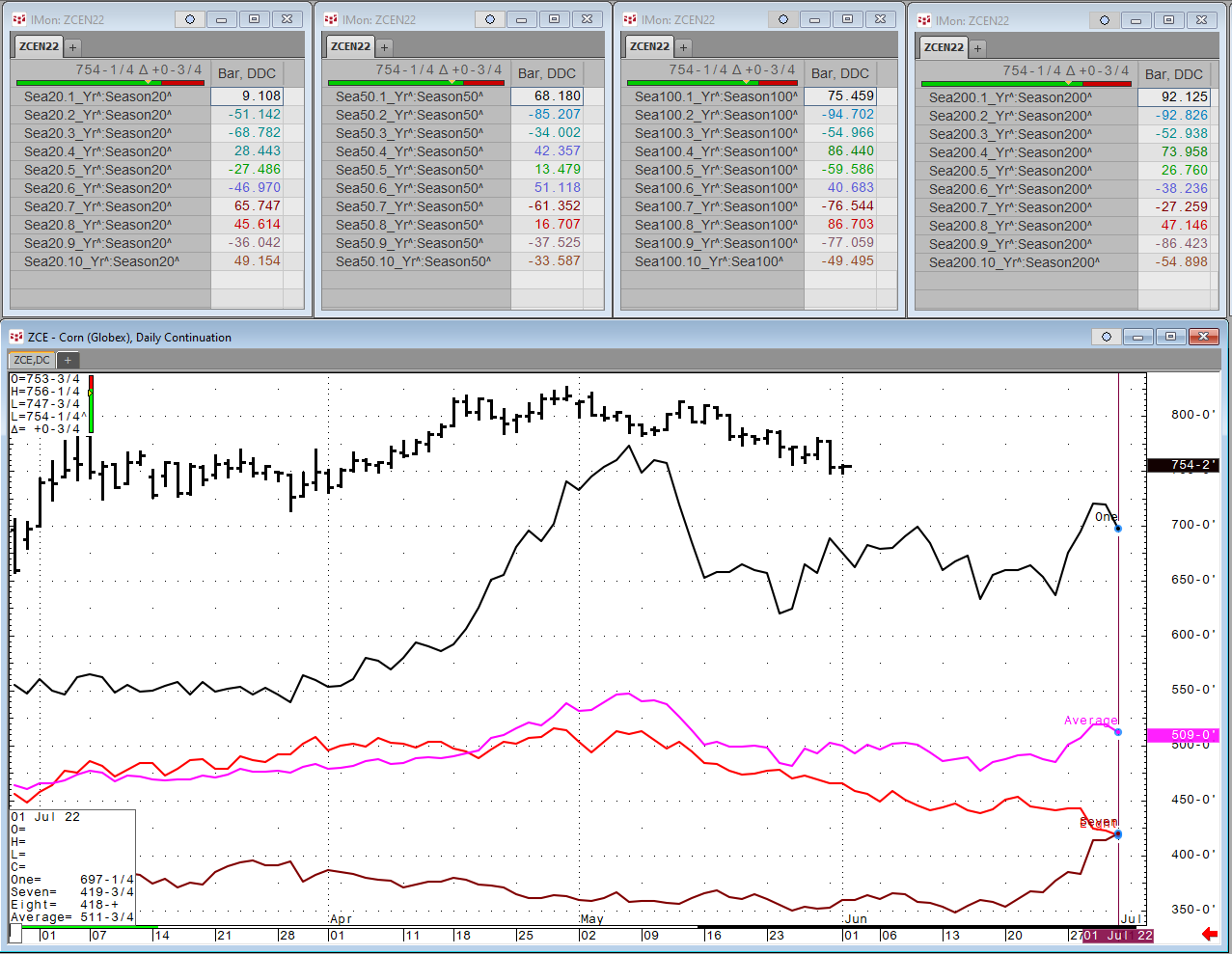

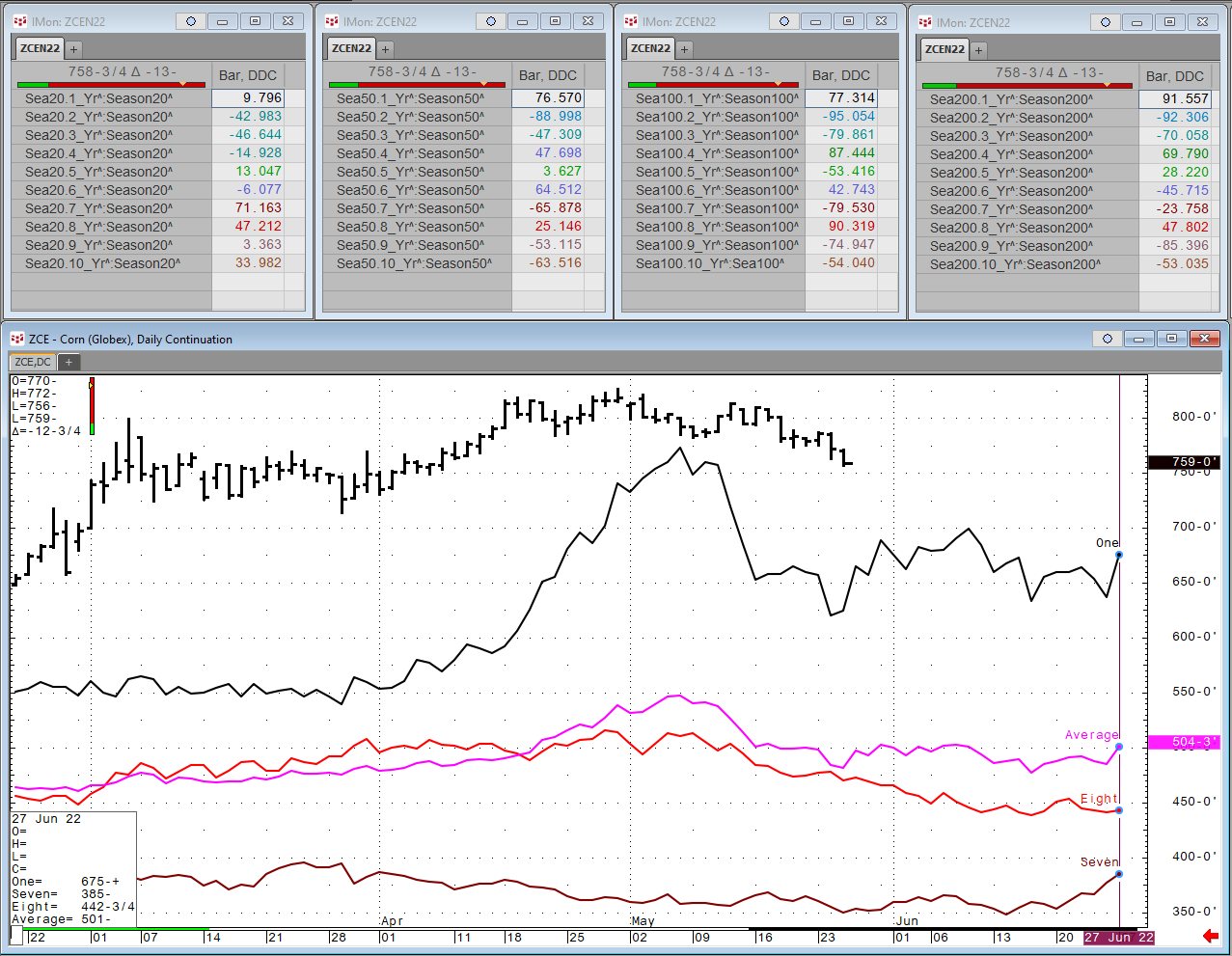

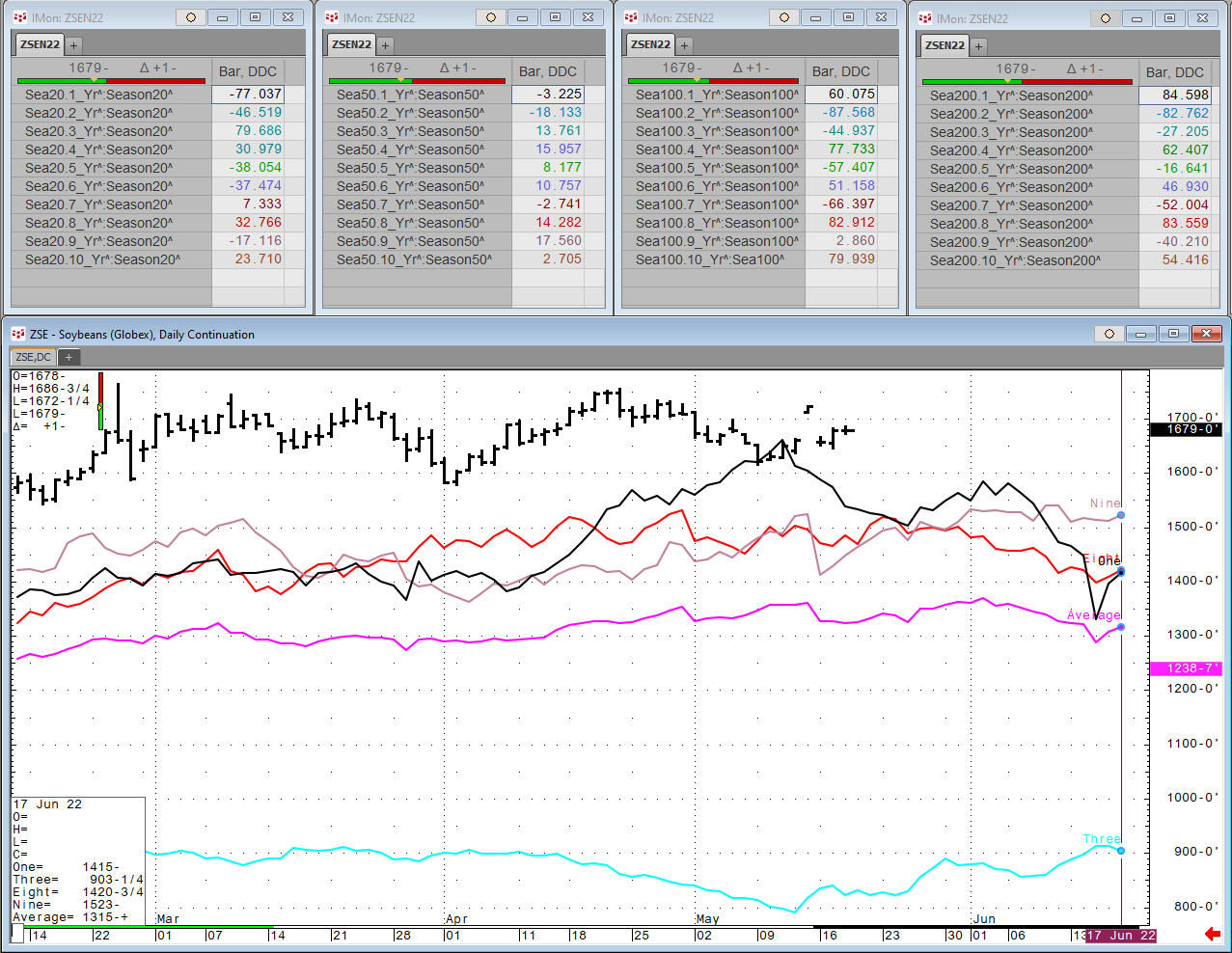

