Shanghai Futures Exchange (SHFE) has announced approval for participation of Qualified Foreign Institutional Investors (QFII) and RMB Qualified Foreign Institutional Investors (RQFII) in commodity futures and options trading. In addition, Dalian Commodity Exchange (DCE), Zhengzhou Commodity Exchange (ZCE) and China Financial Futures Exchange (CFFEX) announced an expansion of the products QFII and RQFII could participate in. Read more here.

QFII and RQFII can invest in 41 commodities, financial futures and option products in China. The list breaks down to twenty-three commodity futures, sixteen commodity options and two financial index options contracts as detailed in the following table.

Traders using CQG have access to world-class graphics and analytics, trading applications offering features specific to the professional trader's needs, Portfolio and Instrument Monitors, sophisticated trade system development tools, expert-Level options analysis and server-side spreading and aggregation.

The remainder of this post focuses on using the CQG Spreader for spreading markets in China, USA and London.

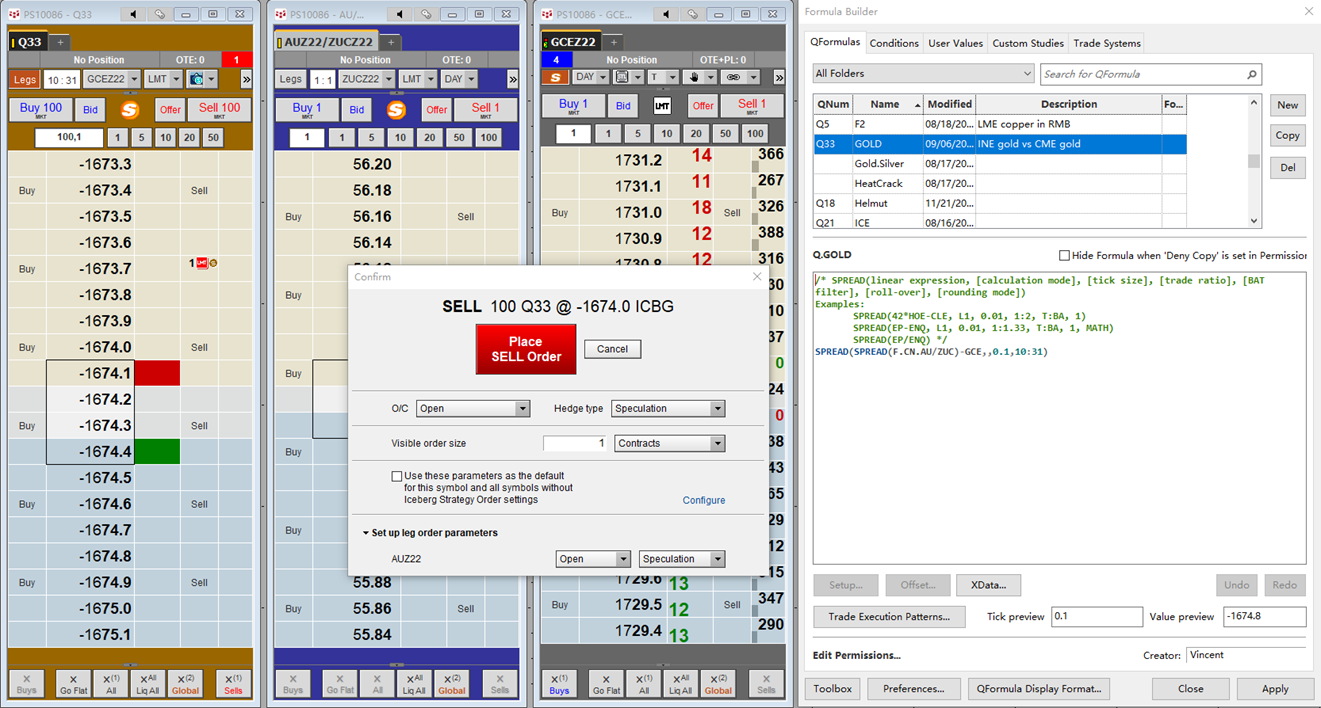

The first example is trading a Gold futures interexchange arbitrage spread via CQG’s spreader platform:

Arbitrage formula: SPREAD(SPREAD(F.CN.AU/ZUC)-GCE,,0.1,10:31)

Shanghai Gold AU/SGX RMB exchange rate ZUC - CME Gold GCE. The minimum price difference unit is 0.1. The price ratio between the two is 10:31. The active leg is on CME.

