March is a critical month for the commodities that feed the world, as it marks the start of the planting season. As the snow melts, farmers warm up their equipment, prepare the soil, and plant the… more

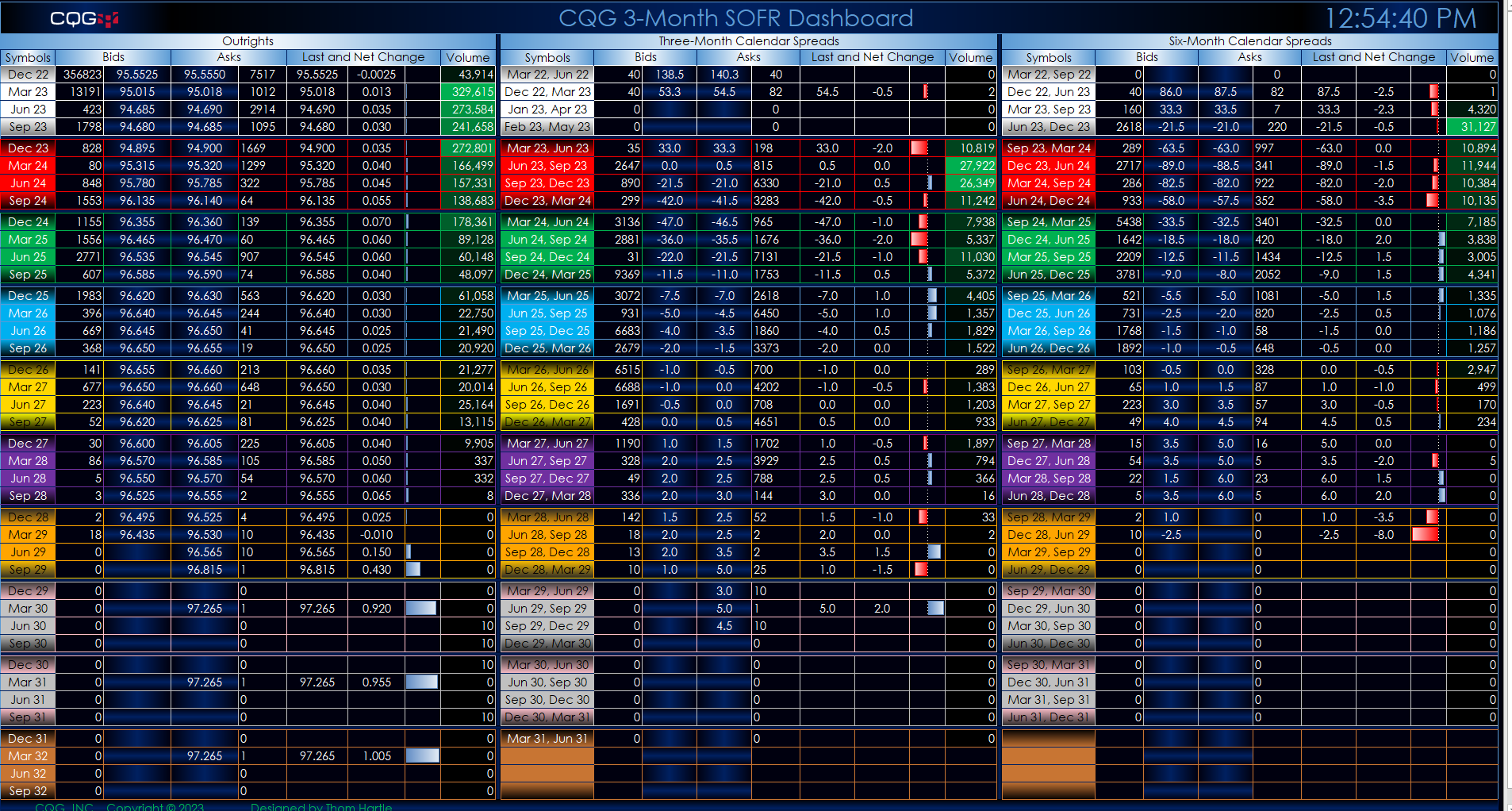

This Microsoft Excel® spreadsheet presents 3-Month SOFR market data. The data includes nearly ten years of quarterly contracts for outrights and exchange-traded three-month and six-month calendar… more

