This Microsoft Excel® spreadsheet presents market data and forward curves of the Globex RBOB Gasoline contracts. The data includes the outrights, exchange-traded calendar spreads, and synthetic… more

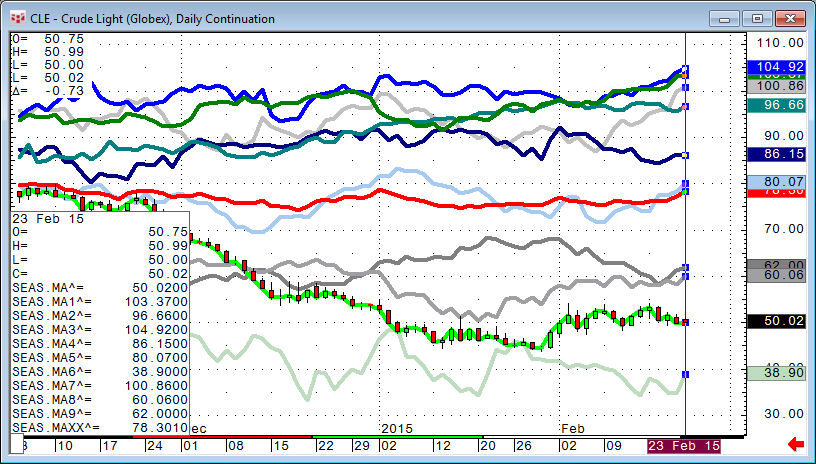

The price of active month NYMEX crude oil is what everyone is focusing on these days, but that price is only a view from thirty thousand feet of what is actually going on in the global oil patch.… more

