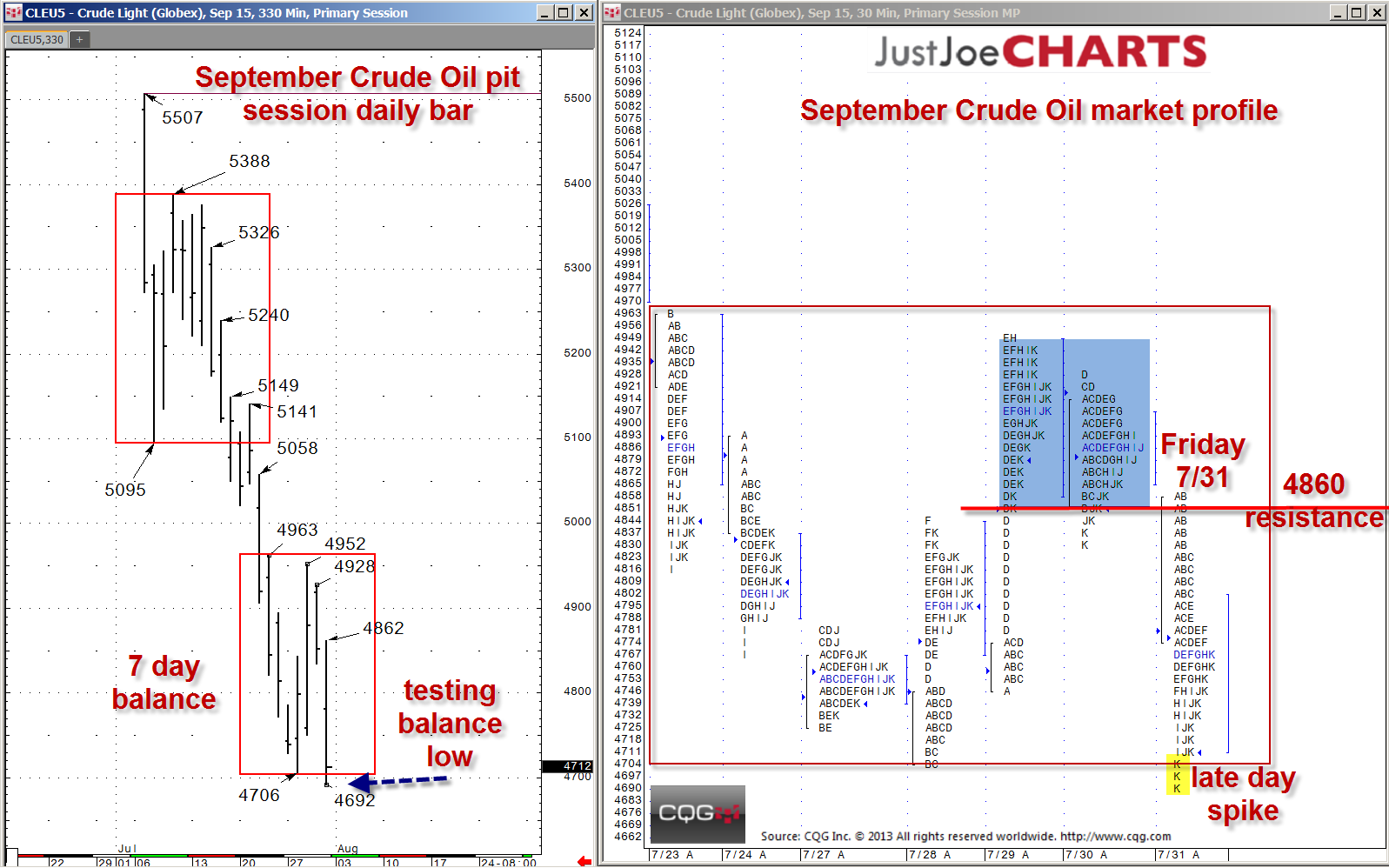

For the past six weeks, crude oil has come off from about $62 down to about $47. However, over the past seven days, the September contract found a rotational range from 47.06 to 49.63. On Friday, July 31, 2015, crude oil took out the 47.06 balance low by 14 ticks late in the day session, but settled slightly above. When a volatile market such as crude oil tests the extreme of a balance bracket, the two most likely scenarios are:

- Gain acceptance outside the balance range and accelerate.

- Get rejected, reenter the balance range, and begin a rotation to the opposite end of that range.

If the market gains acceptance below the 47.06 balance low, the next downside reference of 42.03 on the weekly and monthly charts could become the destination. However, if the market gets rejected below the 47.06 balance low, it may begin a rotation back up to the 48.60 resistance level and possibly the 49.63 balance-bracket high.