Petroleum prices plunged more than 8% this week, their largest weekly loss in more than nine months. Prices have fallen for seven consecutive days and are at their lowest level since May 20th. The… more

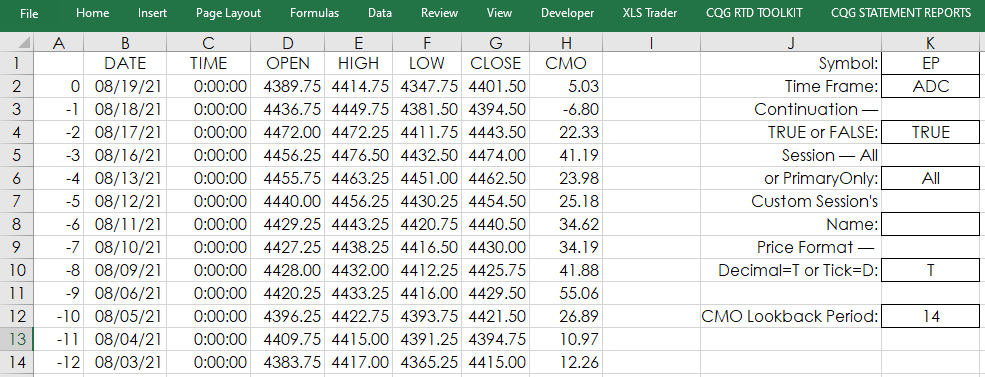

This post builds upon CQG Product Specialist Helmut Mueller's post titled “Most Wanted Seven Studies Plus a Bonus Trading System.” His post provides a PAC with the following studies:

Chande… morePetroleum prices ended the week mixed as the monthly IEA report warned of slowing demand growth linked to the ongoing resurgence of COVID-19 delta variant cases which reached six-month highs in… more

On Sunday, we acknowledge the 50-year anniversary of Richard Nixon’s decision to close the GOLD EXCHANGE WINDOW and put an end to the post-World War monetary system known as Bretton Woods. I can… more

Russell Napier and Yra Harris on Financial Repression and the Age of Debt.

Russell Napier is author of the Solid Ground Investment Report and co-founder of the investment research portal… more

Early last week Senator Elizabeth Warren made her case against Chair Jerome Powell. In a Financial Times article, the senator blasted Powell for his light regulatory touch while praising the… more

The likely growing impact on demand from a serious resurgence of the delta variant of COVID-19 propelled petroleum prices to their largest weekly drop since the week of October 2nd , 2019.… more

A long time ago, I wrote two articles about divergence for our CQG blog that are probably still worth reading. Especially in the second article, I was using peaks on the indicators to measure… more

Last week’s FOMC meeting went as expected but the press conference actually provided some solid questions as the media put some pressure on Chair Jerome Powell. NPR actually received an answer to… more