The US dollar is the pricing mechanism for almost all raw material prices around the globe. As the reserve currency of the world, the vast amount of liquid trading in commodity futures and forward… more

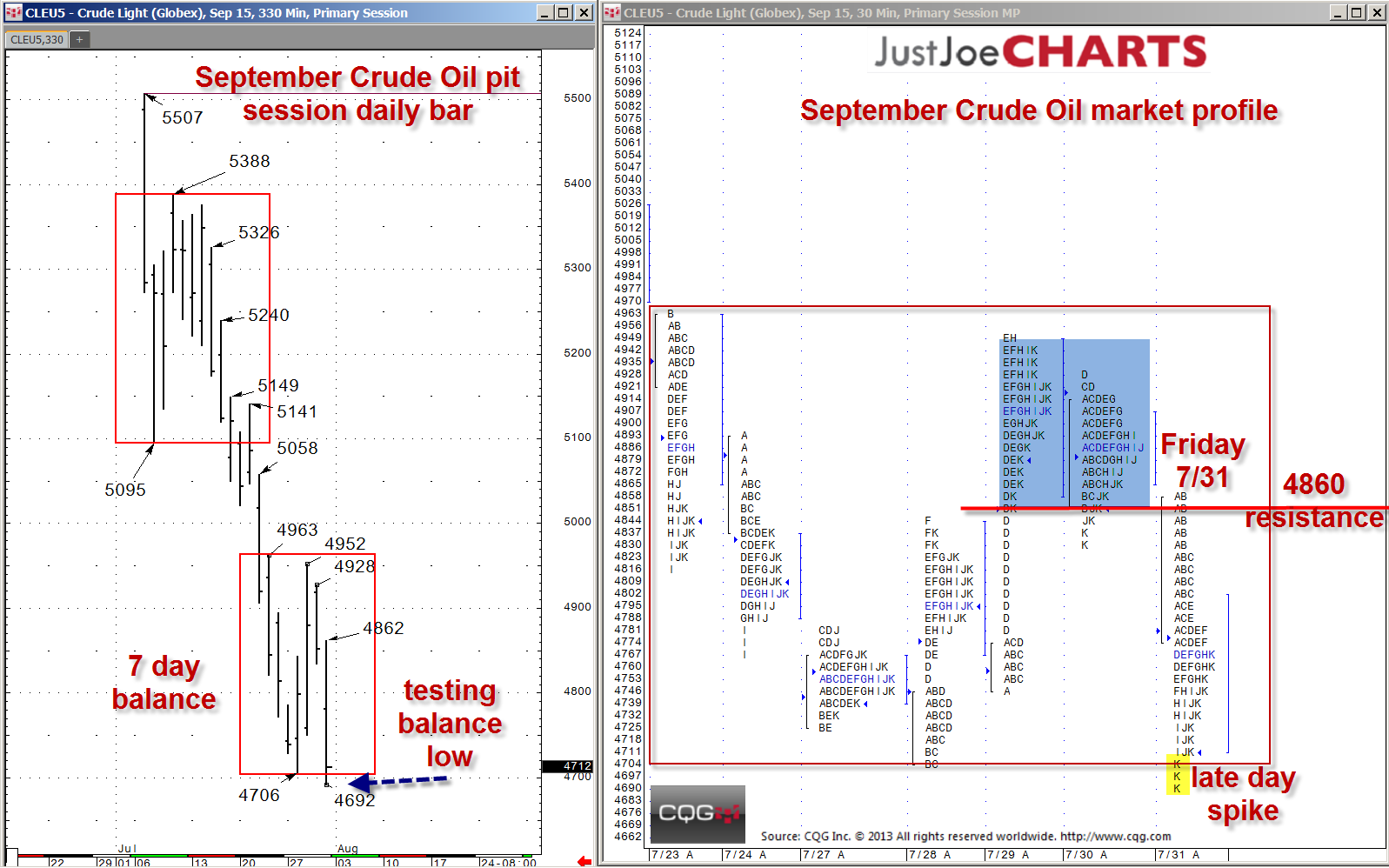

For the past six weeks, crude oil has come off from about $62 down to about $47. However, over the past seven days, the September contract found a rotational range from 47.06 to 49.63. On Friday,… more

