Stories are appearing in the media pointing out the possibility of an AI bubble. Alternative ETFs have been suggested that are not so "tech heavy." One suggestion is the Invesco S&P 500® Quality ETF (Symbol: SPHQ).

According to their web site: "The Invesco S&P 500® Quality ETF (Fund) is based on the S&P 500® Quality Index (Index). The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index tracks the performance of stocks in the S&P 500® Index that have the highest quality score, which is calculated based on three fundamental measures, return on equity, accruals ratio and financial leverage ratio. The Fund and the Index are rebalanced and reconstituted semi-annually on the third Friday of June and December."

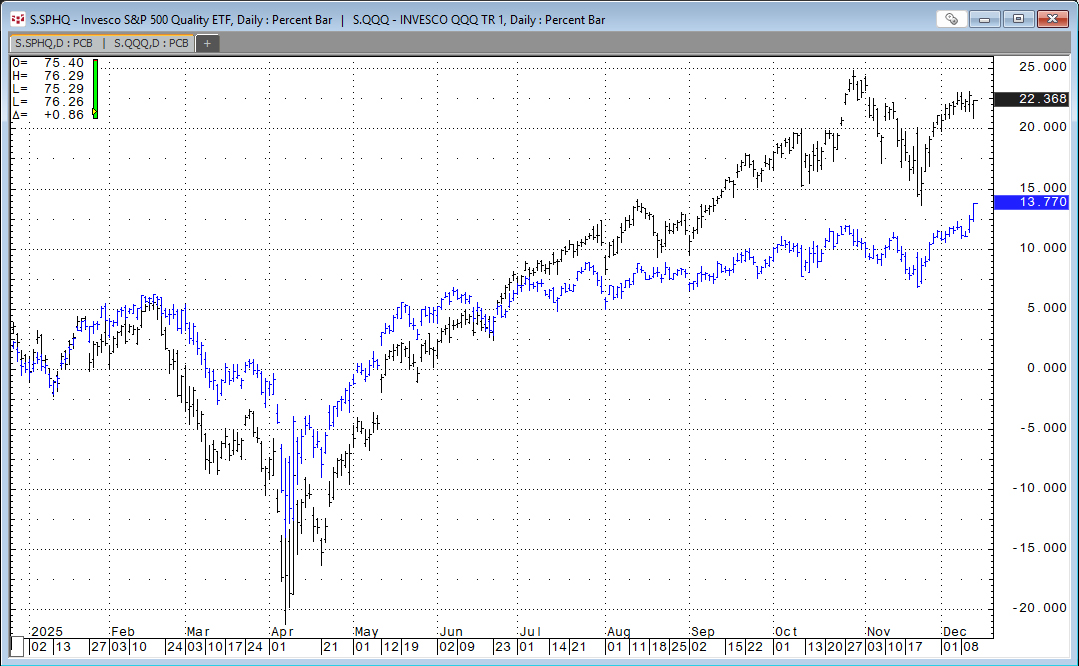

The image above is the percentage net change for the year. The QQQ ETF has outperformed (black). However, the SPHQ ETF (blue) has made new highs for the year and the QQQ ETF has not.

The table is the top ten holdings as of December 10, 2025:

