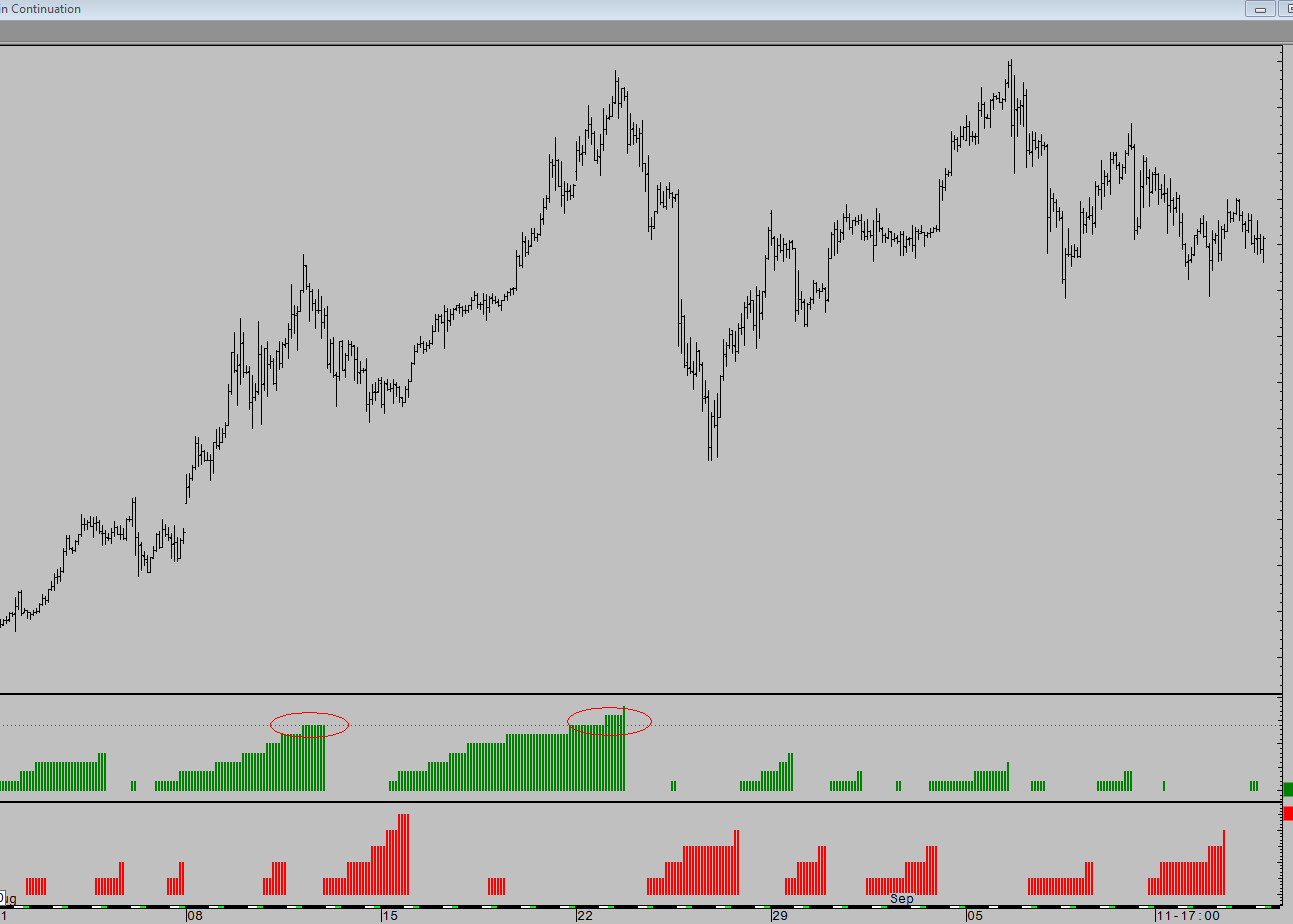

Trend analysis via Step Theory reveals extremes that are rarely breached in any time frame. Below, the green and red studies are tracking uptrends and downtrends in 120-minute time frames. There are two occasions where the uptrend ends around seven before a correction starts. The fractal nature of markets then means that the same process shows itself in any time frame.

