A recent YouTube post from the All-In Podcast interviewed NVDIA's Jensen Huang, Advanced Micro Devices' Lisa Su, MP Materials' Jim Litinsky, and Crusoe's Chase Lochmiller.

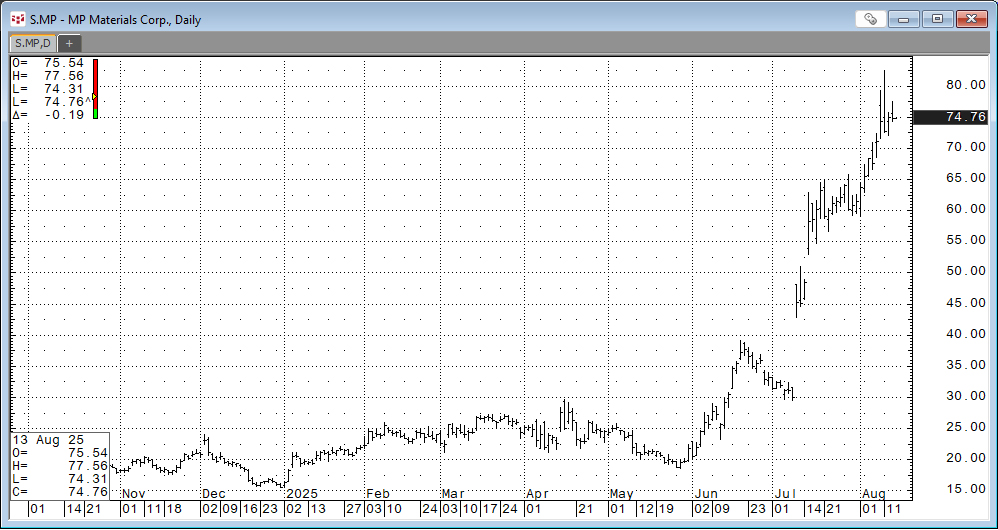

The podcast was interesting and a worthwhile use of time for the opportunity to hear from these CEOs. One item of note was Jim Litinsky discussion of his company's focus (MP Materials Corp). A look at the recent price action for his company shows his company is a stellar performer here in 2025.

If someone wanted to know what ETFs are holding MP Materials Corp, then a quick way to get a list is to use ChatGPT.

The question asked was simple: Which ETFs hold MP Materials Corp?

Here is the detailed response:

Here's a look at exchange-traded funds (ETFs) that currently hold MP Materials Corp (MP) based on the most recent data available as of August 2025:

Highlighted ETFs with Significant MP Exposure

VanEck Rare Earth/Strategic Metals ETF (REMX)

- Weighting: MP Materials is the top holding, making up approximately 6.94% of the ETF's portfolio TipRanks.

- Focus: Targets companies involved in rare earths and strategic metals.

- A Motley Fool article confirms REMX as a compelling option, and as of mid 2025, MP Materials accounted for 11.6% of REMX's net assets The Motley Fool.

iShares Core S&P Small Cap ETF (IJR)

- Holds about 7.2 million shares of MP Materials with a small allocation of around 0.5% of its assets The Motley FoolTipRanks.

SPDR S&P Metals & Mining ETF (XME)

- Contains MP Materials at roughly 1.81% weight TipRanks+1.

Additional Noticeable ETFs from TipRanks (with moderate to notable allocations):

- Sprott Energy Transition Materials ETF (SETM) – About 7.36% weighting in MP Materials TipRanks.

- Invesco S&P SmallCap Materials ETF (PSCM) – Around 5.68% weighting TipRanks.

- Adaptiv Select ETF (ADPV) – Approximately 5.30% weighting TipRanks.

- WisdomTree Energy Transition Metals & Rare Earths Miners UCITS ETF (RARE) – About 3.79% TipRanks.

- KraneShares Electric Vehicles & Future Mobility ETF (KARS) – Roughly 3.27% TipRanks.

