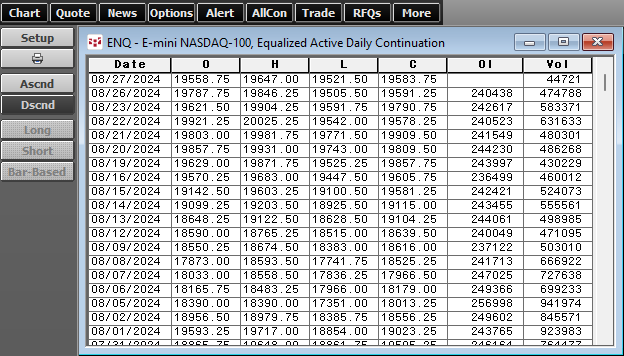

CQG 2024 What's New: Customers can export 1,000 bars of chart data to Excel

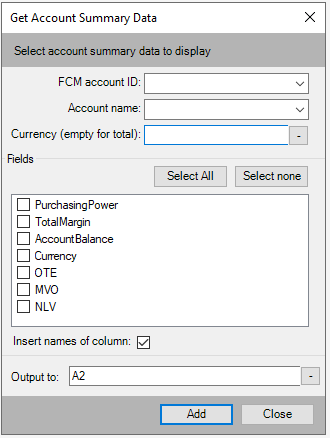

Customers can export 1,000 bars of chart data to Excel using Excel/RTD functions and copy to the clipboard from the Chart/Tabular Display.

In addition, API customers can now pull more historical daily bars.

- API Historical 1,000 Daily Bars

- API Hist Extended 4,000 Daily Bars

- API Hist Ext. Plus 10,000 Daily Bars