I am excited to share the news we just announced, that CQG has entered into an agreement for Broadridge Financial Solutions, Inc. (NYSE:BR) to acquire our firm, subject to customary closing… more

Announcements

To support you and your team in adapting to these updates, we have created detailed video guides. Please take a moment to review them to better understand the changes. … more

Launched October 14, 2024, Options on Cboe Volatility Index® (VIX® Index) Futures offer more choices for participants using directional views and managing equity market volatility exposure. These… more

We've made some significant updates to the Spreader in CQG 1 for institutional trading desks in CQG One v9.9 going to production on Oct 25, 2024.

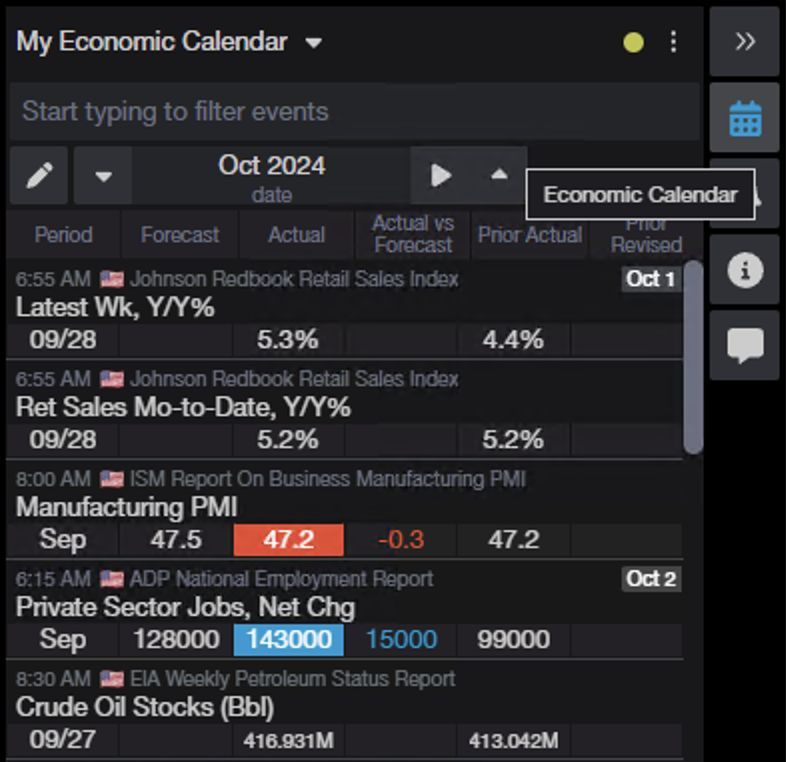

Strategy BuilderImproved synthetic strategy… moreAn Economic Calendar has been added to CQG Desktop and CQG One v 9.9!

Now you can receive notifications for economic events inside the platform.

The widget is included for all users… more

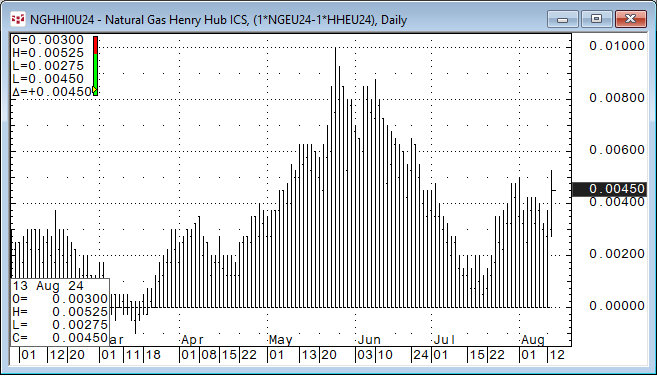

Exchange Traded Spreads Descriptions now provide number of contracts and actuals contracts.

Here is an example using the Quote Spreadsheet V2:

Here is an example using the All… more

CQG is now live with Cboe Europe Derivatives Exchange (CEDX), which is CQG's first offering of equity options, expanding the company's asset class offering to include futures, options on futures,… more

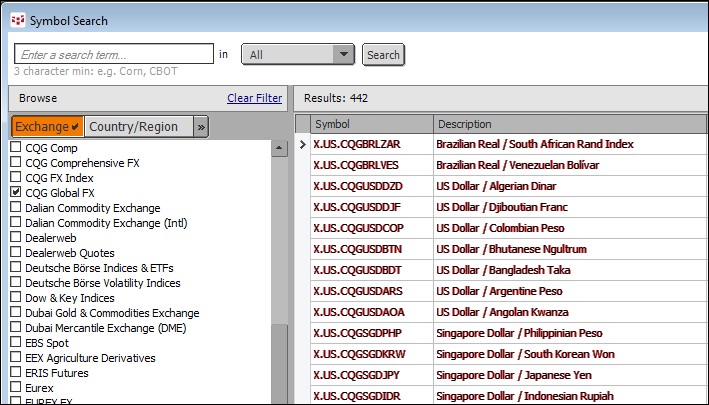

TDL has partnered with Netdania, creating an institutional market data offering integrated into CQG's trading platforms. Sourced directly from tier-1 banks and non-bank market makers worldwide,… more

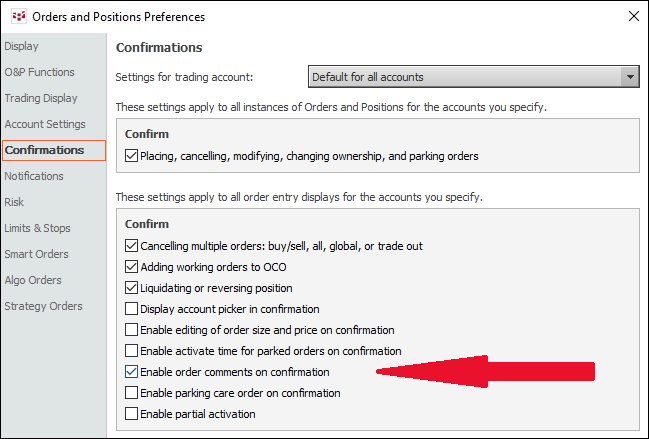

You can add a comment to an order when you confirm the order. In order to enter comments, select via Trading Preferences/Confirmations setting. For more information, please read the Help File.… more

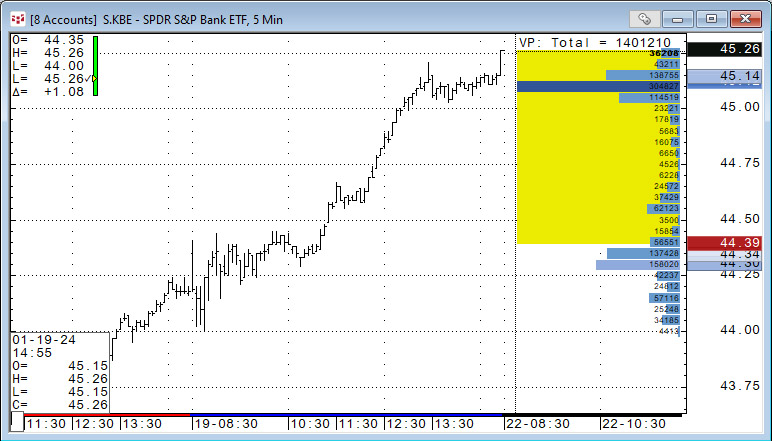

The Volume Profile study displays the total volume in VP header. To enable the feature select "Total" from the Study Parameters Display Bars-Display. For more details, please read the Help File… more