COMEX copper futures posted a 2.10% gain in 2023 and moved 2.99% higher in Q1 2024, settling at $4.0070 per pound at the end of March. One month later, the price was over the $4.50 level, with copper in a technical bullish trend.

Before 2005, nearby COMEX copper futures never traded above the 1988 $1.6065 per pound high. Meanwhile, copper futures have not been below $2 since 2016 and under $3 per pound since 2020.

The recent price action has put copper on a path to challenge the March 2022 $5.01 record peak, which is long-term technical resistance. Over the coming months, that resistance level could become technical support as copper fundamental and technical indicators point to higher prices.

Copper could be on a bullish launchpad

Copper prices have been trending higher since October 2023.

The weekly chart highlights the nearby COMEX copper future's 32.7% ascent from $3.5195 in October 2023 to the latest $4.6695 in late April 2024. The upside target is the March 2022 $5.01 record peak.

China is a critical factor

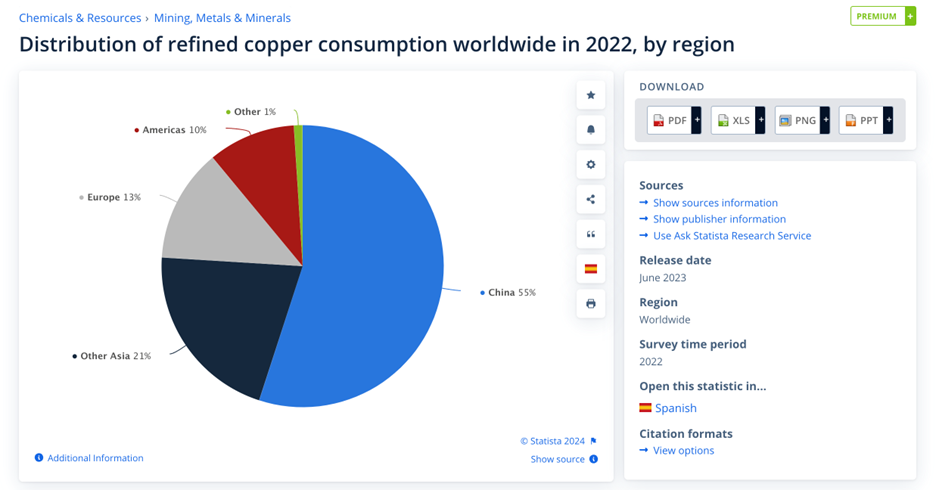

China dominates the global demand for copper as the metal is critical for infrastructure building.

Source: Statista

As the chart highlights, China accounted for over half of the world's refined copper consumption in 2022. Chinese economic weakness in 2023 pressured copper prices. As China emerges from its economic malaise, the demand is likely to increase in 2024.

A new demand vertical supports higher prices

Copper, often referred to as Dr. Copper due to its ability to predict economic trends, is a crucial commodity in the global market. It serves as a barometer for economic growth or contraction, making it a key indicator for investors.

Meanwhile, addressing climate change with green energy initiatives has opened a significant demand vertical for the metal, changing copper's fundamental supply-demand equation. Electric vehicles, wind turbines, and other green energy products require increasing amounts of the red nonferrous metal. Goldman Sachs analysts have dubbed copper "the new oil" because of its growing use in alternative energy initiatives.

Supplies will struggle to keep pace with the increasing demand

The process of bringing new copper production online is a time-consuming task, often taking up to a decade. This, coupled with the fact that many of the latest mining projects are in Africa, presents both challenges and opportunities for the market. Furthermore, the emergence of copper production in the Democratic Republic of Congo, despite historical issues of corruption and other challenges, adds another layer of complexity to the market.

Many analysts forecast a supply-demand deficit that could last until 2030, putting upward pressure on prices.

A mining legend believes there is significant upside potential

Billionaire Robert Friedland is a mining legend, having founded Ivanhoe Mining Ltd. and many other metal and mineral mining companies over the past decades. Mr. Friedland believes copper is a "powder keg" with a price ready to explode. In a late 2023 Bloomberg interview, he said $15,000 per ton is needed to spur new copper mines. A $15,000 per ton price translates to COMEX copper futures above the $6.80 per pound level.

Copper has lots of upside room, and the market could be looking down at the March 2022 $5.01 high as technical support instead of a resistance level over the coming months and years.

While bullish for the copper price, bull markets rarely move in straight lines. Buying the red metal on dips or corrections over the coming weeks could be the optimal approach to building a copper trading or investment risk position.