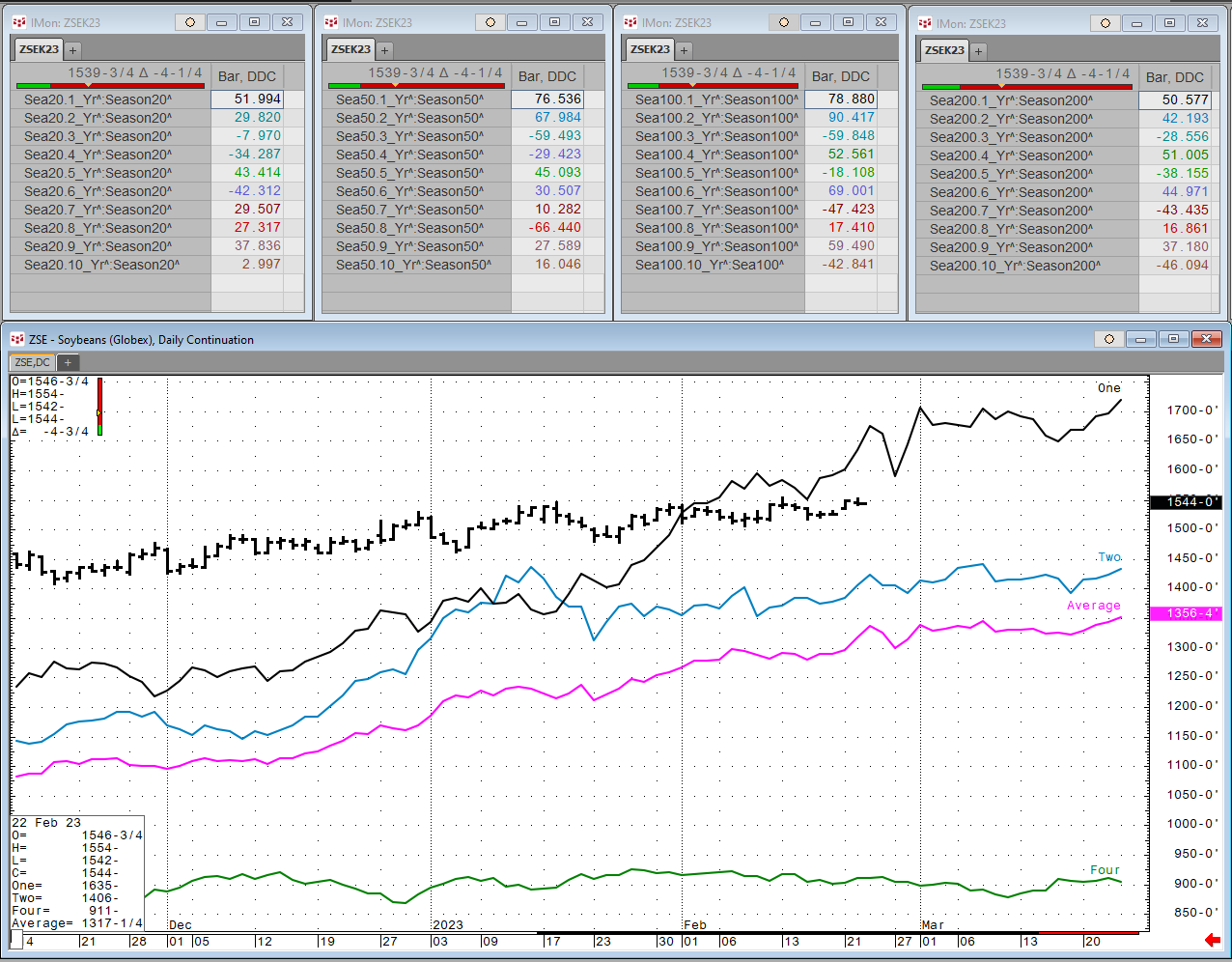

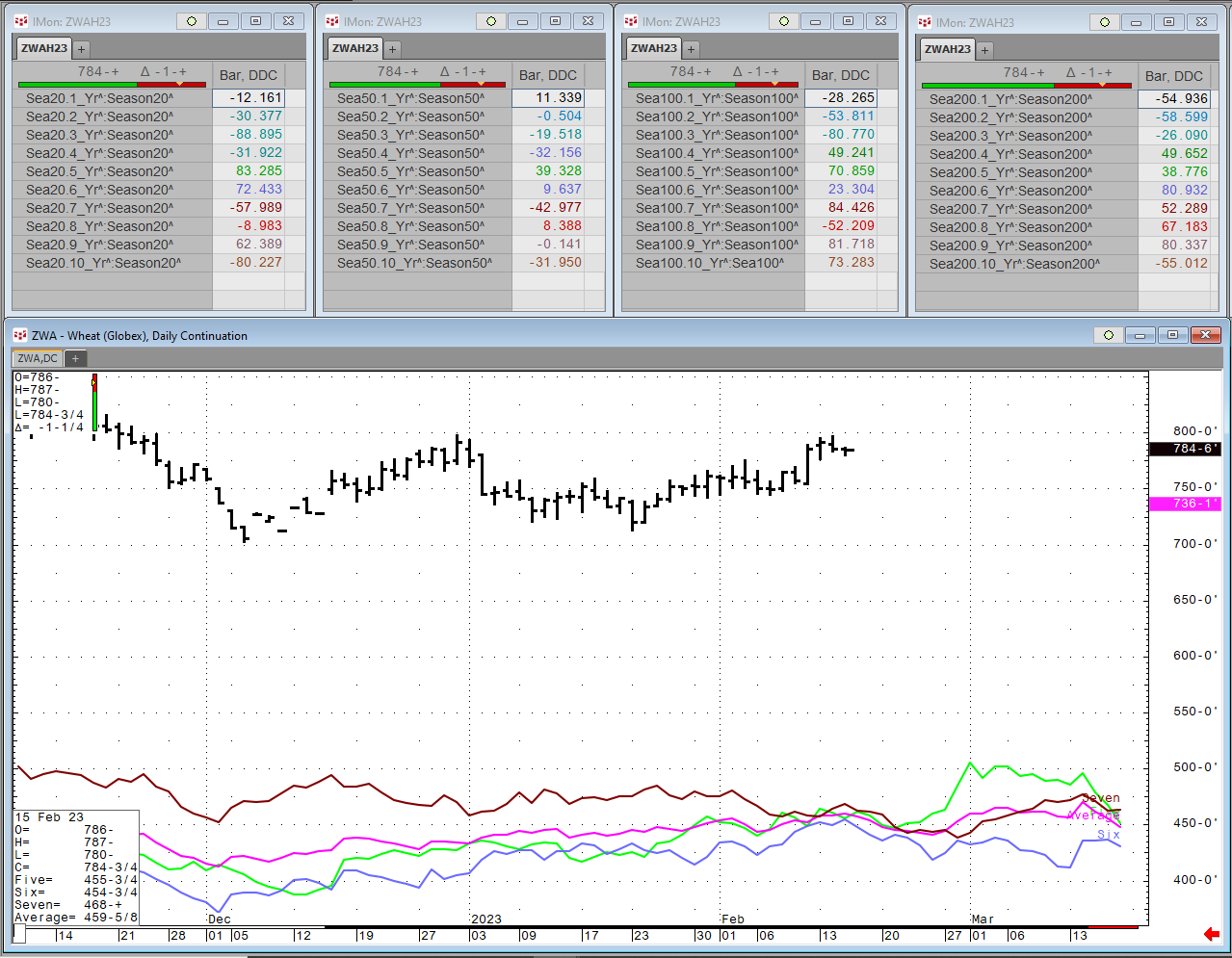

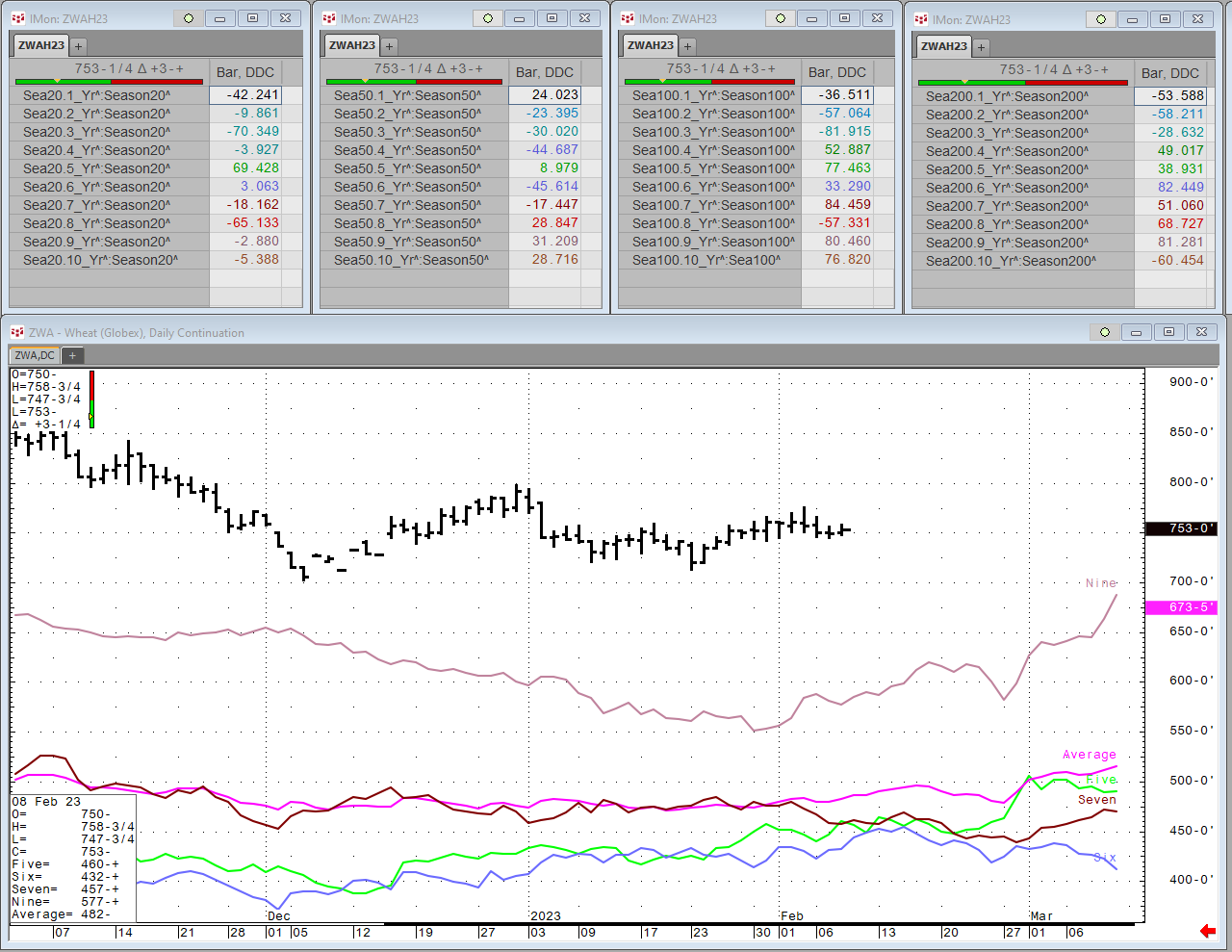

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

I had the pleasure of sitting down with Joseph Wang, one of the better Fed/interest-rate plumbers, who also has a deep knowledge of all things global macro. Listen closely to the latest podcast as… more

The Roundtable Insight - Joseph Wang and Yra Harris on the Fed, Interest Rates, Inflation and the US

Joseph Wang is the CIO at Monetary Macro and previously a senior trader on the open markets desk. The Desk sits at the center of the dollar system as its ultimate and infinite provider of… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

