This Microsoft Excel® dashboard displays market data for Soybean Crush Spreads traded on the CME Globex platform. These spreads have an added layer of complexity due to the soybean contract not… more

Workspaces

These Microsoft Excel® spreadsheets determine the at-the-money option and display a table of thirty strikes above and below the at-the-money. The tables consist of market data and the implied… more

This Microsoft Excel® spreadsheet uses the CQG XL Toolkit to pull in market data for CME Globex-traded soybeans, corn, and wheat.

The forward curves display today's data. If the last price… more

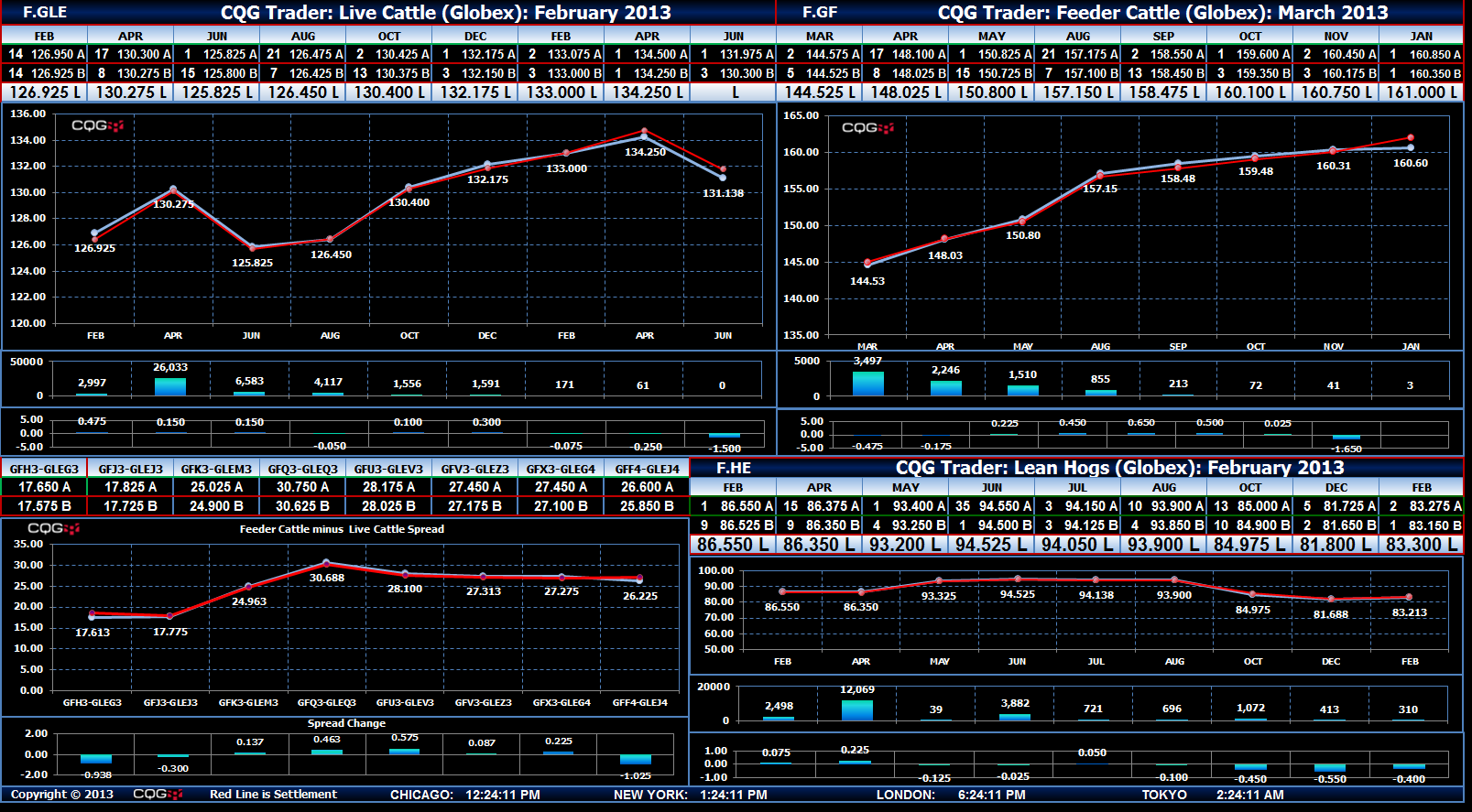

This Microsoft Excel® spreadsheet uses the CQG Toolkit to pull in live cattle, feeder cattle, and lean hogs market data traded on CME Globex.

