On September 2, 2022, Shanghai Futures Exchange (SHFE) announced approval for participation of Qualified Foreign Institutional Investors (QFII) and RMB Qualified Foreign Institutional Investors (RQFII) in commodity futures and options trading. With the approval of the China Securities Regulatory Commission (CSRC), QFII and RQFII can participate in the trading of :

- Gold, Silver, Copper, Aluminum, Zinc, Steel Rebar, and Hot Rolled Coils futures contracts;

- Gold, Copper, Aluminum, and Zinc options contracts.

At the same time, Dalian Commodity Exchange (DCE), Zhengzhou Commodity Exchange (ZCE) and China Financial Futures Exchange (CFFEX) announced an expansion of the products QFII and RQFII could participate in.

QFII and RQFII can invest in 41 commodities, financial futures and option products in China. The list breaks down to twenty-three commodity futures, sixteen commodity options and two financial index options contracts as detailed in the following table.

Circular on the Participation of QFII (Qualified Foreign Institutional Investors), RQFII (RMB Qualified Foreign Institutional Investors) in China Commodity Futures and Options Trading by Exchange

| Shanghai Futures Exchange (SHFE) | |||

|---|---|---|---|

| Futures | CQG Symbols | Options | CQG Symbols |

| Gold | F.CN.AU | Gold | C.CN.AU/P.CN.AU |

| Silver | F.CN.AG | Copper | C.CN.CU/P.CN.CU |

| Copper | F.CN.CU | Aluminum | C.CN.AL/P.CN.AL |

| Aluminum | F.CN.AL | Zinc | C.CN.ZN/P.CN.ZN |

| Zinc | F.CN.ZN | ||

| Steel Rebar | F.CN.RB | ||

| Hot Rolled Coils | F.CN.HC | ||

| Dalian Commodity Exchange (DCE) | |||

|---|---|---|---|

| Futures | CQG Symbols | Options | CQG Symbols |

| No.1 Soybean | F.CN.A | No.1 Soybean | C.CN.I/P.CN.I |

| No.2 Soybean | F.CN.B | No.2 Soybean | C.CN.P/P.CN.P |

| Soybean Meal | F.CN.M | Soybean Meal | C.CN.M/P.CN.M |

| Soybean Oil | F.CN.Y | Soybean Oil | C.CN.Y/P.CN.Y |

| RBD Palm Olein | F.CN.P | RBD Palm Olein | C.CN.L/P.CN.L |

| Iron Ore | F.CN.I | Iron Ore | C.CN.A/P.CN.A |

| LLDPE | F.CN.L | LLDPE | C.CN.B/P.CN.B |

| Zhengzhou Commodity Exchange (ZCE) | |||

|---|---|---|---|

| Futures | CQG Symbols | Options | CQG Symbols |

| PTA | F.CN.TA | PTA | C.CN.TA/P.CN.TA |

| Methanol | F.CN.MA | Methanol | C.CN.MA/P.CN.MA |

| White Sugar | F.CN.SR | White Sugar | C.CN.SR/P.CN.SR |

| Rapeseed Oil | F.CN.OI | Rapeseed Oil | C.CN.OI/P.CN.OI |

| Polyester Staple Fiber | F.CN.PF | ||

| Shanghai International Energy Exchange | |||

|---|---|---|---|

| Futures | CQG Symbols | Options | CQG Symbols |

| Crude Oil | F.CN.SC | Crude Oil | C.CN.SC/P.CN.SC |

| TSR20 | F.CN.LU | ||

| LSFO | F.CN.NR | ||

| Bonded Copper | F.CN.BC | ||

| China Financial Futures Exchange (CFFEX) | |||

|---|---|---|---|

| Futures | CQG Symbols | Options | CQG Symbols |

| CSI 300 Index Futures | F.CN.IF | CSI 300 Index Options | C.CN.IO/P.CN.IO |

| CSI 500 Index Futures | F.CN.IM | CSI 1000 Index Options | C.CN.MO/P.CN.MO |

| CSI 1000 Index Futures | F.CN.IH | ||

| SSE 50 Index Futures | F.CN.IC | ||

The QFII program was one of the earliest financial market liberalization initiatives. The program was designed to attract foreign institutional investors to the Chinese securities market. The RQFII program has been an important supplement toward these efforts. After the regulator cancelled the quota restrictions of QFII and RQFII in 2020 the further liberalization of futures and options markets is another important step in the internationalization of China’s financial markets.

