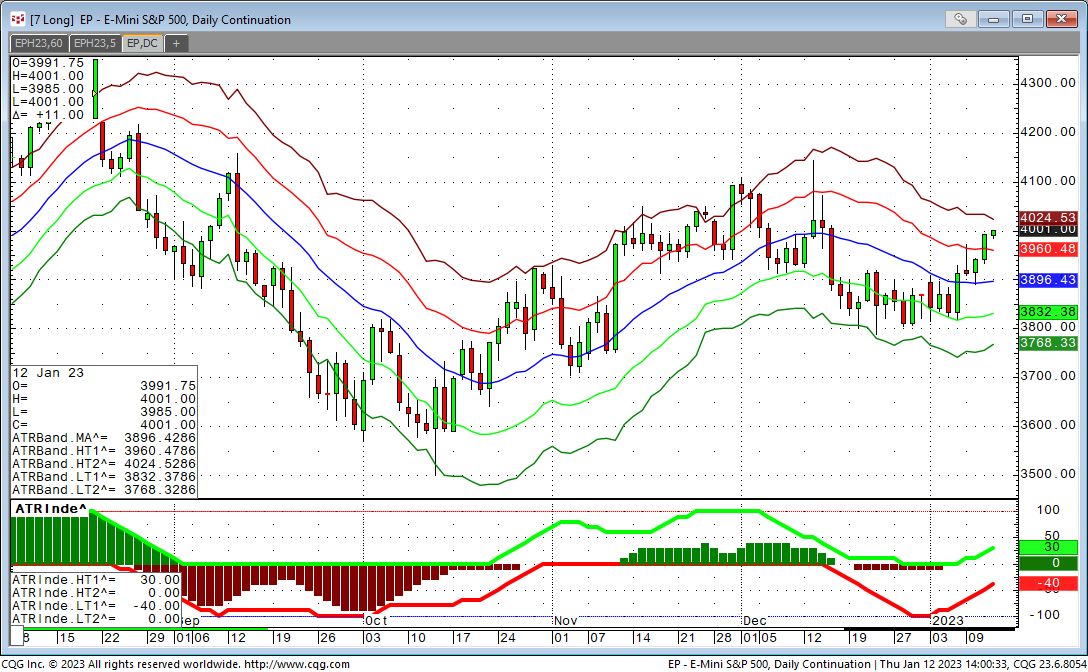

Going all the way back until the famous turtle trading systems, ATR has always been an important measurement for volatility in the markets. ATR’s are still used for exits in trading systems and… more

