Third quarter of 2015 is now in the books, and the results were not pretty for commodity bulls. Overall, a composite of over thirty futures-market-traded commodities moved lower, making the last three months the worst of the year for raw material prices. In Q1 the composite dropped by 6.54%. In Q2 it rebounded by 3.15%. So far in 2015, commodities have moved 13.28% lower.

The Dollar and Commodities - Deflation?

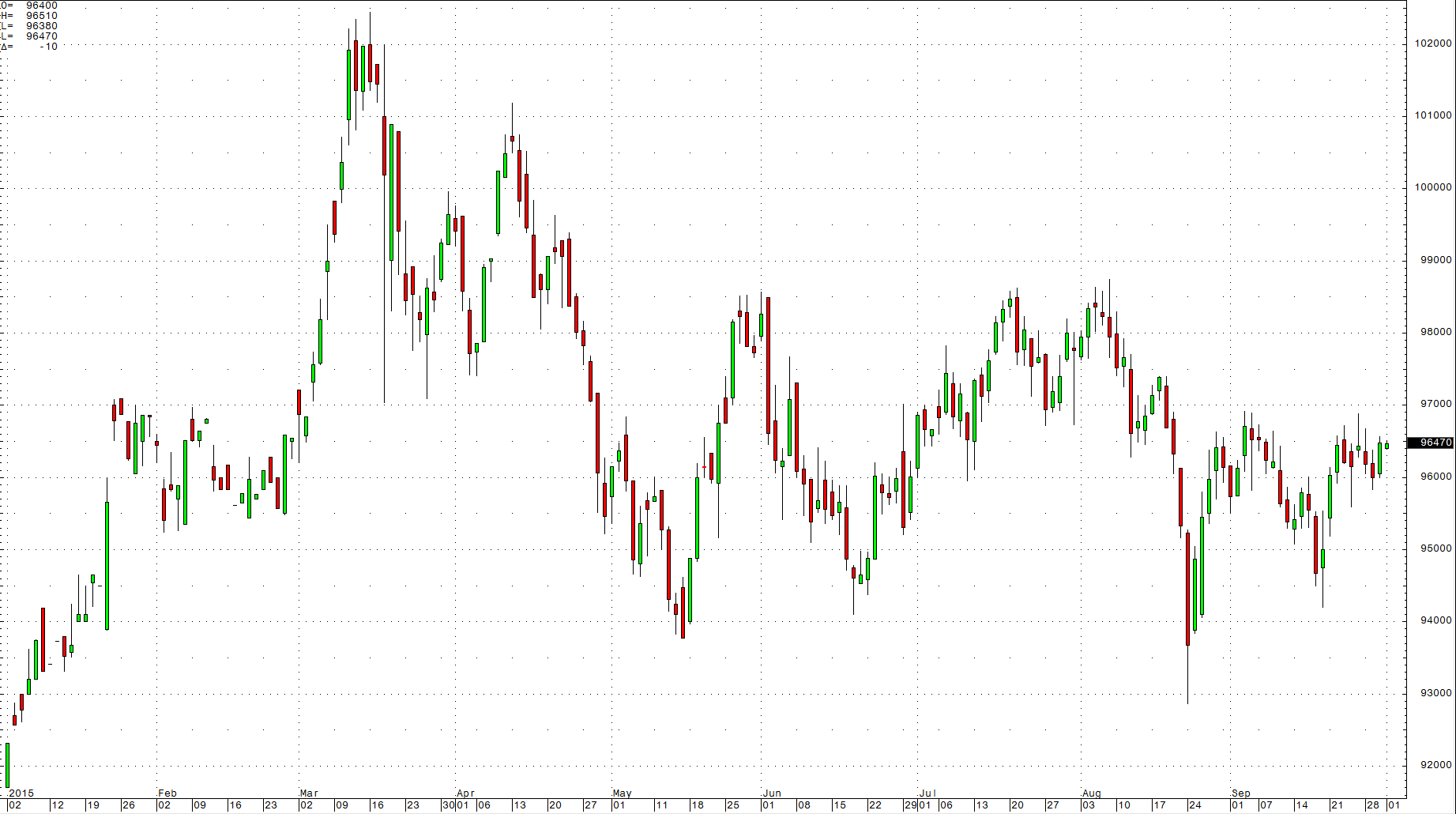

The dollar index futures contract moved only 0.86% higher during the third quarter of 2015.

The dollar index is 6.43% higher thus far for the first nine months of 2015.

The inverse correlation between the dollar and commodity prices held during Q3, with the dollar higher and a composite of thirty-three commodity prices down by 9.26%. During the first nine months of 2015, the dollar index moved 6.43% higher while the commodity price composite moved 13.28% lower. This tells us that commodity prices in 2015 have underperformed the dollar, which indicates real deflationary pressures in the global economy.