Silver 120-Minute Continuation Chart

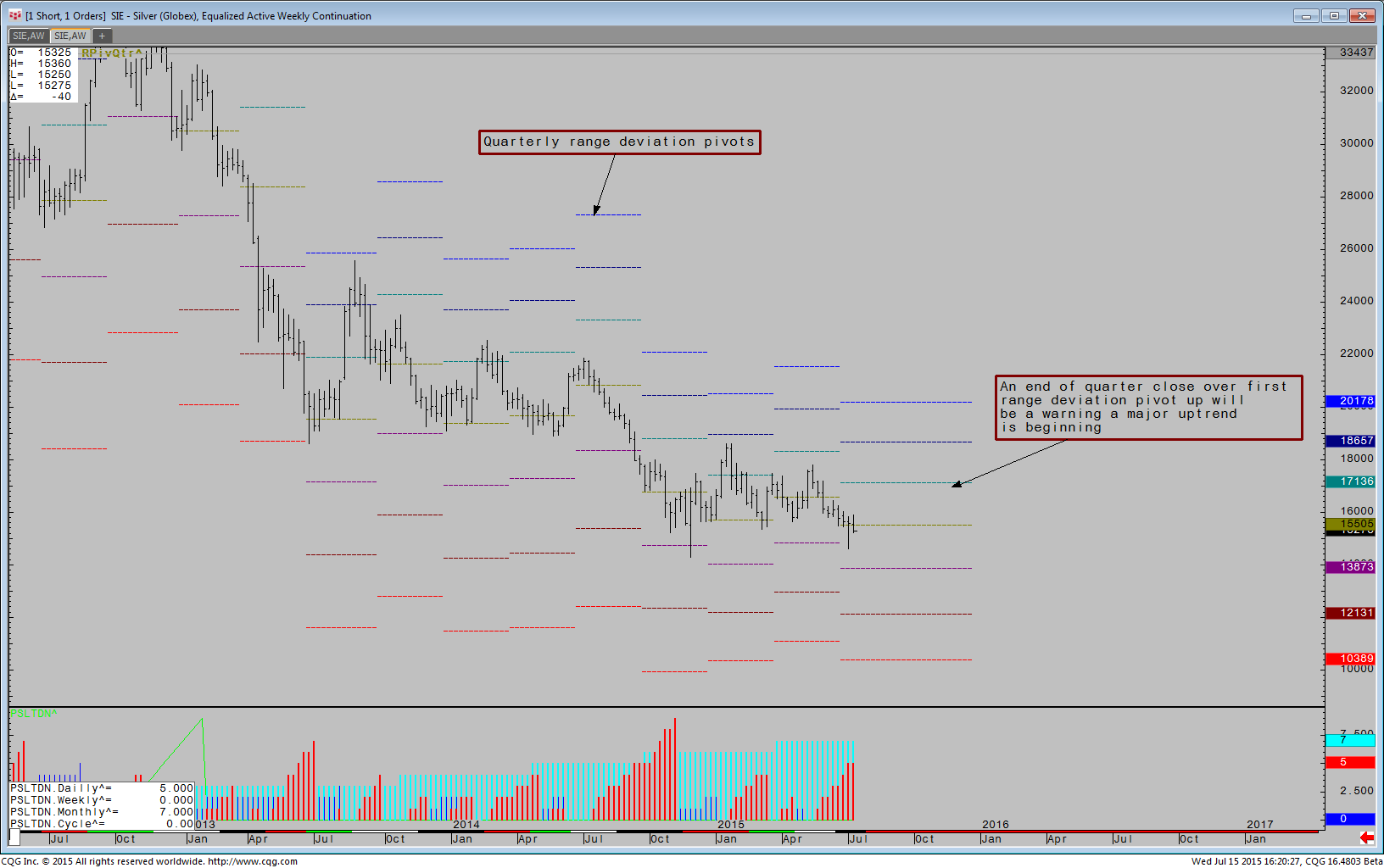

If we move to a monthly time frame, the same process occurs. The study at the bottom of the weekly silver chart below shows the fractal nature of downtrends at daily, weekly, and monthly levels instantaneously. The monthly count for the silver downtrend has hit seven, which tells us that in the months ahead we should expect a correction of some note to the upside given how infrequently downtrends of this magnitude are achieved in monthly time frames. A monthly close over long-term control at 16.55, and/or a monthly close over the first monthly range deviation pivot up, will be a warning that a major downtrend may have ended and an equally major uptrend may be likely.

Silver Weekly Chart

Further insight can be guaged by considering weekly price action against quarterly range deviation pivots. Range deviation pivots are based on the opening price, which means that the values are fixed and have a built-in skew for the trend. This means that in a downtrend, the down pivots expand in order to give the trend more room, whilst the up pivots begin to contract in a concept similar to the Parabolic. If price closes above the first up range deviation pivot at end of quarter, this in combination with the monthly negative step trend count at seven, should warn us of a major move up in the coming months. Because of the monthly time frame, we would need to zoom into trends at daily and weekly levels to look for the exact timing of the correction.

