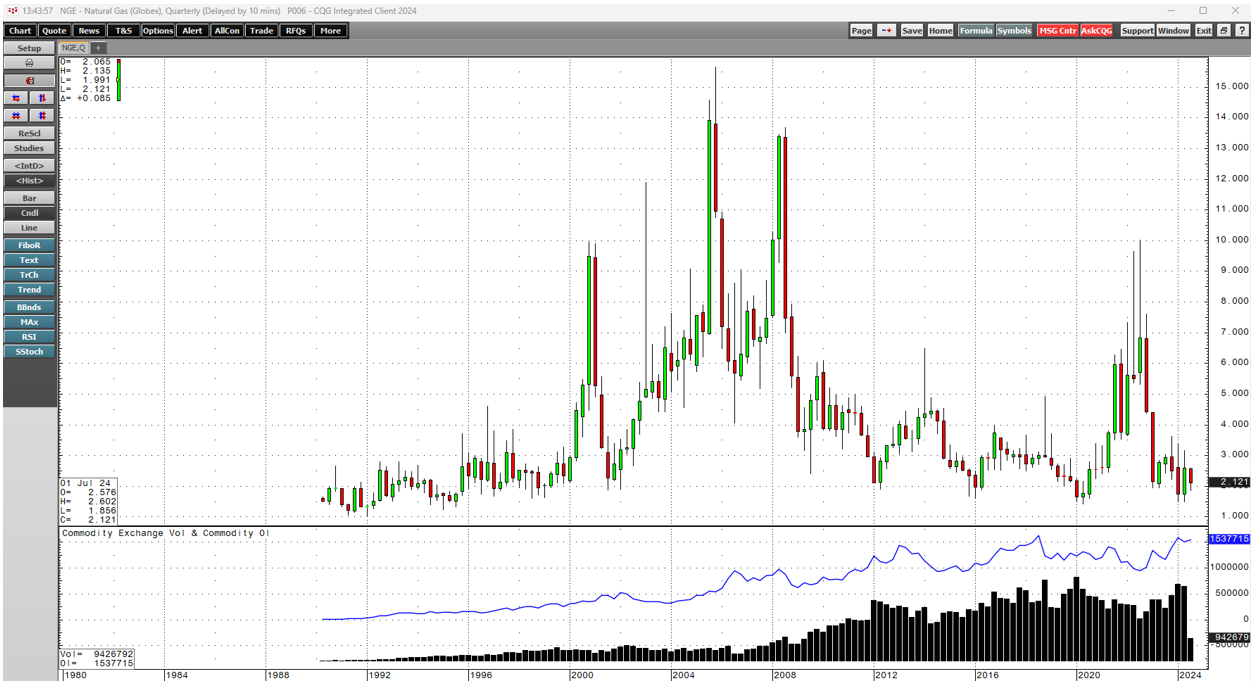

In August 2022, nearby NYMEX natural gas futures prices rose to the highest level since 2008 at over $10 per MMBtu. The rally caused by the war in Ukraine lifted European prices to record highs, and relatively low inventories supported U.S. natural gas futures prices.

Meanwhile, the 2022 rally ran out of upside steam, and the price dropped more than 85% to below the $1.50 level in March and April 2024. While natural gas recovered to over the $2 level in late July 2024, the U.S. futures remain in a bearish trend.

Natural gas is one of the most volatile commodities in the futures arena. Volatility creates opportunities for nimble traders with their fingers on the pulse of markets. Still, success requires careful attention to risk-reward dynamics and the discipline to cut losses early and run profits.

