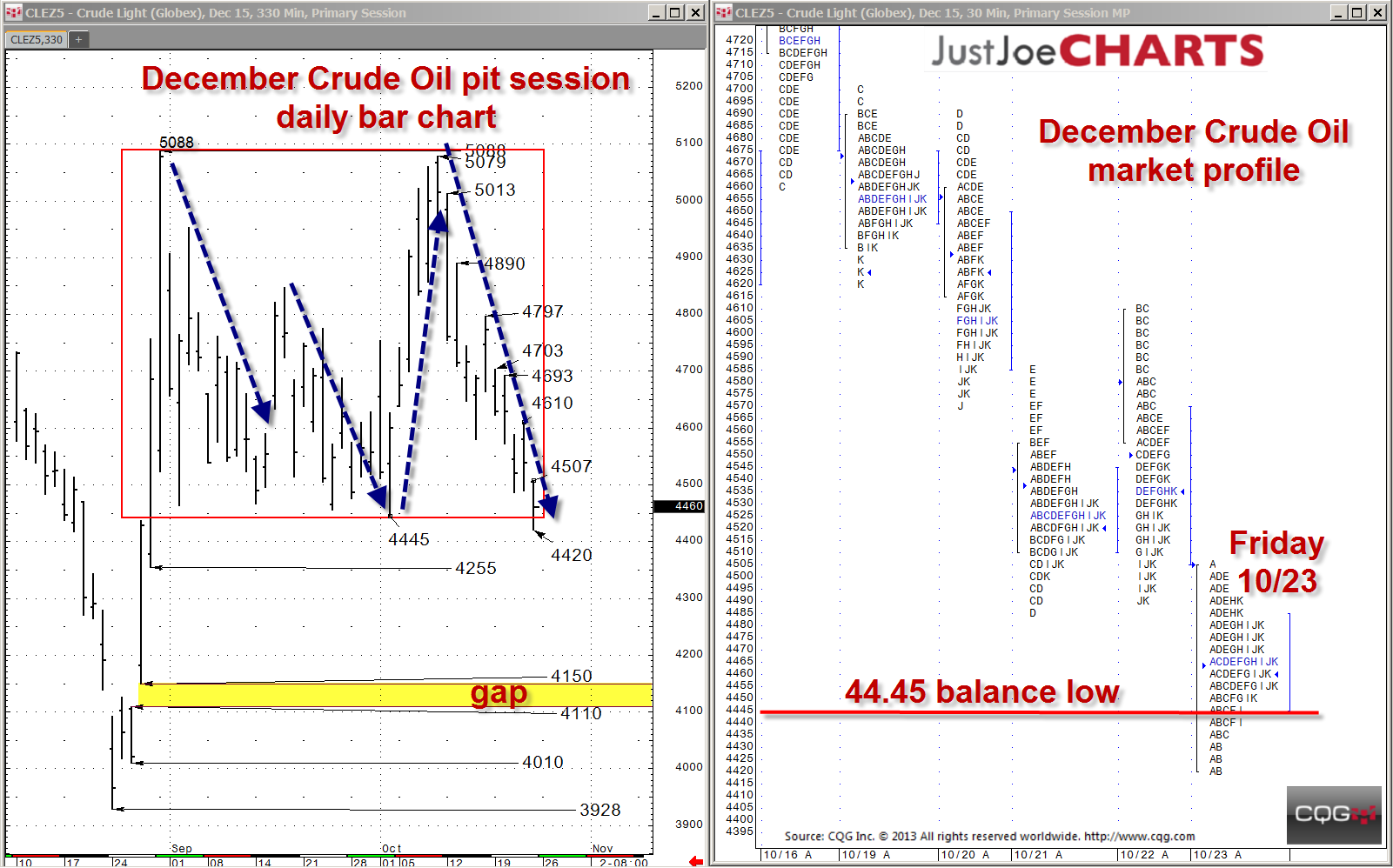

During the past two months, December crude oil has been contained within a 44.45 to 50.88 range. About two weeks ago, the market came within ten ticks of the 50.88 balance high, but failed to take it out. Since that day, the market has gone lower eight of the past ten trading days, and took out the 44.45 balance low on Friday, October 23, 2015. When a market tests the extreme of a clearly defined balance range, the following are the two most likely scenarios:

- Gain acceptance outside the balance range and accelerate.

- Trade near or outside the balance extreme, fail, and begin a rotation in the opposite direction to the other end of the balance range.

If the market gains acceptance below the 44.45 balance low, the next downside target may be the 41.10 to 41.50 gap that was left back in August. If the market fails to gain acceptance below the 44.45 balance low, it may begin a rotation to the opposite end of the balance range.