Coding

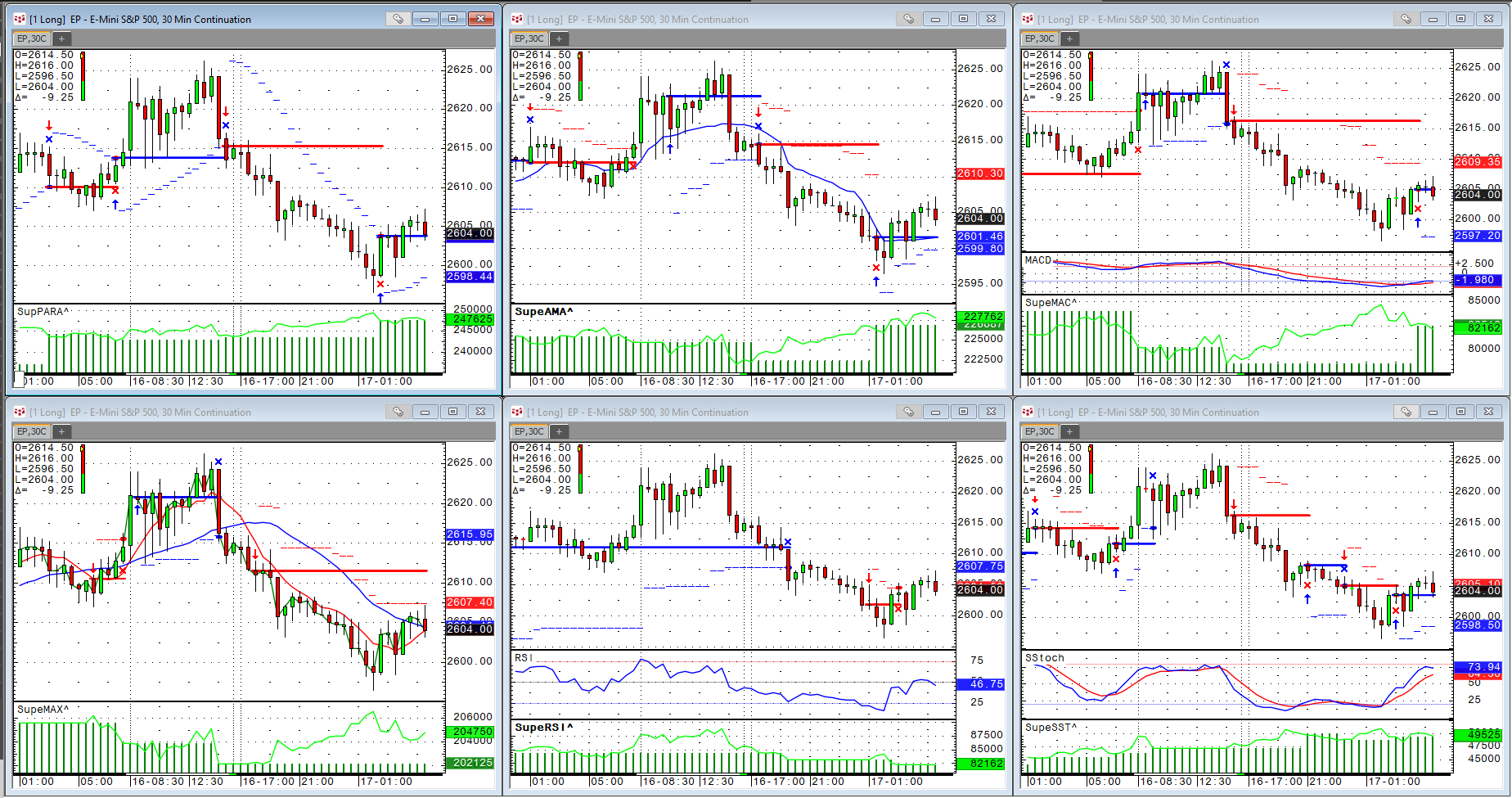

After renewing the Super template in July 2022 I also created a set of trading systems based on very commonly used indicators. The exits are summarized at the end.