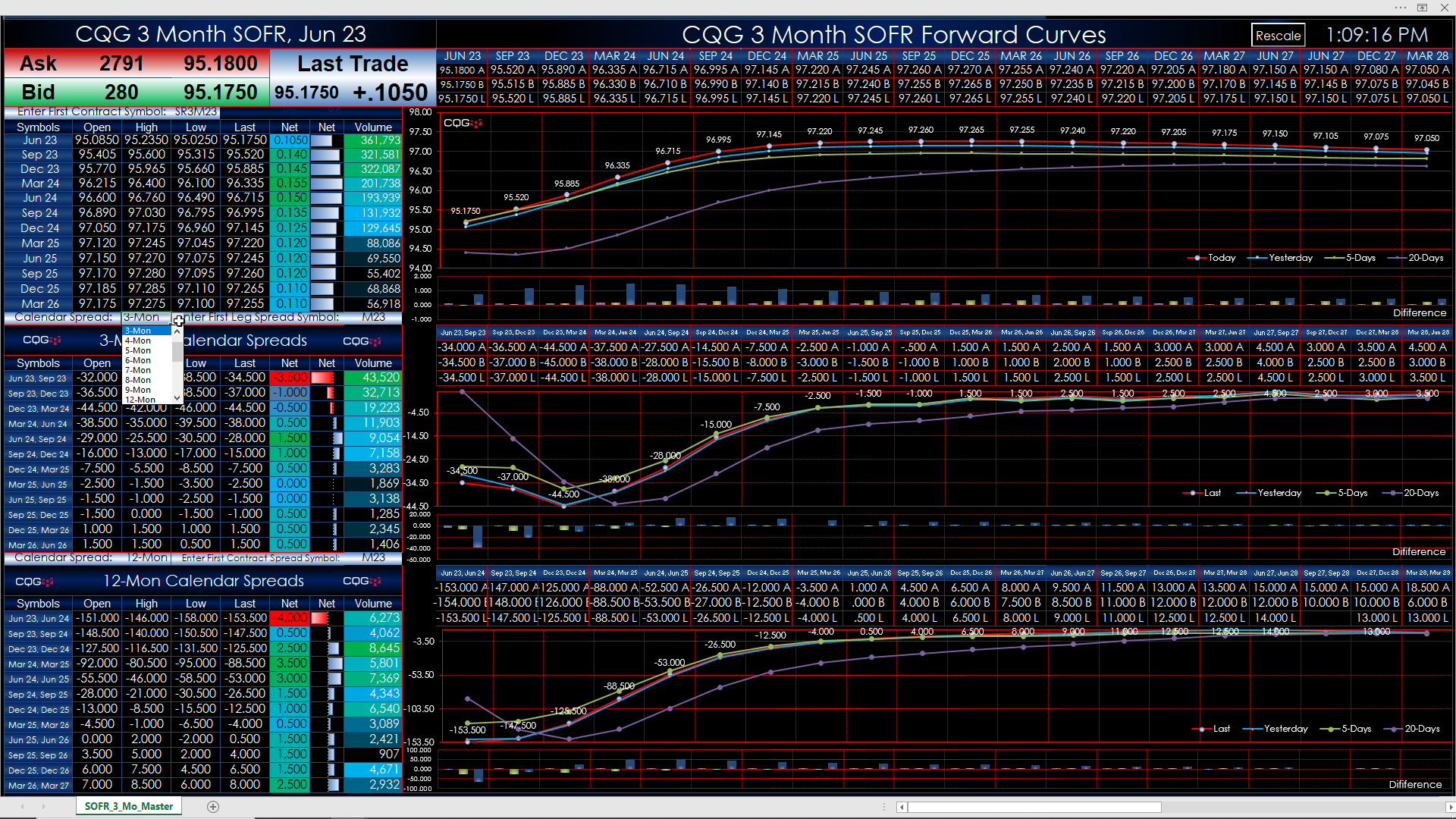

This Microsoft Excel® dashboard pulls in the 3-month SOFR market data traded on the CME Globex platform.

The Dashboard was updated to enable the user to enter in the symbol for the first… more

Helpful Links

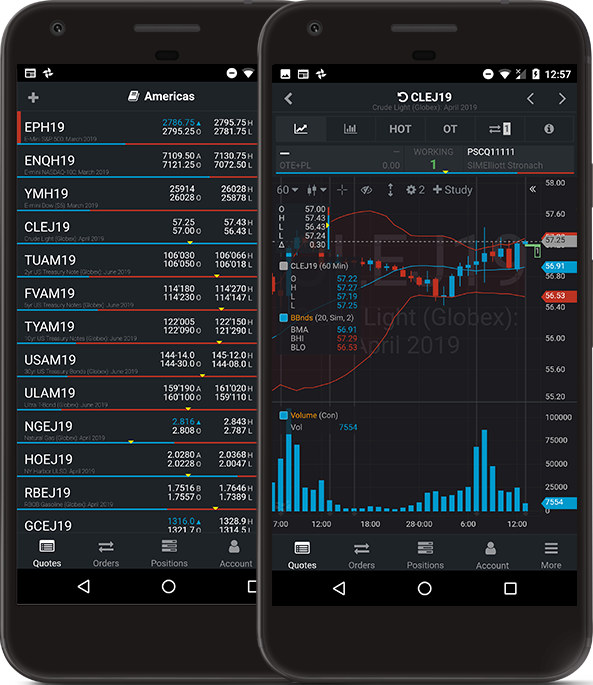

CQG in the App Store: CQG for iOS is available to all customers using a CQG charting or trading product. … more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more