In systematic trading, the word robust is often used loosely. Yet robustness has a precise meaning to professional traders: a strategy's ability to survive regime change, parameter variation,… more

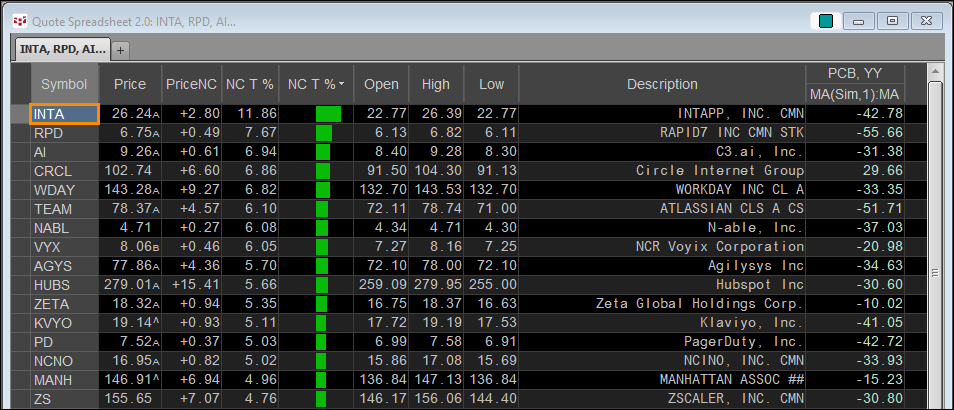

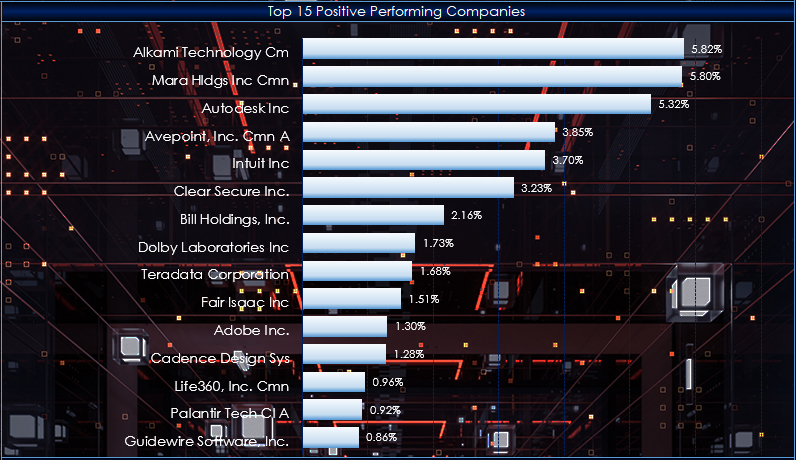

This post details a CQG PAC that can be downloaded and installed to track the day's performance of the holdings of the iShares Expanded Tech-Software Sector ETF (Symbol: IGV).