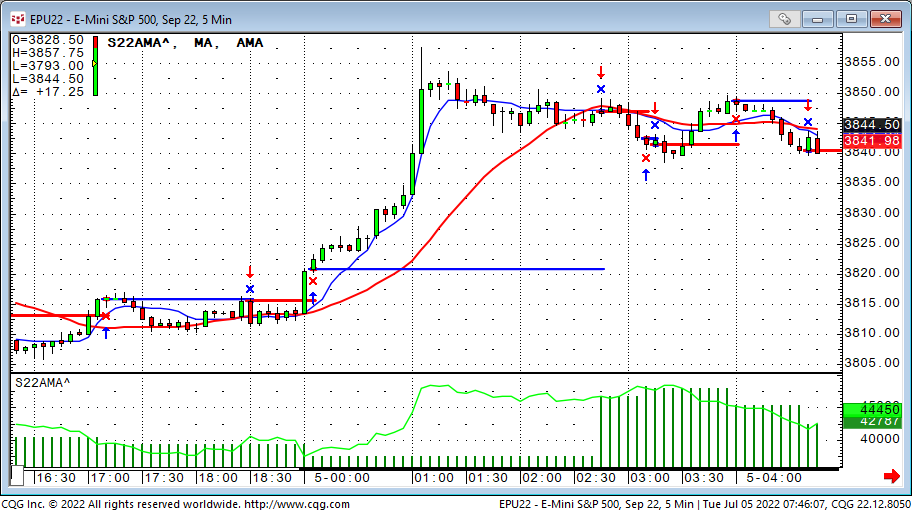

1. AMA trading system… more

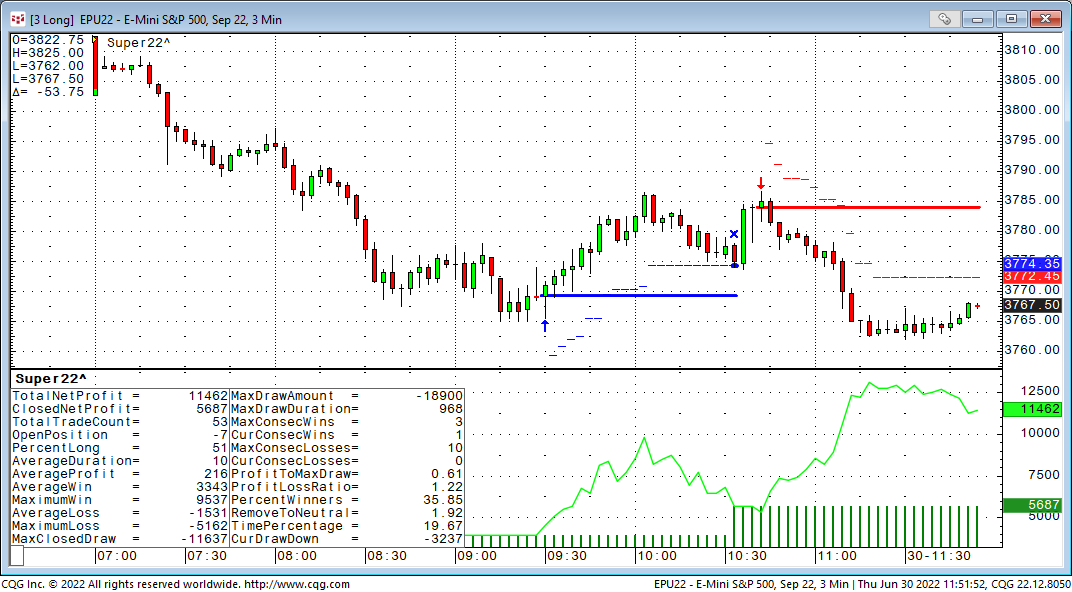

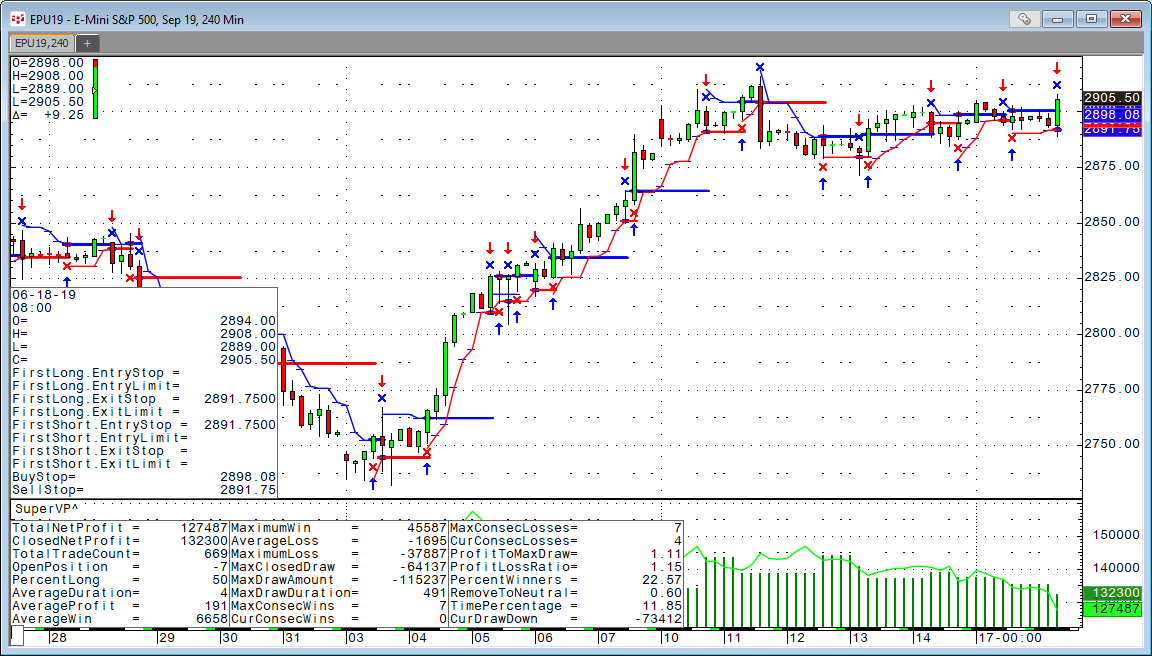

It has been a while since I introduced the Super Template as a shortcut to build trading system inside CQG. In a nutshell, the Super Template is a trading system ready to run, that has a long and… more