Silver Weekly Chart

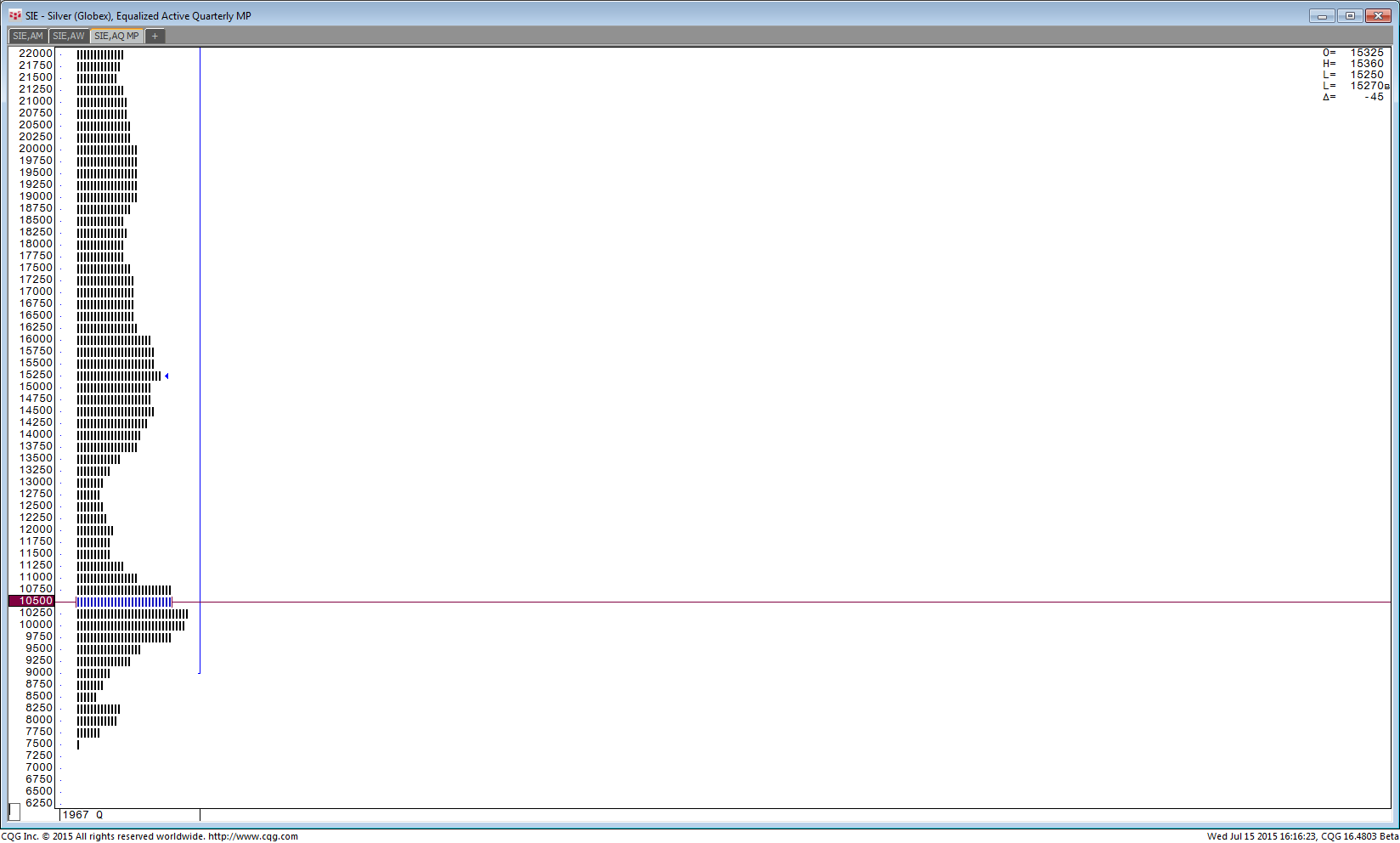

Because of the high time frames involved, we can also consider the Fair Value chart for insight. This reveals price would need to close below 14.27 on a weekly basis to open up major long-term control at 10.50. A close over monthly first up range deviation pivots from here and an accumulation of positive step trends in daily and weekly time frames would suggest the low is in.

Silver Quarterly Fair Value Chart

It is also possible to use Volatility Time Bands at a more granular level for silver to monitor when the downtrend is over. A close above the second up daily volatility time band would be further evidence the uptrend is beginning and the downtrend has ended.

Silver Daily Continuation Chart