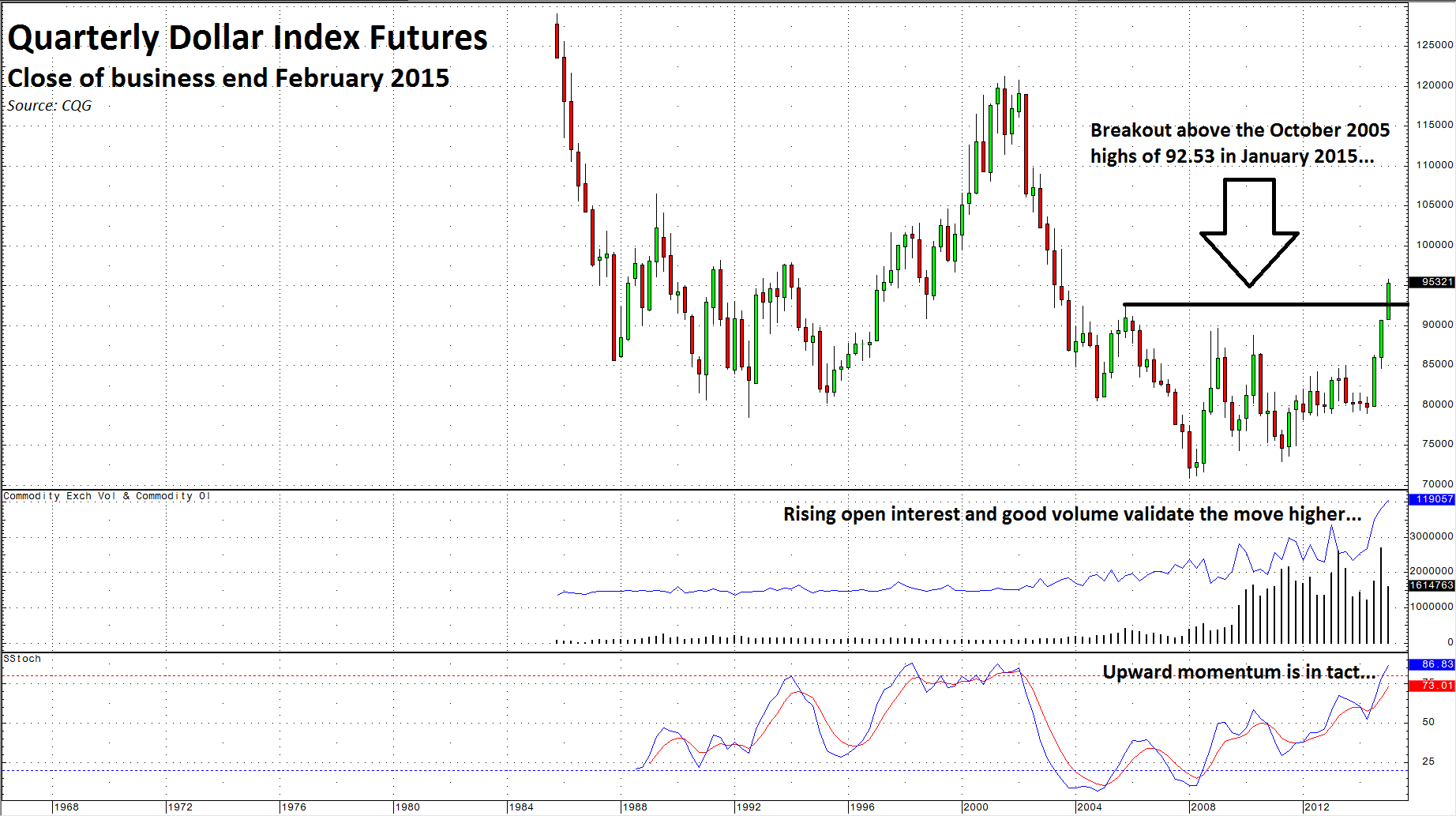

The bull market in the dollar continues to power forward. The US dollar index was up 11.97% in 2014. So far this year the greenback is up another 5.16%. The dollar is one of the strongest markets… more

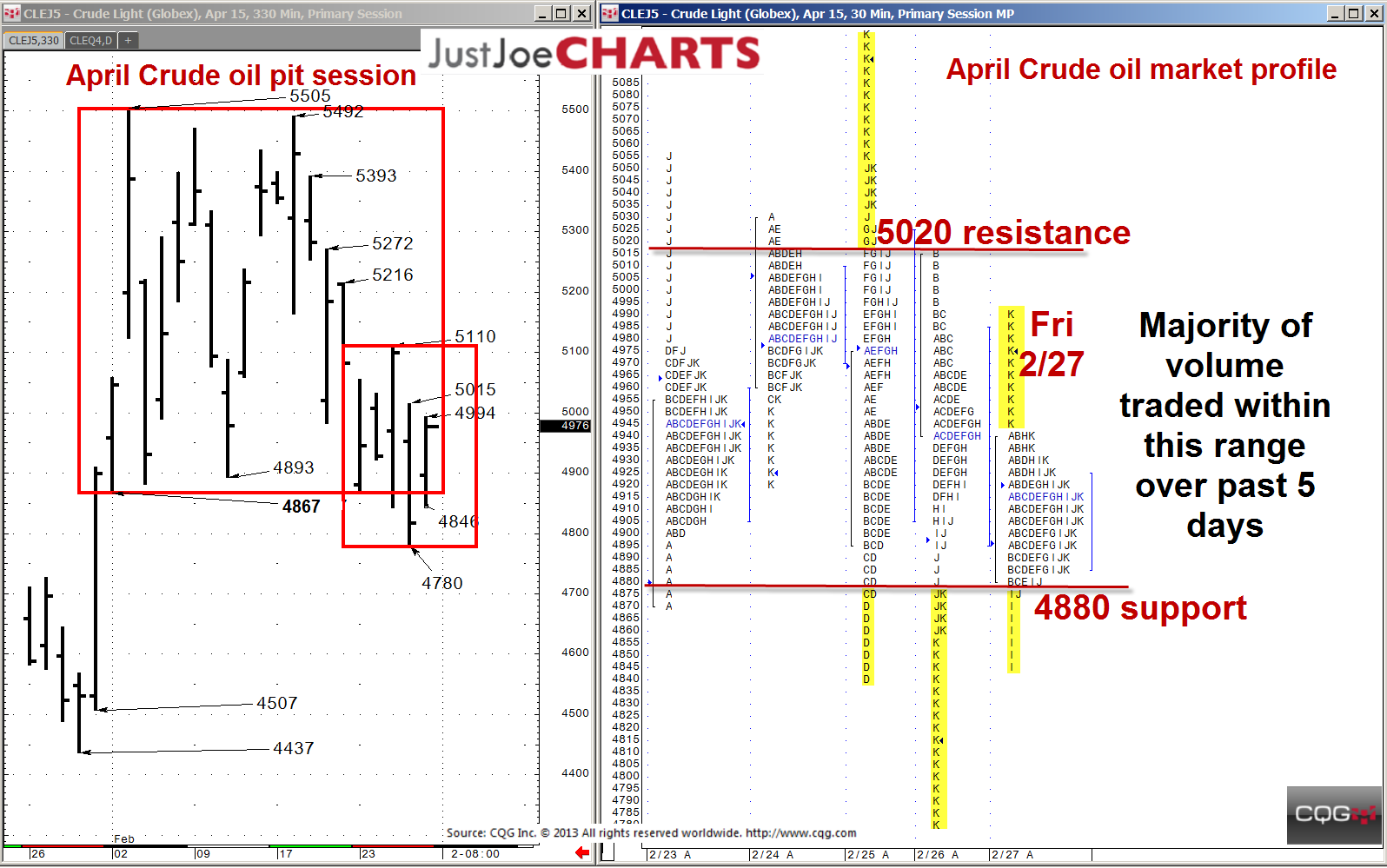

Over the past three weeks, April crude oil found a rotational balance range of 4867-to-5505, traveling from the bottom to the top and back to the bottom of that range a few times. However, three… more

