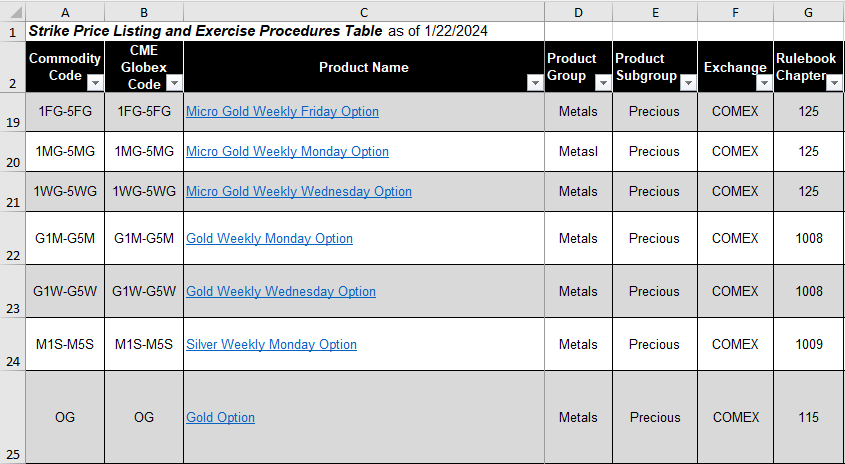

The CME Website has information resources for options traders in the form of downloadable Excel tables with important needed details such as:

Commodity CodeCME Globex CodeProduct NameProduct… moreWorkspaces

This Microsoft Excel® dashboard uses the CQG RTD OptVal formula to calculate implied volatility, theoretical value, delta, and the Greeks using data inputs from other RTD formulas.

… more

You can use Microsoft Excel® and data from CQG to expand the features of your own market display dashboards. This powerful combination can be tailored to your specific needs. This article shows… more

If you use RTD formulas for data from the options markets, then Excel will pull data using your settings in CQG, such as the options model you have selected. An RTD formula for implied volatility… more

Options offer a wide variety of strategies for traders. CQG provides a powerful options analytics package. A number of the analytics tools, such as theoretical value, implied volatility, and the… more

This Microsoft Excel® spreadsheet presents frequency distribution analysis of historical implied volatility (IV) data.

CQG offers its own historical options implied volatility index for… more

This Microsoft Excel® dashboard displays the first two months' expiries of the KOSPI 200 options. Last price, net change, percent net change, implied volatility using Black-Scholes, and today's… more