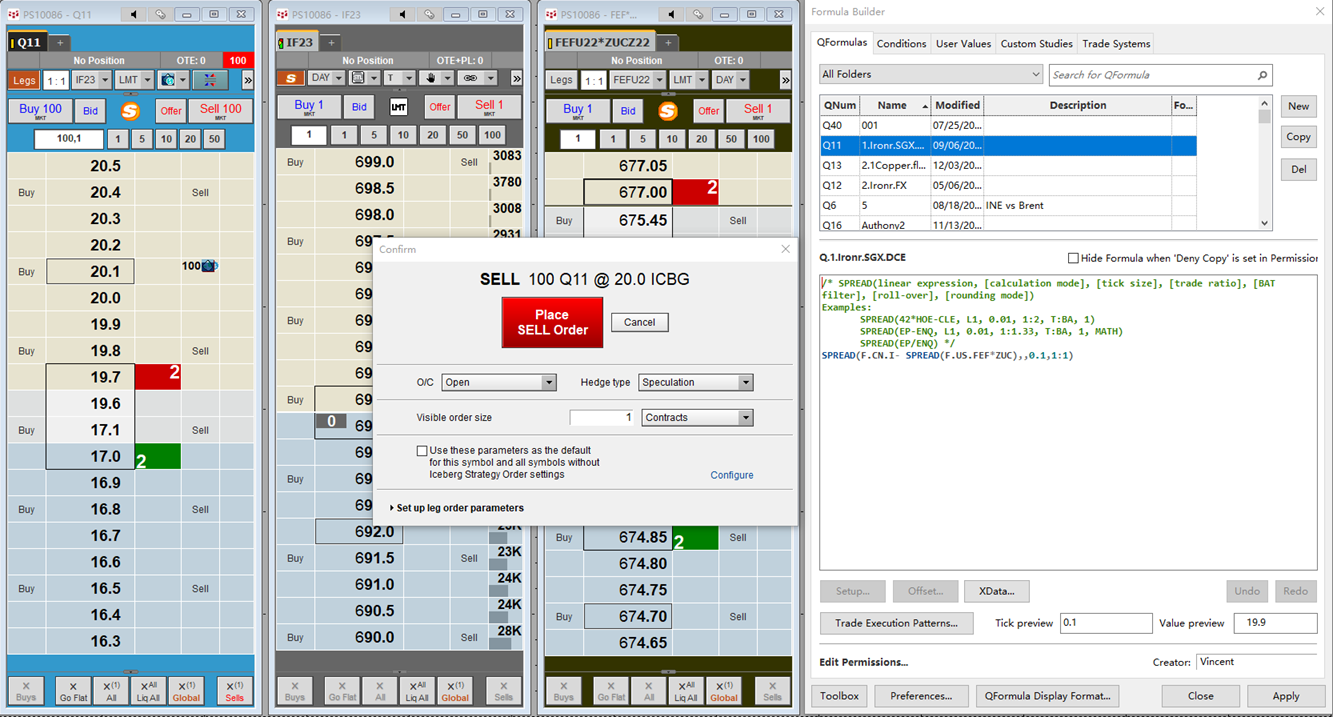

The next example is trading an Iron ore futures interexchange arbitrage spread:

Arbitrage formula: SPREAD(F.CN.I- SPREAD(F.US.FEF*ZUC),,0.1,1:1)

DCE iron ore futures - SGX iron ore market futures FEF * SGX offshore RMB exchange rate. The minimum price difference unit is 0.1. The price ratio between the two is 1:1. The active leg is in Dalian Commodity Exchange.