This Microsoft Excel® spreadsheet is an updated version of the CQG-Powered Excel Horizontal DOM Dashboard, which also includes a correlation display. Two histogram charts have been added to each… more

Quite some while ago I showed, in a very simple way, how to overlay 2011, 2012, 2013, and 2014 data in one chart. I created two very simple code snippets to accomplish that.

This time, I… more

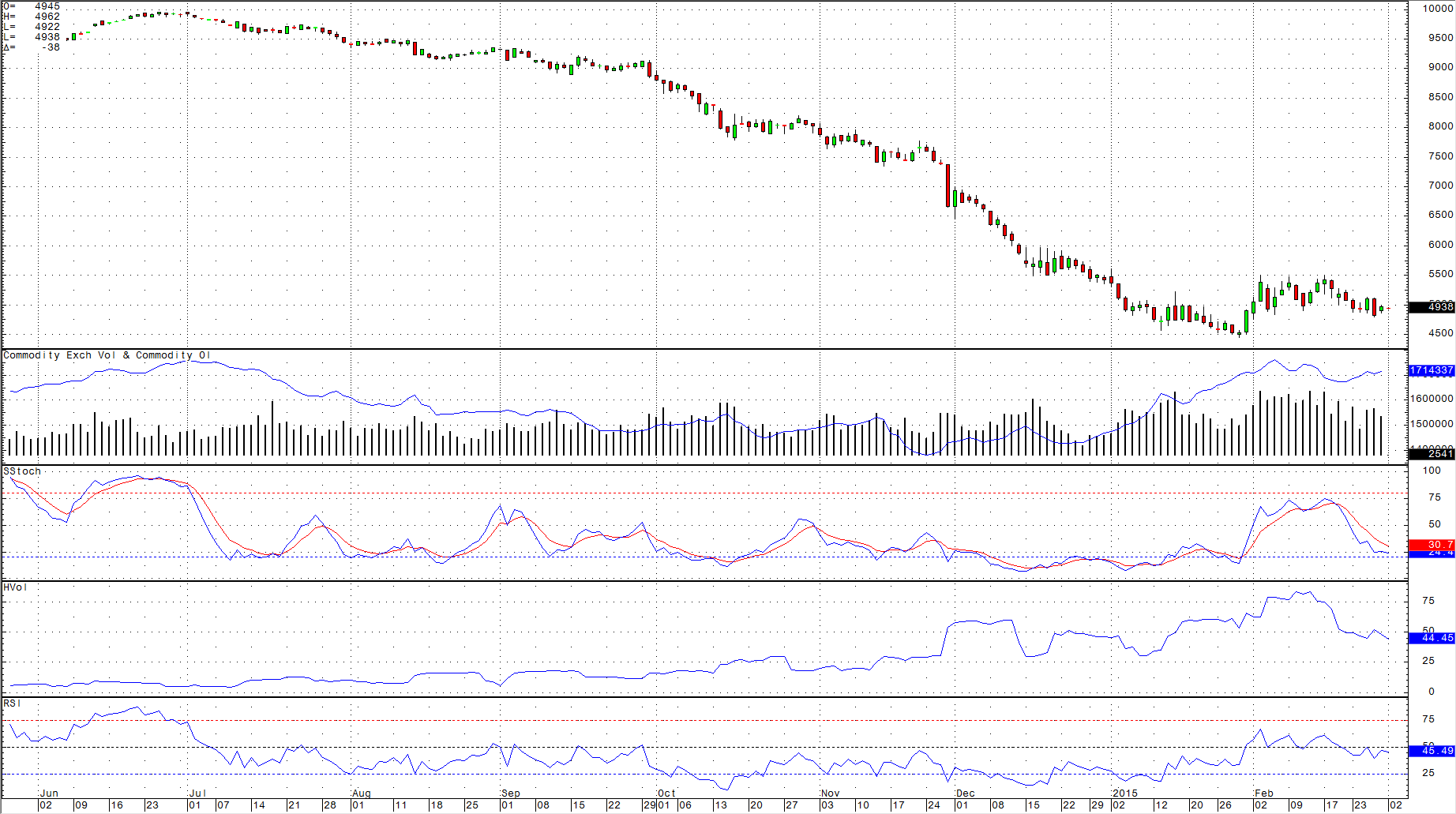

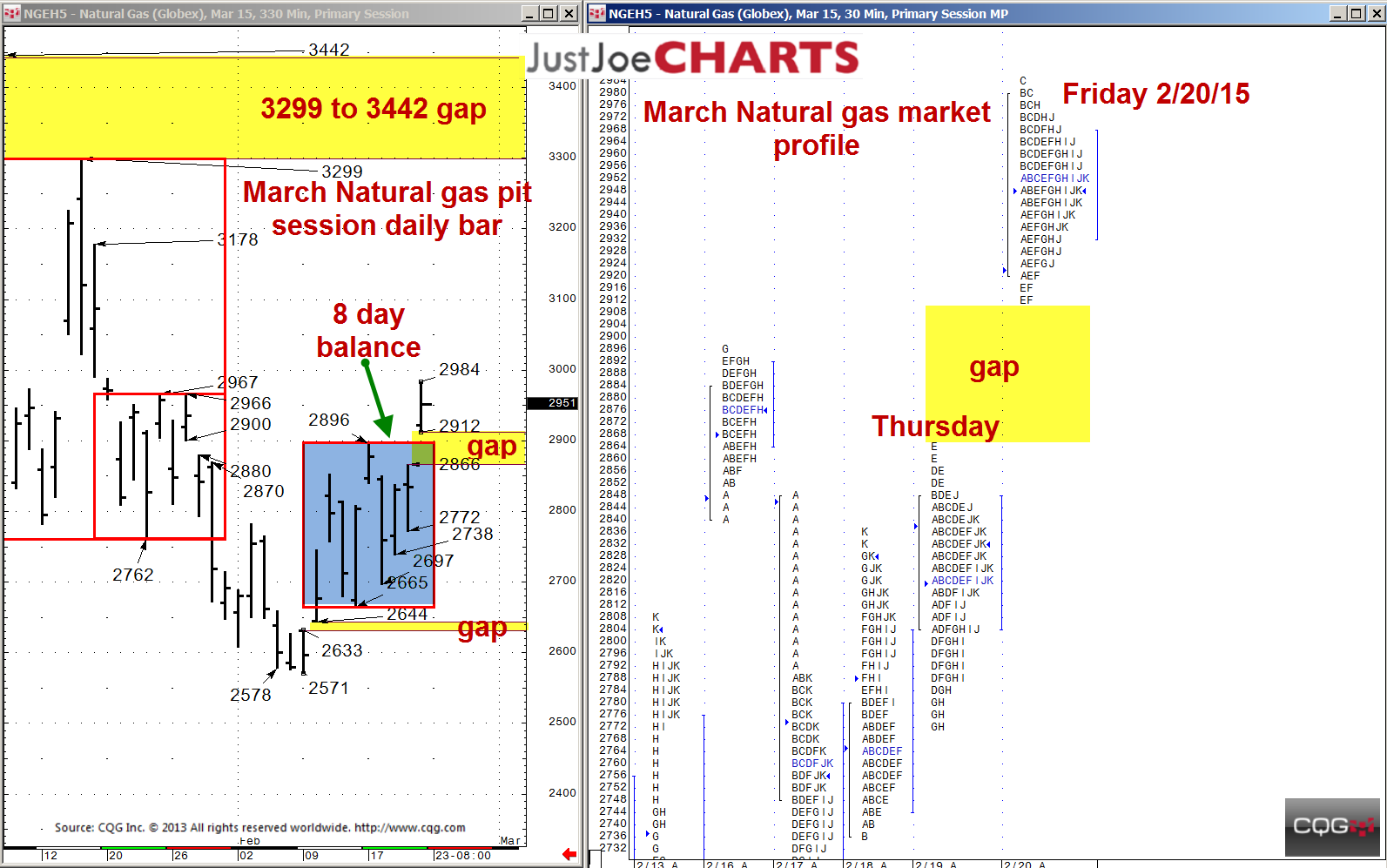

For eight straight trading days, March natural gas has been contained within a 2665-to-2896 rotational balance range. On Friday, February 20, 2015, the market gapped open higher, above the 2896… more

View this webinar recording to see why the CQG and Eris combination is right for you.

Learn about trading Eris Exchange Interest Rate Swap Futures through CQG. The webinar includes an… more

Behavioral and brain research is revealing that the two main factors in great trading lie in how traders use their qualitative judgments.

Predicting others and understanding oneself are the… more

This Microsoft Excel® spreadsheet presents two views of current market data and two correlation matrices. The market data sections use the symbols entered into the first column. The last quoted… more