The raw material markets continued to make a comeback in the final quarter of 2020 after the global pandemic caused a deflationary spiral taking the prices of most assets to lows in March and April. In Q4, commodities posted an 11.77% gain. The asset class was 9.89% higher in 2020. In 2019, it gained 10.98%. In 2018 commodities lost 6.82%. The price action in Q4 turned a loss for the year into a gain.

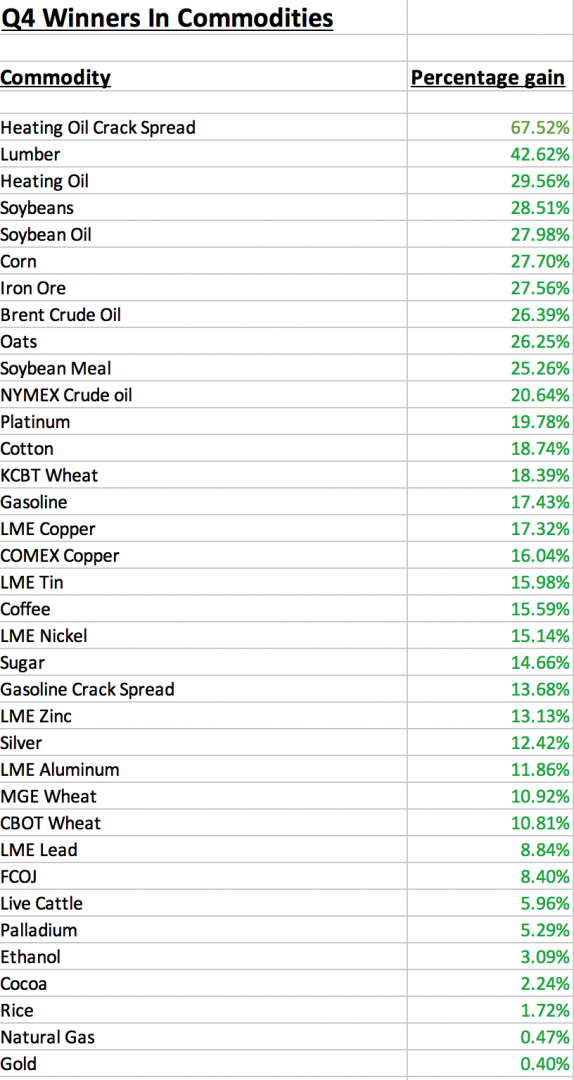

The overall winner of the 29 for the fourth quarter was lumber that posted a gain of 42.62%, with NYMEX heating oil in second place with a 29.56% gain. Soybean futures were 28.51% higher, and the majority of commodity futures posted double-digit percentage gains.

The biggest loser for the quarter was the Baltic Dry Index that fell 17.61%, with lean hogs in second place on the downside with a 3.47% loss in Q4. The price of nearby feeder cattle futures fell 1.70% over the period.

In 2020, lumber futures led the way on the upside with a 115.42% gain, after rising to a new record high of $1,000 per 1,000 board feet in Q3. Iron ore gained 72.78% in 2020, and silver was 47.38% higher for the year. The biggest losers on the year were heating oil futures, down 26.64%, and Brent crude oil with a 21.47% loss. NYMEX crude oil was a close third with a 20.54% loss since the end of 2019. The crude oil markets posted over 20% gains in Q4, which trimmed the losses for the year.

The US dollar is typically a significant factor when it comes to commodity prices, as it tends to have an inverse value relationship with raw material prices. The dollar index posted a 4.29% loss in Q4 and was 6.42% lower for the year. The dollar index was 0.34% higher in 2019.

Quantitative easing, low interest rates, a falling dollar, and the prospects for rising inflationary pressures are a potent bullish cocktail for commodity prices as we head into 2021.