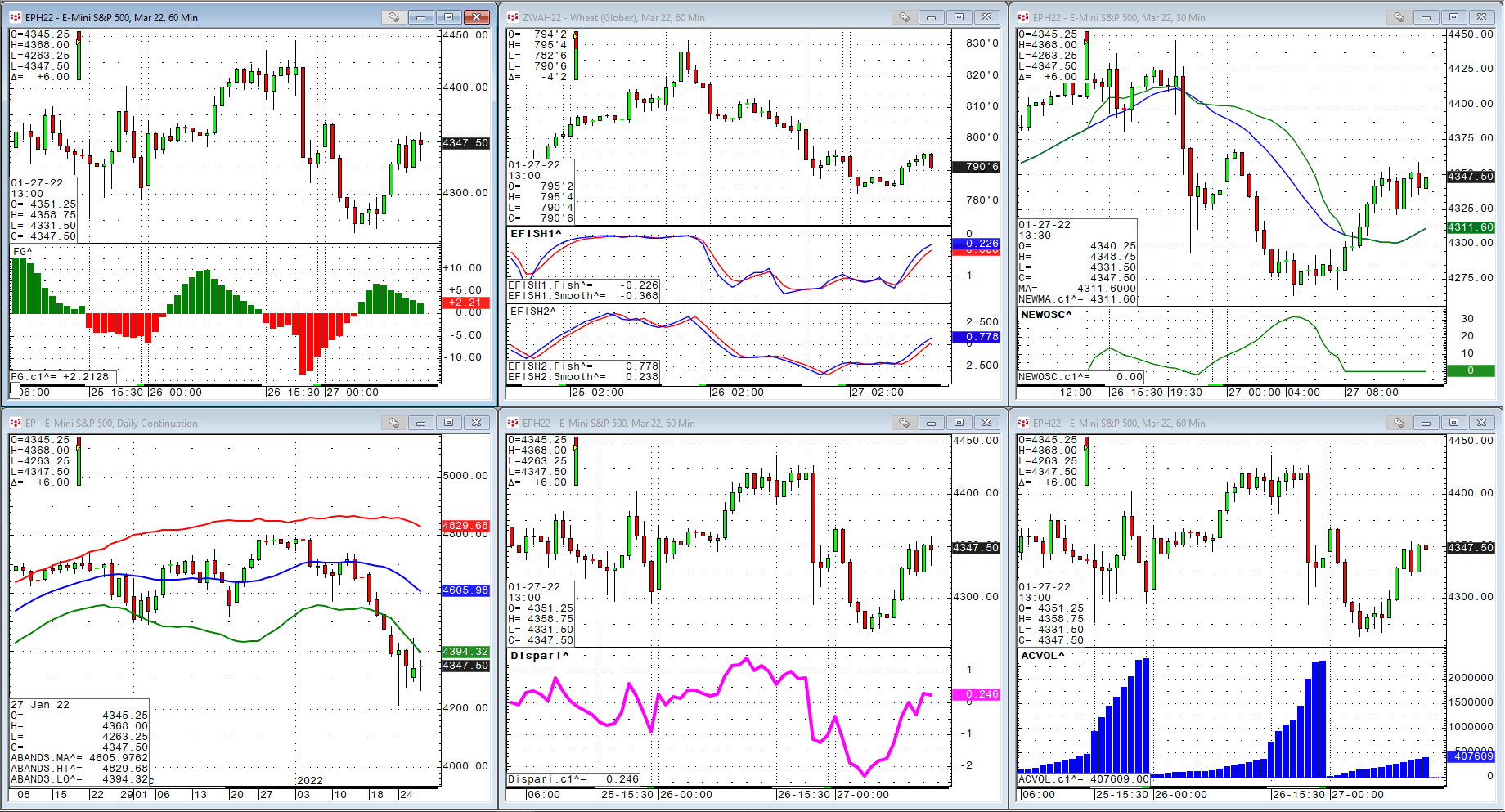

As some kind of review for the last year, I would like to present a few indicators that were coded partly as customer requests or my own research. We had something similar a few years ago: https… more

