Introduction

Cboe Europe Derivatives (CEDX) is a European derivatives marketplace which enables participants to access equity derivatives markets for quotes and trade execution.

CEDX offers a range of futures and options contracts based on Cboe Europe single country indices. Here is a list of the symbols and descriptions:

| Symbols | Description |

|---|---|

| F.CE.EZ50F | Cboe Eurozone 50 Index |

| F.CE.FR40F | Cboe France 40 Index |

| F.CE.DE40F | Cboe Germany 40 Index |

| F.CE.NL25F | Cboe Netherlands 25 Index |

| F.CE.CH20F | Cboe Switzerland 20 Index |

| F.CE.UK100F | Cboe UK 100 Index |

| F.CE.ES35F | Cboe Spain 35 Index, Jul 24 |

| F.CE.IT40F | Cboe Italy 40 Index |

| F.CE.NO25F | Cboe Norway 25 Index |

| F.CE.SE30F | Cboe Sweden 30 Index |

CEDX offers European equity options for quotes and trade execution on over 300 companies.

The companies are based in the following countries:

- Austria

- Belgium

- Denmark

- Finland

- France

- Germany

- Ireland

- Italy

- Norway

- Spain

- Sweden

- Switzerland

- The Netherlands

- United Kingdom

CQG IC and QTrader Cboe Europe Derivatives Page

The downloadable CQG PAC is a page with the following attributes:

- Quote Spreadsheet 2.0

- Options Window and order routing

- Custom chart displaying Bids, Asks, Trades and Settlement prices

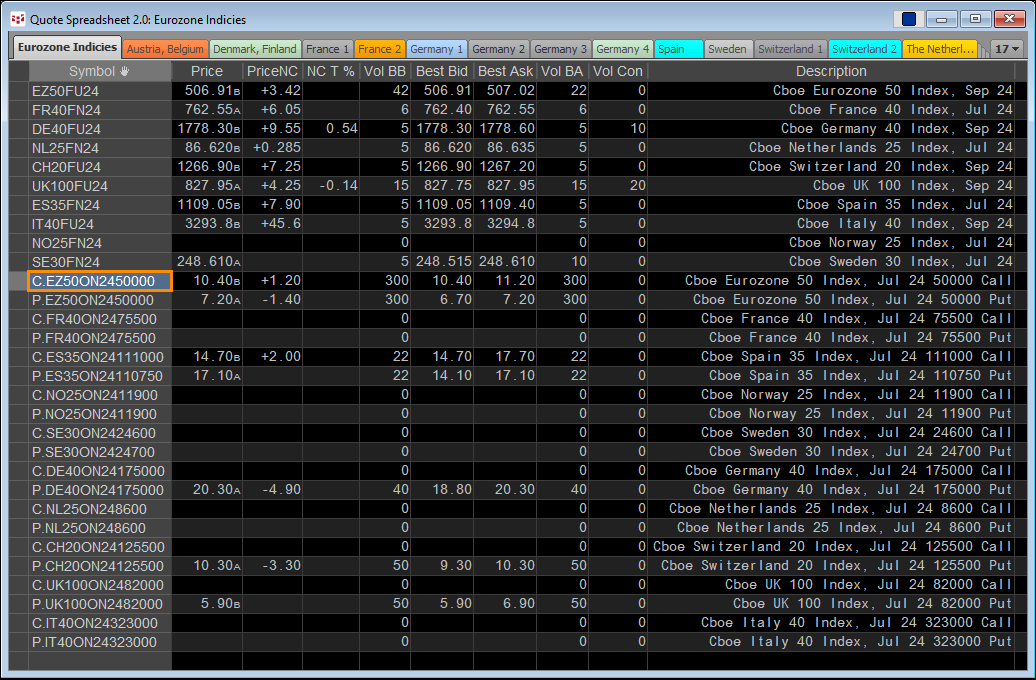

The Quote Spreadsheet 2.0 has tabs. The first tab is the futures and options contracts based on Cboe Europe single country indices.

