Some of the work traders do in building trading systems can be very creative and exciting, but unfortunately some of the work is not. In most cases, traders have a specific idea in mind that they want to test. They create an entry and the corresponding exit, but then also need to create a few additional money management exits. This is very easy to do with CQG Integrated Client, but doing it right, with parameters and on/off settings, still requires some amount of work.

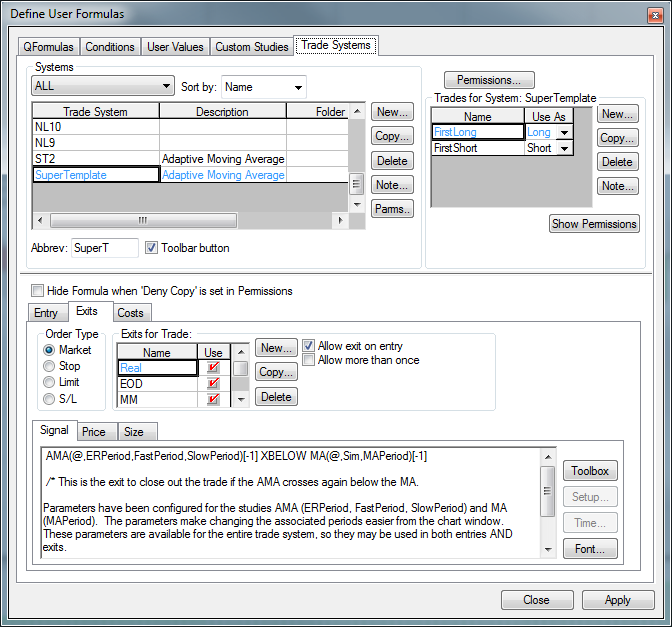

To reduce this work, I have created a "Super Template" that has eight of the most common exits already in place. You just need to configure them correctly, or simply switch them off if you don't want to use them. The template uses the already-installed AMA sample as a mock-up entry, but the goal is to copy the template and substitute the entry and the Real exit with your own idea.

After you have done this, you can use all the other exits by simply switching them on or off and configuring their values.

If you right-click on the P&L plot in the chart of your trading system and select modify trading system you'll get the following set of parameters:

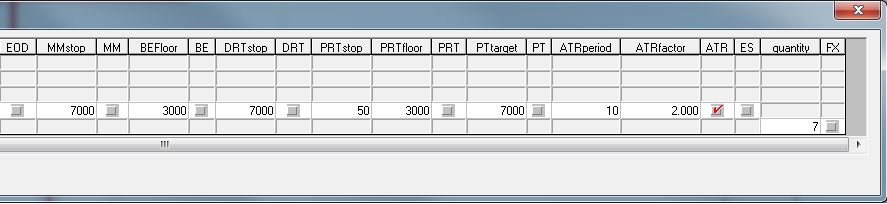

ERPeriod, FastPeriod, SlowPeriod, and MAPeriod belong to the mock-up trading system and use the Adaptive Moving Average against a Simple Moving Average. The details of the remaining parameters are as follows:

- EOD - End Of Day will exit any position at the last bar of the day when checked.

- MMstop - Money Management is a simple stop loss. You just need to specify the amount.

- MM - Money Management Stop is on if checked.

- BEFloor - Break Even Exit will close the position when it returns to its entry price. It needs to reach a certain amount of profit (Floor) before it is activated.

- BE - Break Even Exit is on if checked.

- DRTstop - Dollar Risk Trailing is a classic trailing stop that is based on maximum profit during the trade (calculated by each close).

- DRT - Dollar Risk Trailing is on if checked.

- PRTstop - Percent Risk Trailing puts a stop below the maximum profit close to risk x% of the money already gained in the trade. The value is in percent.

- PRTfloor - Percent Risk Trailing needs to reach a certain amount of profit (Floor) before it is activated.

- PRT - Percent Risk Trailing is on if checked.

- PTtarget - Profit Target exits a position if a certain amount of money is gained.

- PT - Profit Target is on if checked.

- ATRperiod - Average True Range trailing stop uses the value of the Average True Range study when a trade is initiated. ATRperiod is the length of the ATR measurement.

- ATRfactor - ATRfactor is the parameter that determines how many ATRs the stop is placed away from the market.

- ATR - Average True Range trailing stop is on when checked.

- ES - Entry Stop places an initial stop on the low (for long trades), or on the high (for short trades) of the entry bar. Entry Stop is on if checked.quantity - quantity is the trading size, in contracts, for a stock or future trade.

- FX - If FX markets are traded, the quantity gets multiplied by 100,000. If you want a clip size of 1,000,000 per trade, that is a quantity of ten with FX multiplier checked.

A little note at the end: Super Template is not a trading system ready to use and this is not trading advice. This is simply a template to utilize the full suite of CQG's predefined exits with a sample entry and a sample exit.