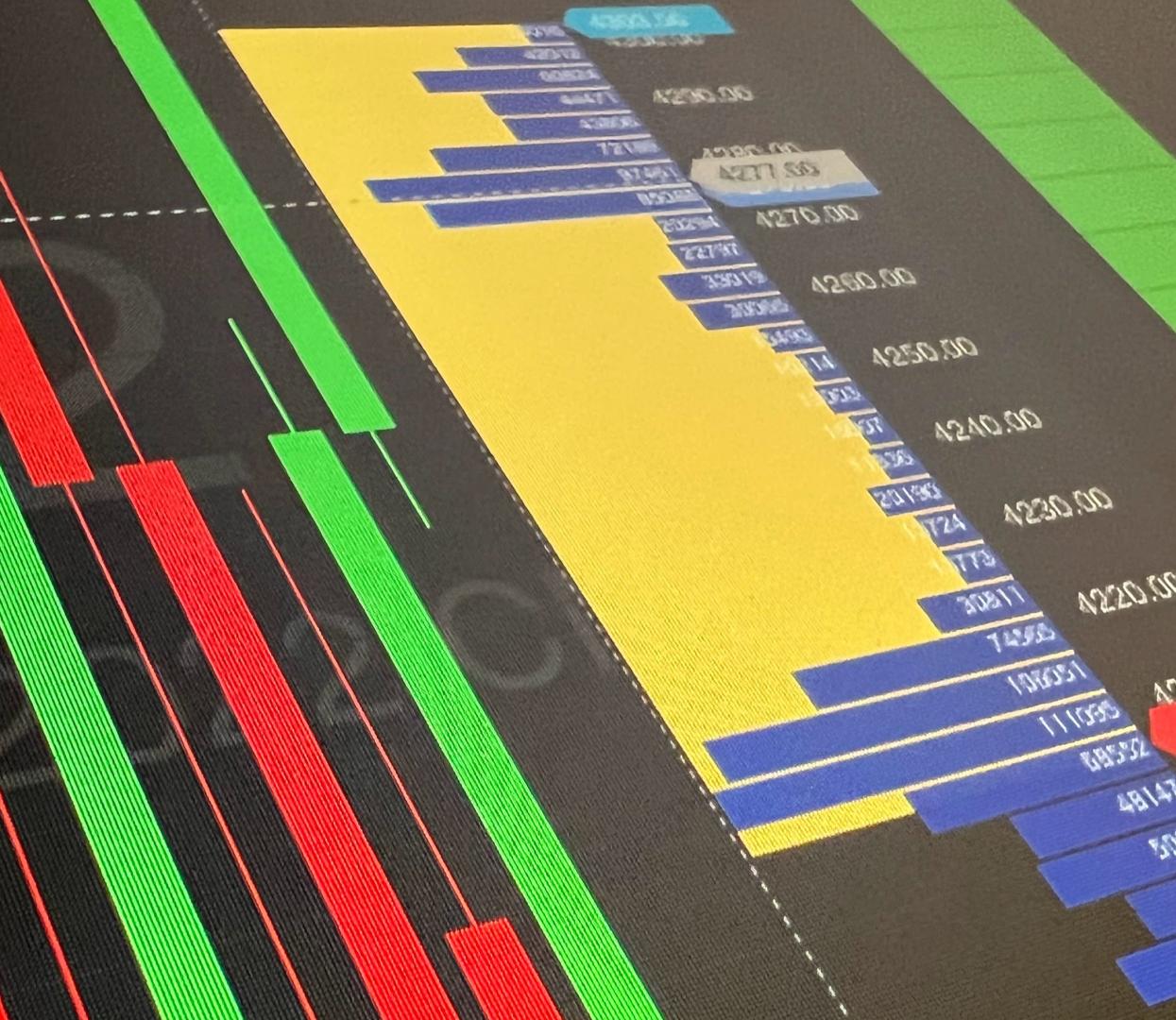

CQG IC and QTrader offer charts that utilize volume for the horizontal scale, not time. The first chart type to discuss is Constant Volume Bars.

Constant Volume Bar (CVB)

The Constant… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more