John Ehlers’, President of MESA Software (mesasoftware.com), goal is to bring the science of engineering and Digital Signal Processing to the art of trading. One such endeavor is his publishing of the Fisher Transform as a technical study for traders and investors.

Ehlers explains in his published research on his website:

https://www.mesasoftware.com/papers/UsingTheFisherTransform.pdf

“It is commonly assumed that prices have a Gaussian, or Normal, Probability Density Function (PDF). A Gaussian PDF is the familiar bell-shaped curve where 68% of all samples fall within one standard deviation about the mean. This is a really bad assumption, and is the reason many trading indicators fail to produce as expected.”

Consequently, he published his Fisher Transform detailing that “prices do not have a Gaussian PDF. By normalizing prices or creating a normalized indicator such as the RSI or Stochastic, and applying the Fisher Transform, a nearly Gaussian PDF can be created. Such a transformed output creates the peak swings as relatively rare events. The sharp turning points of these peak swings clearly and unambiguously identify price reversals in a timely manner. As a result, superior discretionary trading can be expected and higher performing mechanical trading systems can be developed by using the Fisher Transform.”

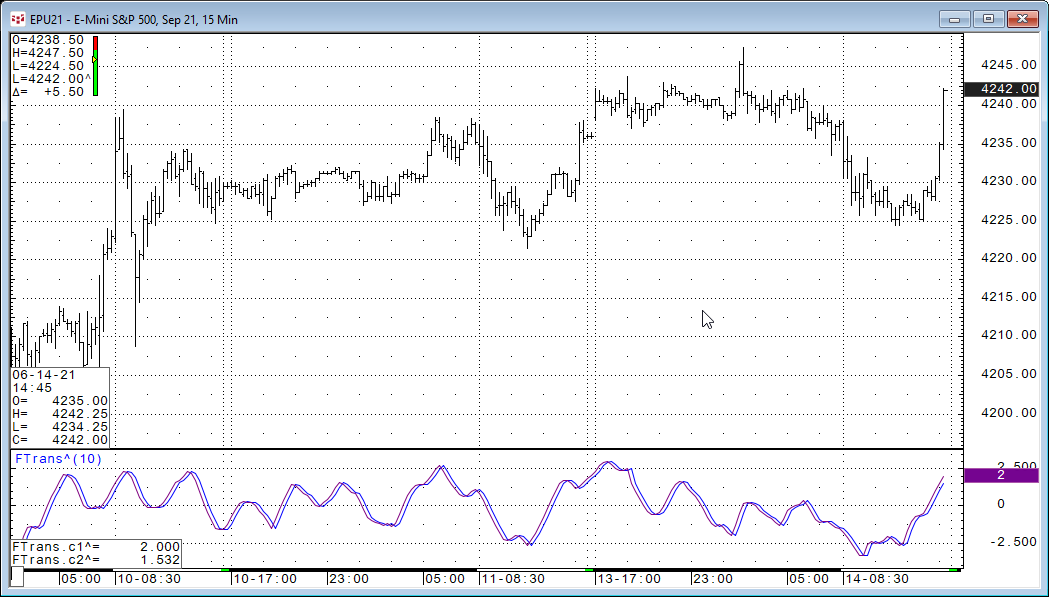

The downloadable CQG PAC creates the Fisher transform study and Trigger line as a unique page in CQG.

Requires CQG Integrated Client or QTrader and exchange enablements.