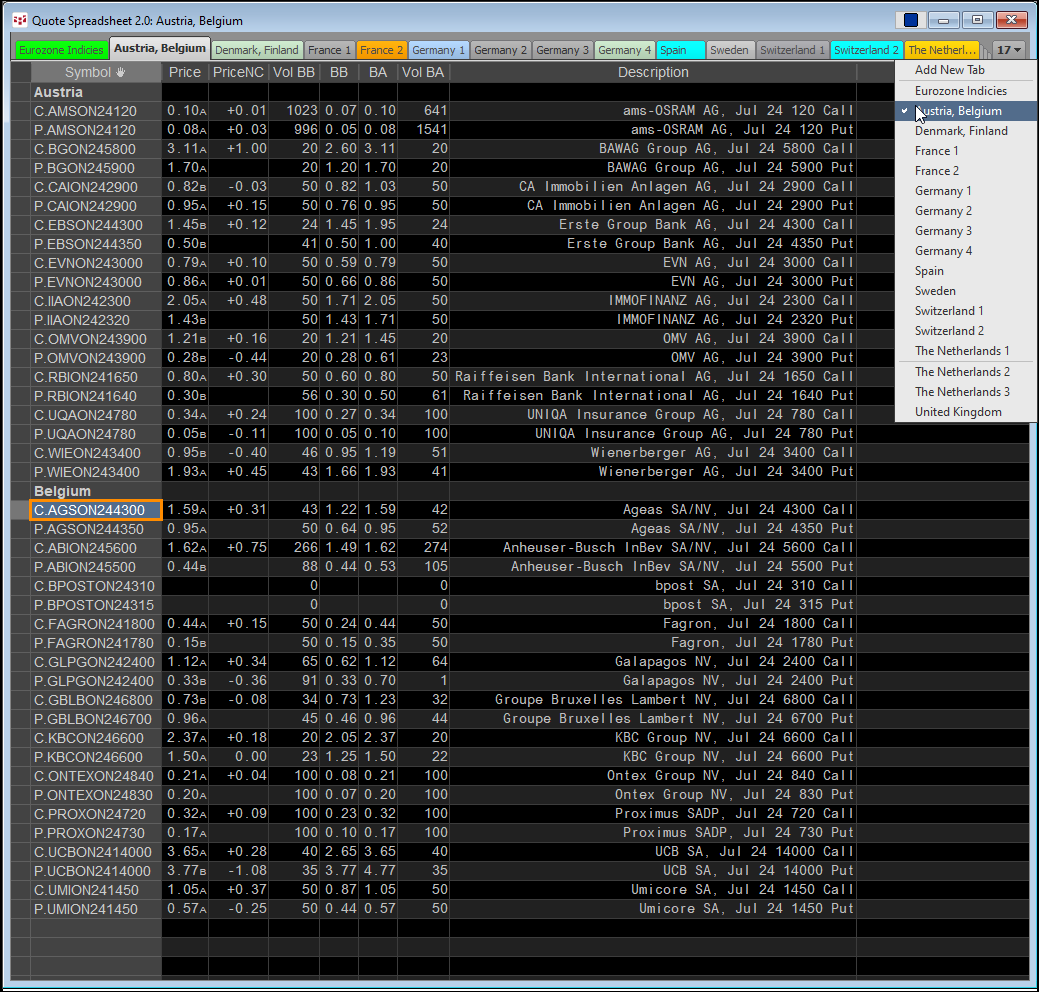

The remaining tabs are the specific countries listing the current market quotes for European equity options for companies based in that particular country. To the far right is a tab for quick navigation to a specific country tab.