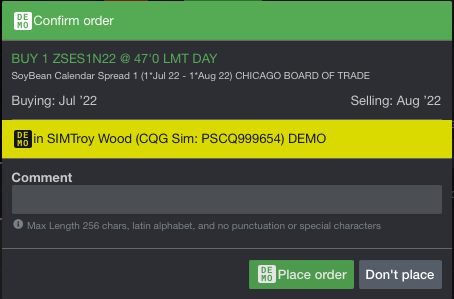

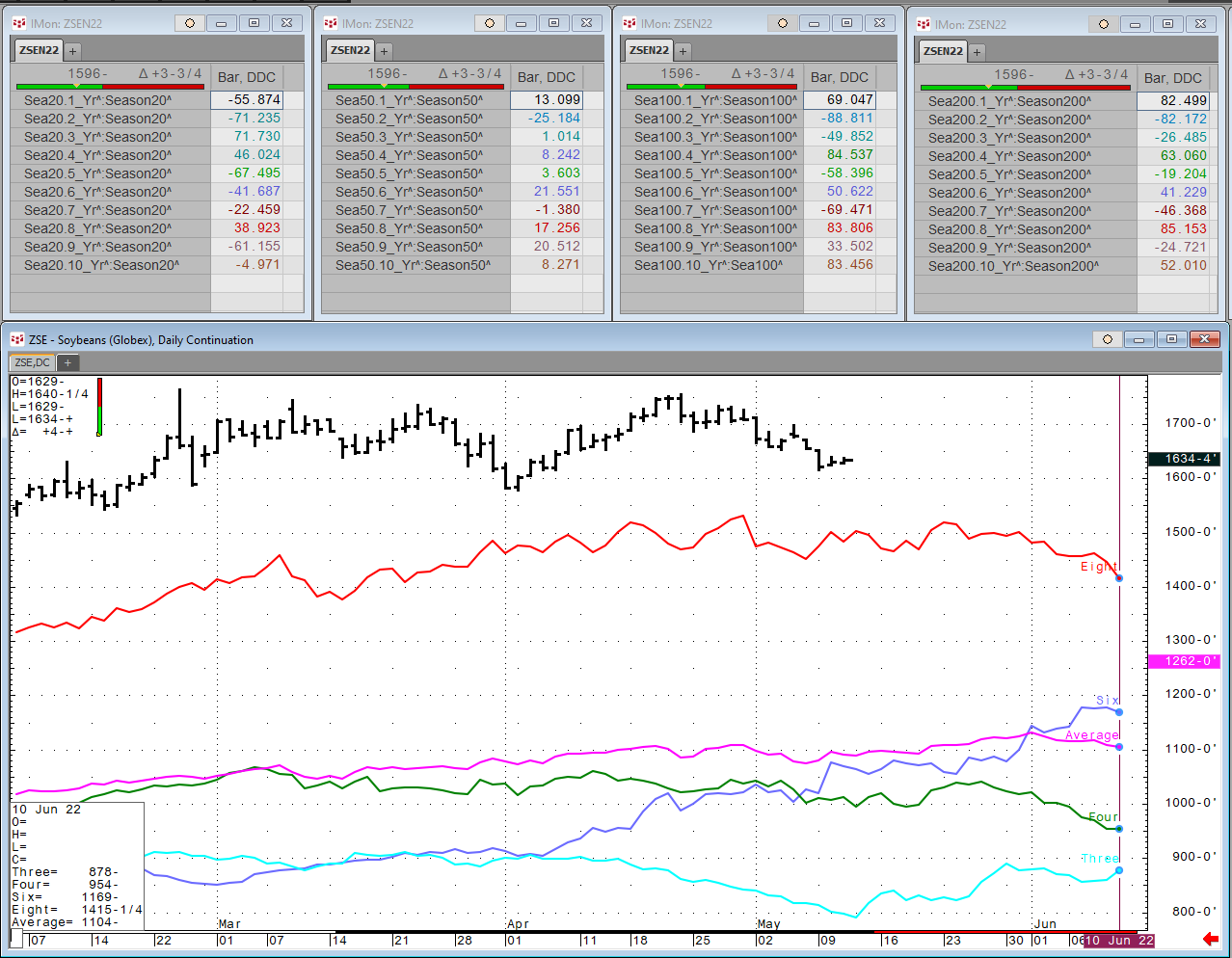

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