The raw material markets declined in Q4. The commodity asset class consisting of 29 primary commodities traded on U.S. and U.K. exchanges moved 3.91% lower in Q4 2023. At the end of 2023, the asset class was 4.52% lower. Commodities were 5.37% higher in 2022 and 26.79% higher in 2021.

The U.S. dollar is typically a significant factor for commodity prices, as it tends to have an inverse value relationship with raw material prices. The dollar index moved 4.52% lower in Q4 and was 2.17% lower in 2023. The decline in the dollar index did little to support most commodity prices.

The Fed's pivot caused the US 30-Year Treasury bond futures to rise 9.5%% in Q4 but were 0.57% lower in 2023, after a 21.66% decline in 2022. The recovery in bonds pushed the dollar index lower in Q4, which could have a lagged impact on commodity prices. The ongoing war in Ukraine and the war in Israel after the October 7 terrorist attack increased geopolitical tensions in Q4.

The sector results for Q4 were as follows:

- Precious metals moved 3.82% higher, led by gold.

- Grains moved 2.89% higher.

- Soft commodities posted a 1.73% gain.

- Energy led on the downside, with a 19.26% decline.

- Animal proteins fell 11.91% during the offseason for demand.

- Base metals edged 0.73% lower.

The sector results for 2023 were:

- Soft commodities led the asset class with a 24.04% gain, thanks to significant rallies in cocoa and frozen concentrated orange juice futures.

- Animal proteins edged 1.74% higher.

- Precious metals fell 8% as the price of palladium plunged.

- Base metals fell 10.03% as nickel declined over 40%.

- Grains declined 13.04% after spectacular rallies in 2022.

- Energy fell 21.85% as volatility continued in the commodities that power the world.

Winners in Q4

In Q4, nineteen commodity futures moved to the upside, with eight posting double-digit percentage gains.

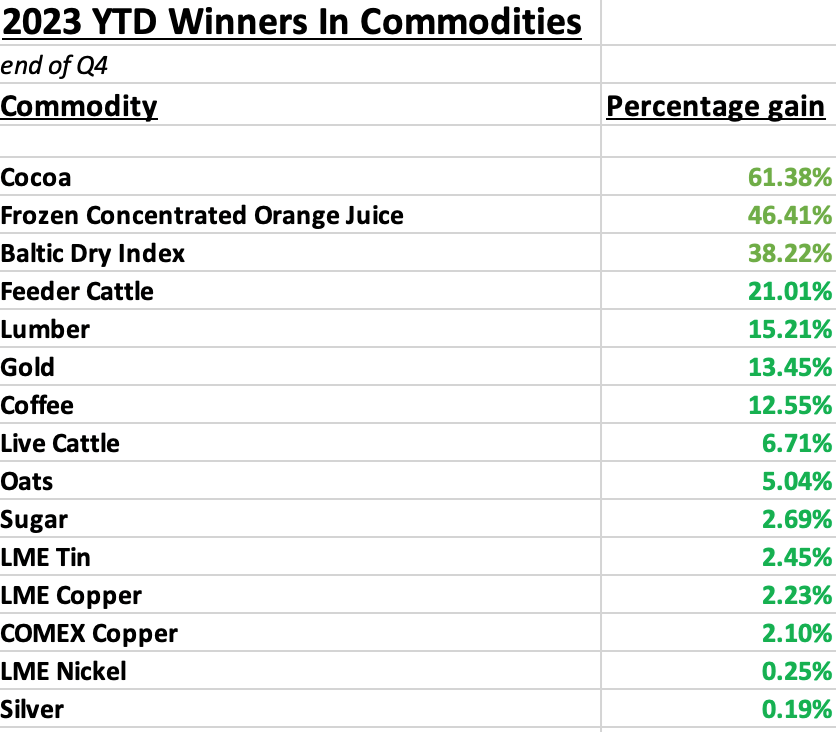

Winners in 2023

Fifteen commodities moved to the upside in 2023, with seven posting double-digit percentage gains.