TradeShare - First Robo-Advising App to Connect Investors across Futures… more

Connection offers Direct Market Access to a new suite of futures based on key energy benchmarks

CQG will introduce day-one connectivity to Nasdaq Futures (NFX) at launch tomorrow, July 24.… more

For over a year now, gold futures have been contained within an 11304-to-13078 balance bracket. Since January 2015, gold has been contained within an even tighter 11416-to-12320 range.… more

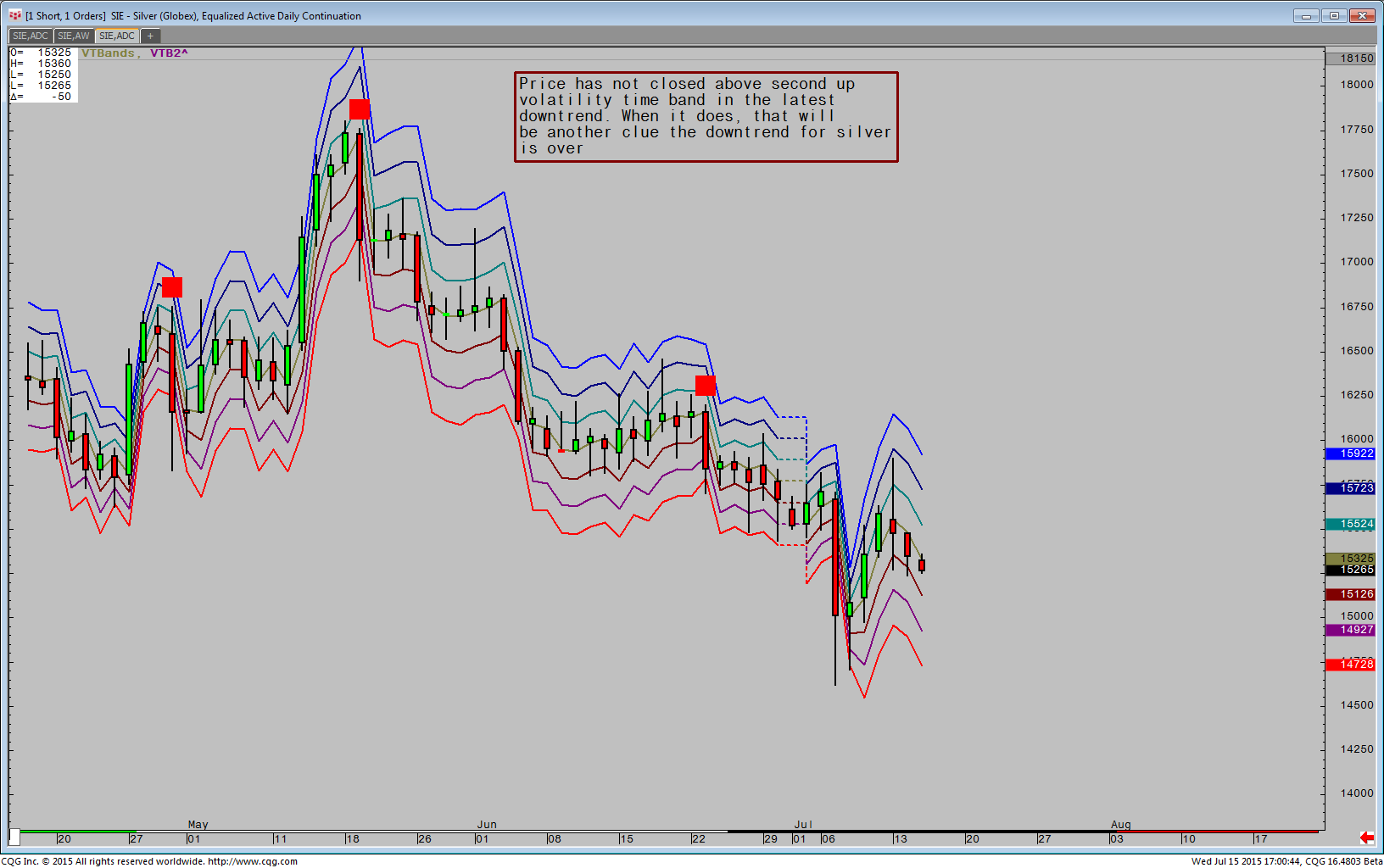

Trend analysis via Step Theory reveals extremes that are rarely breached in any time frame. Below, the green and red studies are tracking uptrends and downtrends in 120-minute time frames. There… more

