The US dollar is the pricing mechanism for almost all raw material prices around the globe. As the reserve currency of the world, the vast amount of liquid trading in commodity futures and forward markets is denominated in the US currency. While the US population represents less than 4.5% of the total people in the world, the nation's currency looms large in the world of raw material markets.

There is an inverse relationship between the dollar and commodity prices. This is because when the dollar falls in value, prices for these staple assets become cheaper in other currencies, encouraging demand. Conversely, when the dollar rises against other currencies, commodity prices become more expensive in local currencies, which in turn encourages selling. Since May of 2014, the value of the dollar has increased and in July of 2015, commodity prices fell sharply.

An Ugly Month for Commodities

July was an ugly month for many commodity prices. Key industrial raw material prices, which have been in a protracted bear market since 2011, moved lower. In some cases, commodity prices are now approaching long-term support levels and in others, they are making new lows, breaking key support levels.

Crude oil, which recovered from March through June, had its worst month in July since 2008, dropping 21% for the month. It now stands only $5.09 above the March lows. Copper, a bellwether commodity in terms of the global economy, broke through long-term support in July and traded down to $2.3375 - the lowest level in six years. Lumber, another diagnostic commodity in terms of housing and economic conditions, fell from $290 to $252, a decrease of 13% in July. Gold, the commodity that has a dual role as a raw material and a currency, broke key support at $1130 and is now trading at five-year lows. Meanwhile, the dollar did not even move significantly higher in July, it just continued the consolidation that began in March.

Is Dollar Consolidation Ending?

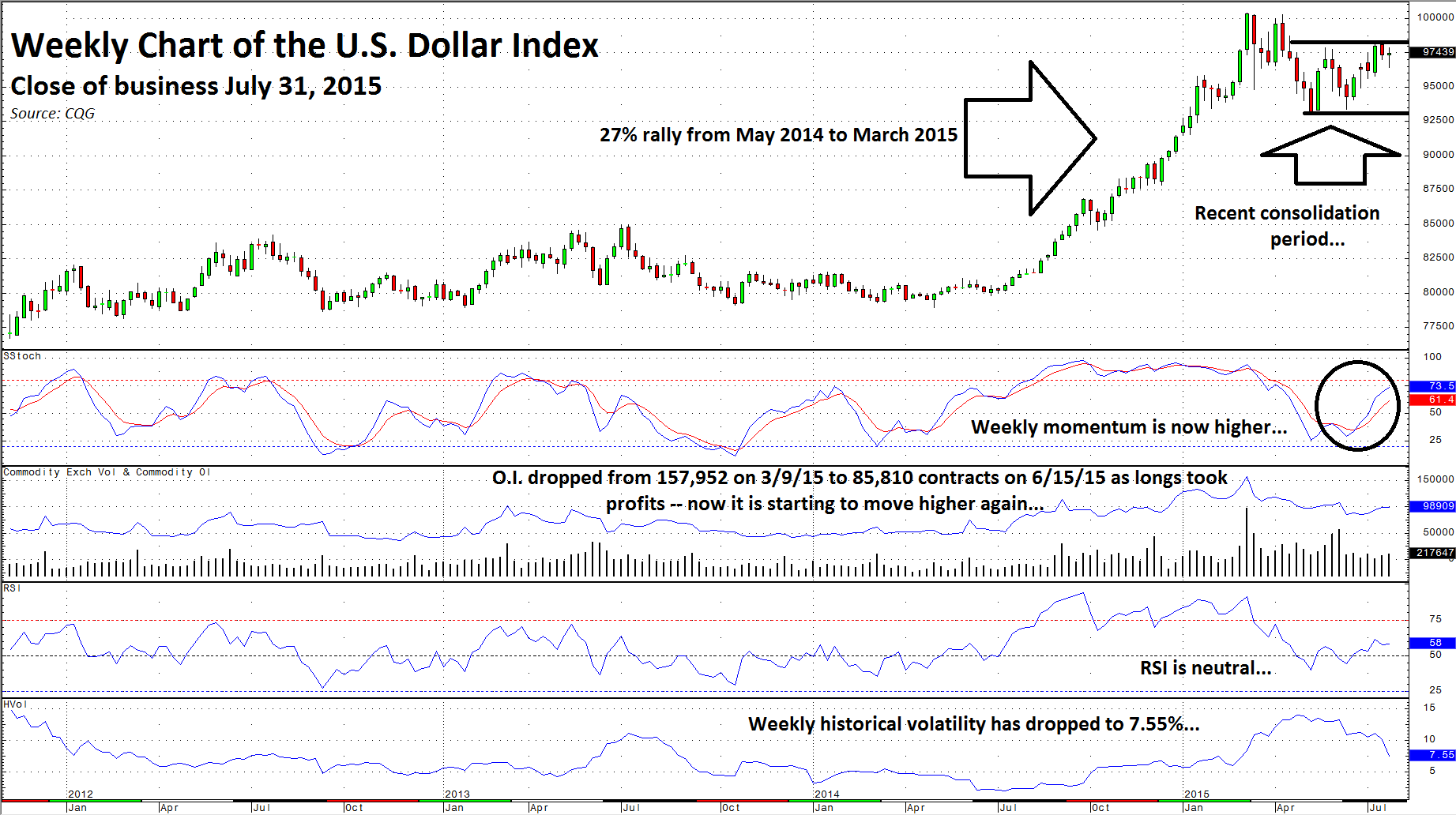

The dollar index rallied more than 27% between May 2014 and March 2015.

As the weekly chart highlights, after making twelve-year highs in March, the dollar entered into a period of correction and consolidation. Longs took profits from the incredible rise in the greenback during the correction, and open interest dropped by over 45%. Just recently, the dollar momentum has turned positive and open interest has begun to rise, indicating that the dollar could be preparing for another leg to the upside.

Higher Dollar and Lower Commodity Prices Ahead?

When considering the relationship between the dollar and commodity prices, it is often a chicken and egg dilemma - which comes first? The bear market in commodity prices began when they peaked in 2011. The dollar rally began in May 2014. Last month, many key commodity prices fell once again, and some fell through support levels to multi-year lows. This is an ominous signal for dollar-based commodity prices.

A continuation of the global economic slowdown has caused consumption of raw materials to fall. China, which is the demand side of the equation for many commodities, has experienced slower growth than in years past. Recent cracks in the Chinese equity market highlights a slowing economy. The Chinese government has cut interest rates four times in 2015; however, this has not helped to support commodity prices. The price action in copper alone is reflective of a weakening China. Lower energy prices have cut the cost of production for many other commodity prices.

Meanwhile, a stronger dollar has cut labor costs in countries that are not dollar-based. As the cost of commodity production falls and demand is weak, the path of least resistance is likely to continue to be lower. Meanwhile, given the relative strength of the US economy and the prospect for rising US rates in a world where other interest rates are likely to remain low, the outlook for commodity prices and the dollar is that recent trends will continue.

The dollar may begin another leg up to new highs in the coming months and, at the same time, commodity prices could continue to falter. Many commodity prices remain at levels today that are well above the prices in 2000, which means that there is still downside in these raw material values. Both commodity prices and the US dollar are feeding off each other these days. It is hard to say which is leading the charge but in both cases, the trend is your friend for the time being.