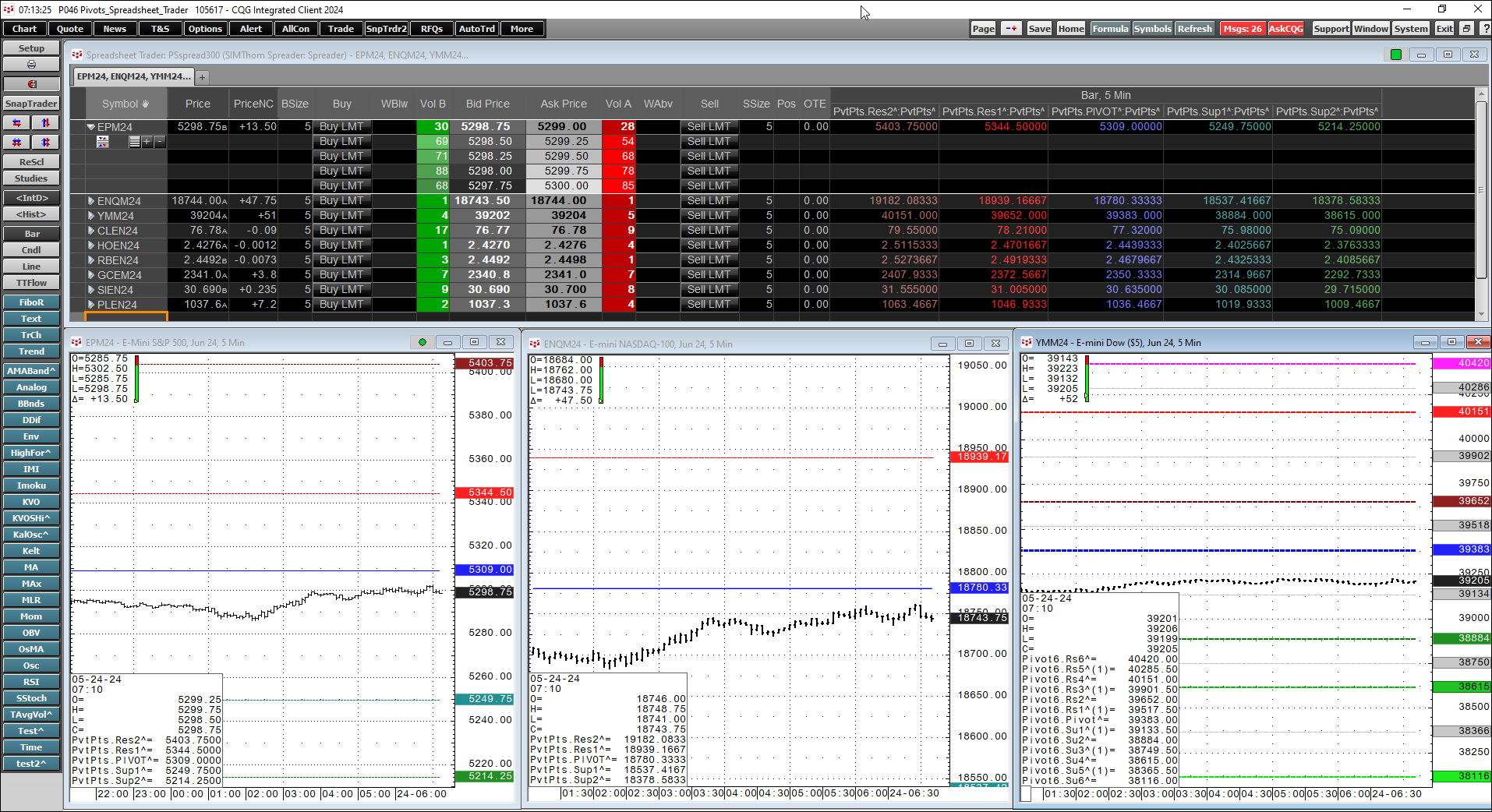

The pivot point is the arithmetic average of the high (H), low (L), and closing (C) prices of the active instrument, Pivot Point = (H+L+C)/3 or Pivot Point = HLC3. The study applied to a chart… more

Most of the Fixed Income futures markets are lower so far this week. The TSE 10 Year JGB, Jun 24 contract is down -0.32 %. The best performer in the USA market is the 30yr US Treasury Bonds… more

This midweek snapshot shows a negative performance for most of the Equity Index futures markets. The best performer in the Japanese market is the JPX Prime 150 Index, Jun 24 with a -0.29%… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

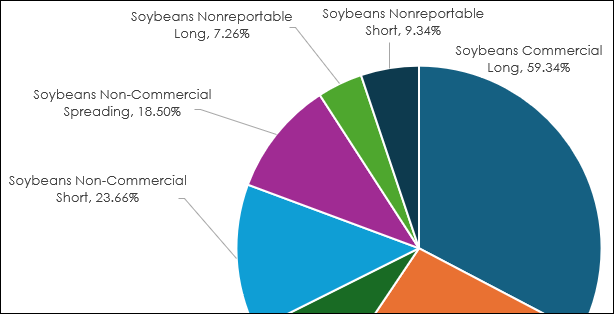

Pie charts are a popular visual presentation used by analysts for detailing a percentage of a whole, with a circle representing the whole and slices representing the categories that make up the… more

This midweek snapshot shows a positive performance for the Equity futures markets. The best performer in the Japanese market is the Nikkei 225 (Osaka), Jun 24 with a +1.23% gain following… more

The TSE 10 Year JGB, Jun 24 contract is down slightly while the rest of the Fixed Income futures markets are higher. The TSE 10 Year JGB, Jun 24 contract is down -0.09 %. The best performer… more

Various improvements and bug fixes.

GeneralAdded more contrast between widgets for light themeReduced brightness of page icons in left barMessages widget in right bar improvementsTrading/… moreEach Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

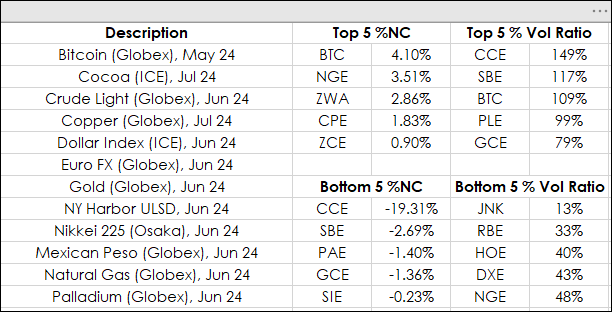

This post presents "how to" rank and sort market data using Excel's SORTBY, CHOOSECOLS, and TAKE functions. This method is a replacement for applying RANK and VLOOKUP functions for ranking and… more