This spreadsheet allows you to pull historical data into Microsoft Excel® using RTD formulas. The sample spreadsheet pulls open, high, low, close, contract volume, contract open interest and one… more

This Dow Jones News newsletter highlights some of the top coverage from Dow Jones' newsrooms around the world. The newsletter's focus is Technology, and coverage highlights include:

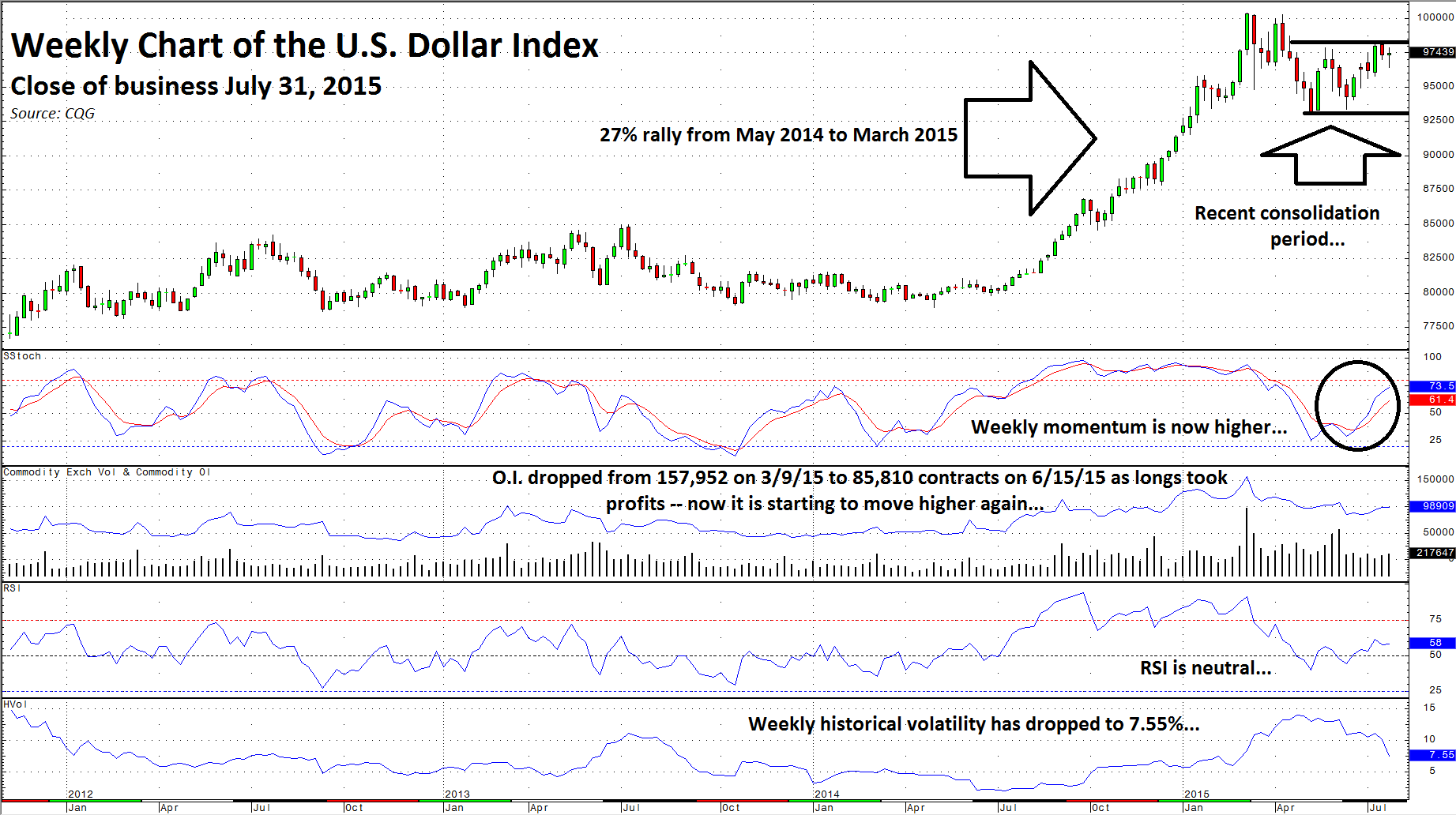

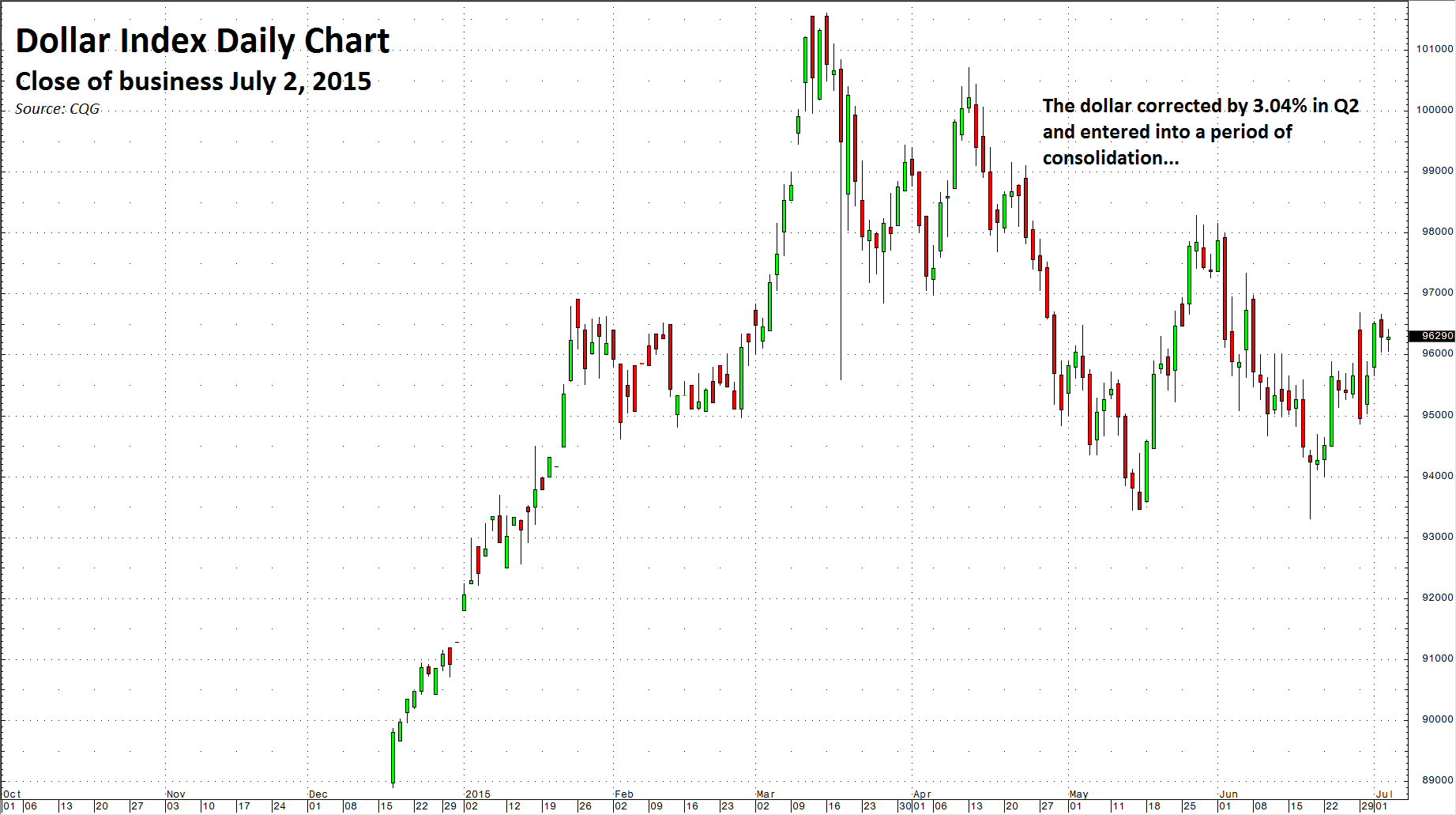

Market-… moreThe rally in the US dollar that commenced in May 2014 saw a period of correction and consolidation during the second quarter of 2015. The world's reserve currency has an inverse relationship with… more