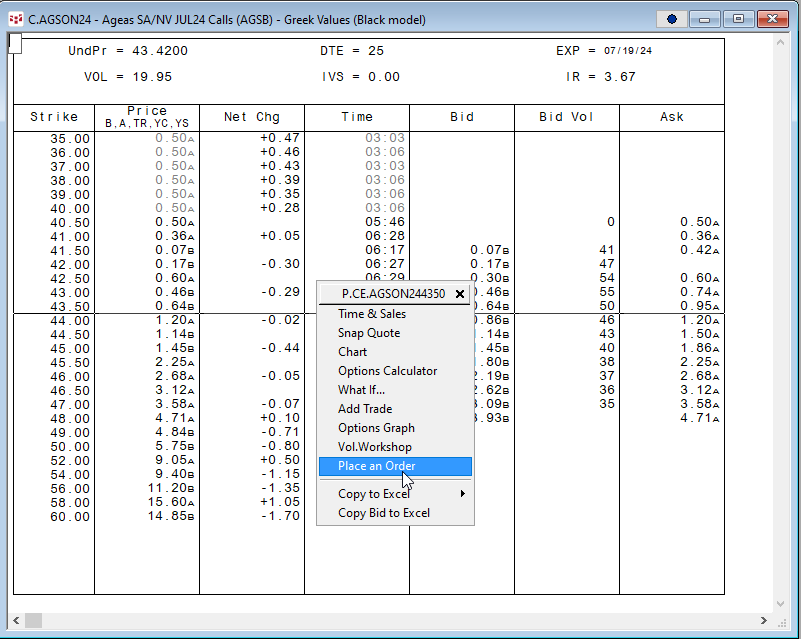

The at-the-money calls and puts are displayed for each equity. The Quote Spreadsheet 2.0 is linked to a CQG Options Window. Setting the preferences for the options window are explained here. The Options Window, a tabbed window, has three views: Standard, Greek, and Theoretical versus Underlying. The Standard view changes based on the value you want displayed: LPrice, TheoV, Delta, Gamma, Theta, Vega, IV, Open Int, and Volume.

To place a trade right-click in the price column at the strike price and select "Place an Order."

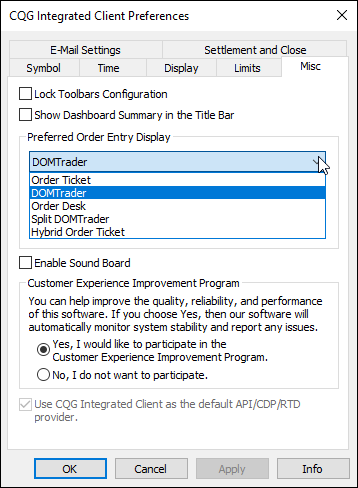

Set the preferred Order Entry display by navigating to Setup > System Preferences > Misc > Preferred Order Entry Display.

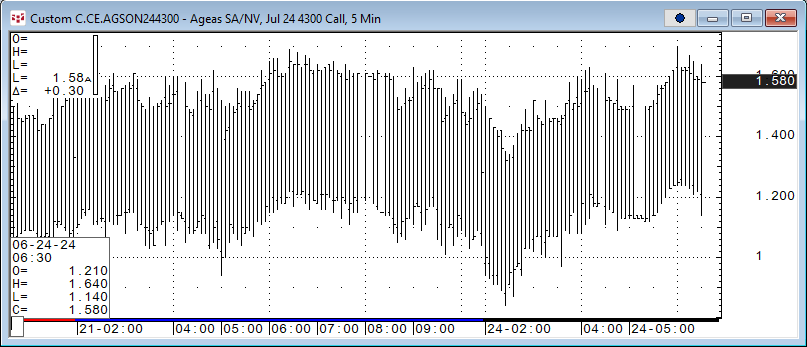

A 5-minute chart is linked to the Quote Spreadsheet 2.0.

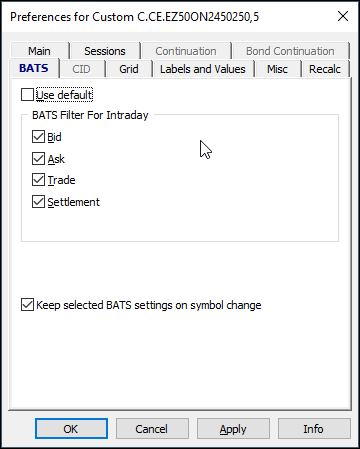

The chart's preferences are set to display the Bids, Asks, Trades and Settlement prices. Right-click the chart to set the BATS Preferences.

Cboe Europe Derivatives (CEDX) enable CQG customers to access the European derivatives marketplace. The downloadable CQG PAC will install a page with the afore mentioned features and functionality.

Requirements: CQG Integrated Client or QTrader.