| # | Ticker | Company | Weight | Ticker | Company | Weight |

|---|---|---|---|---|---|---|

| 1 | AAPL | Apple Inc | 6.59% | PG | Procter & Gamble Co | 3.99% |

| 2 | MA | Mastercard Inc | 4.29% | CAT | Caterpillar Inc | 3.32% |

| 3 | GE | General Electric Co | 4.15% | KO | Coca-Cola Co | 3.03% |

| 4 | COST | Costco Wholesale Corp | 4.12% | GEV | GE Vernova Inc | 2.84% |

| 5 | V | Visa Inc | 4.10% | LRCX | Lam Research Corp | 2.75% |

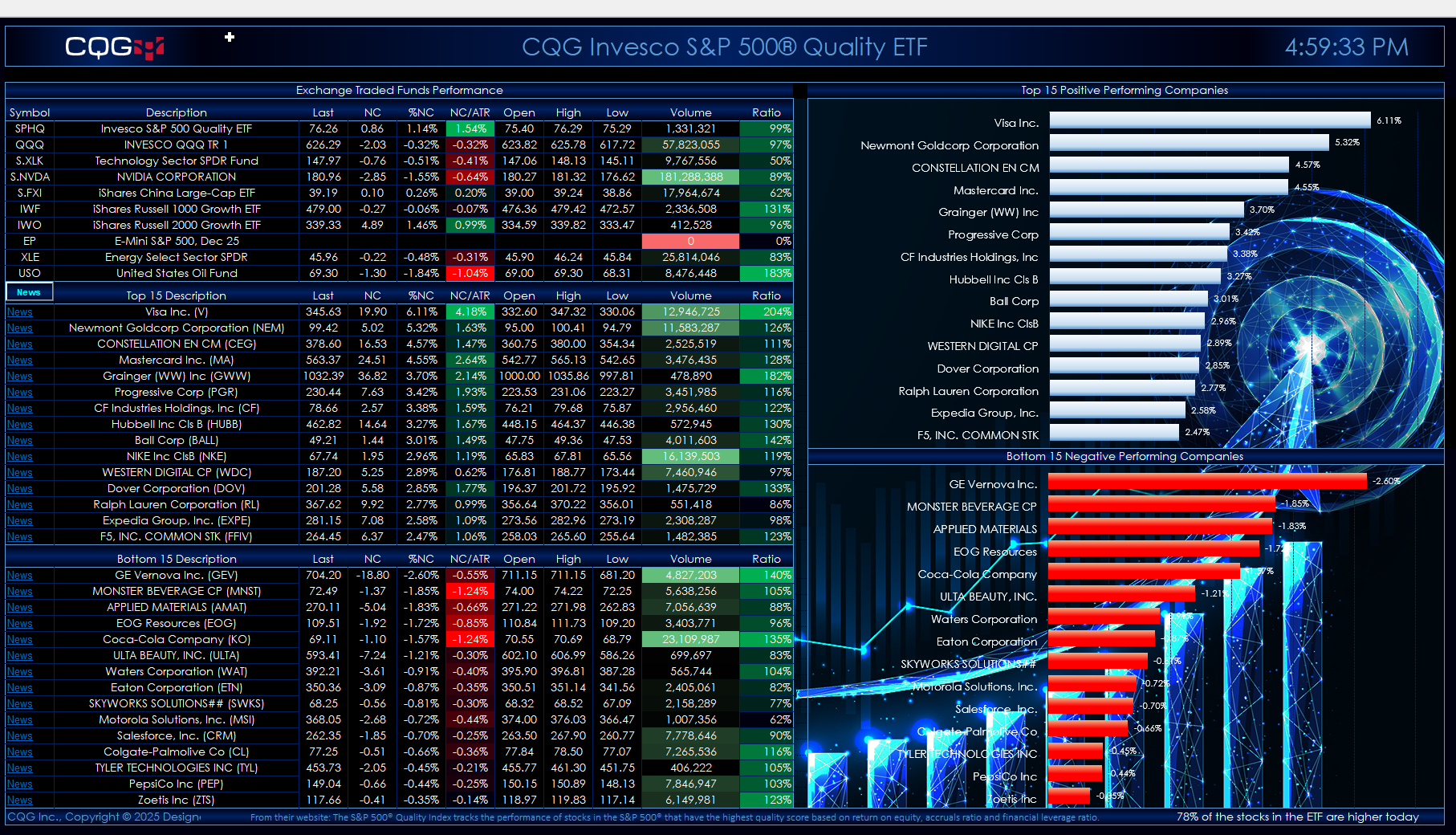

Below is an image of the downloadable Excel Dashboard. During the trading session, the Excel dashboard dynamically ranks the individual stocks held by SPHQ. The Excel dashboard shows the top fifteen positive and bottom fifteen negative performers as histogram bar charts, along with their respective net percent change for today's trading session.

The top section of the quote display allows you to enter your own symbols.

The second section displays the top fifteen performers. The third section displays the bottom fifteen performers.

Quote data includes today's net change as a ratio to the 21-day Average True Range study. Next to today's traded volume is a column that calculates the ratio of today's volume versus the 21-day average of the volume. This ratio column gives you a sense of how active today's trading is relative to recent history. Readings of 100% and higher indicate active trading.

A key feature next to each company name is a link to Yahoo Finance. Clicking the News link will take you to the Yahoo page for that symbol. Note that this could take approximately 30 seconds to open in a browser.

If you open another Excel spreadsheet, then this dashboard will no longer be the active spreadsheet. The macro that updates the links and ranks the stocks by performance will stop. To start the macro, simply click the News toolbar button in the first column.

Make sure to lower your Excel Realtime Data (RTD) throttle to 50 milliseconds or lower. Learn how to do that here.

Two dashboards are available: One has a solid black background, and one has an image background.

Requires CQG Integrated Client or CQG QTrader, data enablements for the NYSE and Nasdaq stocks, Toronto Stock Exchange (TSX) and Excel 2016 or more recent.