- iShares SP/TSX Global Base Metals ETF (XBM) – Approximately 3.24% weight TipRanks.

Summary Table

| ETF Ticker | ETF Name | Approx. MP Materials Weight |

|---|---|---|

| REMX | VanEck Rare Earth/Strategic Metals ETF | ~6.9% (some sources cite 11.6%) |

| IJR | iShares Core S&P Small Cap ETF | ~0.5% |

| XME | SPDR S&P Metals & Mining ETF | ~1.8% |

| SETM | Sprott Energy Transition Materials ETF | ~7.4% |

| PSCM | Invesco S&P SmallCap Materials ETF | ~5.7% |

| ADPV | Adaptiv Select ETF | ~5.3% |

| RARE | WisdomTree Energy Transition Metals & Rare Earths | ~3.8% |

| KARS | KraneShares EV & Future Mobility ETF | ~3.3% |

| XBM | iShares SP/TSX Global Base Metals ETF | ~3.2% |

Final Thoughts

- If you're seeking high exposure to MP Materials, REMX is the standout – especially for targets in rare earths and strategic metals.

- For diversified small-cap exposure, IJR offers some, though minimal, exposure.

- Sector-focused ETFs like XME, SETM, PSCM, and others give more significant exposure tied to materials, metals, and mining industries.

ETF holdings can change frequently, so it's always wise to check the most current ETF fact sheets or holding databases directly for precise figures.

Here, on Workspaces, there are numerous Excel dashboards offered for tracking the intraday performance of the holdings of a particular ETF. The topic of the remaining text for this post.

The REMX ETF has a Chinese company, and the data is not available in CQG.

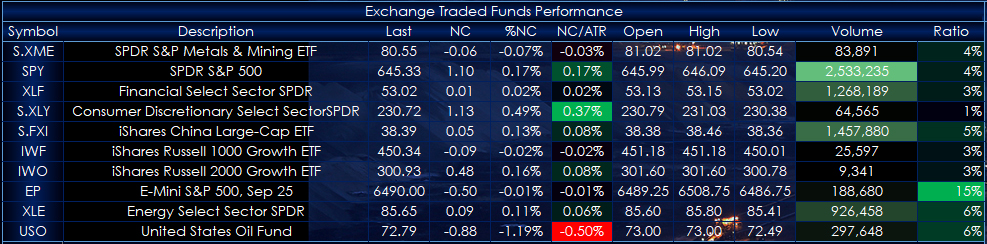

A downloadable dashboard was built and is available at the end of the post. This dashboard is based on the SPDR® S&P® Metals & Mining ETF (Symbol: XME).

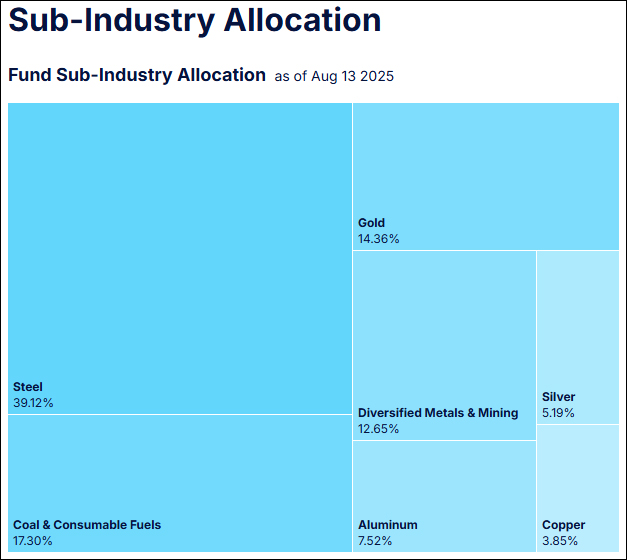

This macro-enabled Microsoft Excel® spreadsheet tracks the holdings of the SPDR® S&P® Metals & Mining ETF. The ETF seeks to provide exposure to the metals & mining segment of the S&P TMI, which comprises the following sub-industries: Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Precious Metals & Minerals, Silver, and Steel. There are 29 companies in the ETF.

