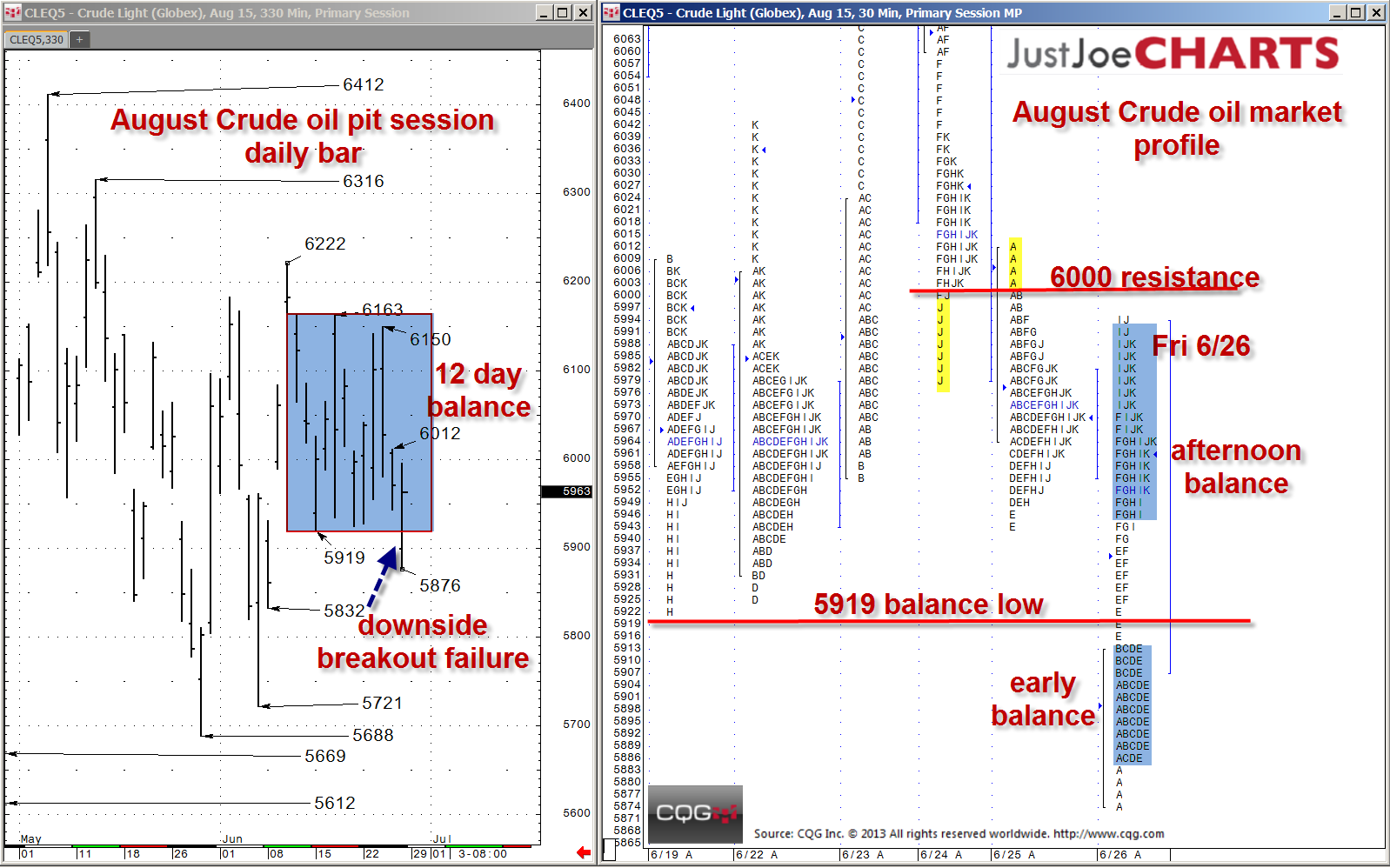

For the last two weeks, August crude oil found a relatively tight, 5919-to-6163 rotational trading range. During that time, the market tested the range's extremes several times on each end. However, on Friday, June 26, 2015, crude oil gapped open lower, below the 5919-balance low. The market traded below balance for a couple hours before a mid-day rally brought the price back above the balance low and settled within the range.

When a market tests the extremes of a defined balance bracket, the two most likely scenarios are:

- Gain acceptance outside of balance and accelerate

- Trade outside of balance, fail, and then begin a rotation to the opposite end of that balance range

If the market gains acceptance above the 6000 resistance level, it would confirm the downside breakout failure. A rotation back up to the 6163-balance-bracket high is then the most likely scenario. However, if the market again trades below the 5919-balance low, the market may test the 5832- and 5721-references below.