The bull market in the dollar continues to power forward. The US dollar index was up 11.97% in 2014. So far this year the greenback is up another 5.16%. The dollar is one of the strongest markets I see out there these days. Fundamentals for the US currency are compelling. Technical analysis validates the fundamentals. Therefore, technomentals suggest to me that the dollar could go much higher from current levels.

Fundamentals

The US economy is currently the strongest economy in the world. While Europe continues to deal with deflationary pressures, like unemployment and a host of other problems, the US is doing just fine. The current level of interest rates around the world provides fundamental support for the greenback. Announced in July, quantitative easing in Europe will remain in place until at least September 2016, if not beyond. The dollar therefore is an attractive currency when compared to the euro from a yield perspective. Negative interest rates across Europe cannot compete with US paper that yields interest. At the same time, the US Federal Reserve is preparing to raise short-term interest rates. A strong dollar gives the Fed governors reason to pause, and requires patience - the new mantra of the US central bank. However, when comparing yields in the US to others available around the world, the dollar may become a no-brainer.

Lower commodity prices caused by the appreciating US currency are negative for the Australian and Canadian currencies. From a fundamental perspective, the dollar continues to provide attractive returns from both a yield and capital appreciation standpoint.

Technicals

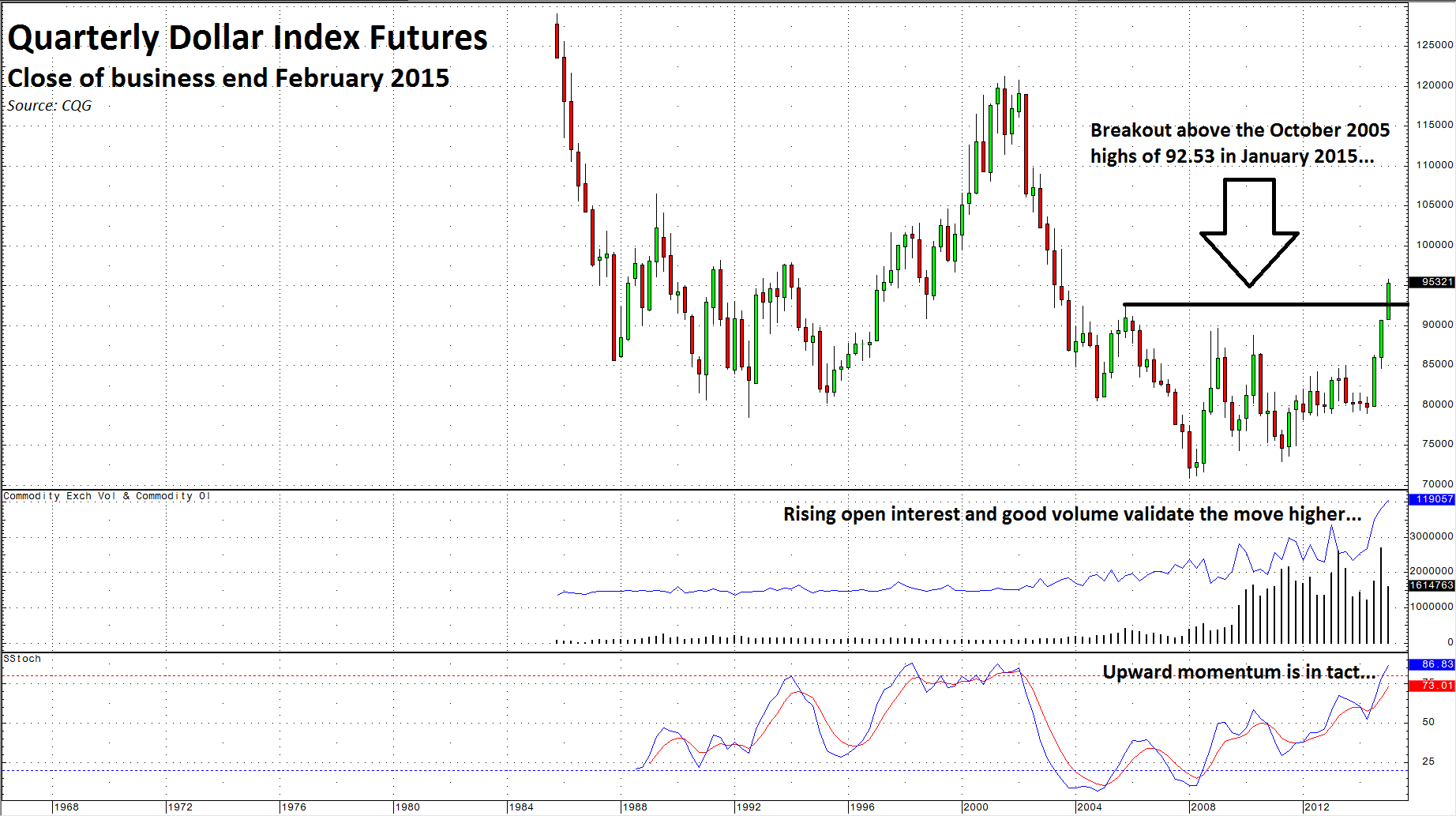

The rally in the dollar began in May 2014. On long-term charts, it broke to the upside when it surpassed the October 2005 highs at 92.53 in January. The quarterly chart of the dollar index highlights just how bullish the action is.