Blogs

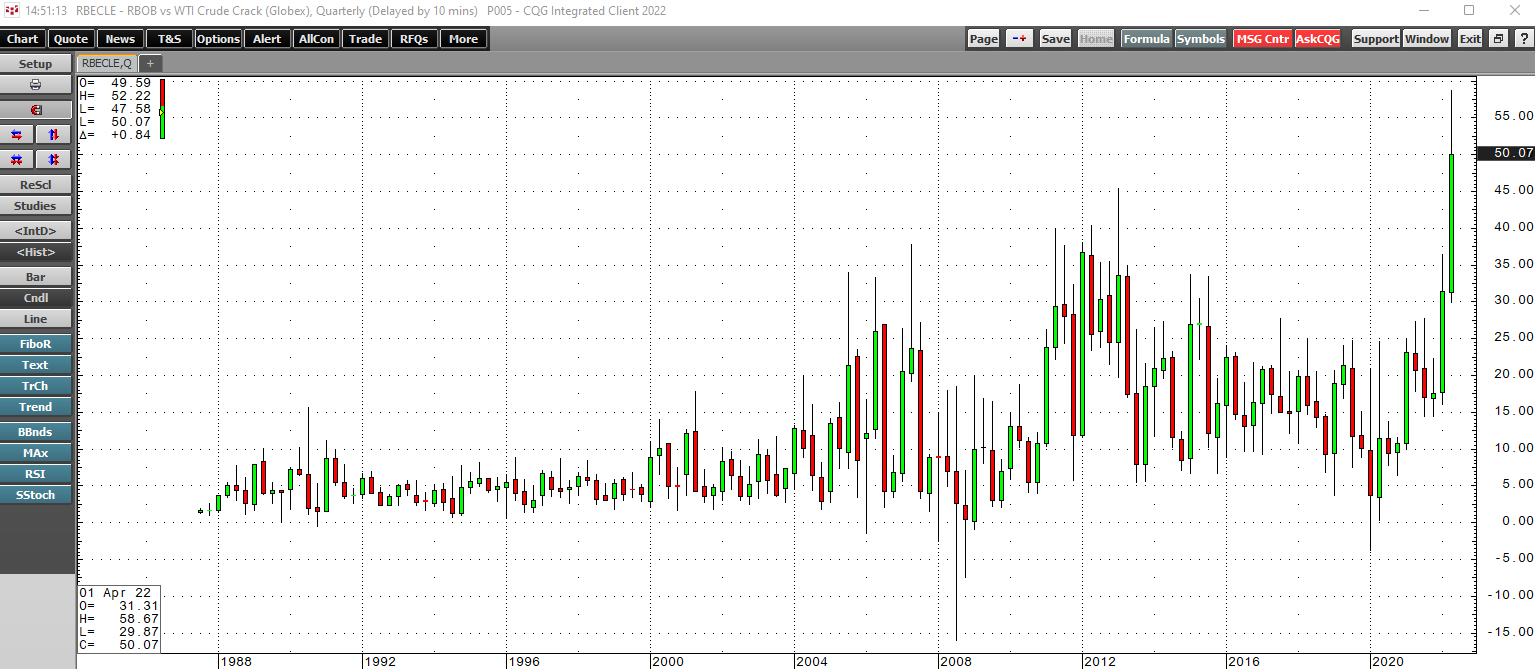

In early March, crude oil prices rose to their highest levels since 2008 when nearby NYMEX futures rose to $130.50, and Brent futures hit $139.13 per barrel. While crude oil reached a fourteen-… more

In addition to the customer facing features for this release, here are features requested by our partners.