A long time ago, I wrote two articles about divergence for our CQG blog that are probably still worth reading. Especially in the second article, I was using peaks on the indicators to measure… more

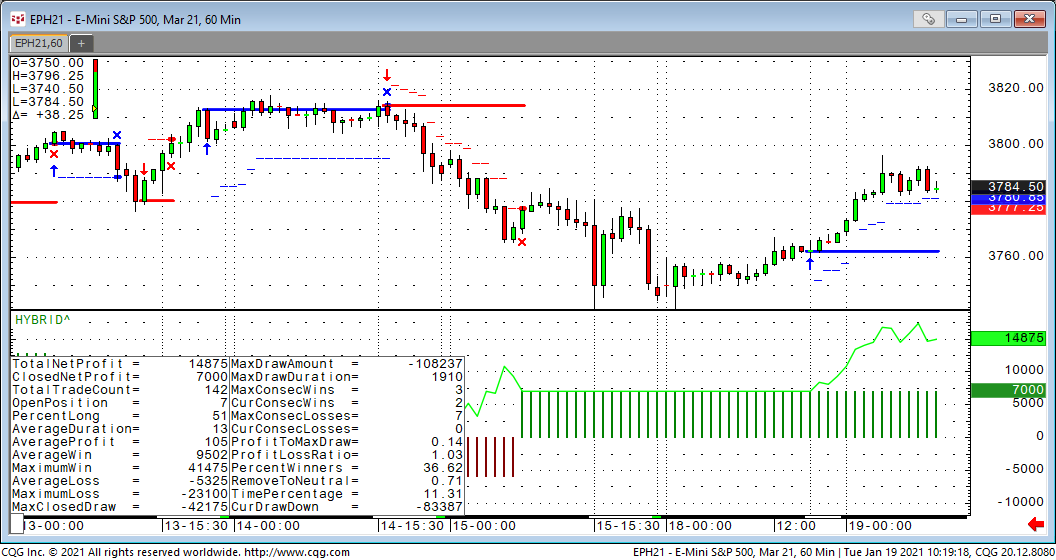

When do I need a hybrid trading system for auto execution? Since we released CQG AutoTrader functionality and XLS Trader we have had some use cases were we wanted to combine the best of both… more

The Average True Range (ATR) study takes the moving average of the true range over the specified period.

Definitions:

True Range = True High - True Low True High = The greater of the… moreHere are two more trading systems based on the Super Template that were recently created on a customers demand.

The idea is to have a few standard trading systems that have many… more

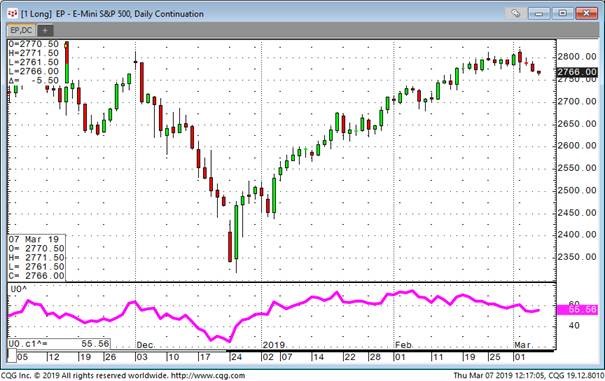

For this post we are looking at Larry Williams Ultimate Oscillator and the Marc Chaikin Oscillator.

Developed by Larry Williams the Ultimate Oscillator is a momentum oscillator designed to… more

Related: Using the Super Template

The idea is to have a few standard trading systems that have many customizable exits already built in:

EOD - End Of Day will exit any position… more