The London Metal Exchange (LME) was founded in 1877. The LME is the world center for the trading of industrial metals. The majority of all non-ferrous metal futures business is transacted on the LME platforms.

The LME is popular for its close ties to industry. The aspect of physical delivery via the world-wide network of LME-approved warehouses makes it the perfect venue for hedging by the industry and providing reference prices for business transactions.

This post is to help navigate the numerous available outright and spread contracts in CQG. At the end of the post is a downloadable PAC for tracking and trading LME contracts for CQG IC/QTrader and links to importing an LME page into CQG Desktop and CQG One. This post is also a general introduction to the LME market.

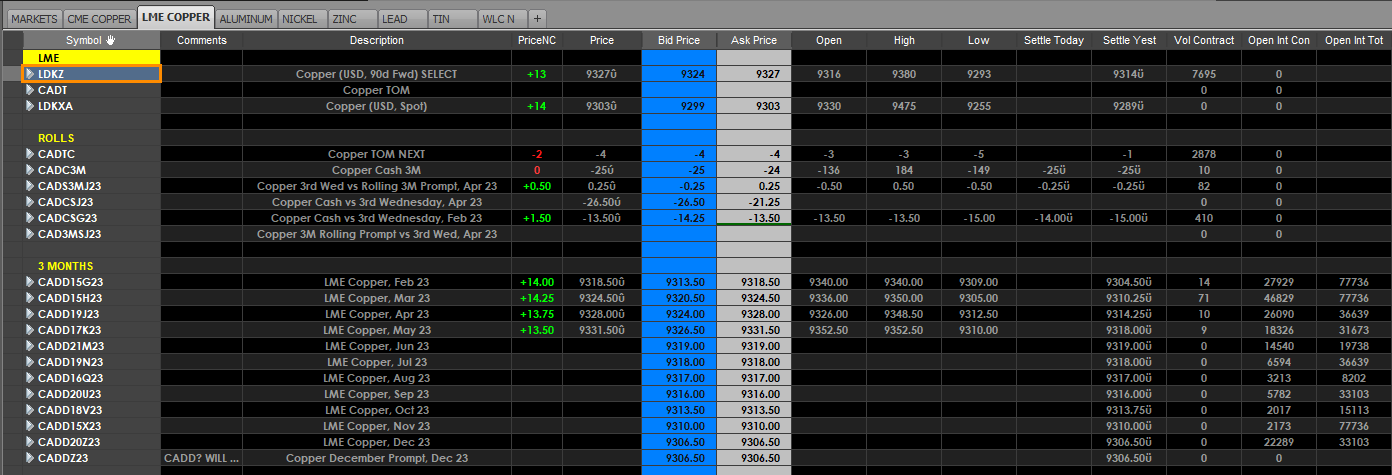

The LME refers to delivery dates as “Prompt Dates.” The use of daily prompt dates is set to mirror physical trading, daily prompts enable users to hedge their physical transactions down to the day. LME futures contracts trade daily out to three months forward, weekly up to six months and monthly up to 123 months in the future, depending on the underlying metal. Weekly prompt dates usually fall on a Wednesday while monthly prompt dates are normally the third Wednesday of the month.