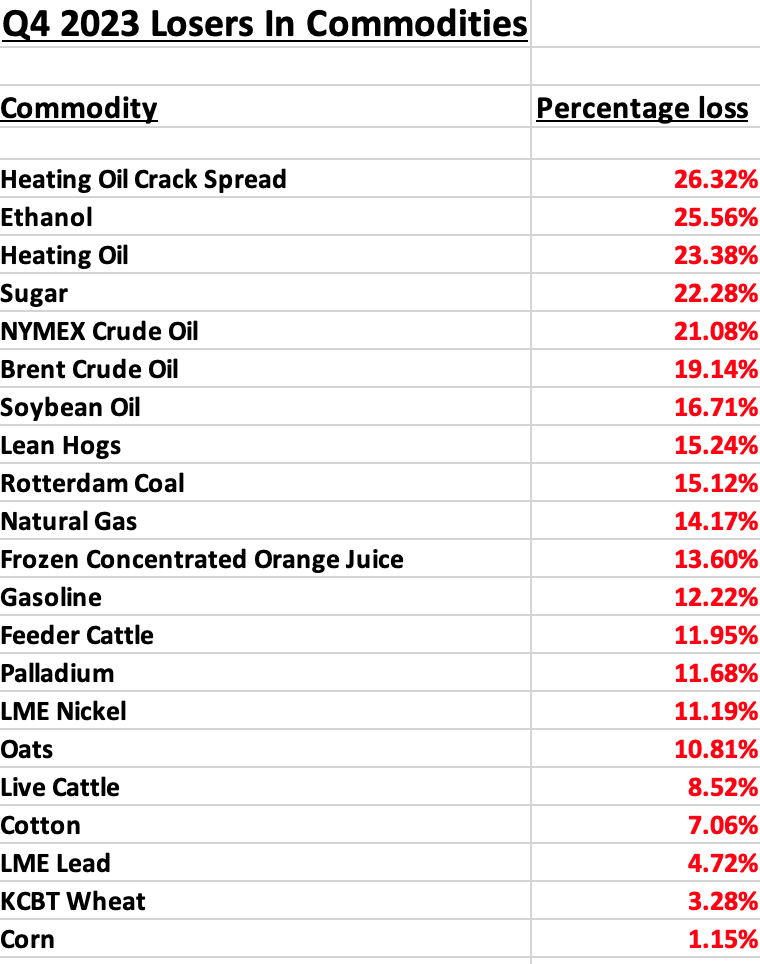

Losers in Q4

Twenty-one commodities posted losses in the fourth quarter of 2023. There were sixteen double-digit percentage losers in Q4.

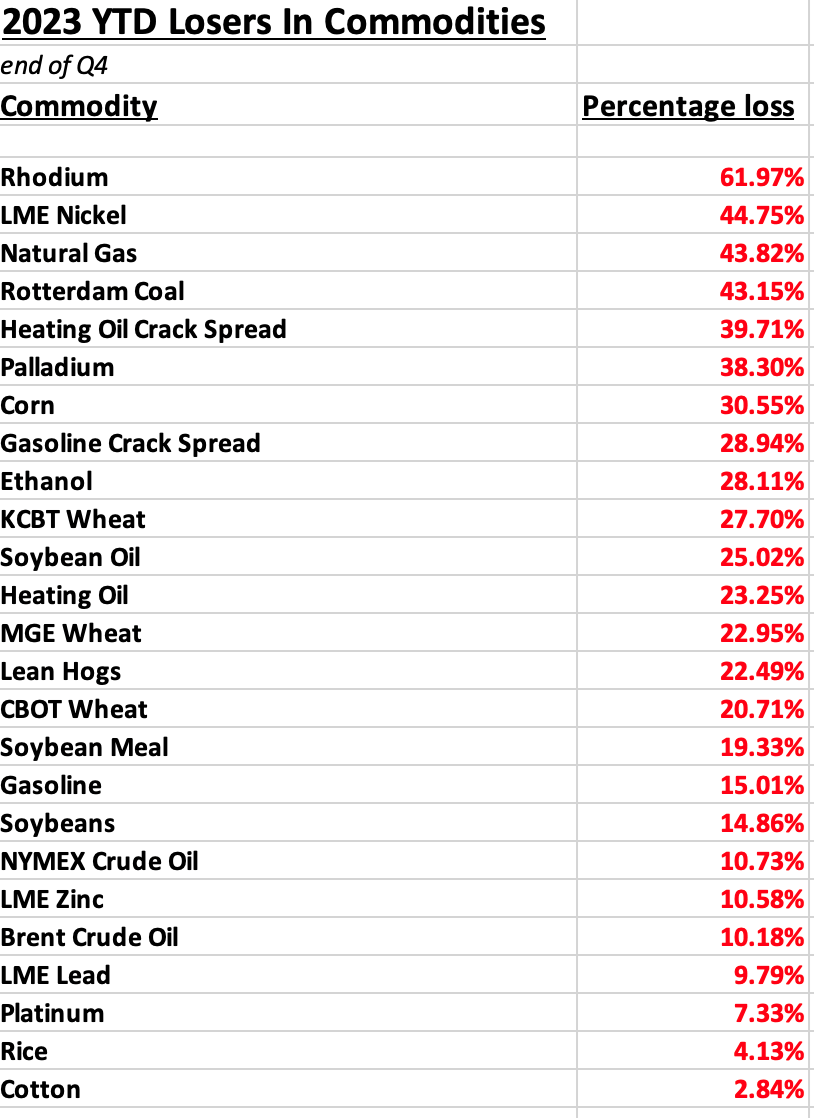

Losers in 2023

Twenty-five commodities posted losses in 2023. There were twenty-one double-digit percentage losers over the period.

Highlight on Gold - Looking forward to 2024

The bull market in gold will celebrate its twenty-fifth anniversary in 2024.

The quarterly chart highlights gold's record highs in 2011, 2020, 2022, and 2023. Meanwhile, the precious metal put in a bullish reversal on the quarterly chart in Q4 2023, which could lead to significant gains in 2024. Falling interest rates, a weaker U.S. dollar, and geopolitical turmoil could create a perfect bullish cocktail for the metal, the world's oldest means of exchange. Moreover, the current environment could support gains in energy, agricultural products, and metals during the coming year.

I expect price variance in markets across all asset classes to remain at very high levels in Q1 2024 and beyond. Trading rather than investing could provide optimal results. Approach all risk positions with a plan, stick to stops, and take profits when they are on the table. Follow market trends as they reflect the herd behavior that drives market prices.

Happy New Year, and all the best for a healthy and profitable 2024!