Not only has the dollar broken to the upside on the quarterly chart, but also it has done so with rising open interest and strong volume. The increased level of participation validates the upward momentum, which remains strong and intact.

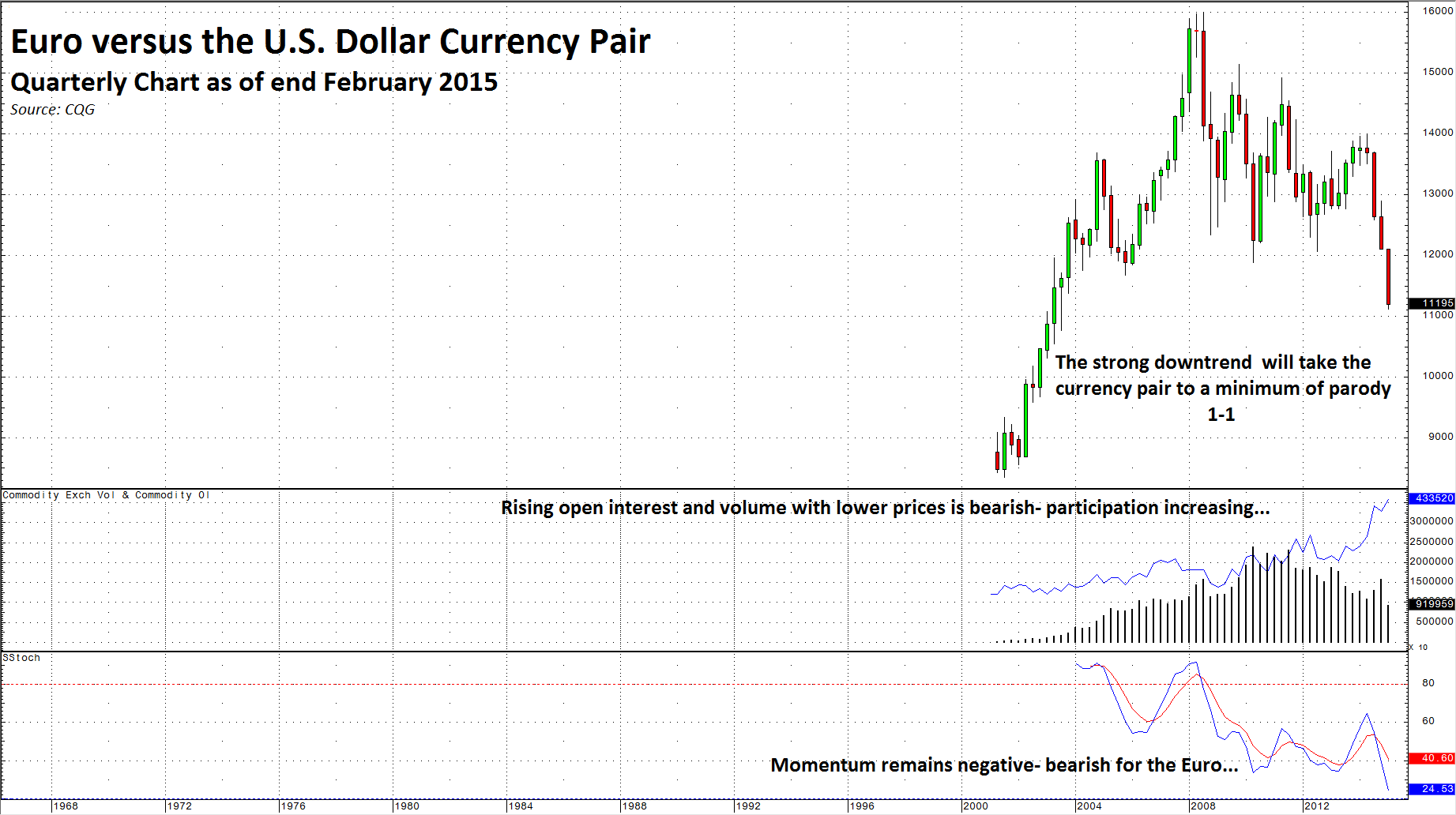

One of the largest components of the dollar index is the relationship between the dollar and the euro. While fundamentals strongly favor the dollar, the technical pictorial uncovers a strong long-term downtrend in the euro currency versus the greenback.

The euro currency has been in freefall against the dollar. Increasing open interest and good volume sets the stage for a continuation of the move lower. Additionally, momentum remains negative, meaning that prospects for a recovery are dim.

A Technomental Conclusion

The technical picture of the dollar validates the fundamentals that underpin both the currency pair with the euro as well as with other currencies. There are many ramifications for a continuation of the dollar rally. It could keep inflation in the US below the target level of 2% set by the Federal Reserve. Priced and traded in dollars, the odds of lower commodity prices rises with dollar strength. US corporate profits may suffer as the stronger dollar makes US business less competitive abroad. Therefore, the higher the dollar goes, the greater the chance that central banks around the world will seek to soften the effects of currency realignment via intervention in the currency markets, selling dollars at time.

I believe that the dollar index will head much higher and that the euro-versus-dollar currency pair will trade at parody in 2015.