- A bullish trend since the 2020 low- Silver breaks above a critical technical resistance level with a powerful Q2 signal

- A bullish key reversal on the quarterly platinum chart in Q2 2025

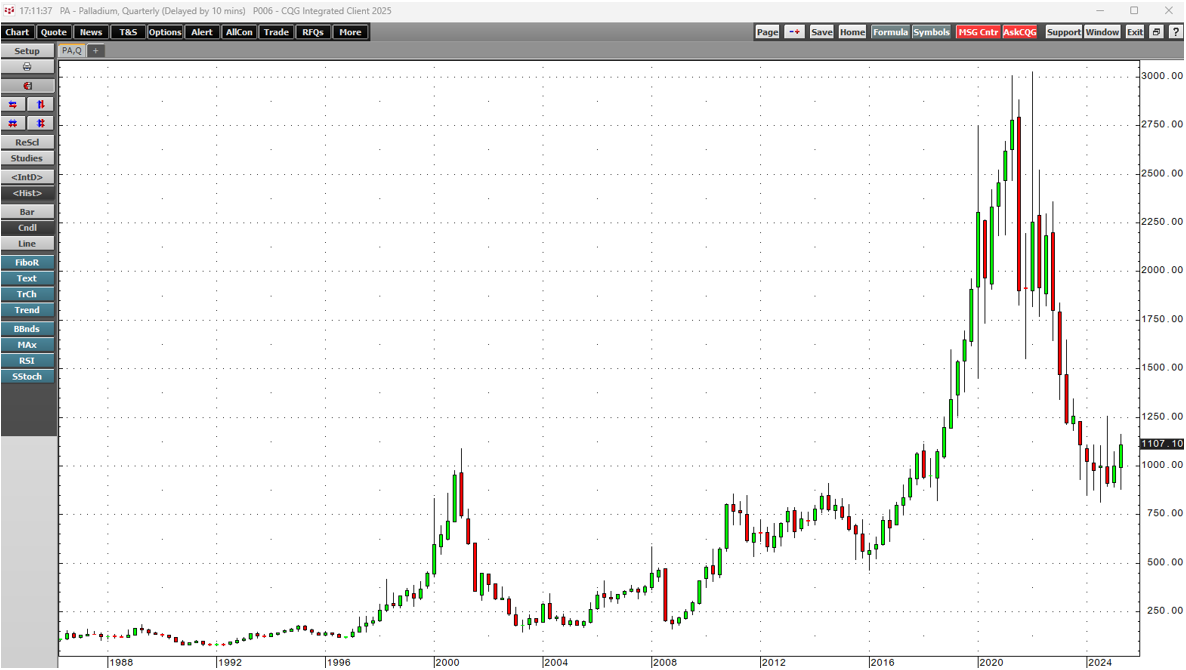

- A bullish key reversal on the quarterly palladium chart in Q2 2025

- Lots of upside room in the three metals

- All precious metals have joined gold's bullish trend

The second quarter of 2025 ended on June 30, with precious metals posting impressive gains over the first half of this year:

- Gold moved 25.24% higher from the end of 2024 to the end of Q2 closing level.

- Silver posted a 22.60% gain from the end of 2024 to the end of Q2 closing level.

- Platinum exploded 49.22% higher over the past six months.

- Palladium moved 21.69% higher from the end of 2024 to the end of Q2 closing level.

Precious metals have been the star performer in the commodity asset class over the first half of 2025. A falling dollar index and a slight improvement in the bond market have contributed to the positive trend, with the dollar index 10.90% lower over the six-months and U.S. long bonds 1.24% higher. Meanwhile, precious metals have rallied across all currency terms, indicating a bearish trend in fiat foreign exchange instruments due to erosion in faith and credit in governments that issue legal tender and debt instruments.

At the end of June 2025, the twenty-six-year bullish trend in gold continued, while silver, platinum, and palladium formed extremely bullish technical reversals on their quarterly charts.

A bullish trend since the 2020 low - Silver breaks above a critical technical resistance level with a powerful Q2 signal

COMEX silver futures did not post a double-digit percentage gain in Q2, but the precious metal formed a bullish reversal on its quarterly chart.

The chart shows that in Q2 2025, COMEX silver futures traded to a lower low than in Q1 before closing the quarter, which ended on June 30, above the Q1 high. The continuous silver futures contract also eclipsed the Q4 2012 high of $35.445 per ounce, rising to a high of $37.405 in Q2 2025.

A bullish key reversal on the quarterly platinum chart in Q2 2025

Platinum and palladium have been laggards in the precious metals sector over the past years. In Q2 2025, the two platinum group metals led the sector and the overall asset class. Platinum was the star performer.

Platinum futures rose over 49% over the first six months of 2025, closing at $1,343.00 per ounce on the nearby October NYME futures contract. The quarterly chart shows that platinum futures formed a bullish key reversal pattern in Q2 2025, rising above the long-term technical resistance level at the Q1 2021 high of $1,348.20 per ounce, and reaching a high of over $1400, the highest price since Q3 2014. The next technical upside target is the 2014 peak of $1516.

A bullish key reversal on the quarterly palladium chart in Q2 2025

Meanwhile, palladium posted an impressive 21.69% gain over the first half of 2025.

NYMEX palladium futures settled at the end of June at $1,107.10 per ounce after rising to a high of $1,193.50. The quarterly chart highlights that palladium also formed a bullish key reversal during Q2 2025, as the precious metal fell below the Q1 low and closed above the previous quarter's high.

Lots of upside room in the three metals

Silver, platinum, and palladium's Q2 technical formations could mean substantial potential over the coming months:

- Silver's next upside target is the Q1 2012 high of $37.48, which could serve as a technical gateway to the 2011 and 1980 all-time highs of $49.82 and $50.3, respectively.

- Platinum's next upside target is the $1,516 peak from 2014. Platinum's all-time high of $2,308.80 was in 2008.

- The next technical resistance for NYMEX palladium futures is at the late 2024 high of $1255 per ounce. Palladium's all-time high of over $3,000 per ounce was in March 2022.

The bottom line is that silver, platinum, and palladium have lots of upside room before they challenge their record peaks and join gold's bullish party.

All precious metals have joined gold's bullish trend

Gold did not set a new record high in June 2025, but it has reached that milestone in seven consecutive quarters.

The quarterly chart illustrates gold's bull market, which began at the 1999 low of $252.50 per ounce and continued into the first half of 2025. Analysts have adjusted their upside forecasts, with some predicting $3,700 to $4,000 per ounce by the end of this year.

Meanwhile, the Q2 2025 quarterly bullish key reversal patterns in silver, platinum, and palladium could mean gold's precious cousins are on a path to outperform the yellow metal over the coming months and catch up on a percentage basis.