The forward curves display today's data. If the… more

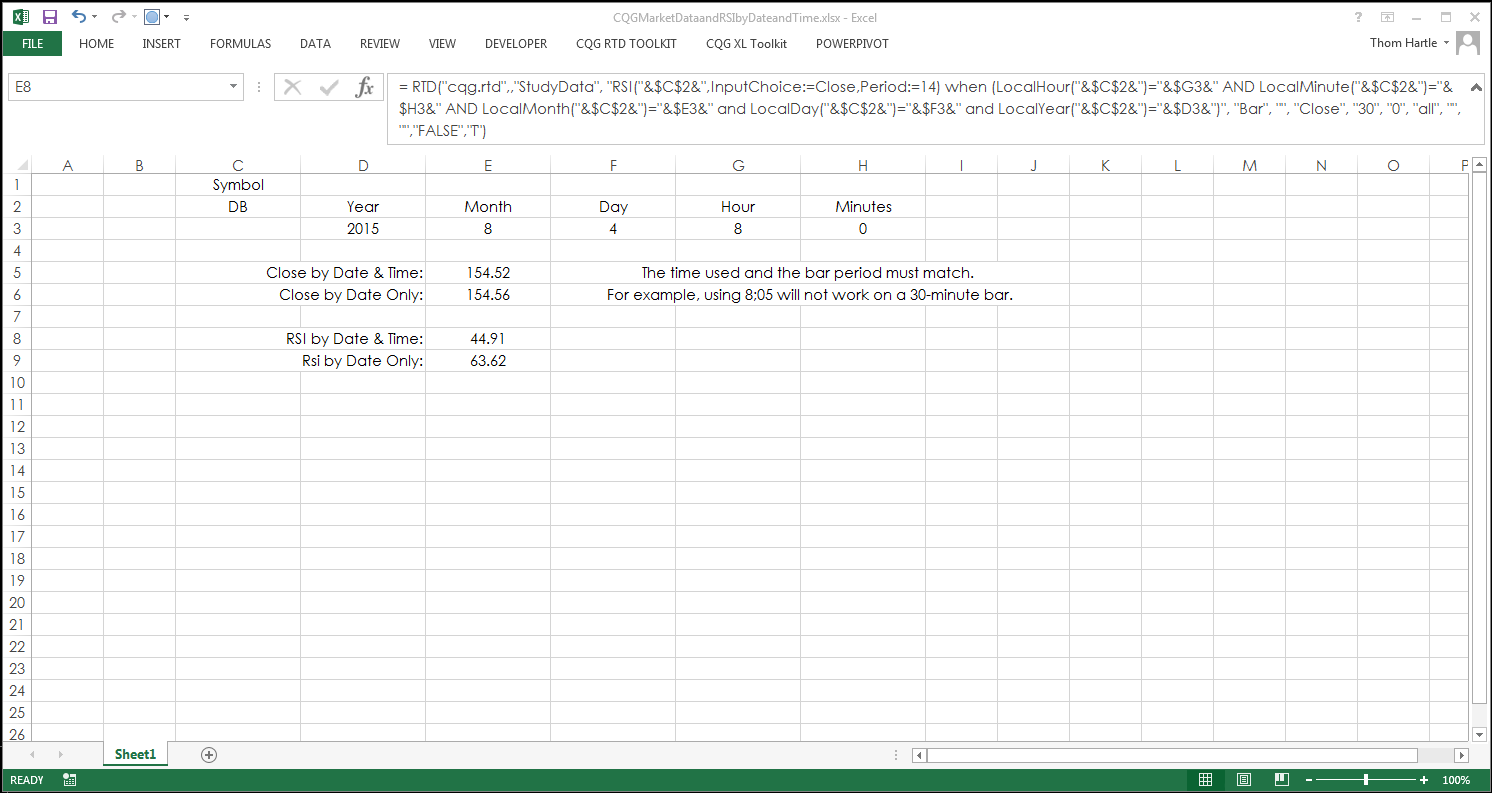

This spreadsheet shows you the RTD formulas for pulling historical data into Microsoft Excel® by using dates and time. The sample spreadsheet pulls the closing price and the value of the RSI study… more