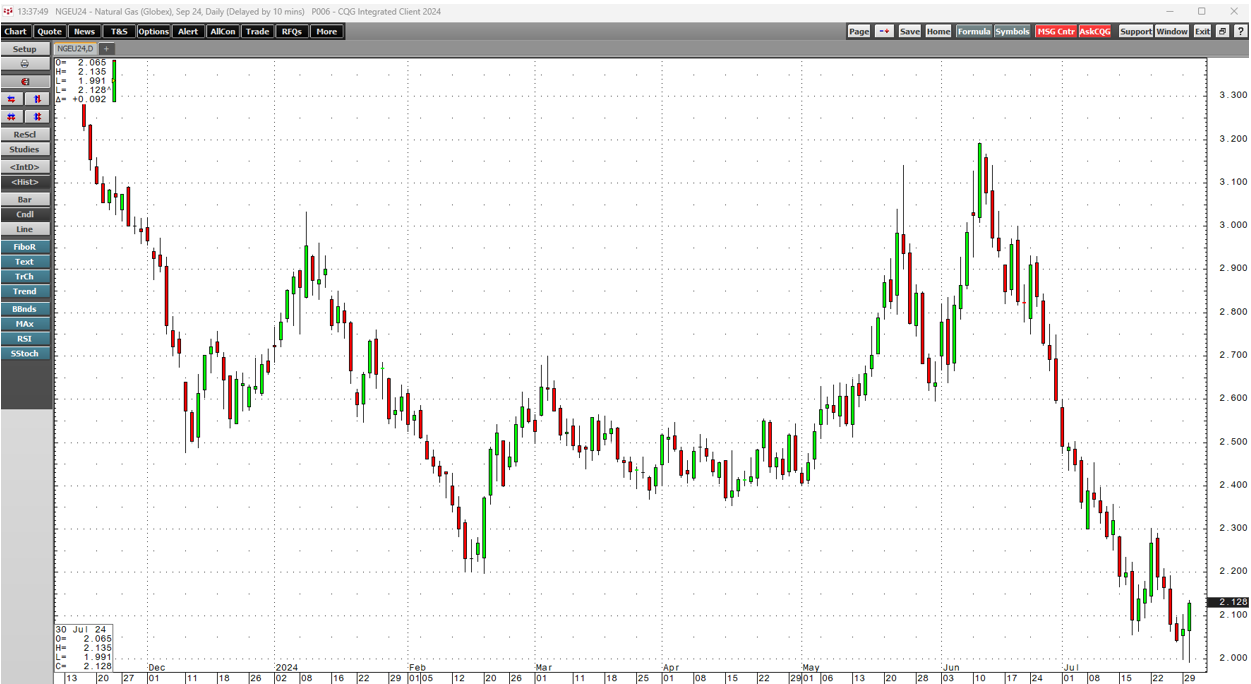

The bearish price action continues

Cooling demand soared as the summer approached, pushing nearby natural gas futures prices higher. After trading at almost $3.20 per MMBtu on June 11, natural gas prices ran out of upside steam.

The daily chart highlights the steady decline throughout the second half of June and July that took natural gas below the $2 per MMBtu level on July 29 and 30.

The weekly chart shows a bearish trend since the August 2022 high, when nearby futures reached the highest price since 2008, at over $10 per MMBtu.

