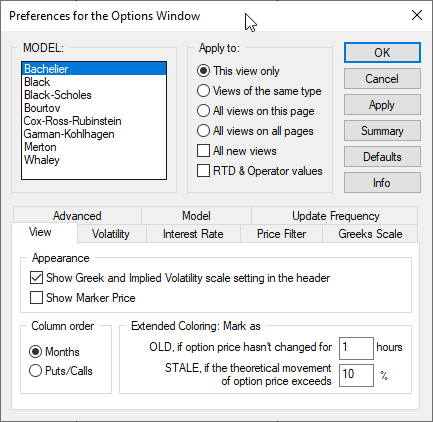

On April 21, 2020 the CME clearing house switched the options pricing and valuation model to Bachelier to accommodate negative prices in the underlying futures and allow for listing of option contracts with negative strikes. CQG 2021 includes the Bachelier model.

And, in August the CME switched back: “Further to Clearing Advisory 20-171 dated April 21, 2020, CME Clearing will revert its options pricing and valuation methodology, currently based on the Bachelier model, effective for trade date on Monday, August 31, 2020. Products will transition from Bachelier back to Whaley or Black 76, depending on the product.”

This link takes you to the Bachelier model help file.