- New highs in COMEX copper futures in July 2025 before price carnage on July 30

- Tariffs had been bullish for the U.S. futures

- Divergence with the LME three-month Copper Forwards

- Fundamentals remain bullish

- Watch the LME-COMEX spread for clues

COMEX copper futures rose to a new record high in March 2025 before the April 2 U.S. tariff announcement excluded the red nonferrous metal, sending the price to nearly $4 per pound. However, copper held above its critical technical support level and was back above $5 per pound by the end of the second quarter.

In early Q3, copper futures exploded higher, reaching a new record high. However, the LME copper forwards have not followed the futures into record territory. On July 30, the Fed left interest rates unchanged and President Trump signed an immediate 50% tariff on some copper imports into the United States, causing the COMEX copper futures price to plunge.

New highs in COMEX copper futures in July 2025 before price carnage on July 30

In early July, President Trump announced a 50% tariff on copper, causing the price to explode to a new record high.

The monthly chart highlights copper's surge that took the price to nearly $6 per pound, as the red metal reached a high of $5.9585 per pound on the nearby September futures contract. After holding above the critical support in early April, the COMEX copper futures rallied to another new record peak.

On July 30, after the Fed meeting and the signing of the executive order for a 50% tariff on some copper imports into the U.S. COMEX copper futures prices for September delivery cascaded over 27% lower, falling below the $4.35 per pound level on July 31.

Tariffs had been bullish for the U.S. futures

Tariffs are trade barriers that can cause commodity shortages in some regions and oversupply in others. While commodities are global assets, tariffs, sanctions, and other trade barriers distort prices. Copper has been a case study in how trade barriers can influence regional prices.

In anticipation of U.S. tariffs, copper was transferred from the London Metals Exchange to COMEX warehouses. At the end of 2024, LME stocks were at 271,400 metric tons and had declined by 66.61% to 90,625 tons at the end of Q2 2025.

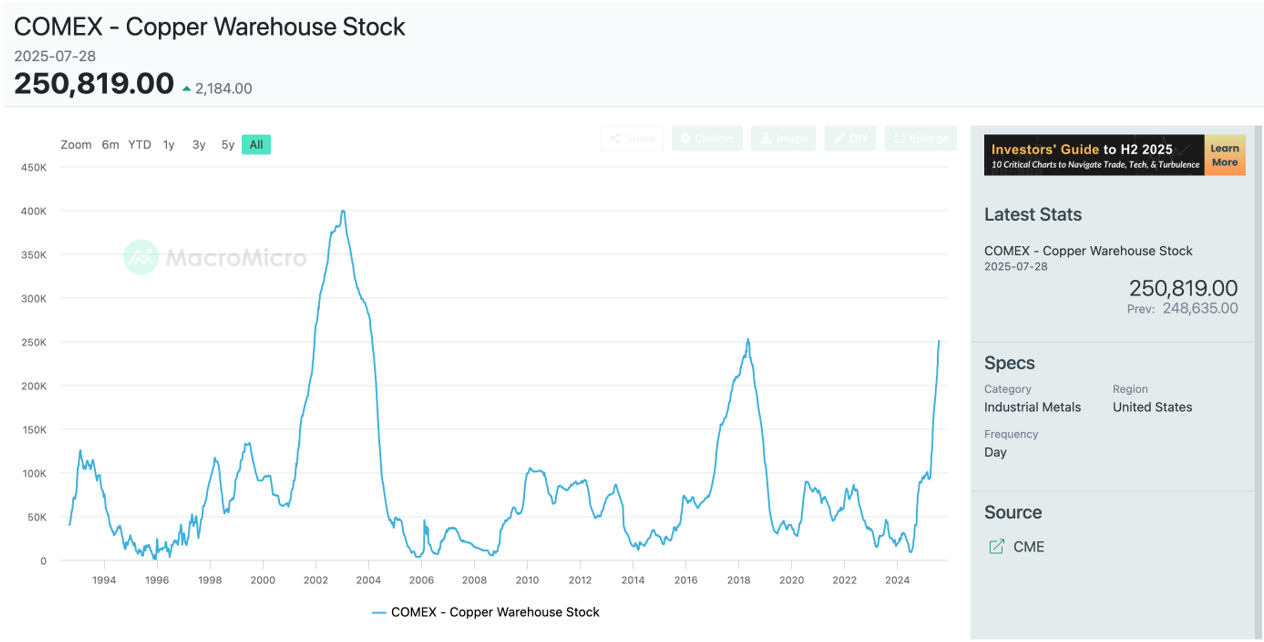

Source: en.macromicro.me

Meanwhile, over the same period, COMEX copper warehouse inventories rose 126.7% from 93,161 to 211,209 metric tons. In late July, the LME stocks stood at 136,850 tons, with COMEX stocks at 250,819 tons. The bottom line is that copper flowed from abroad to the U.S. had distorted the supply and demand fundamentals, leading to a significant price divergence. The divergence corrected with the price carnage on July 30 and 31.

Divergence with the LME three-month Copper Forwards

Three-month copper forwards on the London Metals Exchange reached a record high of $11,104.50 per metric ton in May 2024 when COMEX copper futures rose to $5.1985 per pound.

When COMEX copper futures reached a peak of $5.2770 in March 2024, the LME forwards only rose to $10,110.49 per ton. The latest $5.9585 per pound high in futures only resulted in a lower high of $10,020.50 per ton in the LME three-month forwards. Therefore, the tariffs had caused the locational price distortion in the copper market. The late July copper futures price plunge corrected some of the distortion in what was the blink of an eye. Copper futures experienced their most substantial price correction in decades.

Fundamentals remain bullish

Copper fundamentals support higher prices for the following reasons:

- Global copper demand is increasing as the red metal is critical for green energy initiatives.

- China is the world's leading consumer of refined copper. Any improvement in the Chinese economy will only increase the demand side of copper's fundamental equation.

- It takes the better part of a decade to bring new copper mines into production.

- Many of the new mining projects are in politically challenging countries, such as the DRC, the Democratic Republic of Congo, and Indonesia, which create production, logistical, and other roadblocks.

- Copper's bull market began decades ago, and the price continues to make higher lows and higher highs.

The alignment of technical and fundamental factors supports an eventual continuation of bullish price action in the copper market. The 2025 trade barriers only accelerated the rally and price volatility in the COMEX futures market over the past months.

Watch the LME-COMEX spread for clues

Copper's supply and demand fundamentals support a continuing bull market that remains intact since the 2001 60.50 cents per pound low in 2021. Before the plunge I wrote,

"However, one of the crucial factors over the coming months will be LME copper's ability to catch up with the COMEX futures, which would validate and could accelerate the bullish trend. Therefore, careful attention to the spread between the three-month LME copper price and the nearby COMEX futures could provide clues about the short-term path of least resistance of the volatile metal."

The price correction narrowed the spread between the LME forwards and the COMEX futures. With the arb level closer to reality, fundamentals could now guide the price direction. However, the tariffs could continue to distort prices over the coming weeks and months, causing copper volatility to remain elevated.

I remain bullish on copper as of late July 2025, but as we witnessed on July 30 and 31, the higher the price rise, the greater the odds of substantial corrections. Buying copper on price corrections has been optimal for over two decades, and I expect that trend to continue. I view the price action on July 30 as another in a long series of golden buying opportunities for the red nonferrous metal.