Myriad complex factors on a macro and microeconomic basis dictate the price direction for the commodities market over the coming three months and beyond. The pandemic continues to be the most significant factor facing markets across all asset classes. A shift in US policy under the incoming Biden administration is also likely to cause volatility in commodities and markets across all asset classes. Substantial changes in tax, energy, trade, and other policy areas will translate to price volatility in most markets. The economic fallout from the global pandemic will continue to be a legacy of 2020 for years to come.

Winners outnumber losers in Q4 in commodities

During the period from October through December 2020, all of the commodity sectors posted gains. Thirty-six products posted gains with many double-digit percentage increases. The list of gains are as follows:

In 2020, the following twenty-nine commodities posted gains:

The losers in Q4 in commodities

Only three commodities posted losses in the fourth quarter of 2020 as the market continued to experience a rebound from the price carnage earlier in the year:

The year-to-date performance ended with losses in ten of 39 products:

Digital currencies explode higher

The CFTC has defined digital currencies as commodities. The cryptocurrency asset class that was all the rage in 2017 plunged in 2018. In 2019, the digital currencies made a comeback, but the risk-off conditions weighed on many of the members of the asset class in Q1. In Q2 and Q3, they made a comeback. In Q4, they exploded higher. The asset class’s market cap moved from $344.464 at the end of Q3 to $767.482 billion at the end of Q4, a rise of 122.80% over the three months. Bitcoin rose 171.38% in Q4 and was 303.19% higher in 2020. Ethereum posted a 108.19% gain in Q4 and was 469.43% higher for the year. Litecoin was 170.40% higher for the period and moved 198.06% higher since the end of 2019. Bitcoin Cash was 52.93% higher in the fourth quarter and 67.91% higher in 2020. The number of tokens moved higher from 7,254 at the end of Q3 to 8,153 on December 31, a rise of 12.39%. The digital currency asset class’s market cap reached a peak of over $800 billion in late 2017. The rising number of tokens has diluted the asset class over the past two and one-half years. Bitcoin, the leader of the pack, outperformed the market cap in Q4 and 2020. Bitcoin and the other cryptocurrencies moved higher during the early days of 2021.

Issues to look forward to in Q1 2021

The staggering economic costs of the global pandemic will be its legacy. The liquidity and stimulus will influence markets over the coming months and years. Even after the tragic loss of life from the global pandemic, the population will continue to grow. The number of commodity consumers worldwide continues to grow by approximately 20 million each quarter. Economic stagnation is likely to remain in the aftermath of the virus. The stimulus will weigh on the value of fiat currencies and boost government debt levels around the world. The decline in the purchasing power of fiat currencies could eventually cause commodity prices to skyrocket. Many markets made comebacks in Q2 through Q4, which could become a launchpad for the future. If the price action after 2008 repeats, we could see a bull market in the raw materials asset class in the coming months and years. Commodity prices were moving appreciably higher as 2020 ended.

We are likely to see significant changes in US tax, energy, trade, and other policy areas in 2021. The January 5 runoff election in Georgia is the first significant event of 2021 as it will determine the balance of power in the US Senate. A victory by the two Democrats would hand President-elect Biden clear sailing for his initiatives over the coming two years. A majority in the House of Representatives and Senate will provide powerful support for the new President’s plans. If Republicans maintain control of the Senate, President Biden will need to negotiate and compromise, leading to a more centrist approach. However, tax, energy, and many other US government policy and regulatory areas will shift, causing markets to react and adapt.

I expect price variance in markets across all asset classes to remain at very high levels throughout 2021 and beyond. The global financial crisis in 2008 and the worldwide pandemic of 2020 were very different events. However, central banks and governments employed the same tools to deal with each situation. The only difference between 2008 and 2020 is that the liquidity levels and stimulus in 2020 were far higher. Commodities rallied from 2008 through 2011, reaching multi-year and all-time highs. Even though we have seen substantial rallies in raw material prices since the March and April 2020 lows, it still may be early days for the bullish trends.