The Federal Reserve, over the entire year, has stated that it will raise interest rates in 2015. However, at the recent September FOMC meeting, the central bank left rates unchanged due to "uncertainty" surrounding the global economy. Due to lower commodity prices, inflation is running below the Fed's 2% target rate. Chairperson Janet Yellen said in a speech after the recent meeting that she still expects rates to rise in 2015.

China is a Bearish Factor

Third quarter of 2015 was the worst yet for commodity prices, and the major reason for the swoon was China. China is the world's number one consumer of commodities, and economic issues facing the Asian nation are responsible for lower commodity prices.

In July, the Chinese stock market plunged. The government instituted new rules and regulations for equity trading that inhibited selling and encouraged buying. The government has also taken other steps to achieve their target growth rate of 7%.

During Q3, China floated a $1 trillion yuan infrastructure bond. They have also cut interest rates five times so far in 2015. In August, the People's Bank of China devalued the yuan.

China has made all of these moves to increase economic activity as the economy cools. However, China continues to slow, and the weakening economy has caused contagion. Chinese economic tremors have been tantamount to a tsunami felt around the globe.

Commodity producers have suffered under the weight of falling raw material prices. Stocks in commodity producers like Glencore PLC, Rio Tinto, and BHP Billiton have declined sharply. Nations that depend on revenues from commodity sales like Brazil, Australia, and Canada have seen their currencies depreciate.

The world has come to expect Chinese growth as a given. Now, the slowing economy has decreased demand for raw materials. While China continues to grow, the downtrend in the Chinese economy continues to be a bearish factor for commodity prices as we move forward into the final months of 2015.

Tin, Sugar, and Rice Were the Only Winners

The only three winners in the world of commodities during Q3 were tin, which appreciated by 11.27%; sugar, which was up by 3.29%; and rice, which rallied by 26.26%.

Tin is still down 19.97% in 2015. The increase in sugar is a bit misleading as the market is in a big contango, and lower-priced October futures rolled to March. However, sugar did show strength during the final week of the quarter. The explosive move in rice was due to a weaker crop because of El Niño-related weather issues.

Precious metals, as a sector, fell by 7.67%, with platinum posting the largest loss down 15.79%. Silver lost 6.82% while palladium fell by 3.23%. Gold lost 4.83% of value during the third quarter. Meanwhile, base or nonferrous metal prices slid lower during the quarter. The sector lost an average of 6.18%. Tin was the only metal posting a gain. Nickel lost 11.22% while aluminum fell by 6.59%. Copper on the LME dropped by 10%; on COMEX the red metal declined 10.48%. Zinc was down 15.31% while lead lost 5.22% of value.

Every other commodity sector posted losses. The worst performing sector in Q3 was energy, which plunged by 19.31%. NYMEX crude oil was down 24.18%. Brent crude lost 24%. Gasoline was the worst performer, losing 33.31% while heating oil dropped 18.65%. Natural gas was 10.88% lower and ethanol fell 4.84%.

The composite of grain prices was down by 5.75%. KCBT wheat was the big loser, down 17.78%; CBOT wheat shed 16.73% of value. Corn dropped 10.14% while soybeans moved 14% lower. The soybean crush moved lower as soybean oil fell by 20.46%, and meal was down 10.74%. Oats dropped 14.11%. As mentioned, rice was the only bright spot for bulls as the commodity rallied by 26.26% since El Niño caused the size of the crop to shrink.

The soft commodity composite was the best performing sector of the quarter, losing 5.29%. Cocoa was down by 4.74% during Q3. Cotton lost 11% of value, sugar rose 3.29%, and coffee fell by 8.35%. Frozen concentrated orange juice plunged 10.93% on weak demand.

Animal protein prices moved south, with live cattle falling 15.8% and feeder cattle dipping by 17.02% in Q3. Lean hog prices moved 1.21% lower over the quarter as a composite of the sector lost 11.35%.

Q4 - More Volatility Ahead

Perhaps the most important take away from the action in Q3 is the fact that commodity prices are underperforming the dollar so far in 2015. This is due to weakness in the demand side of the equation for raw materials: China. Higher US interest rates in Q4 will be supportive for the dollar. A higher dollar may force commodity prices even lower in the months ahead.

El Niño could bring some real volatility to agricultural commodity prices over Q4 and into 2016. Droughts, floods, excessive heat, frigid winters, hurricanes, and typhoons are often associated with El Niño. These types of weather events can wreck havoc with agricultural output. Therefore, keep your eyes on grains and soft commodities. These prices have dropped to levels where downside risk is limited.

Expect volatility throughout the balance of 2015 in all markets. A US interest rate hike, El Niño, and a global environment of economic and political turbulence continue to influence commodity prices. It looks like the bear market is not close to over, which is bad news for many commodity producers around the world.