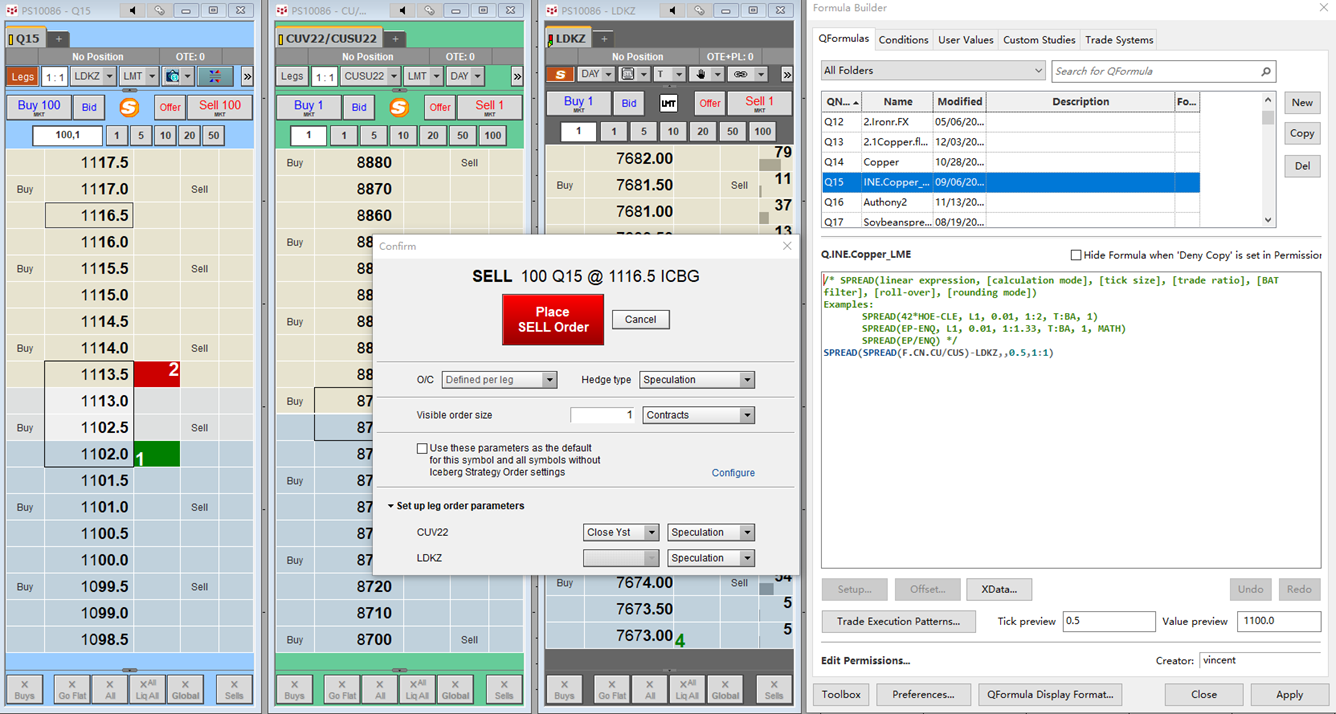

The next example is trading a copper futures interexchange arbitrage spread:

Arbitrage formula: SPREAD(SPREAD(F.CN.CU/CUS)-LDKZ,,0.5,1:1)

Shanghai copper CU/Hong Kong stock exchange RMB exchange rate CUS - LME copper. The minimum price difference unit is 0.5. The price ratio between the two is 1:1. The active leg is on the LME.

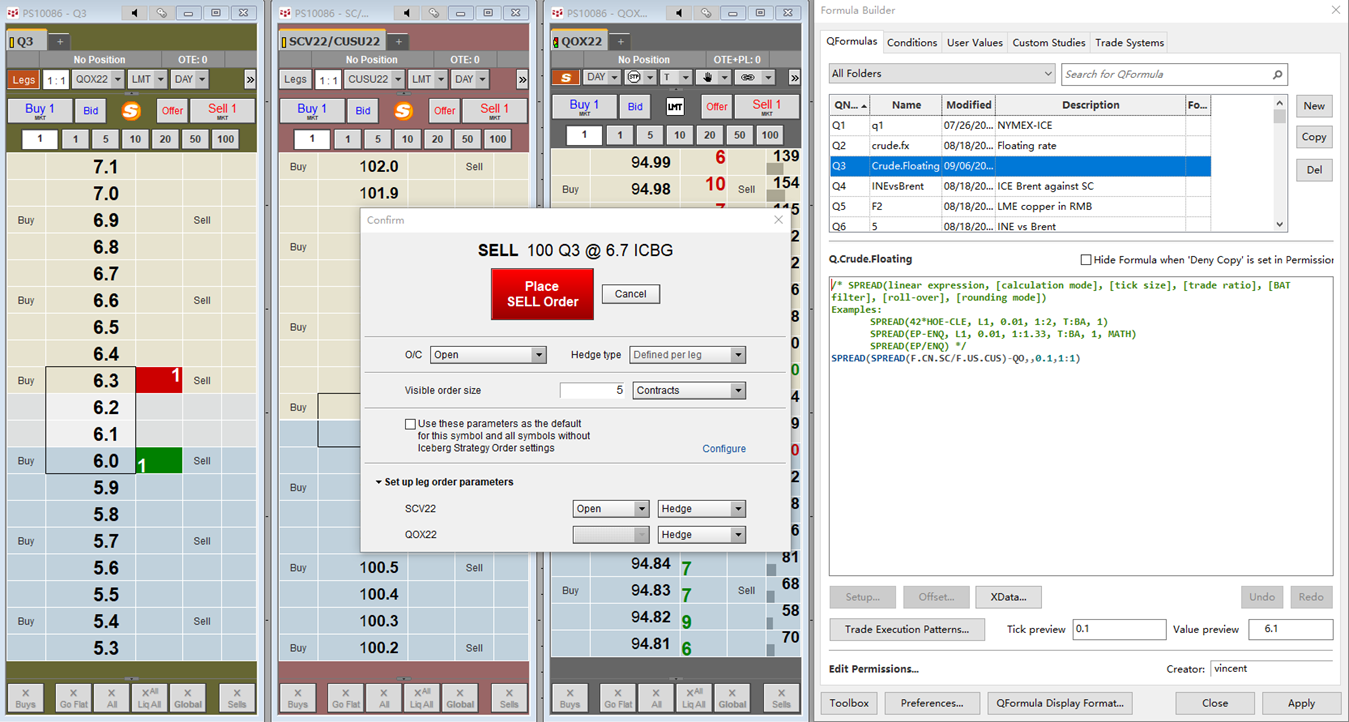

The next example is trading Crude Oil future spread:

Arbitrage formula: SPREAD(SPREAD(F.CN.SC/F.US.CUS)-QO,,0.1,1:1)

INE crude oil SC/Hong Kong stock exchange RMB exchange rate CUS - ICE Brent oil QO. The minimum price difference unit is 0.1. The price ratio between the two is 1:1. The active leg is on ICE. The order type is hedging policy. The direction of opening and closing positions to open a position.

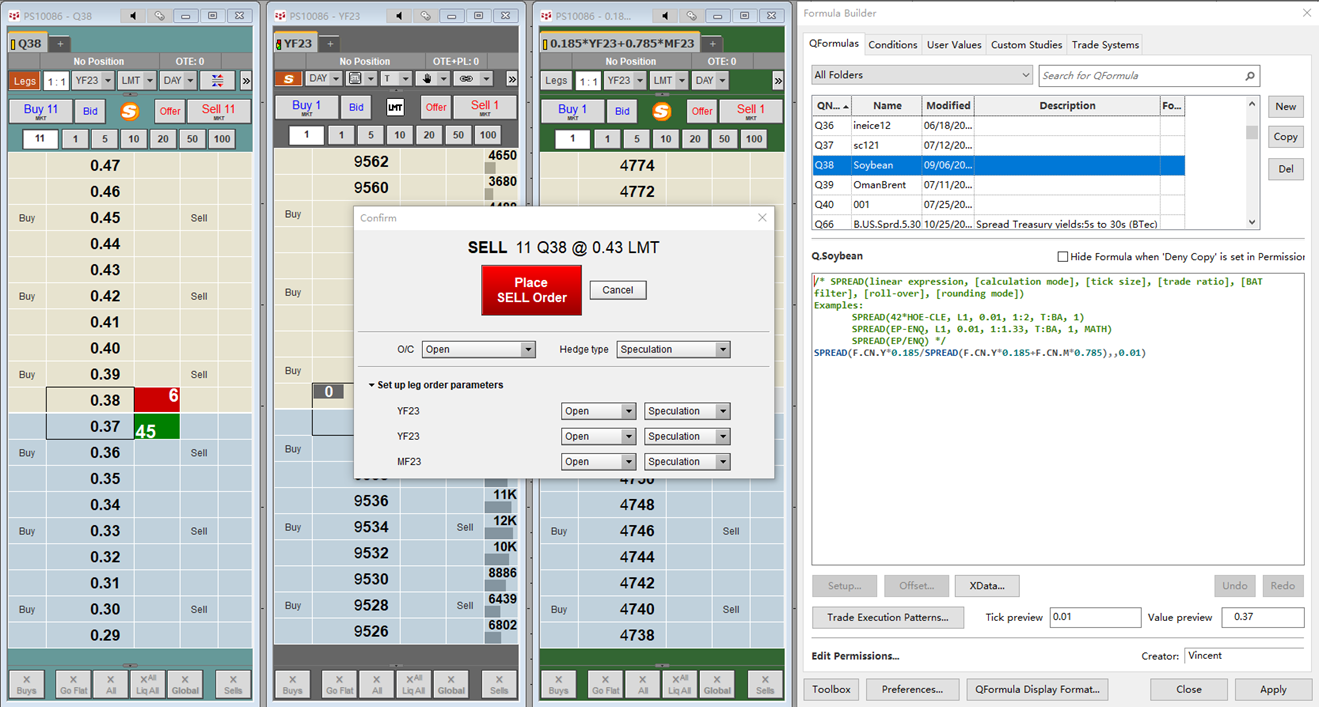

The last example is trading Soybean Oil vs Soybean meal spread:

Arbitrage formula: SPREAD(F.CN.Y*0.185/SPREAD(F.CN.Y*0.185+F.CN.M*0.785),,0.01)

Soybean oil*0.185/(soybean oil*0.185+soybean meal*0.785) The smallest unit of price difference is 0.01. The active leg is in soybean oil. The order type is speculation. The direction of opening and closing positions is opening.

To trade in China an open live account is required. For trading the spreads detailed in this post the CQG Spreader enablement is required and is only available for CQG IC.