TradingAdded trade type options to Trade Registration WidgetAdded trade amendment… moreAT A GLANCE

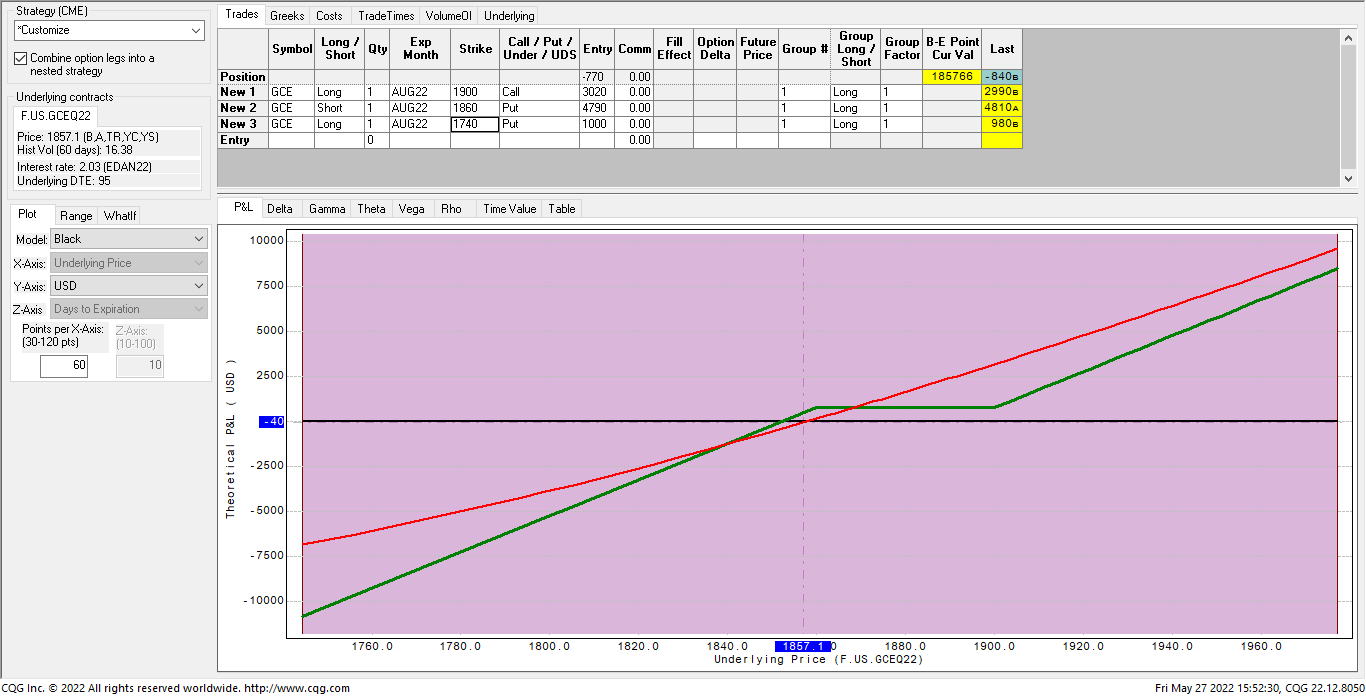

TRADING-RELATED TWEETS SURGED 52% IN 2021, WHILE 80% OF INSTITUTIONAL INVESTORS SAY THEY USE SOCIAL MEDIA FOR THEIR REGULAR WORKFLOW BLOOMBERG QUICKTAKE HAS… moreOver the past few weeks, I’ve asked several options pros with over forty years’ experience about a specific options strategy that I developed for speculators which has limited downside risk and… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Dr. Barbara Kolm is the Vice President of the Austrian Central Bank, since 2018. She is also the Director of the Austrian Economics Center (AEC) and President of the Friedrich August von Hayek… more