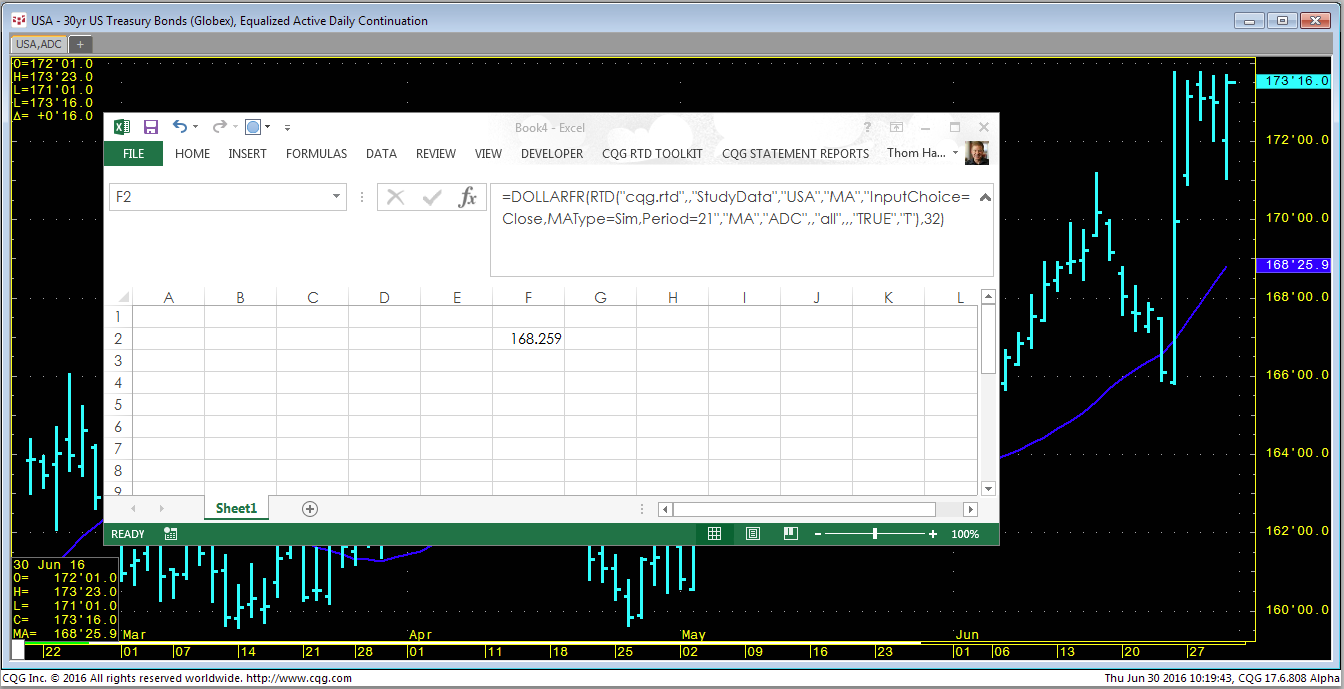

When pulling a study value into Excel using RTD, you may not see the same value in Excel that you see on a chart. It is important that the RTD formula uses the same parameters as applied to the… more

Workspaces

This Microsoft Excel® spreadsheet uses RTD market data functions that call the daily open, high, low, and close by dates to automatically update the bottom of the table with today's market data.… more

This Microsoft Excel® spreadsheet uses the RTD correlation formula to pull historical correlation values from CQG.

You can enter the symbols for two markets, time frame, and the… more

Four new chart types have been added to CQG. This article details the RTD formulas for calling market and study data into Excel using these new chart types. The chart types are:

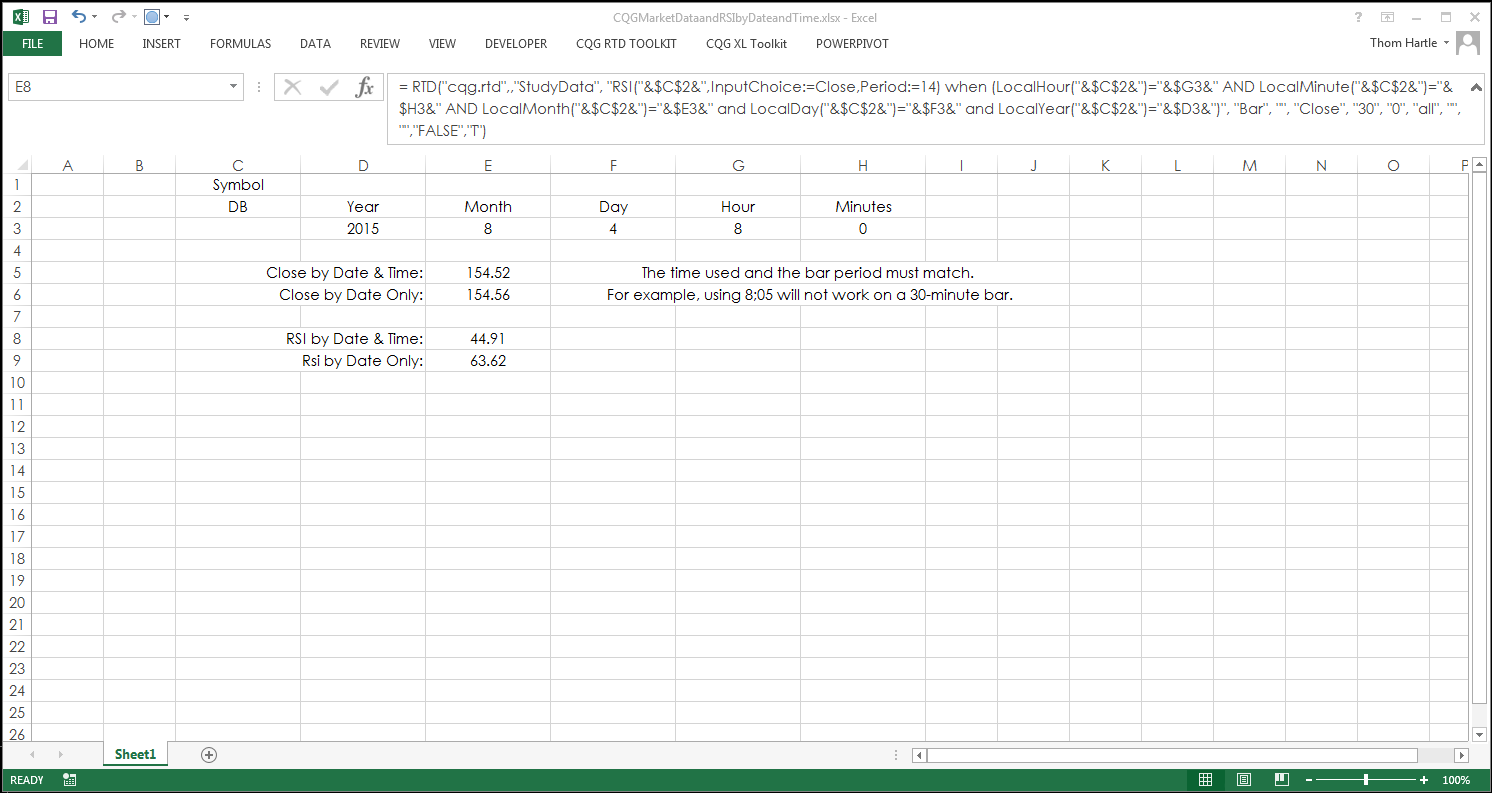

Heikin-Ashi… moreThis spreadsheet shows you the RTD formulas for pulling historical data into Microsoft Excel® by using dates and time. The sample spreadsheet pulls the closing price and the value of the RSI study… more

This spreadsheet allows you to pull historical data into Microsoft Excel® using RTD formulas. The sample spreadsheet pulls open, high, low, close, contract volume, contract open interest and one… more

This Microsoft Excel® dashboard uses the CQG RTD OptVal formula to calculate implied volatility, theoretical value, delta, and the Greeks using data inputs from other RTD formulas.

… more

You can use Microsoft Excel® and data from CQG to expand the features of your own market display dashboards. This powerful combination can be tailored to your specific needs. This article shows… more

If you use RTD formulas for data from the options markets, then Excel will pull data using your settings in CQG, such as the options model you have selected. An RTD formula for implied volatility… more

Options offer a wide variety of strategies for traders. CQG provides a powerful options analytics package. A number of the analytics tools, such as theoretical value, implied volatility, and the… more