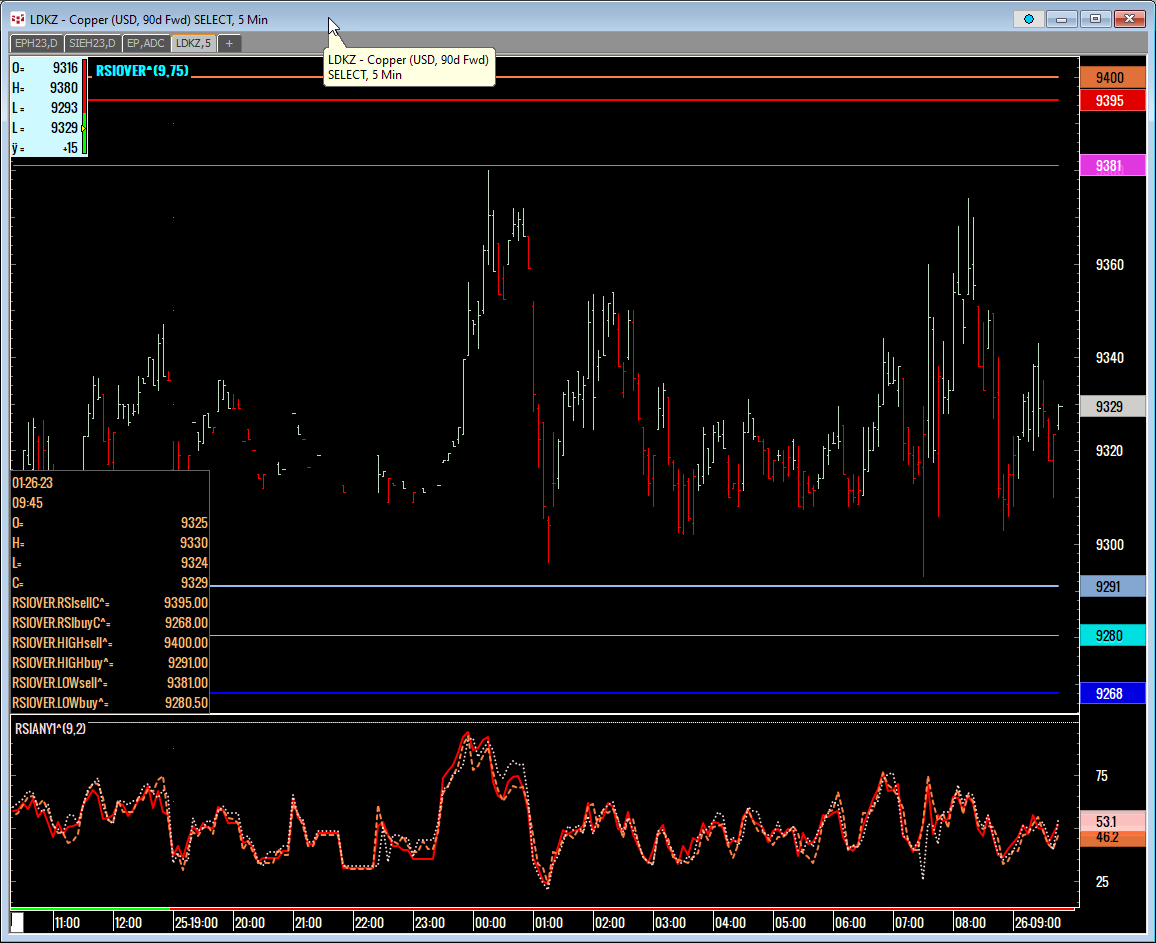

The most active contract typically is the 90 day (aka 3 month) forward contract (e.g., for copper the symbol is LDKZ which is cash Copper (USD, 90d Fwd) SELECT). This contract settles 90 days from your trade date.

If you take a position in LDKZ and don’t liquidate the same day you will have a position with a futures symbol with a specific prompt date. You can enter your contracts specific prompt date which would be for Copper: Root symbol + Day + Month (symbol month) + Year, e.g., symbol CADD22J23. If your contract Is not a third Wednesday date it is called a “broken date” and most likely does not have any liquidity. The only contracts that are usually active are the 90 Day (LDKZ), any specific third Wednesday date (e.g., April CADD19J23), Cash (LDKXA also called spot which the prompt date is 2 trading days from today), TOM (CADT: Tomorrows prompt which is 1 trading day from today), and any spread combinations of all of these.

Unless you’re taking delivery, you will be required to close out or roll your position’s specific settlement date. Most speculative participants will offset their broken date contracts in a nearby third Wednesday date or when it becomes the cash contract. If you use a nearby 3rd Wednesday, you can trade the Cash vs 3rd Wednesday spread to properly offset both positions (e.g., F.US.CADCSJ23). Overall, there are numerous ways to offset or roll your position.