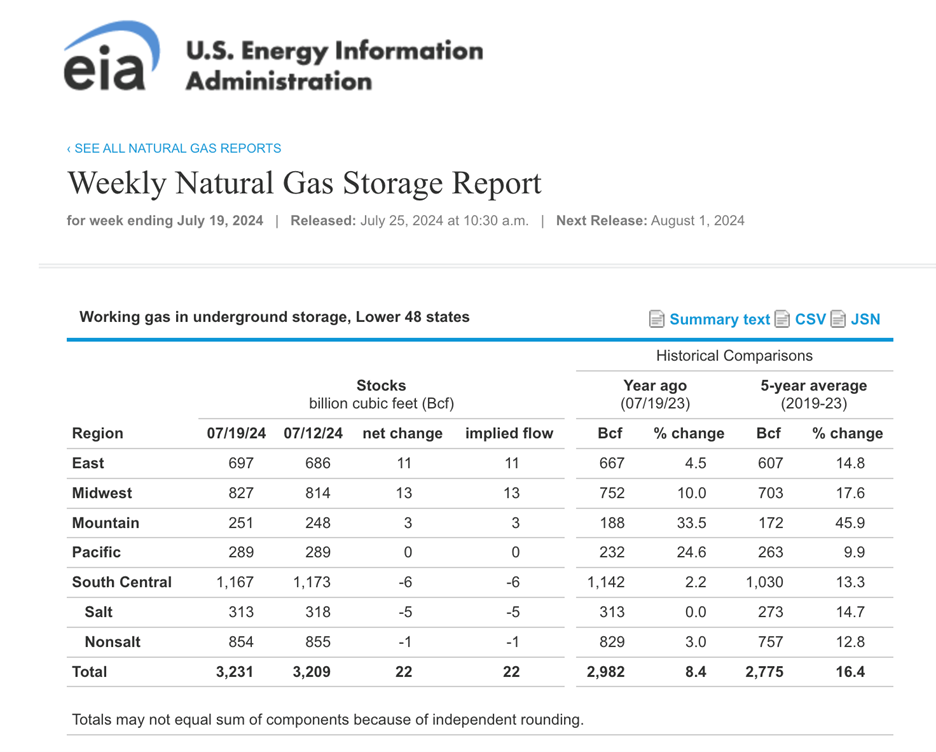

Inventories are high - Zero is not necessarily a bottom

Natural gas ended the 2023/2024 withdrawal season at 2.259 trillion cubic feet, the highest level in years if not history. A glut of natural gas has weighed on U.S. prices.

Source: EIA

The chart highlights at 3.231 trillion cubic feet for the week ending on July 19, natural gas in storage across the United States was 8.4% above the previous year and 16.4% over the five-year average for mid-July.