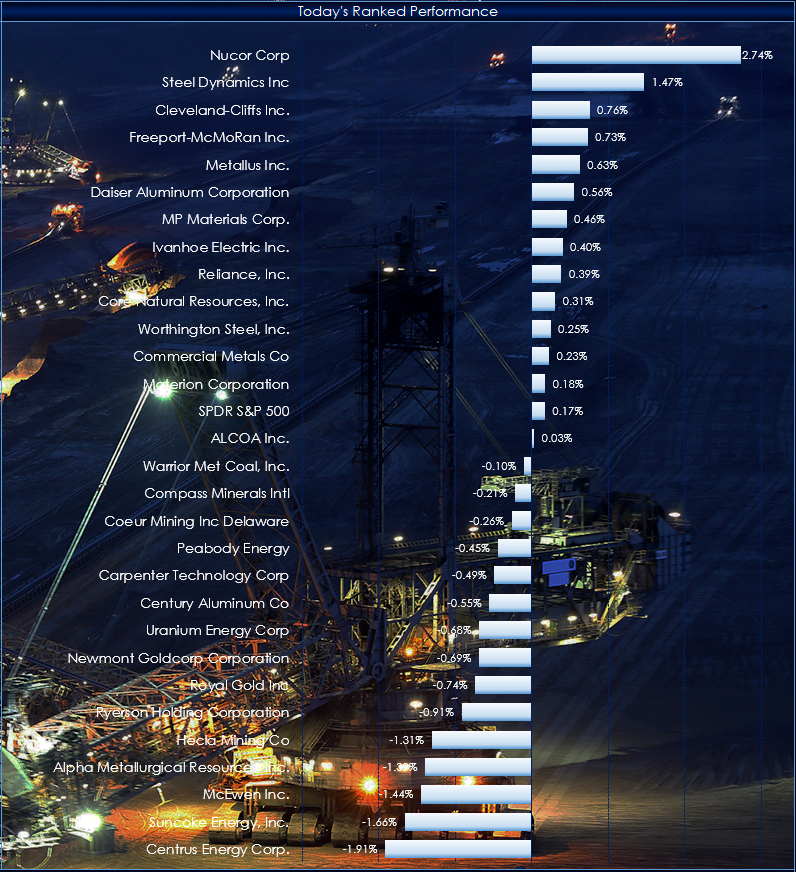

The dashboard has two main sections. During the trading session, the individual stocks are dynamically ranked by percent net change for the current session.

The quotes portion of the display is divided into two sections: The first section allows you to enter your own symbols.

The second section displays the ranked by percentage net change of all the holdings.

Quote data includes today's net change as a ratio to the 21-day Average True Range study. Next to today's traded volume is a column that calculates the ratio of today's volume versus the 21-day average of the volume. This ratio column gives you a sense of how active today's trading is. Readings of 100% and higher indicate active trading.

Next to each company name is a link to Yahoo Finance. The links are updated using VBA code. Clicking the News link will take you to the Yahoo page for that symbol. Note that this could take approximately 30 seconds to open in a browser. Turning off Extensions in your browser will make this happen faster.

If you open another Excel spreadsheet, then this dashboard will no longer be the active spreadsheet. The macro that updates the links and ranks the stocks by performance will stop. To start the macro, simply click the "News" toolbar button in the first column.

Make sure to lower your Excel RealTimeData (RTD) throttle to 50 milliseconds or lower. Learn how to do that here.

Conclusion

The point of this post was to illustrate the use of ChatGPT as a tool. The request for a list of ETFs holding MP Materials Corp took just a few seconds and delivered a thorough list.

Two Excel Dashboards are available: A Black Background and a Visual Image Background.

Requires CQG Integrated Client or CQG QTrader, data enablements for the NYSE and Nasdaq stocks, and Excel 2016 or more recent. This post was assisted by AI and reviewed by Thom Hartle.