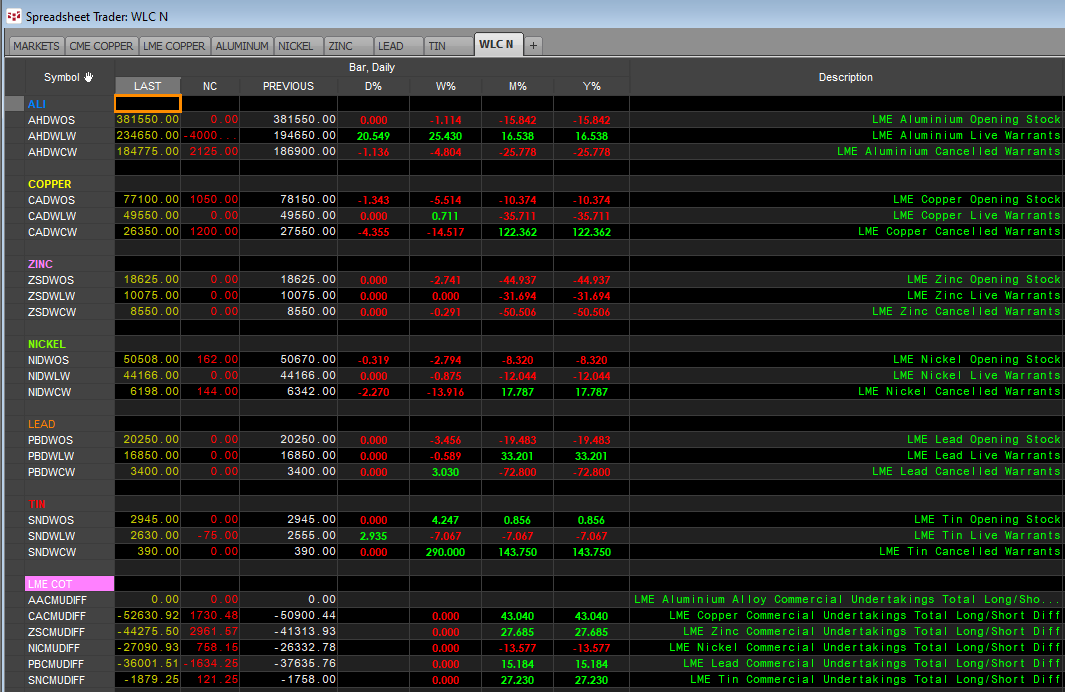

This page here for Integrated Client and QTrader as well as CQG desktop and CQG One users and lists all the currently relevant LME contracts. You will see everything from the 90-day forward to the third Wednesday to third Wednesday spreads.

In the image above there are multiple tabs: Markets, CME Copper, LME Copper, Aluminum, Nickel, Zinc, Lead, Tin, and WLC N. The WLC N tab is warrant and opening LME stock data plus LME Commitment of Traders reports.

The four charts have unique studies (I like to call them Easter eggs):

- Current Close relative to the High and Low for the year and percent change

- Forward contract and forward Open Interest charts, overlaid are forward contracts and individual contract open interest

- VWAP Bands from this year and last year

- The auto RSI (where does the market have to go for the RSI to read 70?) with RSI numbers based on High, Low and Close Right-click on the studies to learn more from the parameters and formulas.

Right-click on the studies to learn more from the parameters and formulas.

Two Excel Spreadsheets are available at the bottom of the Post.

lme3rdwedpromptdate_vo.xlsx provides the symbols based on the third Wednesday of each month.

lmedatesanddata.xlsx has three tabs for displaying the current symbols and market data, historical data, and a third Wednesday of the month lookup table.

Please let us know if you have any questions and Happy Trading!

Links

Downloads

The CQG PAC requires IC or QTrader version 2022 or higher