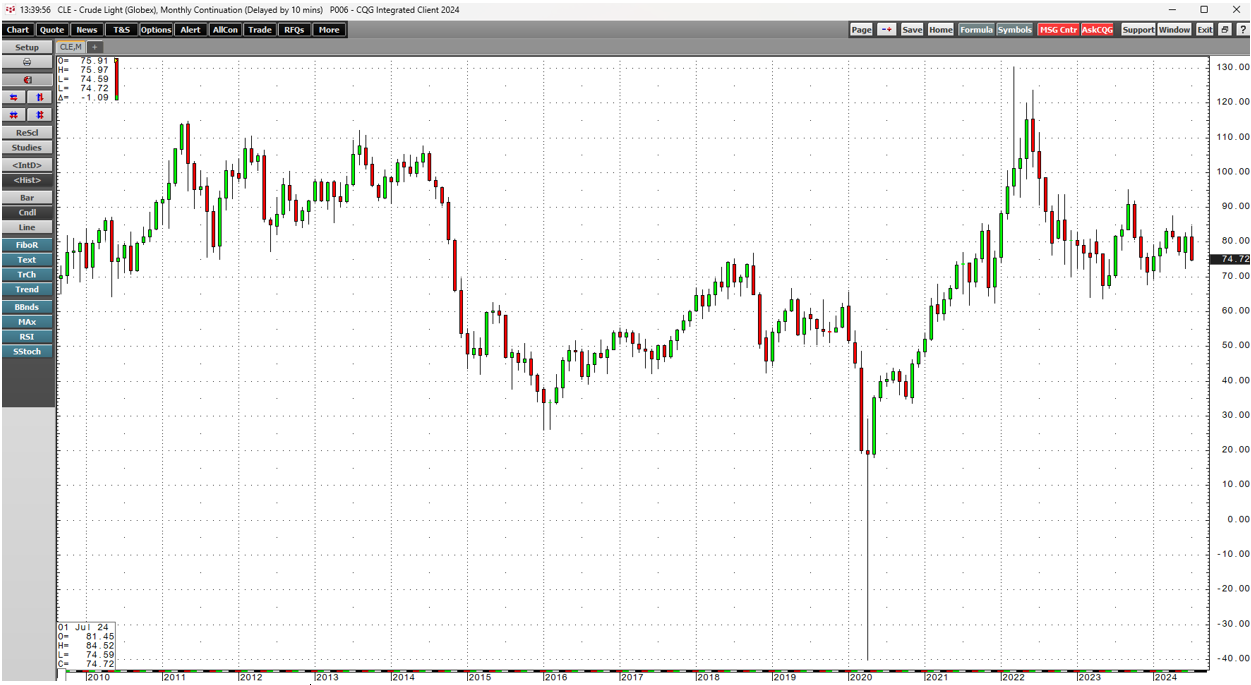

One issue facing natural gas prices could be what we witnessed in the NYMEX WTI crude oil futures market in April 2020.

The monthly chart illustrates that crude oil prices dropped below zero to negative $40.32 per barrel as the global pandemic gripped markets across all asset classes. Crude oil's price fell to the lowest in history as no storage was available for supplies. With natural gas inventories at the highest level in years, the potential for negative prices because of storage at capacity could be a real and present danger for the energy commodity.

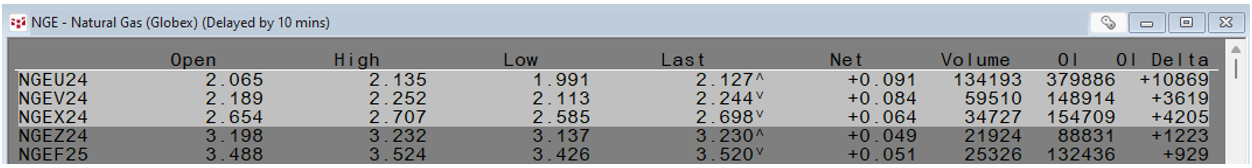

The forward curve reflects the seasonality

While inventories are sufficient to meet the coming demand during the peak heating season, the natural gas futures market forward curve displays significant seasonality.

The U.S. NYMEX natural gas forward curve illustrates the nearly $1.40 per MMBtu premium for U.S. natural gas for delivery in January 2025 compared to the nearby futures for September 2024 delivery. While nearby prices are around the $2.12 level, in January 2025, prices are near the $3.52 per MMBtu level.

Europe and weather are critical for the 2024/2025 winter season

As the war in Ukraine continues, the potential for higher European prices remains challenging for energy consumers. Western Europe continues to rely on Russian supplies.

While the temperatures over the past two winters have not created significant shortages, there is no guarantee that the 2024/2025 winter season will be as temperate.

Therefore, European temperatures are critical for prices. Since U.S. natural gas now travels by ocean vessel in liquid form to areas where prices are higher, a cold European winter could impact U.S. inventories and prices. Meanwhile, unseasonably low temperatures across the U.S. during the upcoming winter could also cause stocks to drop and prices to rise.

The election could have a long-term price impact

The future of U.S. energy policy could be the most significant factor facing natural gas and other traditional energy markets over the coming months. In late July, the election is a toss-up after an assassination attempt on the challenger and a change at the top of the incumbent ticket, with the Vice President replacing the sitting President.

The Democrats favor combating climate change by supporting alternative and renewable energy sources while inhibiting the production and consumption of hydrocarbons. The Republicans favor a return to a "drill-baby-drill" and "frack-baby-frack" approach to fossil fuels to achieve energy independence and increase revenues. The November election could create a lot of volatility in the oil and gas futures arena.

One factor that could favor a price recovery in NYMEX natural gas futures is the historically high number of open long and short positions.

The quarterly chart shows the bearish natural gas futures trend with open interest above the 1.538 million contract level. The historically high level could indicate an overabundance of speculative short positions. Few factors ignite a rally like a herd of short covering as the peak season for demand approaches.

Natural gas prices have declined from over $10 per MMBtu in August 2022 to below the $2 level in late July 2024. Expect lots of volatility over the coming weeks and months as uncertainty over the upcoming winter, the future of U.S. energy policy, the war in Ukraine, and bearish sentiment could cause significant price variance during the 2024/2025 winter season.