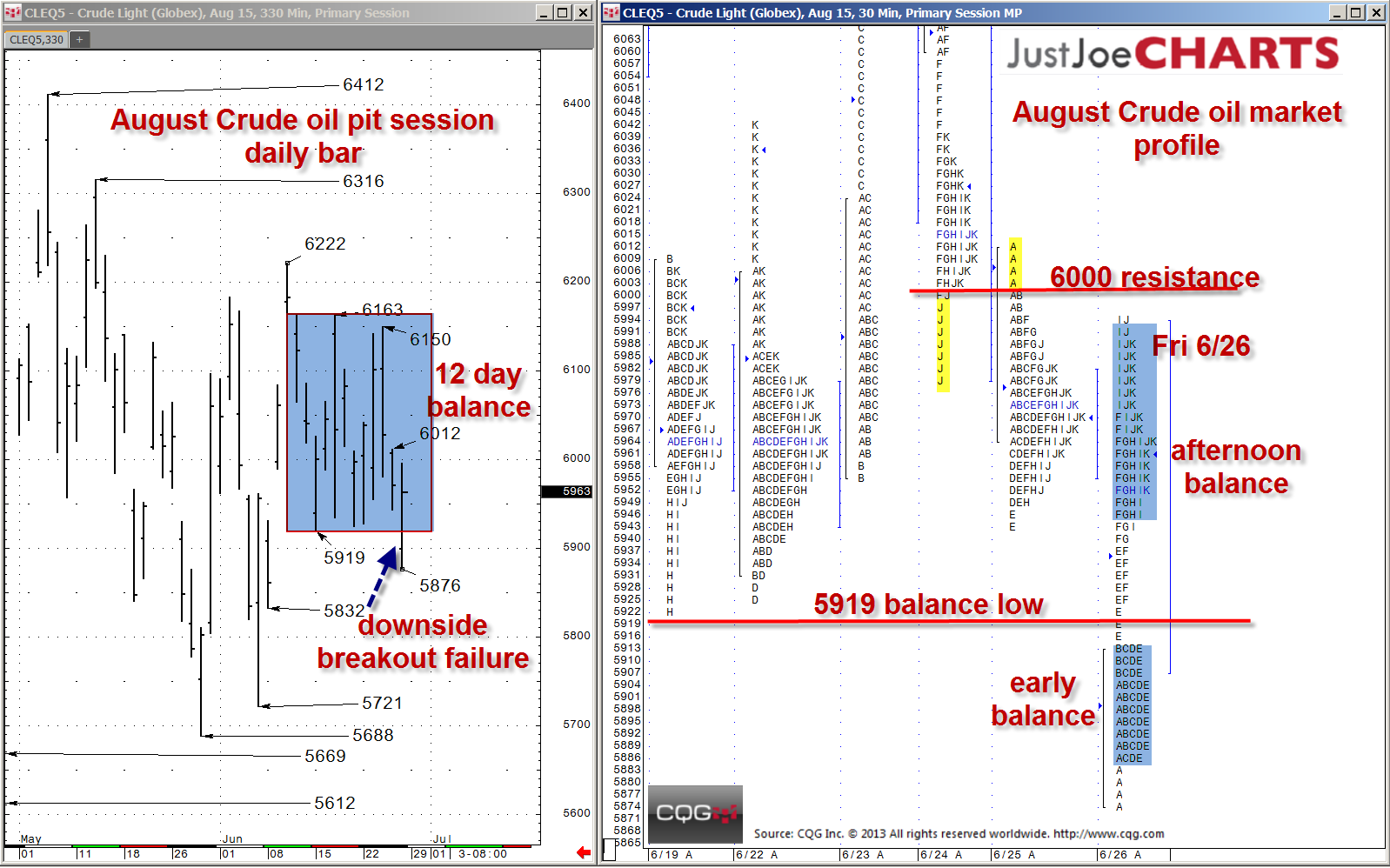

For the last two weeks, August crude oil found a relatively tight, 5919-to-6163 rotational trading range. During that time, the market tested the range's extremes several times on each end.… more