From the… more

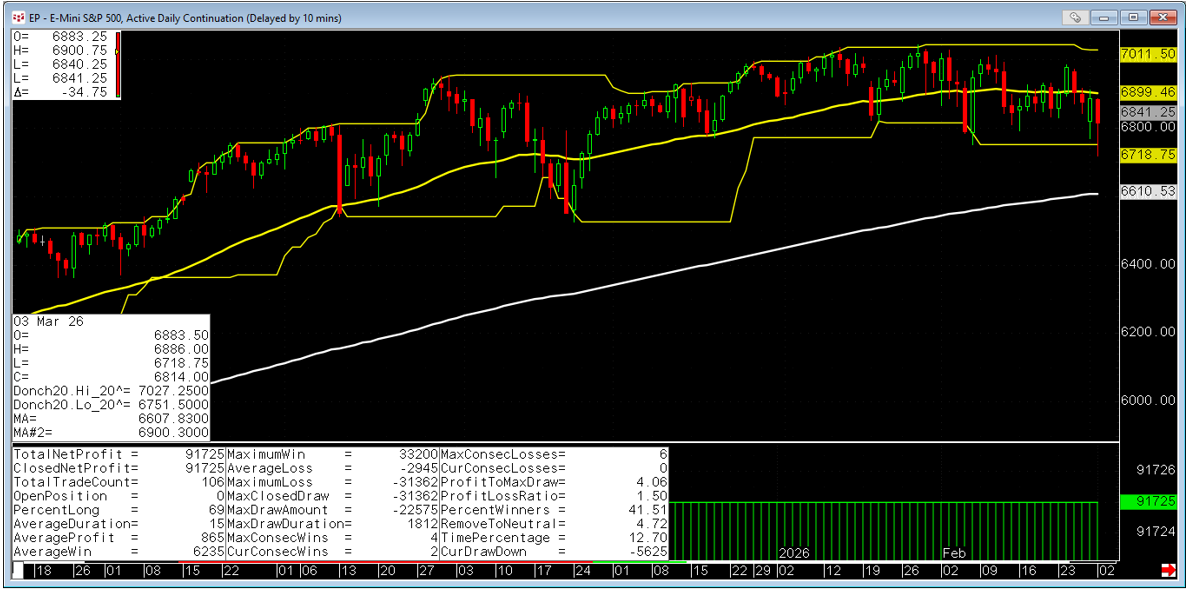

Midweek, the OSE 10 Year JGB, Mar 26 contract is unchanged. The best performer in the US market is the 2yr US Treasury Note (Globex), Jun 26 contract, which is down -0.3136%. The best… more

This midweek look shows the Nikkei 225 (Osaka), Mar 26 contract, down with a loss of -4.60%. The best performer in the US market is the E-mini NASDAQ 100, Mar 26 contract showing a gain of… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

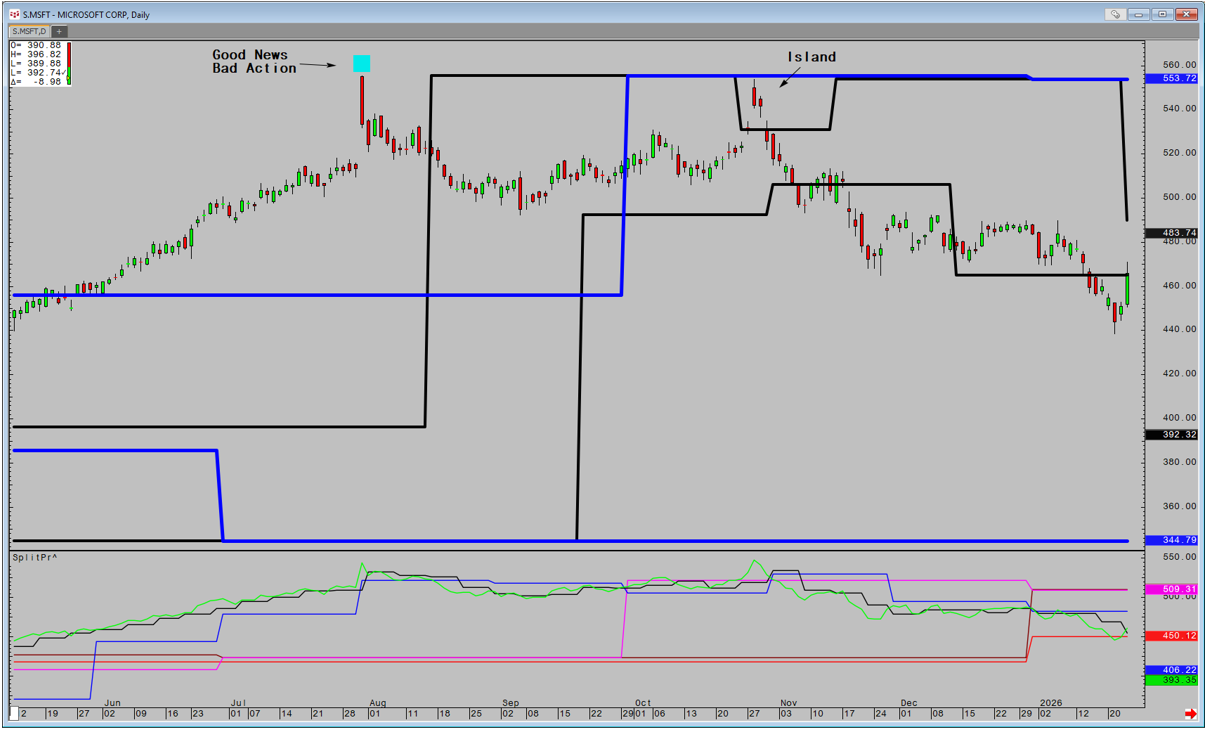

The switch from my haven of Futures and Fx, to the world on USA equities and ETF's to run a Hedge Fund, presented a new set of challenges. My world had moved from 80 instruments to focus on to… more

This post details a Microsoft Excel dashboard that tracks the day's performance of the holdings of the iShares Expanded Tech-Software Sector ETF (Symbol: IGV).

From the iShares website… more

I am excited to share the news we just announced, that CQG has entered into an agreement for Broadridge Financial Solutions, Inc. (NYSE:BR) to acquire our firm, subject to customary closing… more

This video, presented by CQG Product Specialist Helmut Mueller, walks you through using his Super Template for developing and testing a trading system.

The Super Template is installed in CQG… more