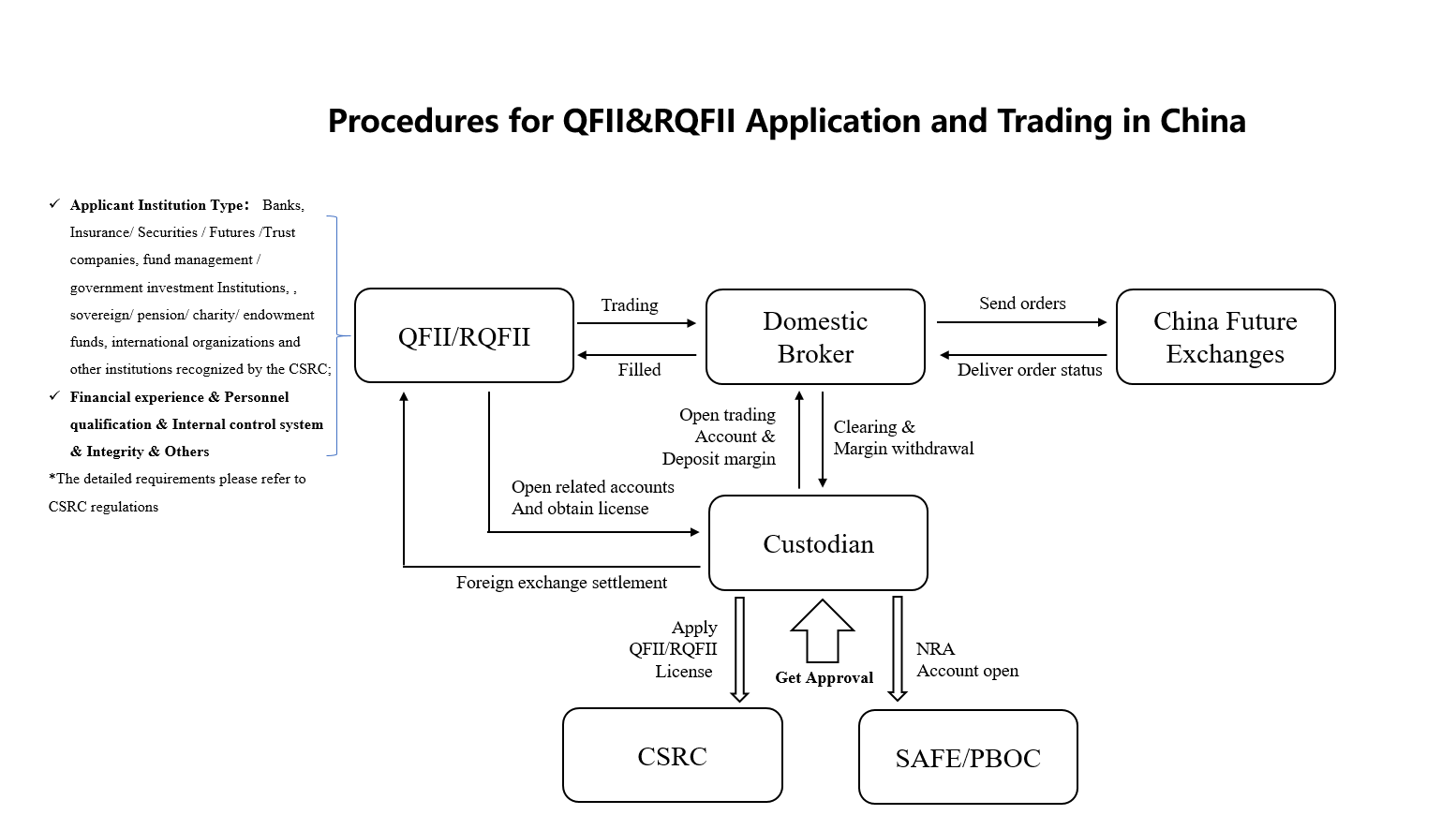

This table lists the steps for those participants who want to enter the China futures markets via the QFII/RQFII access:

- The pre-QFII&RQFII who meet qualifications select the custodian and obtain a license from CSRC. The custodian also needs to assist QFII/RQFII to open the special accounts from SAFE/PBOC.

- QFII & RQFII choose their domestic broker, and open a trading account; The custodian assists to do the money transfer (e.g. Margin).

- Then QFII& RQFII can use CQG to trade the allowed China Futures contracts.

- Domestic brokers would clear the account and assist to deposit/withdraw the Margin.

- The custodian would assist the QFII & RQFII transfer money back to their offshore bank account.

CQG entered the China market in Shanghai in 2018. We provided a bridge between China domestic customers who were trading overseas markets and overseas customers who were trading in the China domestic markets. With an established local server in Shanghai and CQG’s technology, customers could trade in the China market within a low latency and stable environment.

Sample of CQG’s Charting and Order Routing (CQG’s DOM Trader).

QFII/RQFII is expanding access to the futures/options markets. CQG is a global trading technology vendor mainly supporting two technology solutions (order routing and market data services). This enables foreign investors to access Chinese domestic derivatives market, which are OI (Overseas Intermediary) and QFII/RQFII.

After CQG's five years of deep operation in China, we have established solid partnerships with multiple China domestic FCMs. Clients can trade via our FCM partners to access China domestic financial derivative market.

Please read this post for five examples of spreading markets in Chine vs LME, China vs USA and China vs China.