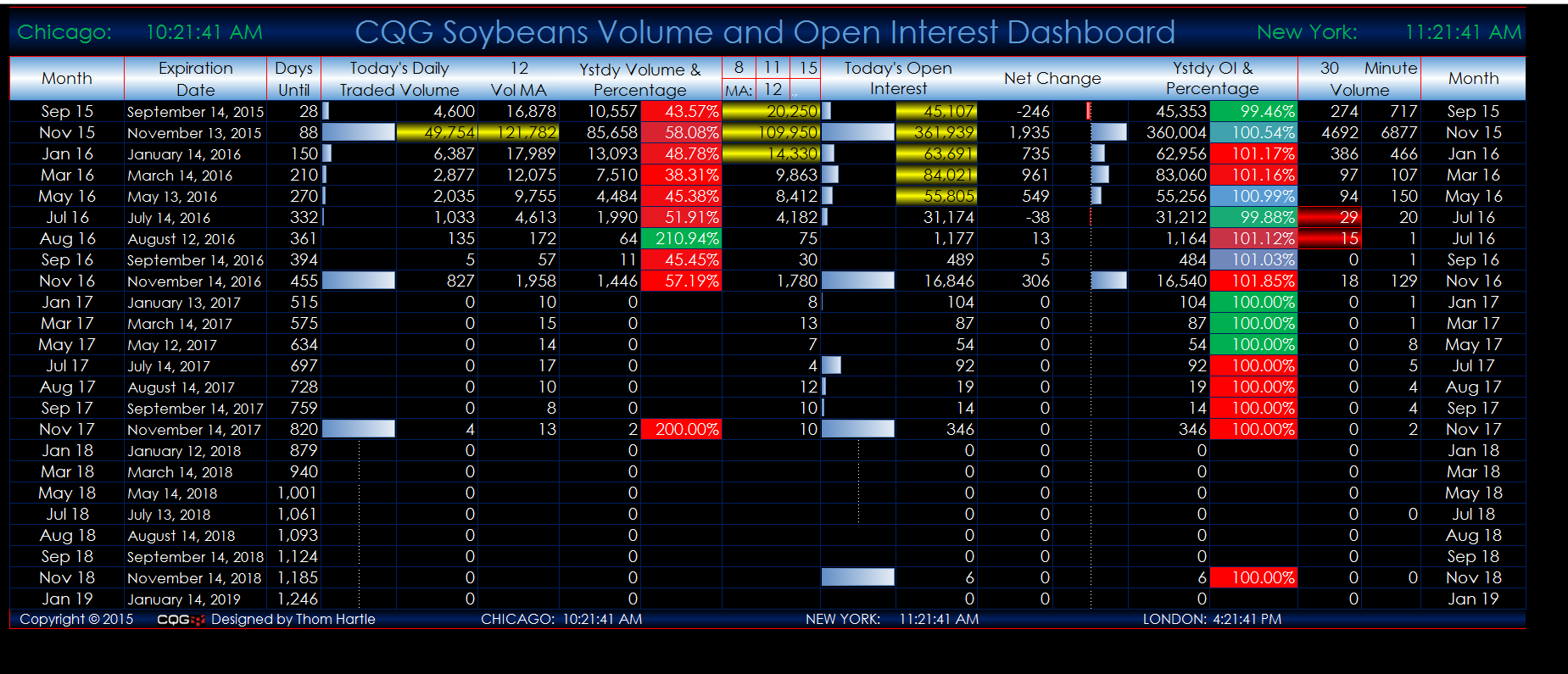

This Microsoft Excel® dashboard displays volume and open interest data for soybeans, soybean meal, and soybean oil contracts for tracking the rolls. All of the active deliveries for each… more

To access the RTD feature in CQG Trader, please contact your FCM. (CQG Trader RTD only works with 32-bit Excel).

This spreadsheet displays the current last, best bid, and best ask prices… more

To access the RTD feature in CQG Trader, please contact your FCM. (CQG Trader RTD only works with 32-bit Excel).

This spreadsheet displays the current last, best bid, and best ask prices… more